DXY is still firm as EUR struggles:

AUD jackknifed over the hawkish RBA:

Commodities are waiting on China:

Bug Miners too:

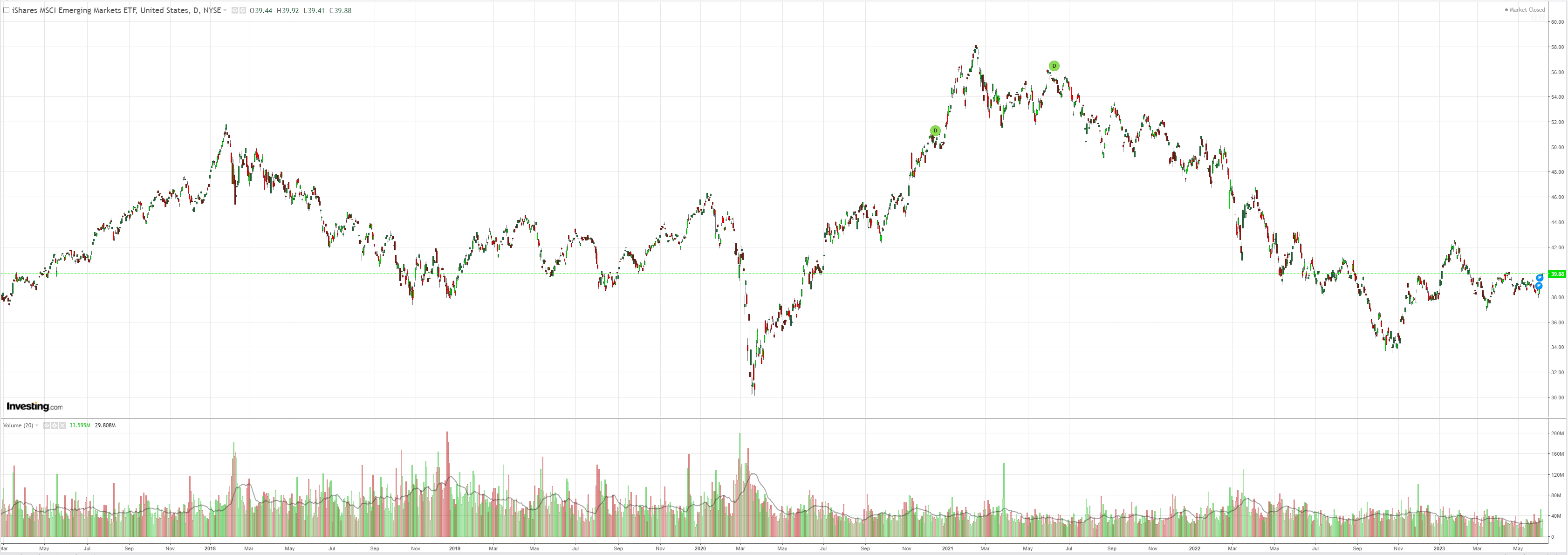

EM stocks are having another crack:

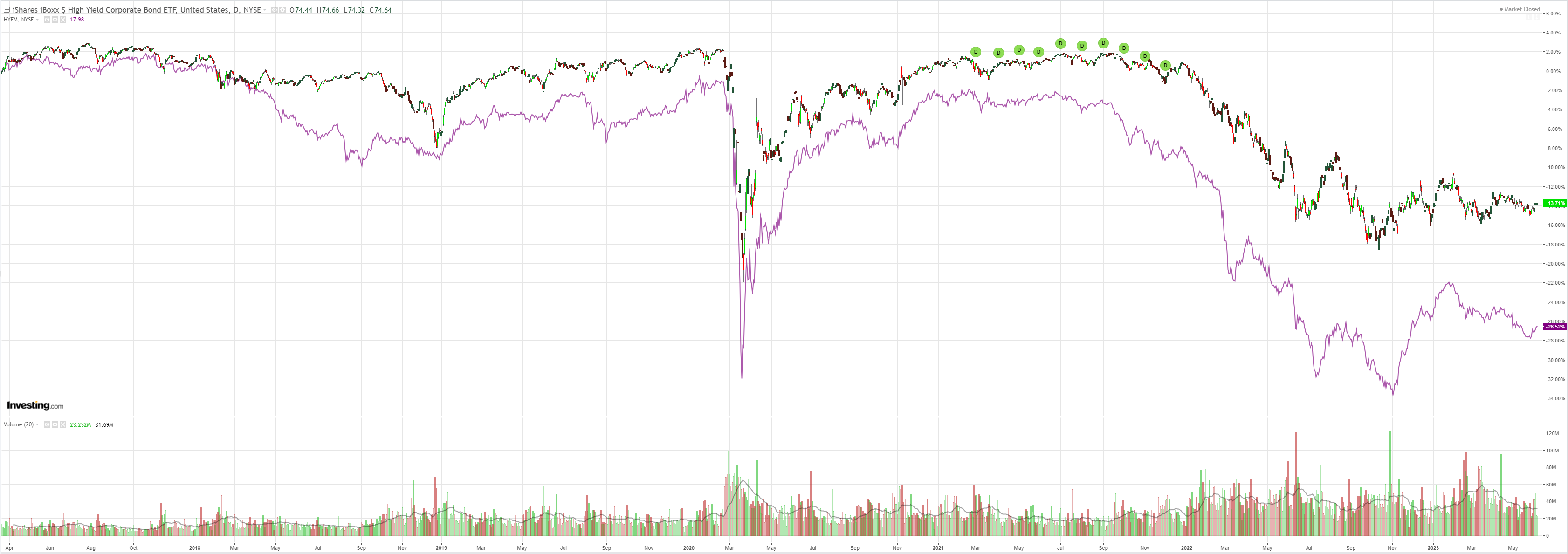

So is junk:

The Treasury curve flattened again:

As the AI bubble sucks ’em in:

Cash rate futures markets are pricing another RBA hike by October:

My own view is that it will take some top-tier data turning openly recessionary to prevent the central bank from hiking again in July.

TD Securities reckons August:

It was a line ball call for today rate decision but the RBA firmly showed its resolve to return inflation back to target by raising the cash rate target to 4.10%. We expected a 25bps hike today, contrary to the consensus for a hold as the upside surprise in the Apr inflation print and higher-than-expected Fair Wage Commission decision presented a strong case for the Bank to move sooner.

The RBA is cognizant of the pickup in public sector wages and the signalling effect from the recent rise in award wages. Interestingly, the Bank dropped its key sentence on “medium-term inflation expectations remains well anchored” – (this was in every MPS since Jul’22) which in our view reads hawkish. We expect another 25bps hike from the RBA though we think the Bank would prefer to move again in August after the release of official Q2 CPI and updated wage forecasts from the RBA’s staffers.

The forthcoming wage rises in the public sector and awards are a blip. Leading indicators for the jobs market are clearly wage negative.

But that is not relevant if the RBA’s reasoning for hiking is a gap between productivity and wages.

If so, it will have to hike at every meeting from here to eternity.