DXY was hit last night and EUR rose as US inflation only came in stinking hot:

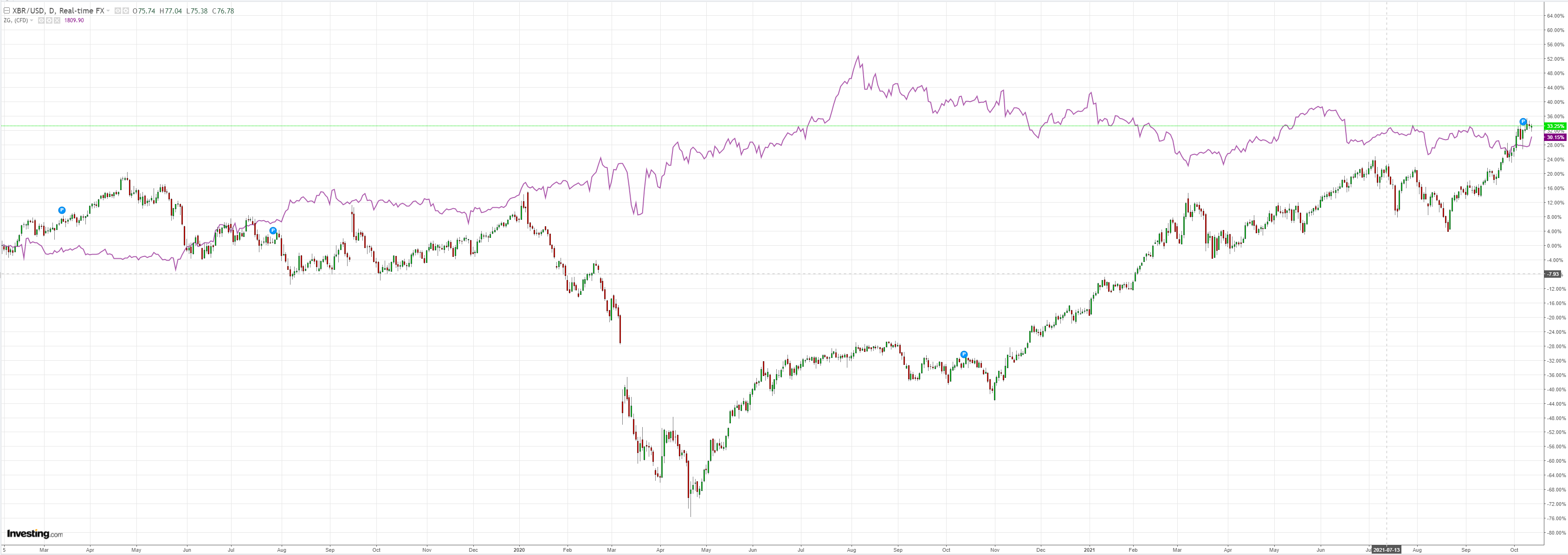

AUD jumped and looks set for more until energy pops:

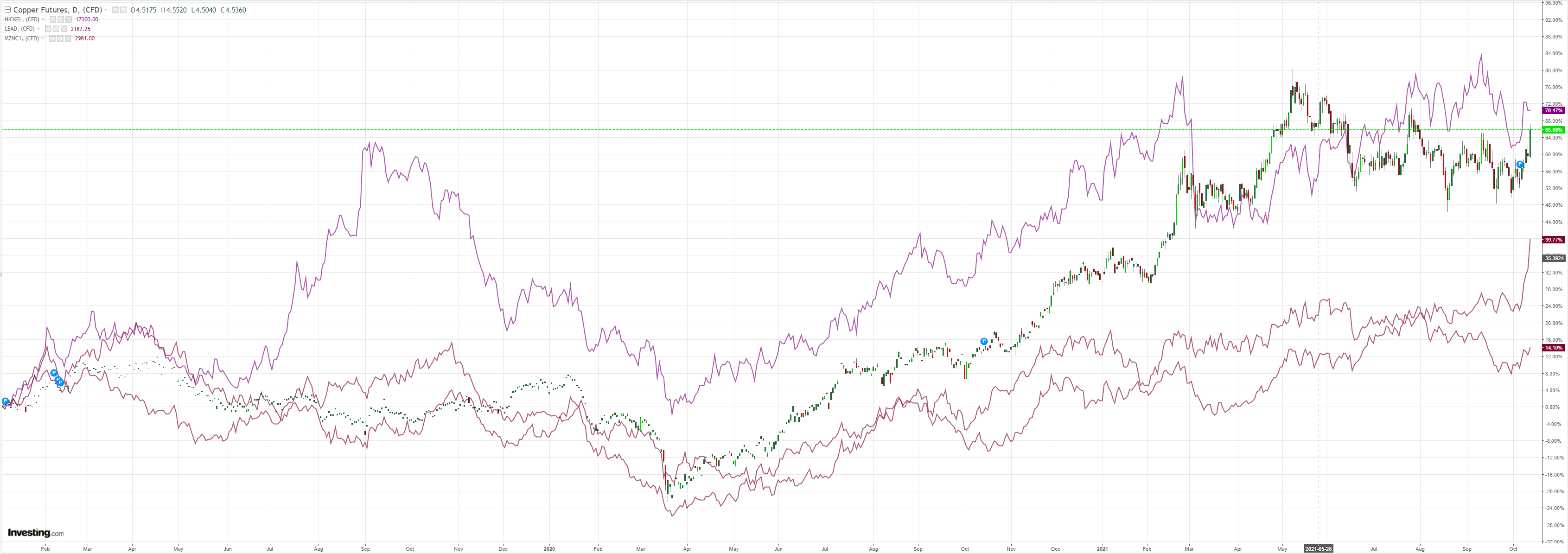

And now for some base metals melt-up!

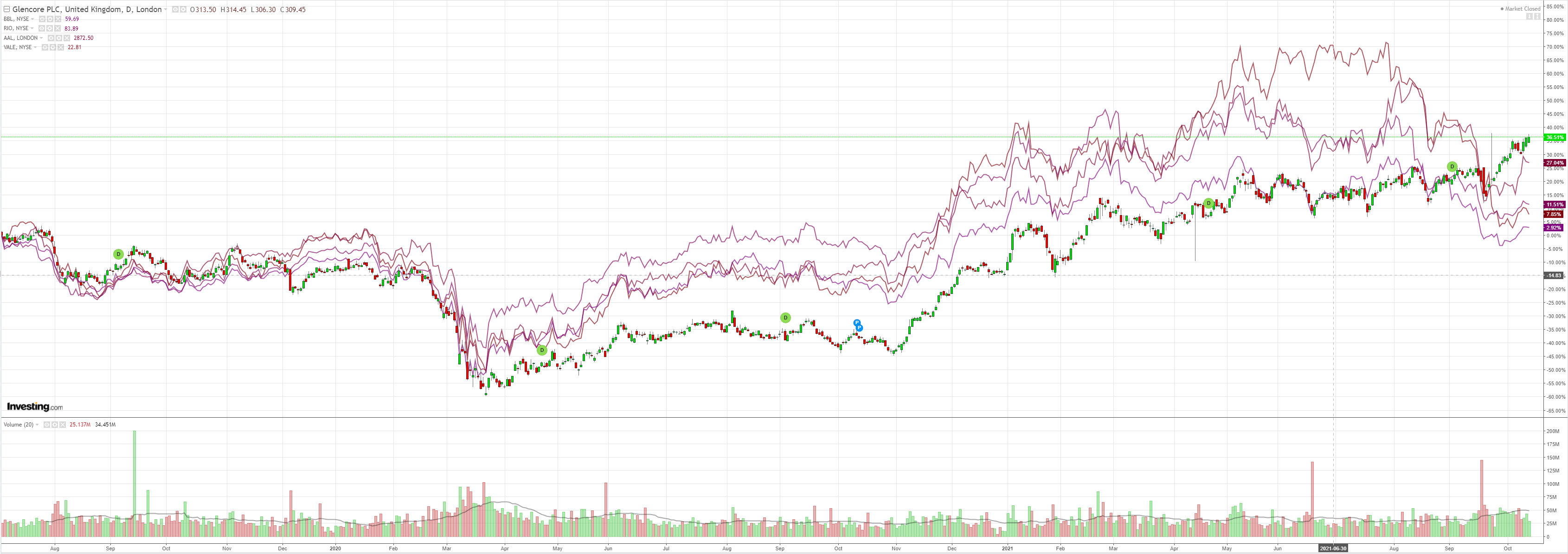

Big miners sagged except Glencoal:

EM stocks still stuffed:

EM stress took a break:

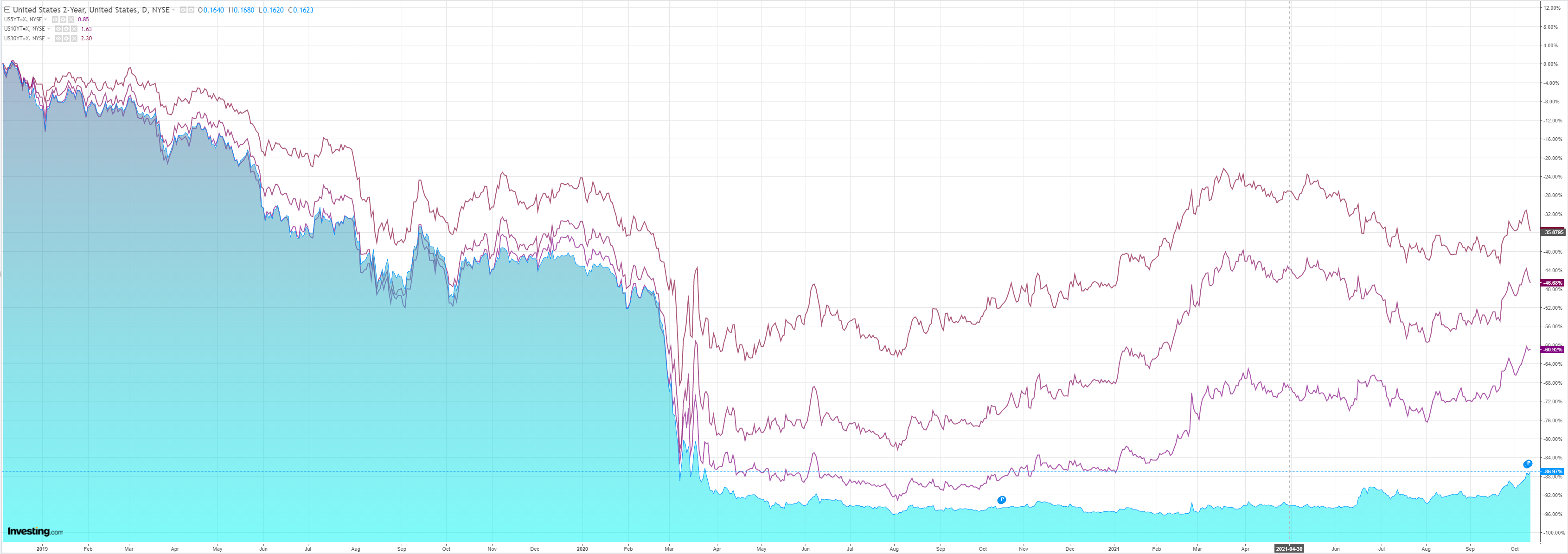

As the US curve suddenly rolled over:

Which helped tech:

Westpac has the wrap:

Event Wrap

US CPI in September rose 0.4%m/m and 5.4%y/y (est. +0.3%m/m, 5.3%y/y), with the ex-food and energy measure +0.2%m/m and 4.0%y/y (as expected). Supply chain disruptions are continuing to lift prices, although gains have moderated over the last three months. Used vehicle and airfare prices fell in September after a large three-month climb through June. There were large gains in new car and food prices, but a large drop in apparel prices.

FOMC minutes from the 21-22 September policy meeting added little to the known statement, projections, and press conference. They did confirm that most policymakers believed the “substantial further progress” standard had been met and that a gradual reduction of the pace of QE purchases may “soon be warranted.” The minutes indicated that if a decision on tapering were to be made at the next meeting (2-3 November), it could start in mid-November or mid-December. On inflation, it was expected prices would remain elevated in coming months, and some were concerned that could feed through to longer-term inflation expectations. But several also observed most of the pressures were coming from pandemic related supply-demand imbalances.

Eurozone CPI in September was confirmed at 0.0% m/m (+0.3%m/m harmonised) and 4.1y/y for both headline and harmonised measures. August industrial production contracted 1.6%m/m (est. -1.7%m/m) which, given upward revisions to prior readings, saw a beat in the annual pace at 5.1%y/y (est. 4.7%y/y).

UK production data for August was solid. GDP rose +0.4%m/m (est. +0.5%m/m), due to softer service activity of +0.3%m/m (est. +0.6%m/m) which countered strong industrial production (+0.8%m/m, est. +0.2%m/m).

Event Outlook

Australia: RBA Deputy Governor Debelle will speak on ‘Climate Risks & the Australian Financial System’ at 9am AESDT. The labour force survey for September is subsequently expected to report the loss of 200k jobs in the month; but this decline will only lead to a small rise in the unemployment rate to 4.7% as many of those out of work leave the workforce temporarily owing to lockdown restrictions. October MI inflation expectations are also due.

New Zealand: REINZ housing data for September should be released today. RBNZ Deputy Governor Bascand will speak at 1:30pm NZT on “The contribution of strong balance sheets to New Zealand’s economic resilience and recovery from the pandemic”.

China: Annual CPI inflation is very weak (0.8%yr in August) despite persistent upstream price pressures as represented by the PPI (9.5%yr in August).

United States: The downtrend in initial jobless claims is expected to persist in coming months as new COVID-19 cases fall and the economy re-opens. The FOMC’s Brainard, Bowman, Bostic, Logan and Barkin are all due to speak.

So, the CPI is hot and the Fed is going to taper. The bond market suddenly realised that that is going hammer growth, as China slows fast as well, and it duly smashed the curve lower which aided duration stocks. All pretty normal.

Completely contradicting that, base metals went nuts presumably on inflation concerns stemming from base metals. That’s the stupidity of stagflation fears for you.

AUD can run until the energy bubble bursts and takes down the rest of the commodity complex with it.