DXY is consolidating after its big fall:

AUD is afire:

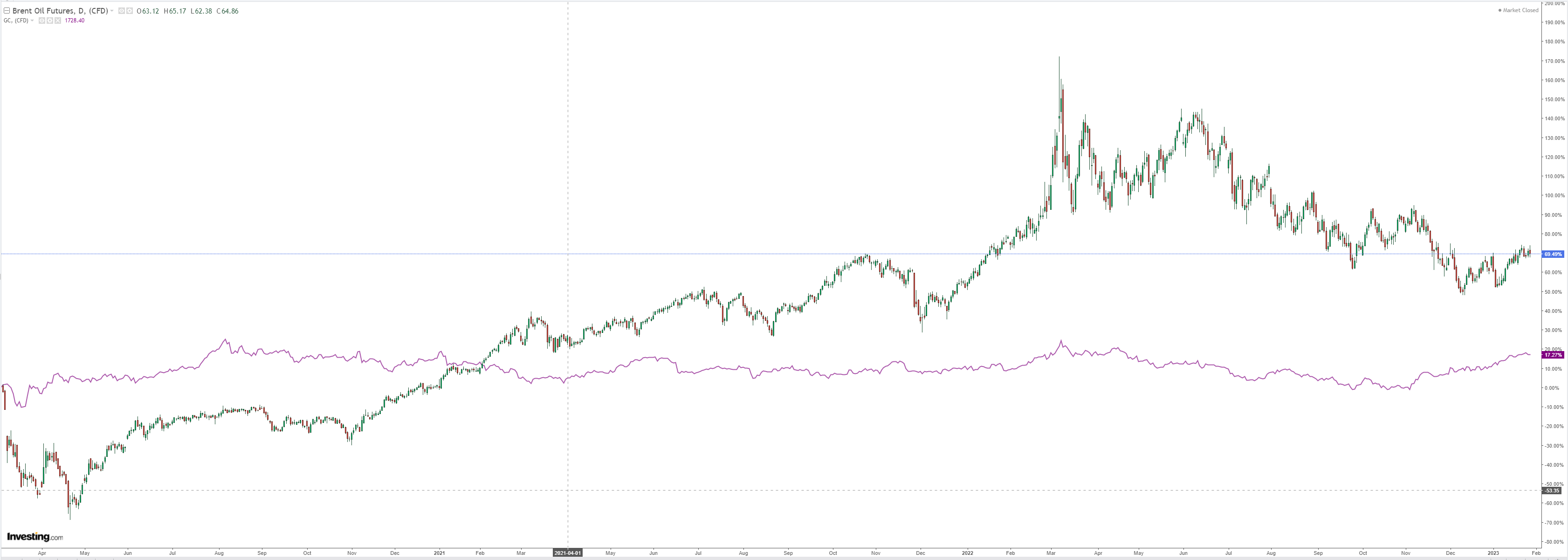

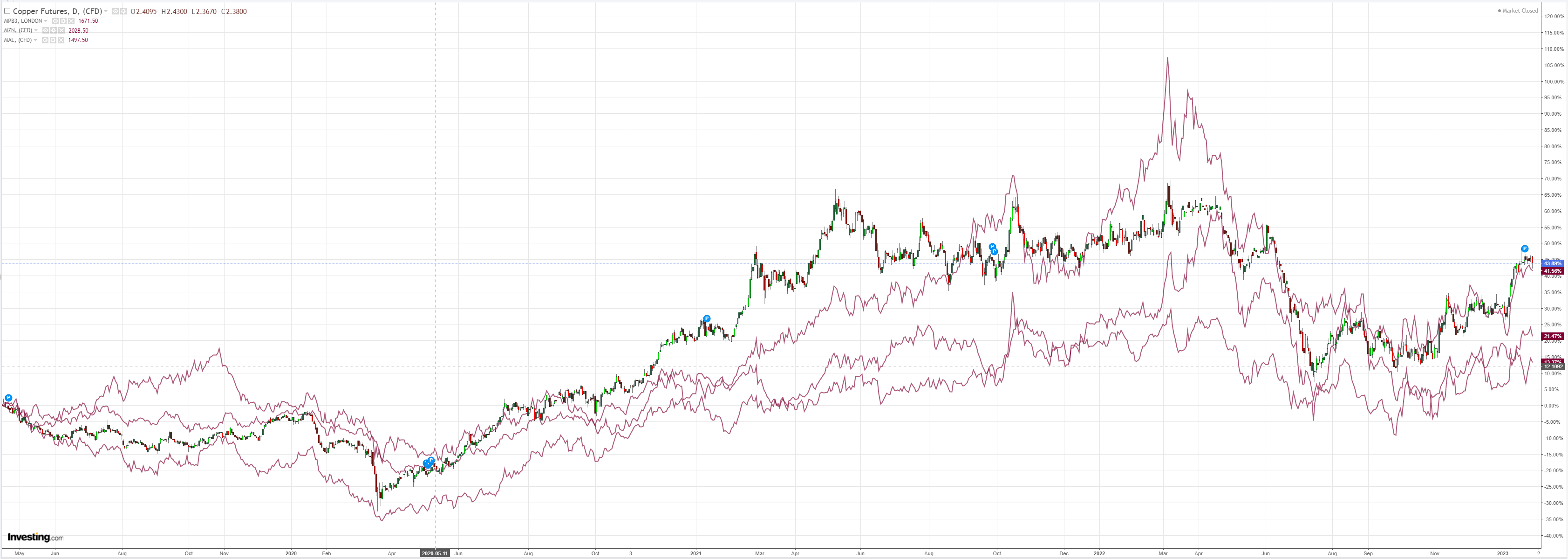

Base metals are looing for China confirmation:

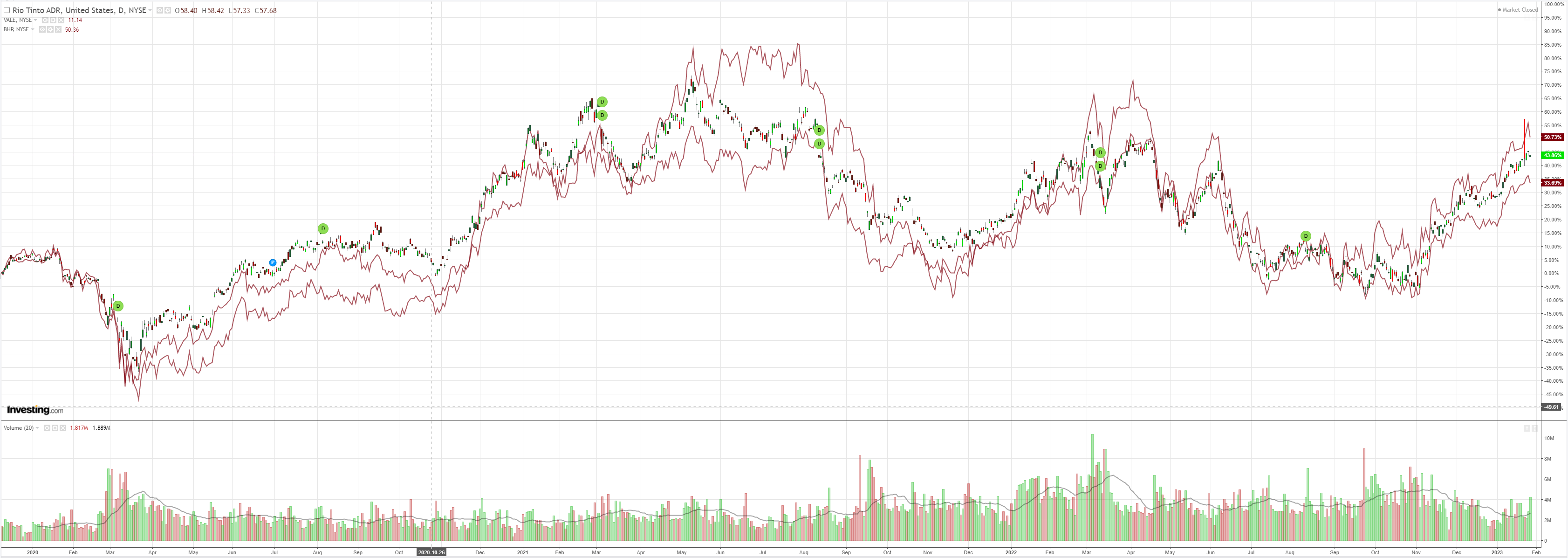

Big miners (ASX:RIO) dropped:

