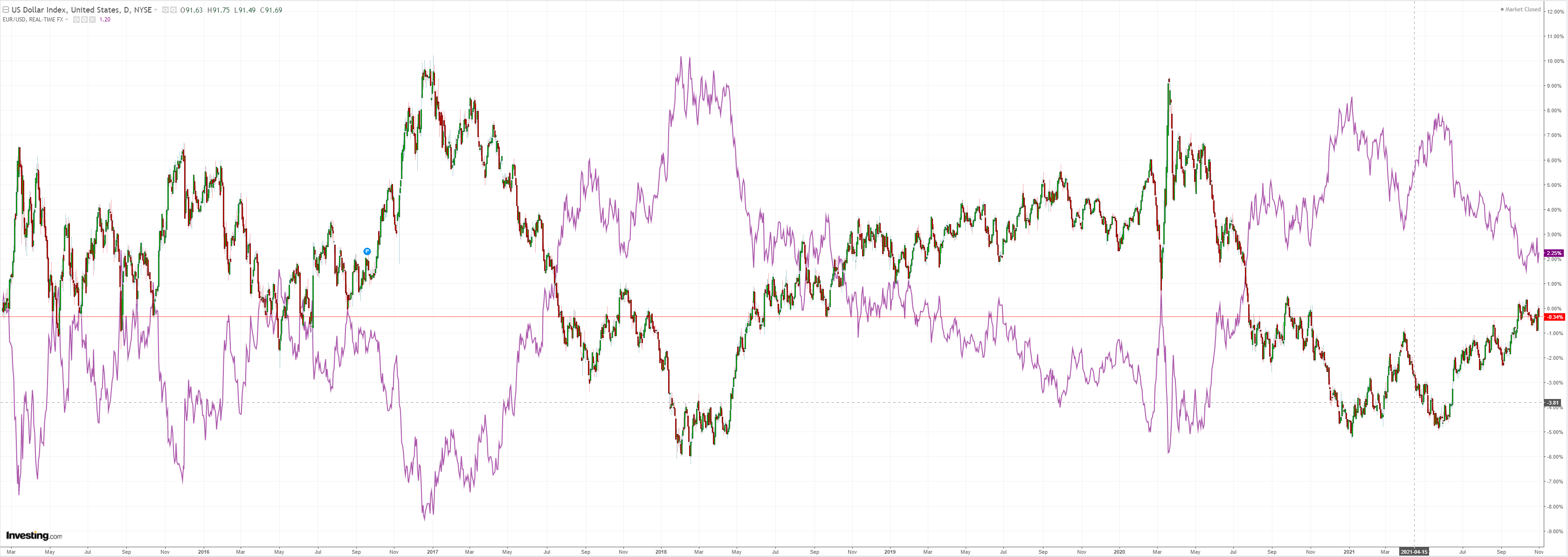

DXY eased last night and EUR bounced:

The Australian dollar eased on the crosses:

Base metals were nowhere:

Big miners too:

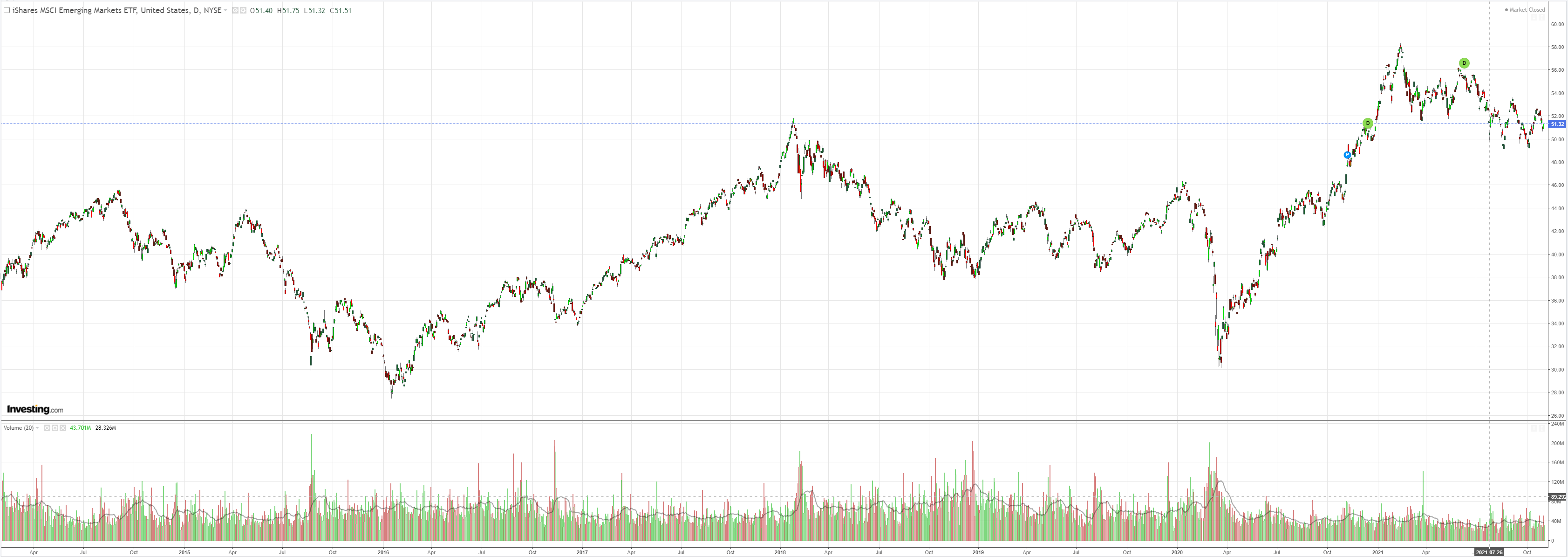

EM stocks firmed:

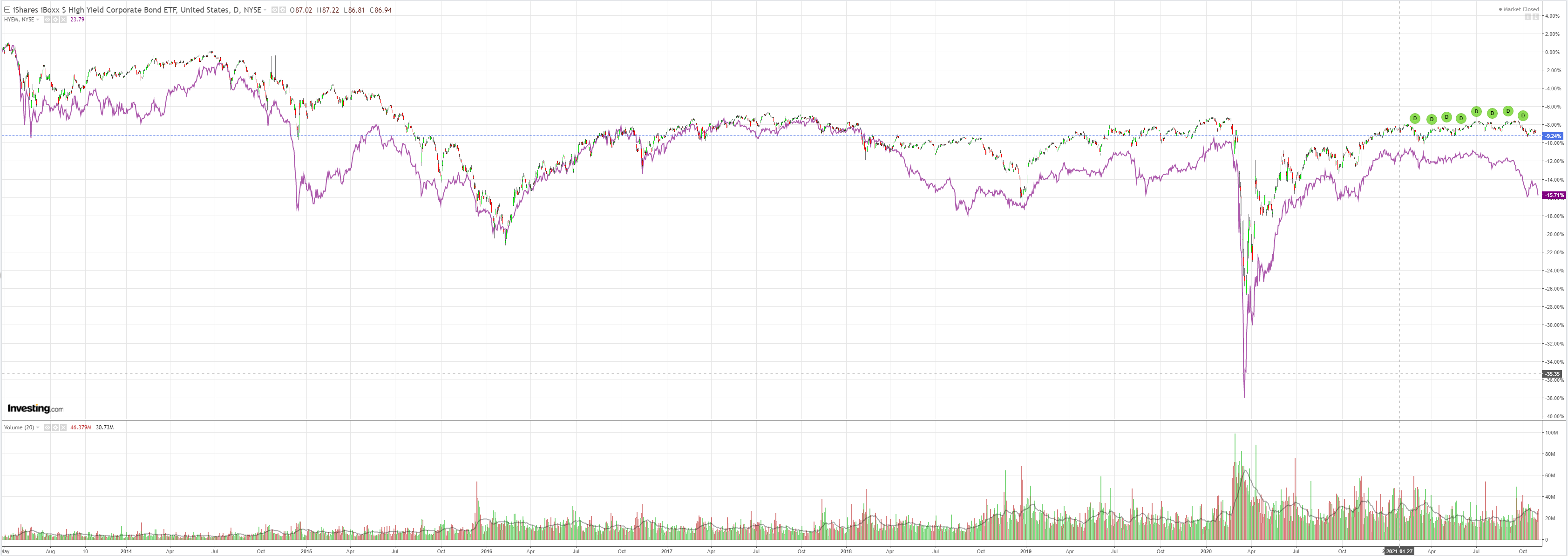

But junk let go:

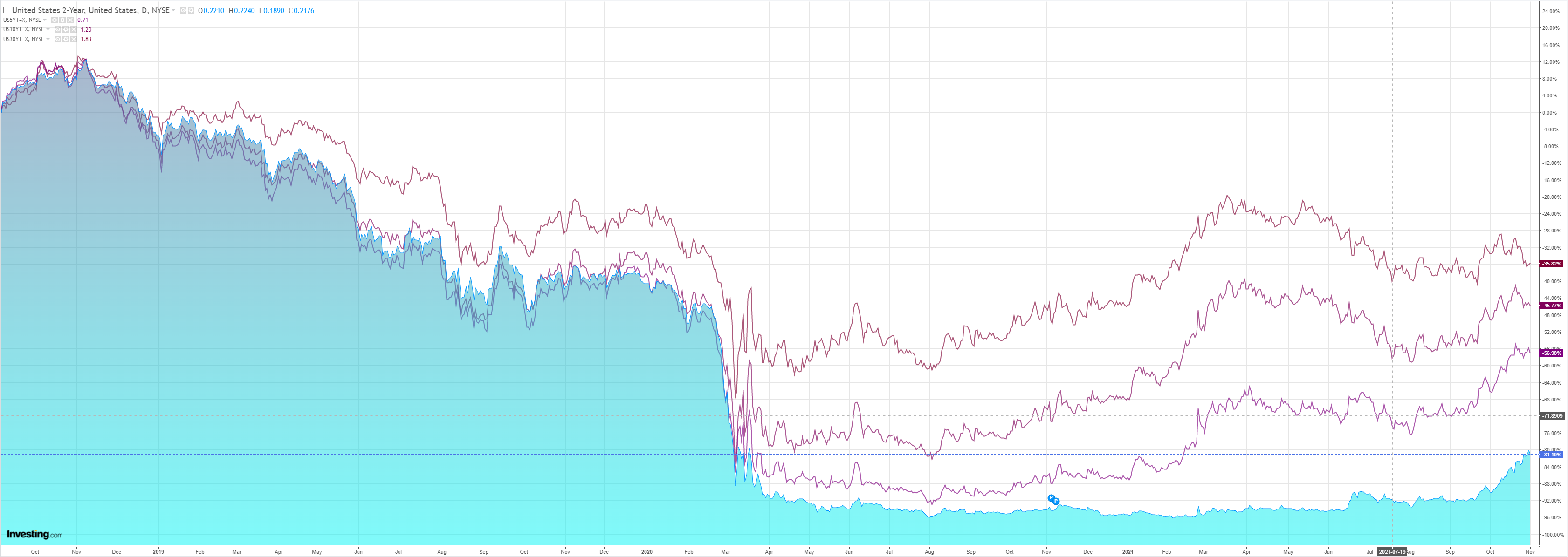

The US curve steepened for once:

Growth went up anyway:

Westpac has the data wrap:

Event Wrap

US ISM manufacturing fell by less than expected, to 60.8 (est. 60.5, prior 61.1), with a clear theme of supply challenges constraining activity, and adding to delivery times and pushing up prices. New orders pulled back to 59.8 from 66.7, but employment managed to tick up to 52.0 from 50.2. The final Markit. manufacturing PMI was marked down to 58.4 from the flash 59.2.

UK Markit/CIPS manufacturing PMI was finalised at 57.8 (flash 57.7, prior 57.1), but still referred to the severity of supply difficulties constraining output. Selling prices rose to a record pace but optimism was sustained.

German retail sales in September disappointed with a 2.5% fall (est. +0.4%m/m), with particularly sharp declines in clothing (-9.6%m/m ) and other non-food goods.

Event Outlook

Aust: The RBA’s policy decision will be the highlight of the day. Particular interest will be shown in any changes to their economic forecasts and forward guidance on the likely timing of future rate increases. RBA Deputy Governor Debelle will be a panel participant at the Impact X Sydney Summit on technological solutions for climate issues.

NZ: Building permits are expected to return to more normal levels after last month’s surge in medium-density consents in Auckland (Westpac f/c: -5.0%). RBNZ Governor Orr will speak at 9:30am on the housing market.

Goldman brought forward US rate hikes:

- We are pulling forward our forecast for the Fed’s first rate hike by one full year to July 2022, shortly after tapering is scheduled to conclude. We expect a second hike in November 2022 and two hikes per year after that. However, the range of possible outcomes is wide, especially in the longer term.

- The FOMC will announce the start of tapering next week, presumably at the$15bn per month pace noted in the September minutes. If implementation begins in mid-November, the last taper would come in June 2022. Large surprises on the virus, inflation, wage growth, or inflation expectations could prompt a revision, but we think the hurdle for a change in either direction is high.

- The main reason for the change in our liftoff call is that we now expect core PCE inflation to remain above 3%—and core CPI inflation above 4%—when the taper concludes. Sequential core inflation should be lower at that point but still around 2%, with shelter running hot. Taken together, we think this will make a seamless move from tapering to rate hikes the path of least resistance.

That was enough to lift DXY but market soon returned to kicking the carcass of a broken RBA. Hopefully, it will attempt some kind of repair today but I doubt the market will listen. It knows a mincing poser when it sees it.

Australia will need some worse data before the AUD turns lower.