DXY was hammered overnight and that reversed all recent trends:

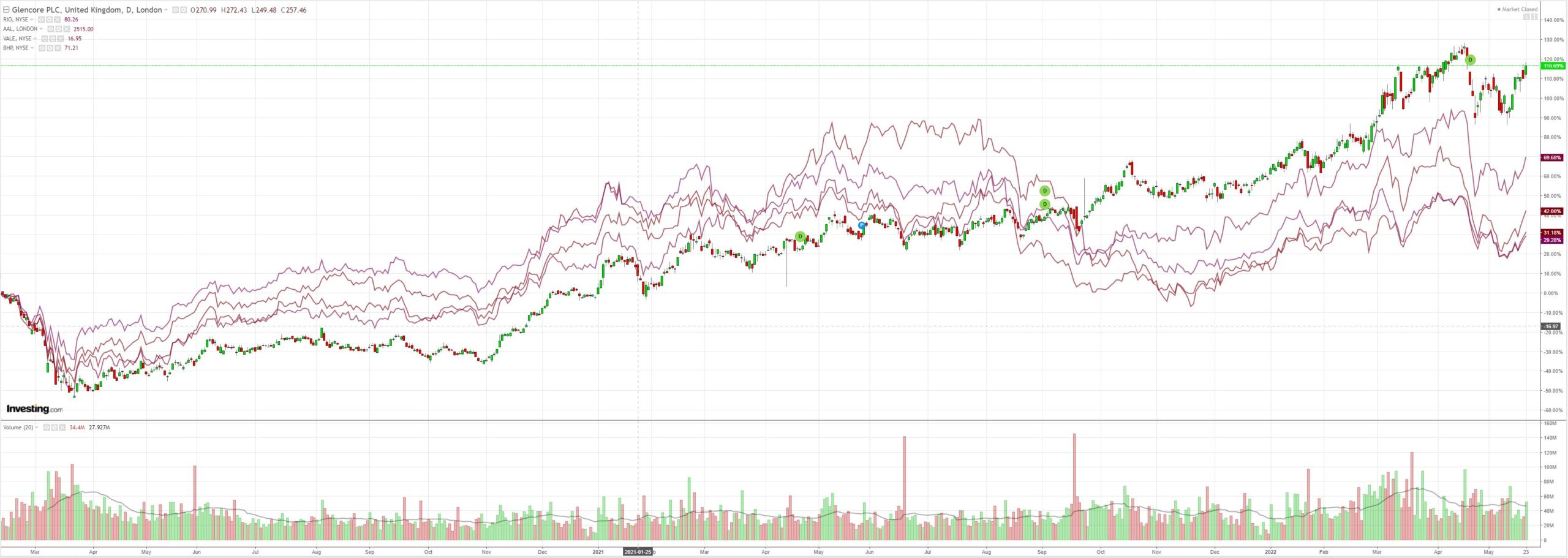

{[5|AUD}} up with all things commodities and EM (NYSE:EEM):