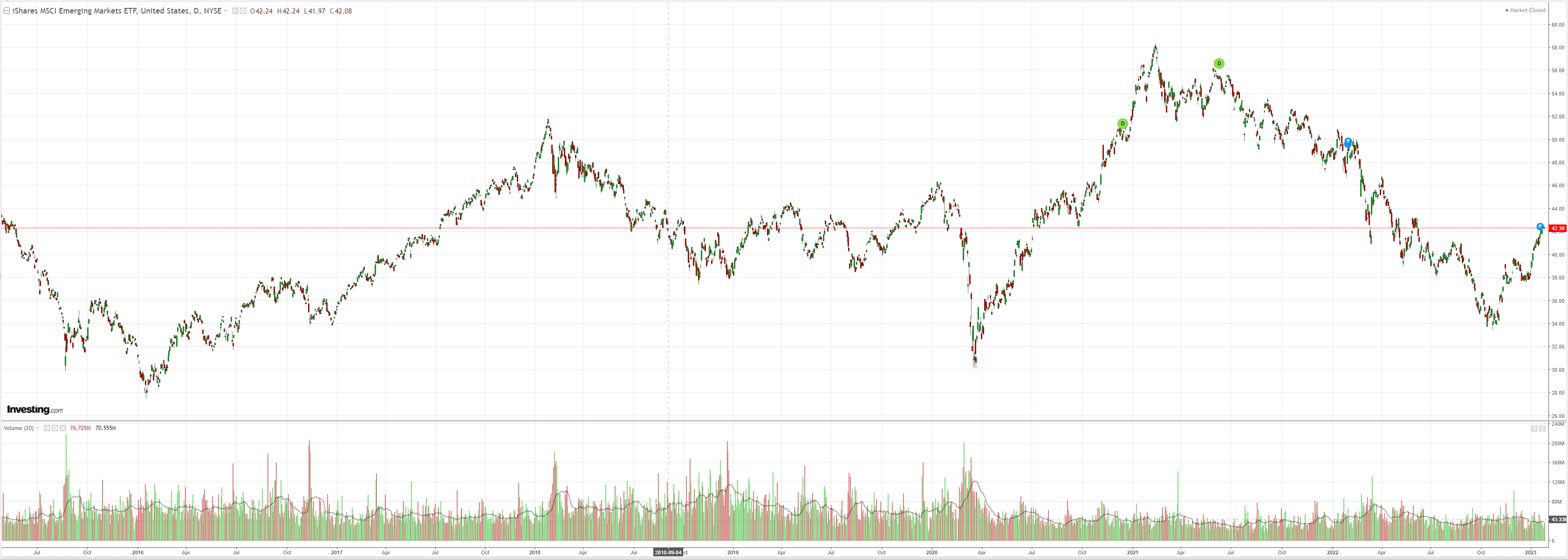

EM stocks (NYSE:EEM) will reopen into the return of China this week:

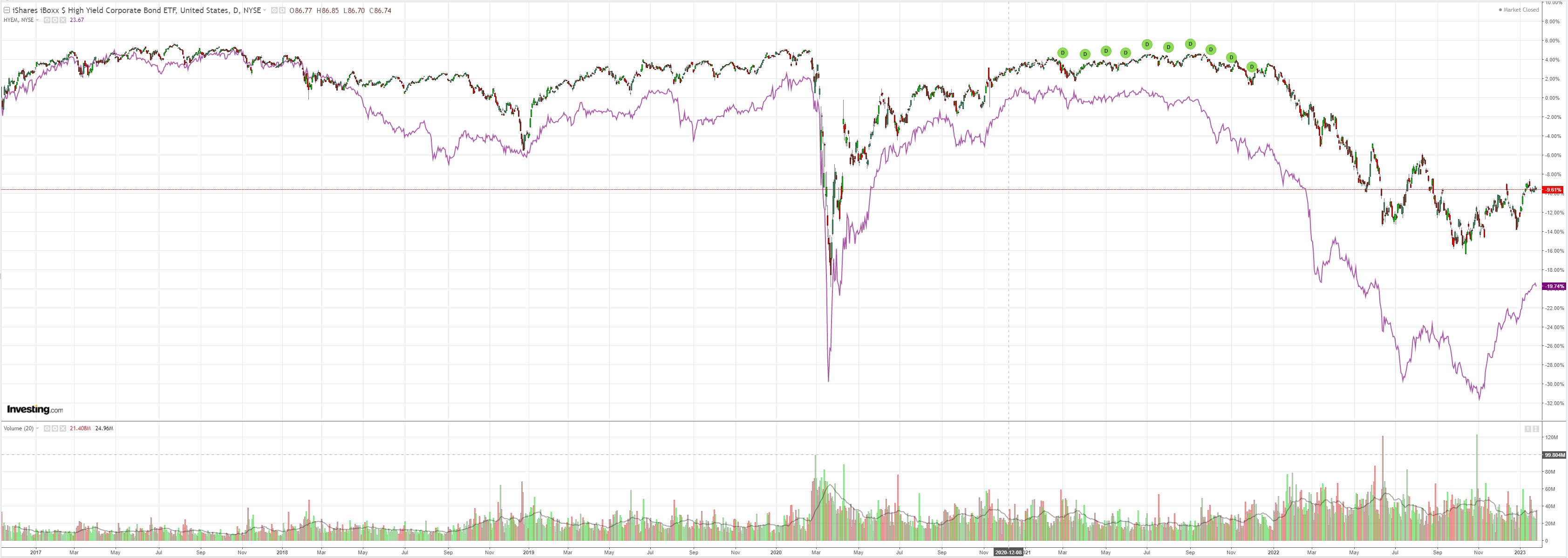

Junk (NYSE:HYG) faded:

