DXY was roughly flat last night though all over the place in the process:

Australian dollar likewise though rising risk-off is obvious in the yen cross:

Oil lol:

Base metals softened:

Big miners are still hanging on:

EM stocks recaptured support:

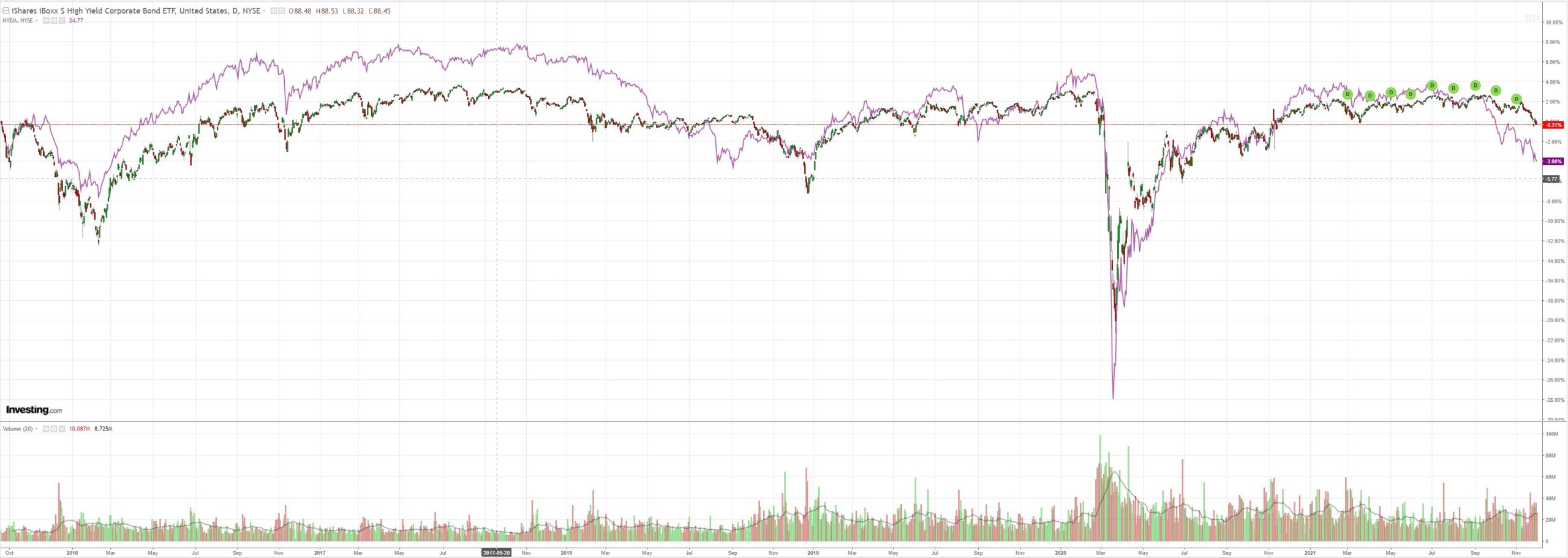

Junk got worse:

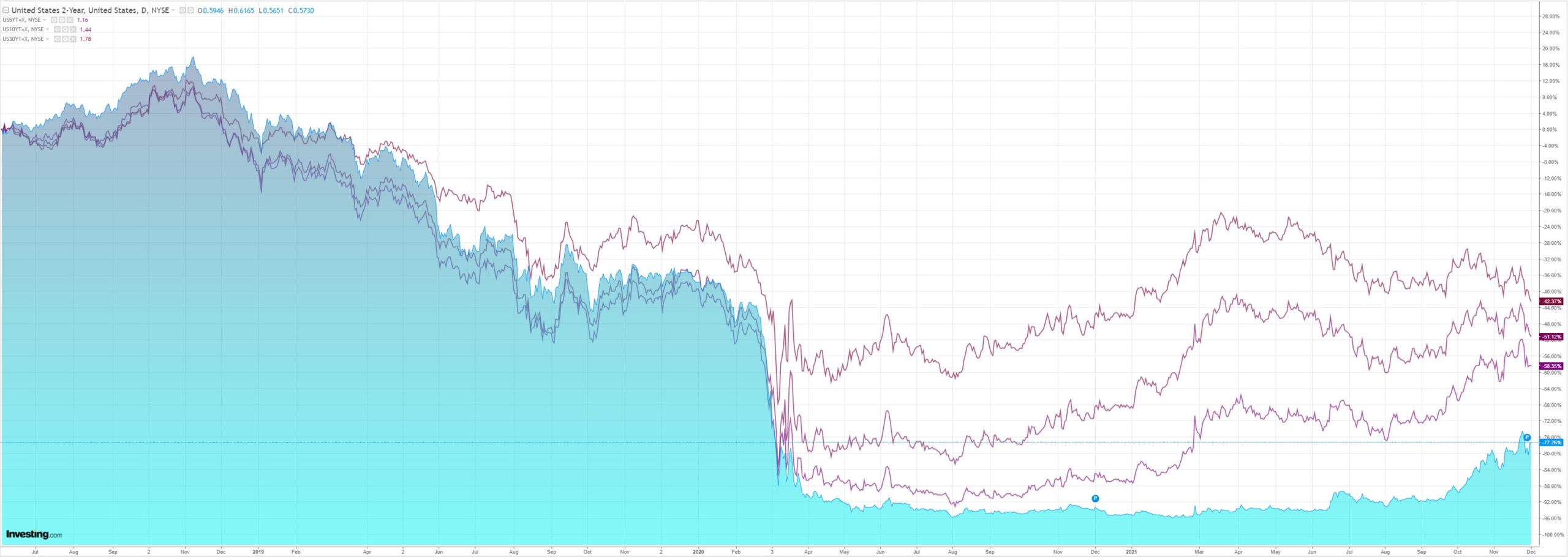

As the Treasury curve pancaking really gets moving:

Which stocks did not like much:

Westpac with the wrap:

Event Wrap

The second day of testimony from Fed Chair Powell largely repeated yesterday’s key messages, emphasizing the likelihood the FOMC will accelerate the pace of tapering, as well as highlighting persistent inflation pressures.

WHO said that current vaccines do appear to be effective against the omicron variant, although further information on its communicability, morbidity and severity of symptoms is unlikely for another 10 days.

US manufacturing ISM survey was as strong as expected, with the headline reading of 61.1 (est. 61.2, prior 60.8) reflecting firmer new orders (61.5, prior 59.8) and employment (53.3, prior 52.0), while prices paid pulled back to 82.4 (from 85.7). ADP employment in November was close to consensus at 534k (est. 525k).

German retail sales in October disappointed, as Covid concerns appear to have weighed on consumers, with a fall of 0.3%m/m against an expected rise of 0.9%m/m.

Event Outlook

Australia: Housing finance approvals are expected to lift in October as house prices continue to rise and turnover increases on reopening (Westpac f/c: 4.0%). A narrowing of the trade surplus is anticipated in October due to a rebound in imports and a further pull-back in export earnings as a result of falling iron ore prices (Westpac f/c: $10.8bn).

NZ: In Q3, the terms of trade are expected to lift further with price gains for commodity exports outstripping those for imported goods (Westpac f/c: 2.0%).

Eurozone: Strength in employment growth should continue to see the unemployment rate gradually fall in October (market f/c: 7.3%).

US: Initial jobless claims are anticipated to stabilise after recently hitting multi-decade lows (market f/c: 240k). The FOMC’s Bostic will discuss the high cost of housing at a virtual conference hosted by the Atlanta and Dallas Feds, and will then take part in a discussion at a virtual Reuters event. Quarles will share his departing thoughts to the American Enterprise Institute, while Daly and Barkin speak at the Peterson Institute.

UBS with some analysis:

There may be light at the end of the tunnel, but the tunnel seems to have gotten longer as more bad news around the coronavirus crisis has emerged. Various countries across Europe have implemented stronger controls due to the rapid rise of COVID-19 case counts, and although these cases are still predominantly caused by the delta variant, omicron is working its way through and posing a risk to even well-vaccinated areas.

The US dollar has gained in the last couple of months due to rising expectations of policy tightening by the Federal Reserve. Now its safe-haven at-tribute is adding fuel to this trend. However, markets are increasingly asking whether the Fed is ready to tighten in light of the new developments. We think that inflationary pressure is strong enough in the US to allow tapering to proceed in line with the Fed’s plan, i.e., to end its asset purchases by the middle of next year, if not sooner. There is also considerable uncertainty over the outlook for fiscal policy, but we expect a government shutdown to be avoided and the debt ceiling to be raised in time to avoid a default. We therefore think the path to EURUSD 1.10 is well paved. In our base case, we expect solid support around 1.10, but the latest round of volatility might make room for more downside.

We expect the European Central Bank to keep interest rates negative for a long time, and its discussion around plans for asset purchases after the PEPP emergency program ends next spring is not helping the common currency. We therefore see little upside for the euro, unless the global economy suddenly looks much brighter.

As we know, AUD is a EUR proxy.

My own thoughts are developing probabilistically into three scenarios:

- OMICRON is harmless and Fed tightens. Chinese keeps brakes on property. DXY up. AUD down.

- OMICRON is somewhat harmful to DMs, Fed pauses, Chinese stimulate as exports are hit, DXY down. AUD up.

- OMICRON is harmful and triggers new DM lockdown wave. Fed pauses. China flood stimulates. But risk assets hammered and DXY up. AUD down then up.

There are obviously subsets on a continuum of these scenarios.