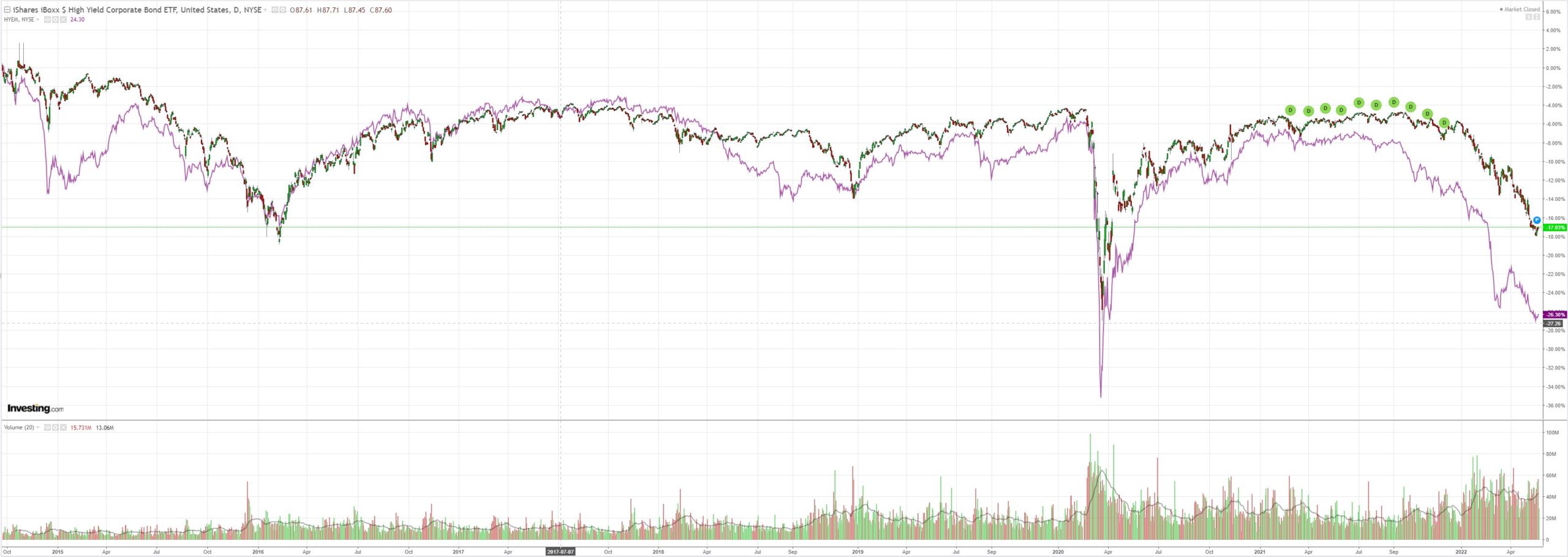

However, it is still not led by credit (NYSE:HYG) which is sign that this is a bear market rally:

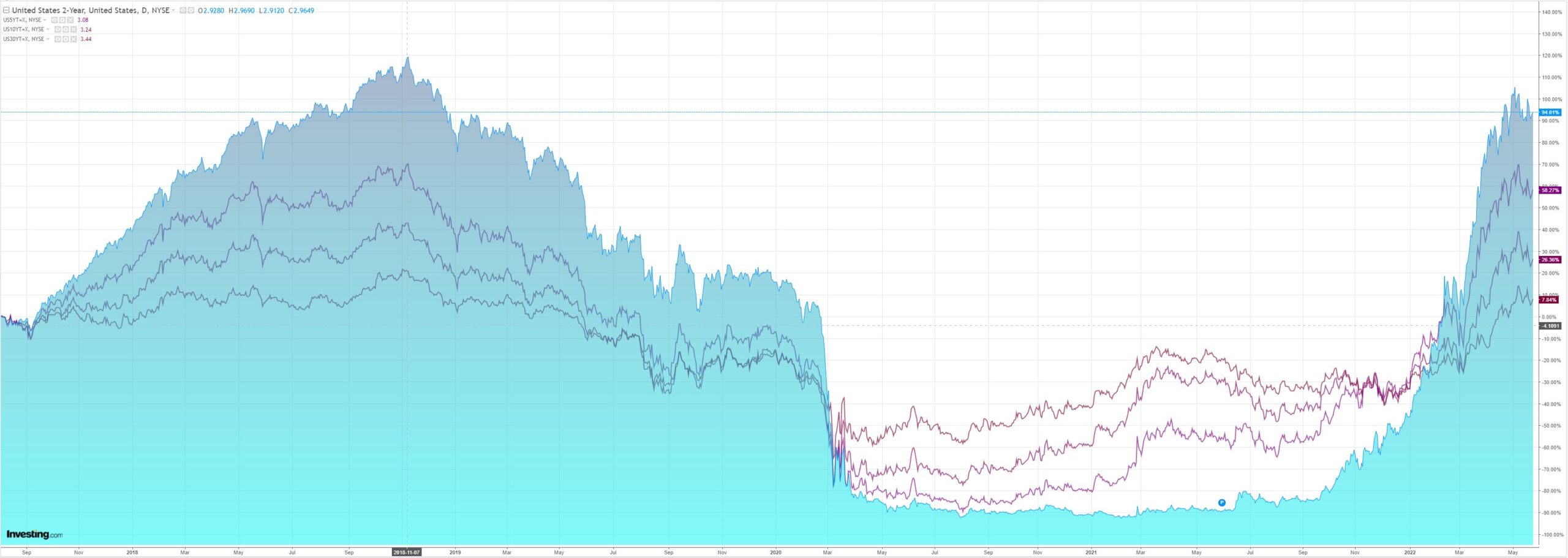

The Treasury curve steepened:

Stocks bounced:

Westpac has the wrap:

Event Wrap

US Chicago Fed national activity survey for April was close to expectations at 0.47 (est. 0.50, prior revised down to 0.36 from 0.44), still indicating above trend growth.