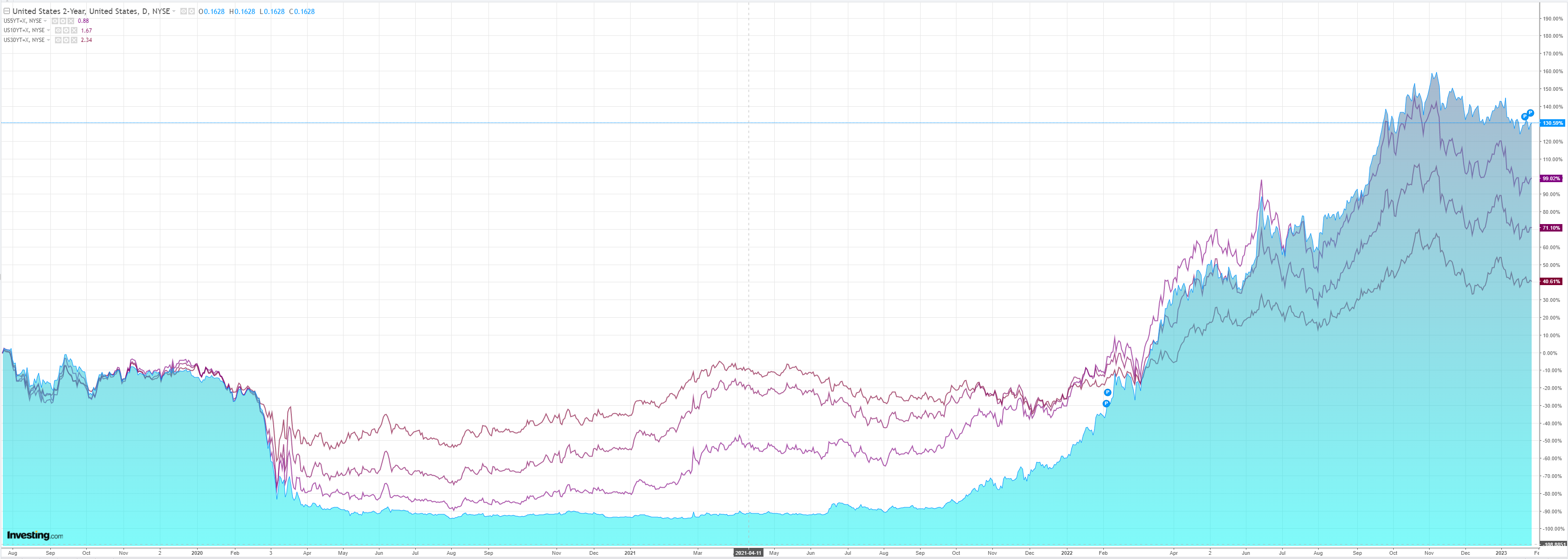

US yields have quietly rebounded:

Stocks are full of hope despite poor earnings:

Credit Agricole (EPA:CAGR) outlines the week ahead:

The USD seems to be in a terminal decline ahead of next week’s FOMC meeting, which many FX investors seem to think could signal the beginning of the end of the central bank’s current tightening cycle. In particular, markets are expecting the pace of Fed hikes to slow to a 25bp crawl while Fed Chair Jerome Powell may also express confidence that the monetary tightening delivered in recent months is already having the desired effect of cooling down the US economy. As a result, the USD has become one of the worst performers in G10 FX ahead of the meeting.

The above being said, while we expect a policy downshift at the Fed’s next meeting, we think that the FOMC will stick with its commitment to bring inflation under control, potentially at the expense of tipping the US economy into a recession. We also think that the US data next week could confirm that the US labour market in particular remains quite tight and continues to fuel wage inflation. In turn, this could encourage FX investors to take profit on some of their stretched short-USD positions.

Also next week, the ECB is expected to deliver on its promise to hike by 50bp and ‘signal’ another significant hike at its March meeting. Indeed, the improvement in the Eurozone activity data in recent months has corroborated the central bank’s view that a recession could be avoided and added credibility to its hawkish policy stance. That said, with

inflation peaking and some downside risks to growth remaining, the ECB seems less likely to exceed the already hawkish market expectations and thus offer FX investors more incentives to buy the EUR.

We also believe that the BoE will deliver another ‘dovish hike’ as the MPC remains divided on the need for additional aggressive tightening. As part of its updated economic projections, the central bank could paint a less negative economic outlook than in November but should continue to see inflation falling in the coming quarters given the still-high market rate hike expectations. The GBP could cede some ground as a result.

Elsewhere, focus will be on retail sales out of Australia as well as PMIs out of Japan and especially China. FX investors will look for early evidence that the Chinese economy is now recovering. In addition, the upcoming OPEC meeting could also support the nascent recovery of oil prices. Evidence that China is recovering as well as further recovery in global commodity prices could make commodity currencies more resilient in the face of a less dovish-than-expected Fed next week.

I can’t see much to pivot the AUD upwards there.

Any move upward in oil from here is going to pose serious problems for the reflation trade and AUD but that will take more time for Chinese data to play out bullishly.

Q4 S&P earnings are about 12% reported and are down a few percent. That should matter sooner or later but it is anybody’s guess when.

The only other factor I can see turning the AUD at some point is the local economy. The further the re-risking trade gets, the more the RBA will hike. Two more 25bps moves will be enough to freeze the stalled economy to the spot.

The AUD is afire but it’s headed for an icy wall of economic recession and buckling yields.