DXY launched overnight as EUR swooned on peaky German inflation:

AUD was shoved right back to the cliff’s edge:

Oil fell though!

Metals held on:

And miners (LON:GLEN):

EM stocks (NYSE:EEM) too:

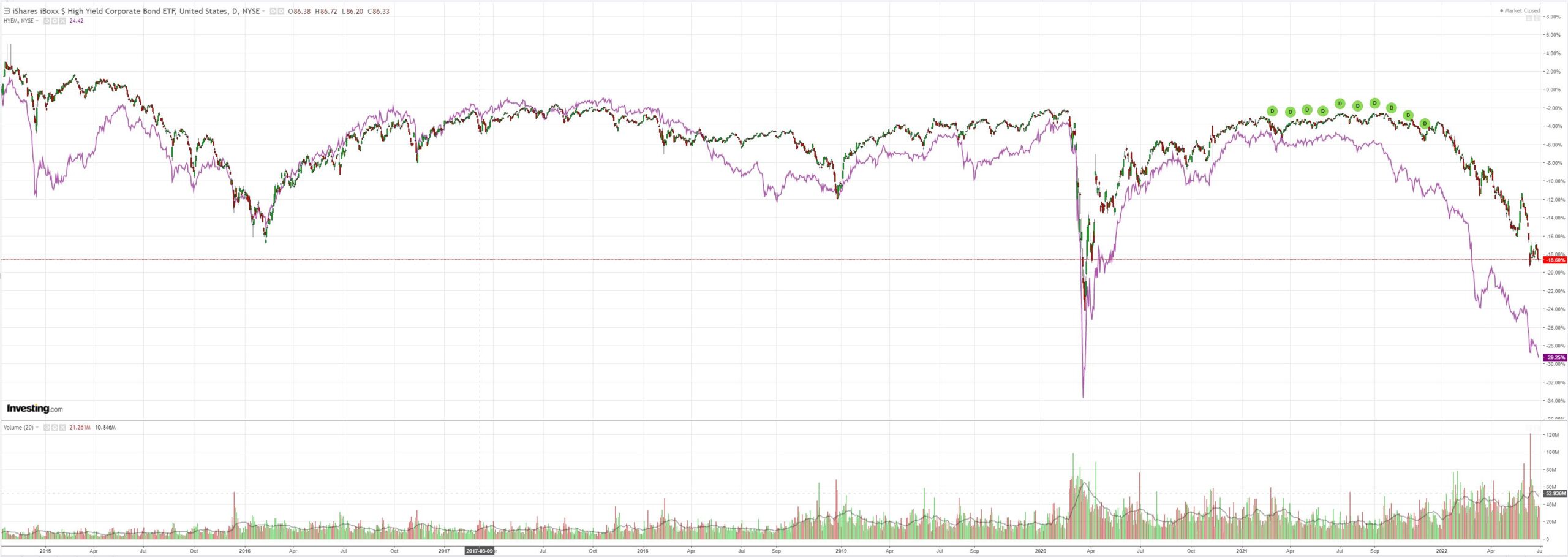

But the bid daddy of them all, junk spreads (NYSE:HYG), are the highway to hell:

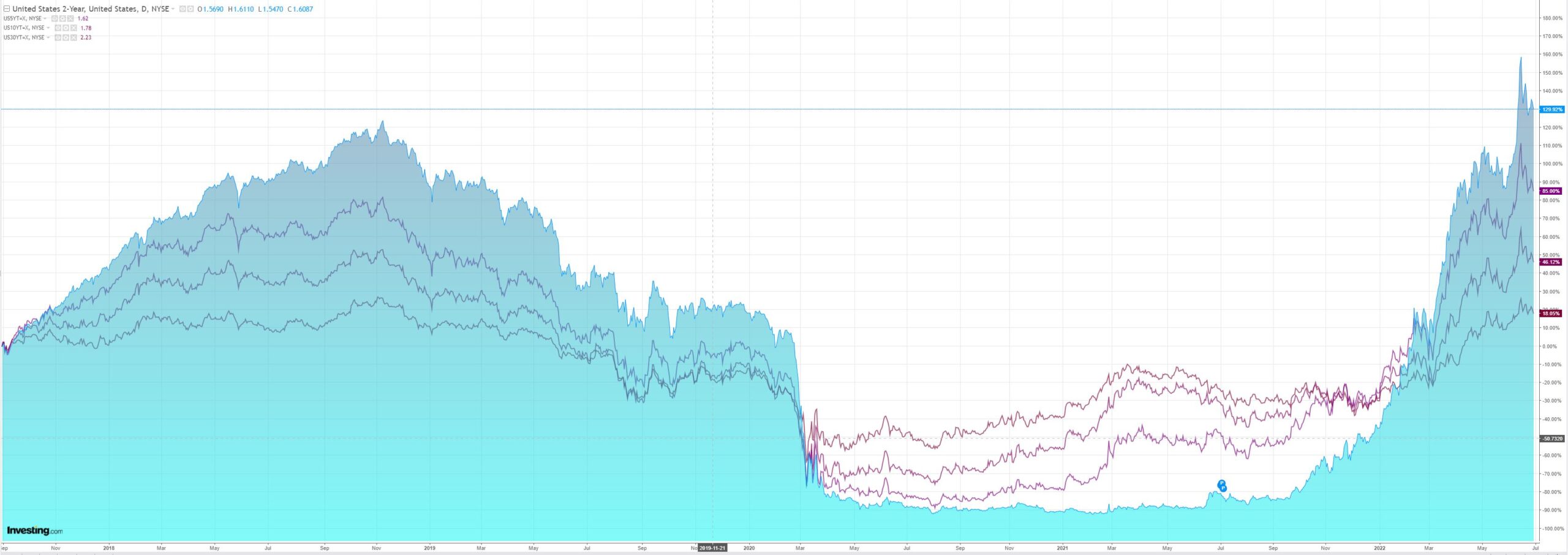

Despite easing Treasury yields:

Which helped stocks to not fall too much:

Westpac has the wrap:

Event Wrap

The third estimate of US Q1 GDP was revised lower to -1.6% annualised from -1.5%, with a surprising fall in personal consumption to +1.8% from +3.1%. Uncomfortably, prices were firmer with the core PCE rising to 5.2% from 5.1%.

German CPI was lower than expected, with HICP falling 0.1%m/m, for an 8.2% annual pace (est. +0.4%m/m, +8.8%%y/y). Although there were Govt. subsidies for transport which pulled down the headline, other categories were expected to be higher. Spanish CPI was notably higher, lifting the EU harmonised level to 10.0%y/y – a 37-year high (est. 8.7%, prior 8.5%).

Eurozone economic confidence at 104.0 was firmer than expected (est. 103.0, prior 105.0). Both manufacturing and services showed slight gains.

ECB and Fed speakers (notably Powell and Lagarde) restated their resolve to contain inflation, acknowledging the potential for lower growth, but suggesting that recession can be averted. FOMC member Mester was notably more hawkish, calling for 75bp hikes, stressing the need to avoid embedding inflation expectations, and favouring a Fed funds rate over 4% by next year.

BoE Gov. Bailey stressed the MPC’s resolve to move aggressively if required, but also highlighted the vulnerability of UK economy. Incoming MPC member Dhingra was decidedly more negative on the expected outcomes for the UK economy but agreed with the need to fight inflation.

Event Outlook

Aust: Private sector credit growth is set to post a softer gain in May given the start of the RBA’s interest rate tightening cycle (Westpac f/c: 0.5%).Meanwhile, job vacancies are expected to remain very strong in Q2.

NZ: Supply shortages, cost pressures and interest rate increases should continue to weigh on ANZ business confidence in June. RBNZ Chief Economist Conway will speak about the housing market at 11:30 NZT.

Japan: Another decline in industrial production is expected in May as manufacturers battle supply issues (market f/c: -0.3%).

China: The easing of virus disruptions should see the manufacturing PMI and non-manufacturing PMI lift into expansionary territory in June (market f/c: 50.5 for both).

Eur/UK: The European unemployment rate is set to hold near its lows in May, laying the foundation for robust wages growth (market f/c: 6.8%). In the UK, the final estimate of Q1 GDP is due (market f/c: 0.8%) and June’s Nationwide house prices are expected to reflect a slowing in price growth momentum (market f/c: 0.5%).

US: Weakness in personal income is raising concerns over purchasing power as households run down savings for personal spending (market f/c: 0.5% and 0.4% respectively). Although PCE inflation looks to have crested, price pressures will only slowly abate through 2022 (market f/c: 0.7%mth headline, 0.4%mth core). Initial jobless claims are set to remain at a low level (market f/c: 229k) and concerns around supply issues will remain prominent in June’s Chicago PMI (market f/c: 58.0).

European inflation peaking before the US is not good for anybody. This puts the rocket back under DXY and from there the global dominoes fall.

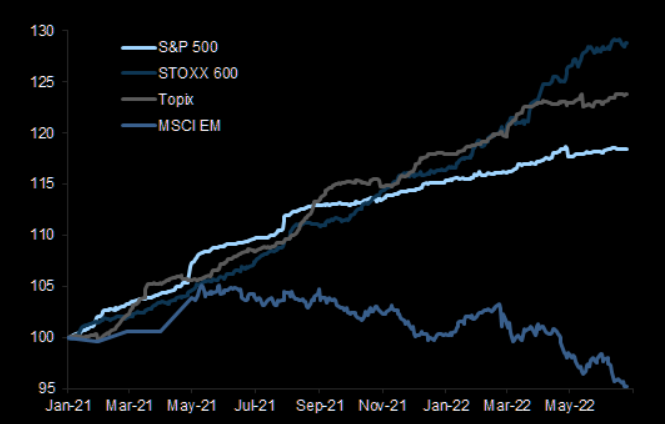

EM and commodity capital flows dry up. Interest rates rise and exports fall in the same EMs. EM profits get smashed until such a time as the stress flows back to DMs and they roll over as well:

The AUD tracks EM junk on the highway to hell every time:

Nothing will stop it until the Fed pivots.