DXY was stable last night:

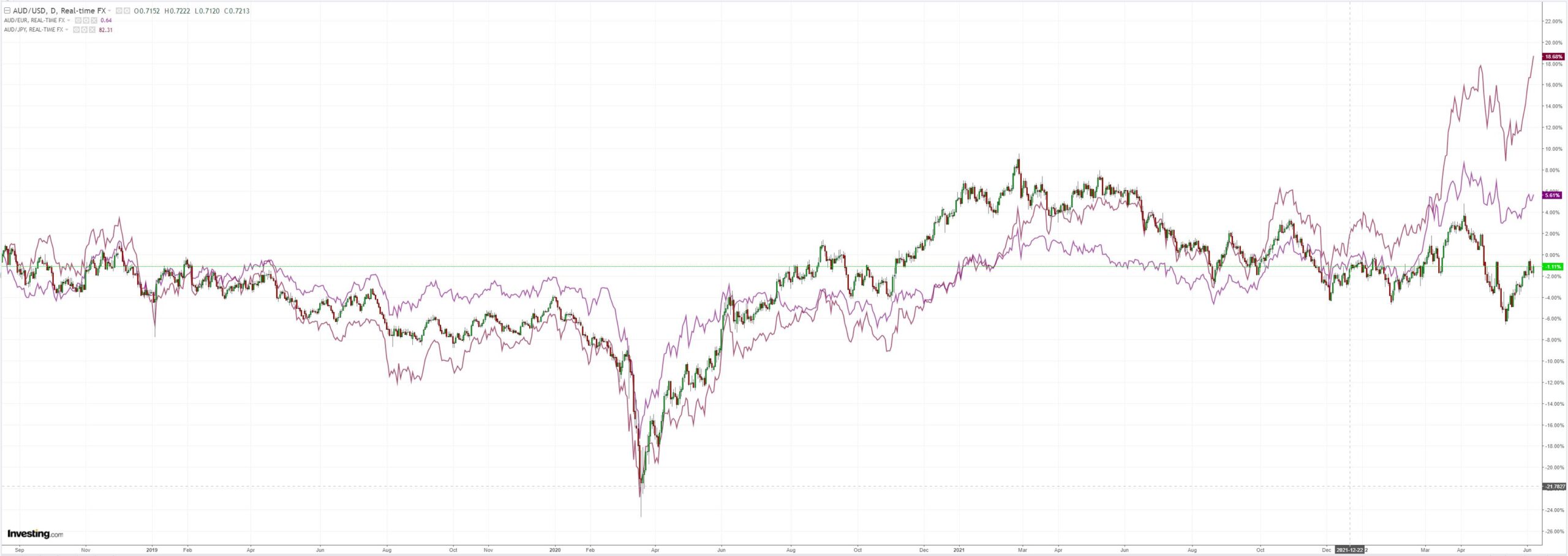

But AUD flew. JPY is a falling anvil:

Meaning CNY is next:

Oil is a big problem for everybody:

A very big problem:

Metals were milder:

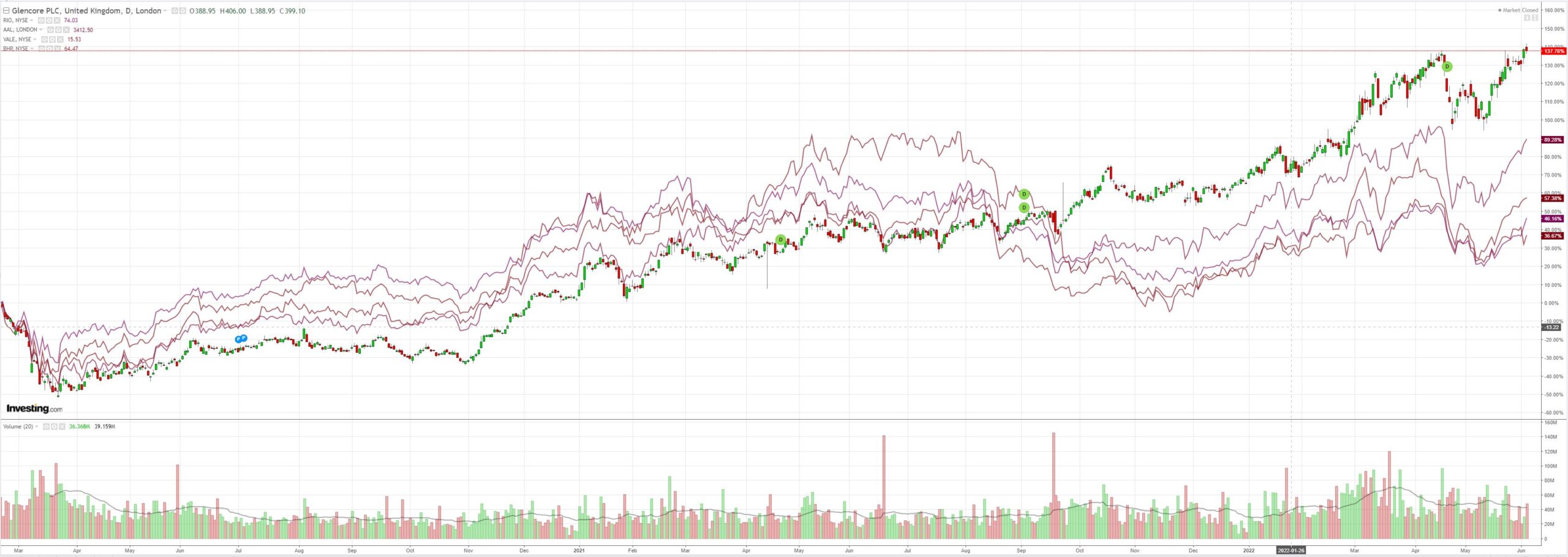

Miners (LON:GLEN) boomed:

EM stocks (NYSE:EEM) didn’t:

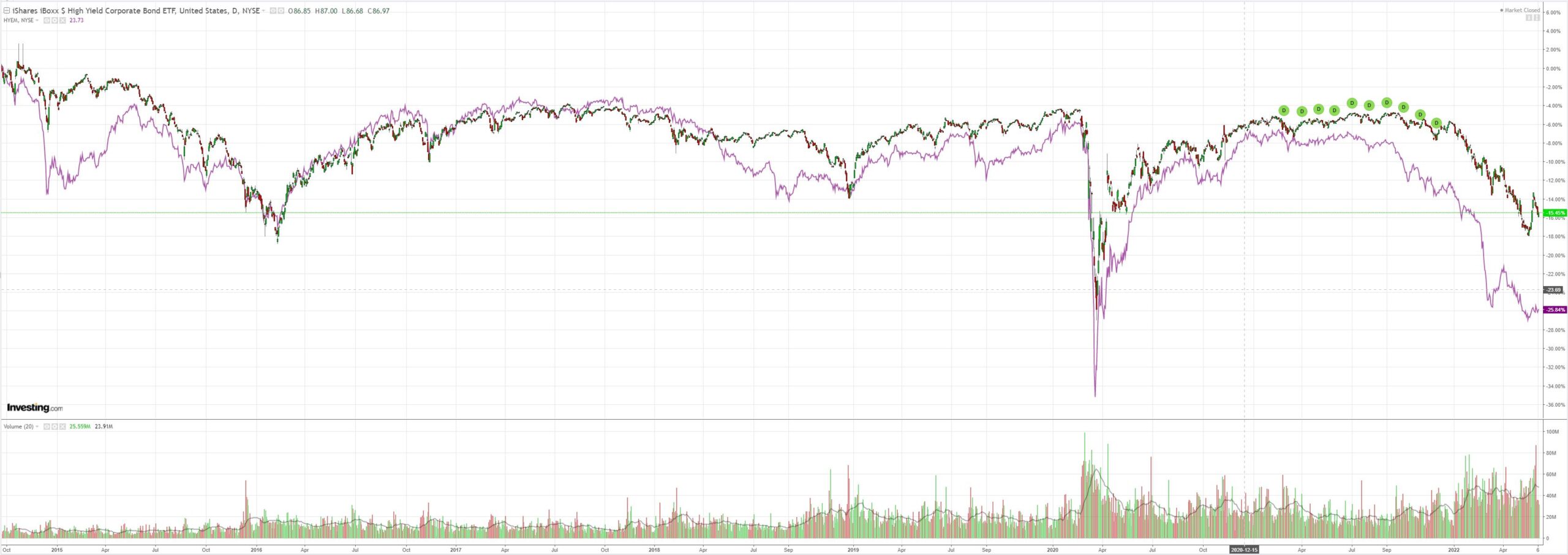

Junk (NYSE:HYG) is quite unconvinced:

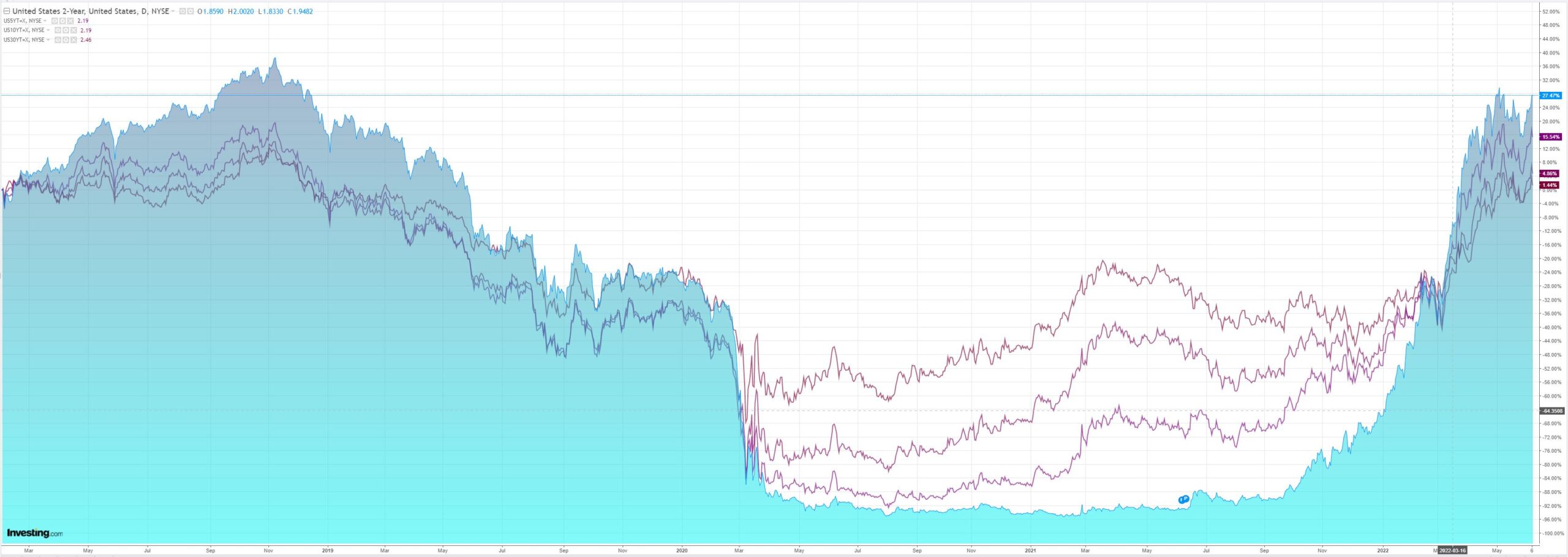

The United States 2-Year curve was smashed:

Which growth stocks liked:

Westpac has the wrap:

Event Wrap

Eurozone investor confidence (Sentix) was stronger than expected, rising to -15.8 (vs. estimate -21.2, prior -22.6). German factory orders fell 2.7% in April (vs. +0.4% expected).

Event Outlook

NZ: Dairy prices are expected to begin their recovery at the upcoming GlobalDairyTrade auction (Westpac f/c: 2.0%).

Japan: A small revision is anticipated in the final estimate of Q1 GDP (market f/c: -0.3%).

Eur: The final estimate of Q1 GDP will confirm Europe’s slow start to 2022 (market f/c: 0.3%).

US: The final estimate of April’s wholesale inventories should continue to reflect the robust pace of inventory accumulation (market f/c: 2.1%).

The Albanese Government’s energy policy errors have now been compounded by an RBA policy error. It’s now odds-on that Albo will follow up with energy subsidies which will be the final error in a triptych of bullish AUD mistakes.

Loose fiscal and tight monetary policy is a recipe for a higher currency. Especially since the RBA cannot impact energy prices.

How far the AUD gets is probably still dependent upon the wider global recession worries and bear market rally.

But the macro mismanagement of the Australian economy has reached a new low today.