Germany’s IFO survey rose to 93.0 (est. 91.4, prior 91.9), current conditions up to 99.5 (prior 97.3, est. 96.8) while expectations were more sluggish at 86.9 (est. 86.5, prior 86.8). IFO cited resilience within the German economy despite inflation, supply constraints and conflict in the Ukraine, with no visible signs of recession.

ECB President Lagarde was more hawkish than expected, signalling 25bps hikes in July and September and an end to QE. Holzmann referred to price stability being important for social peace, Nagel cited risks of higher wages in 2H’22 in Germany, and Villeroy stressed the importance of containing inflation with policy normalisation.

BoE Gov. Bailey reiterated the need to raise rates, concerned about the cost of living crisis in UK, while insisting that inflation developments were outside the control of BoE.

China’s Premier Li announced 33 measures to support the economy, including doubling targeted funding for SMEs, property sector support, addressing production and supply chain issues, supporting cargo transportation, boosting energy projects, and cutting taxes on items such as vehicles.

US President Biden said he was weighing cutting tariffs on Chinese goods: “I am considering it. We did not impose any of those tariffs. They were imposed by the last administration and they’re under consideration”.

Event Outlook

NZ: Despite more moderate spending in core categories, real retail sales should receive a boost from new vehicle sales in Q1 (Westpac f/c: 2.2%).

Japan: The easing of health restrictions will act as a support to the Nikkei services PMI in May, but weakness in Chinese demand and ongoing supply issues are a concern for the Nikkei manufacturing PMI.

Eur/UK: Rising cost pressures and the ongoing Russia-Ukraine conflict are key risks to European manufacturing and services in the May S&P Global (NYSE:SPGI) PMI report (market f/c: 54.8 and 57.5 respectively). Meanwhile, the UK’s S&P Global PMIs are better positioned to weather these headwinds but a sharp slowdown in activity is still coming (market f/c: 55.0 and 57.0).

US: The May S&P Global PMI report should continue to point to robust momentum across both manufacturing and services although price pressures are still an ongoing risk (market f/c: 57.8 and 55.3 respectively). The challenge of sourcing materials and labour will continue to be highlighted in the May Richmond Fed index (market f/c: 10). Meanwhile, rising mortgage rates are expected to result in a further slowing of new home sales activity in April (market f/c: -1.7%). The FOMC’s George is also due to speak.

Nothing there to change my view. This is still a tactical rally not bottom.

Credit Agricole (EPA:CAGR) welcomes Albo with a weak AUD:

With a bit over 70% of the vote counted, the Australian Labor Party (ALP) will either form a minority government or govern outright in Australia. The ALP currently holds 71 seats, which is 5 short of the majority needed to form a government outright. Five cross-bench MPs have already offered the ALP support on supply and confidence motions, however, so there is little political uncertainty to hold back the AUD even in the event of a hung parliament. Historically, AUD/USD has traded below its short-term fundamentals when the ALP has won a government the week and month after the election, however. In the current environment, we believe this will translate into the AUD underperforming fellow risk-correlated currencies such as the NZD; the AUD/NZD cross has traded lower in the Asian session. It is also important to note a record low number of primary votes went to the two major parties/coalitions – the ALP and the Liberal-National party (LNP) coalition. Instead, the Green Party and independent candidates picked up over one-third of the vote. The “teal” independents did especially well and decimated the Liberal Party in many of its former strongholds. Even former Treasurer Josh Frydenberg lost his seat to a teal independent. Teal independents are backed by the Climate 200 fund and have climate action, anti-corruption and pro-women policies as their main platforms. The big swing in the electorate towards addressing climate change has the leaders of Australia’s big carbon-intensive, export-oriented energy and mining companies queuing up to ask new PM Anthony Albanese for details on his plans to address climate change. As for the now, the opposition Liberal Party, decimated by the teal independents, it is in for a period of self-examination that will be critical in defining Australia’s political landscape going forward.

All irrelevant. It’s global forces right now and, notwithstanding this tactical turn, one more leg lower for AUD is still my base case.