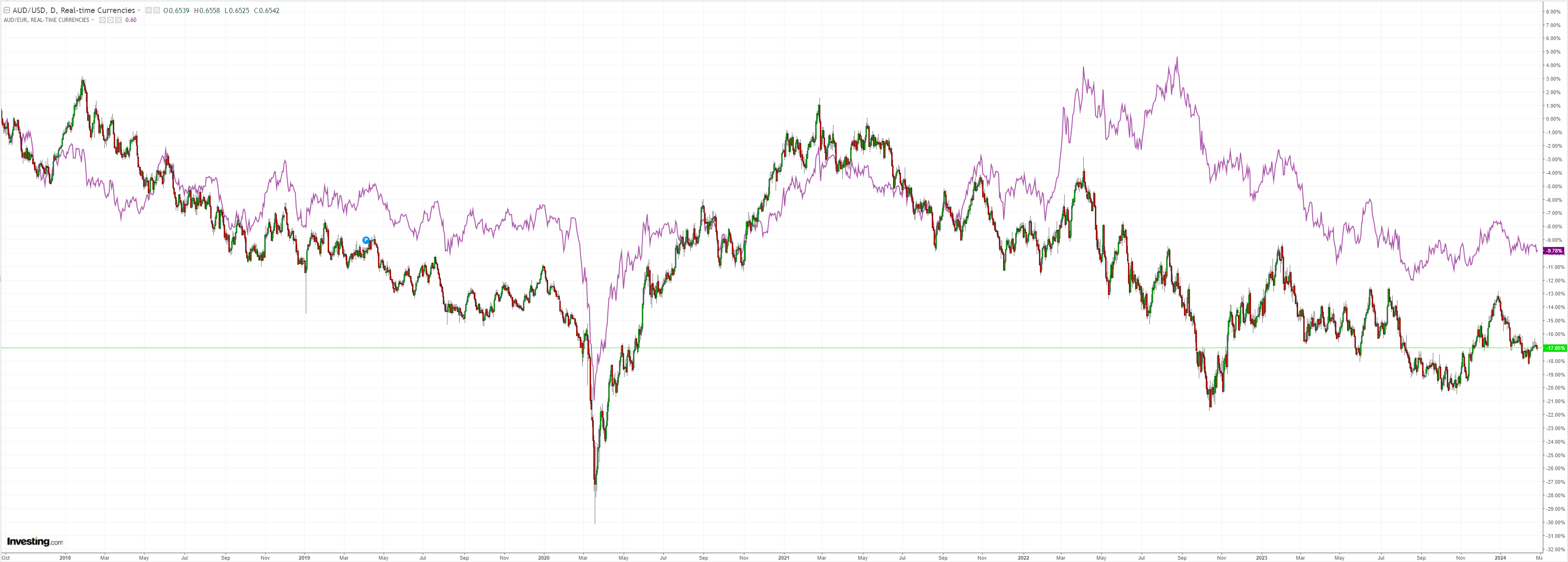

DXY is easing:  AUD is stalled:

AUD is stalled:

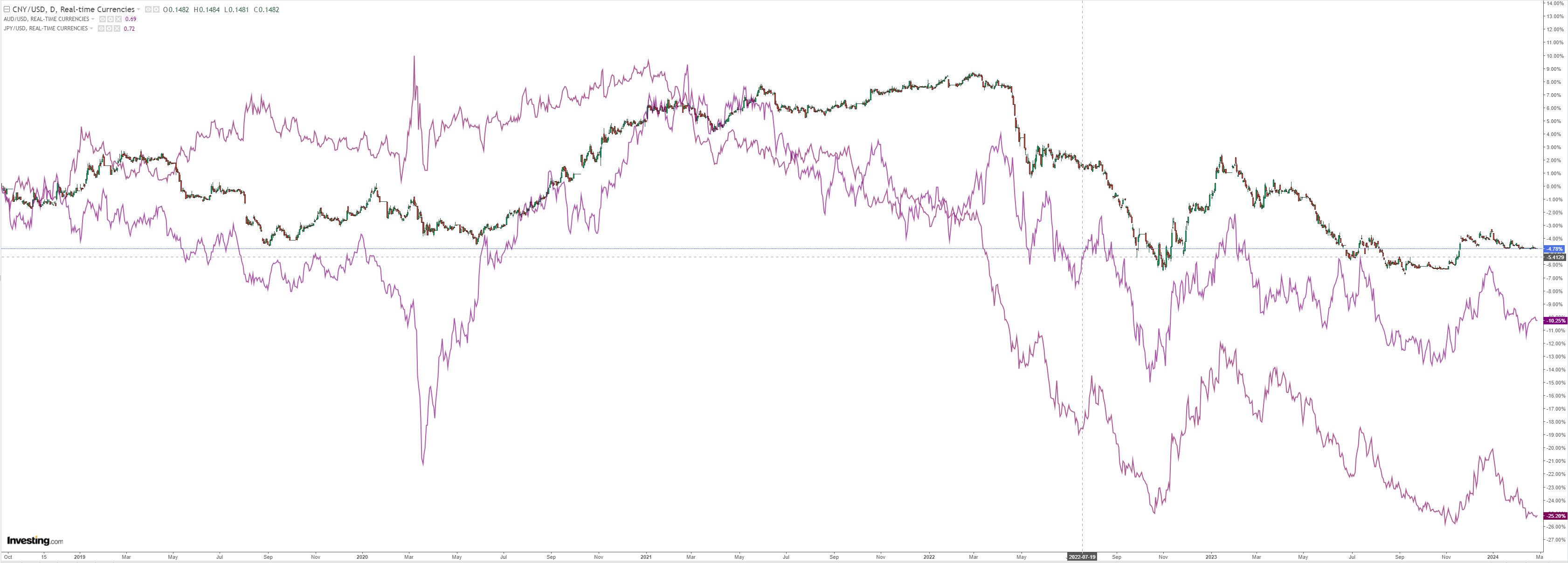

North Asia is a lead weight:

Oil is creeping higher:

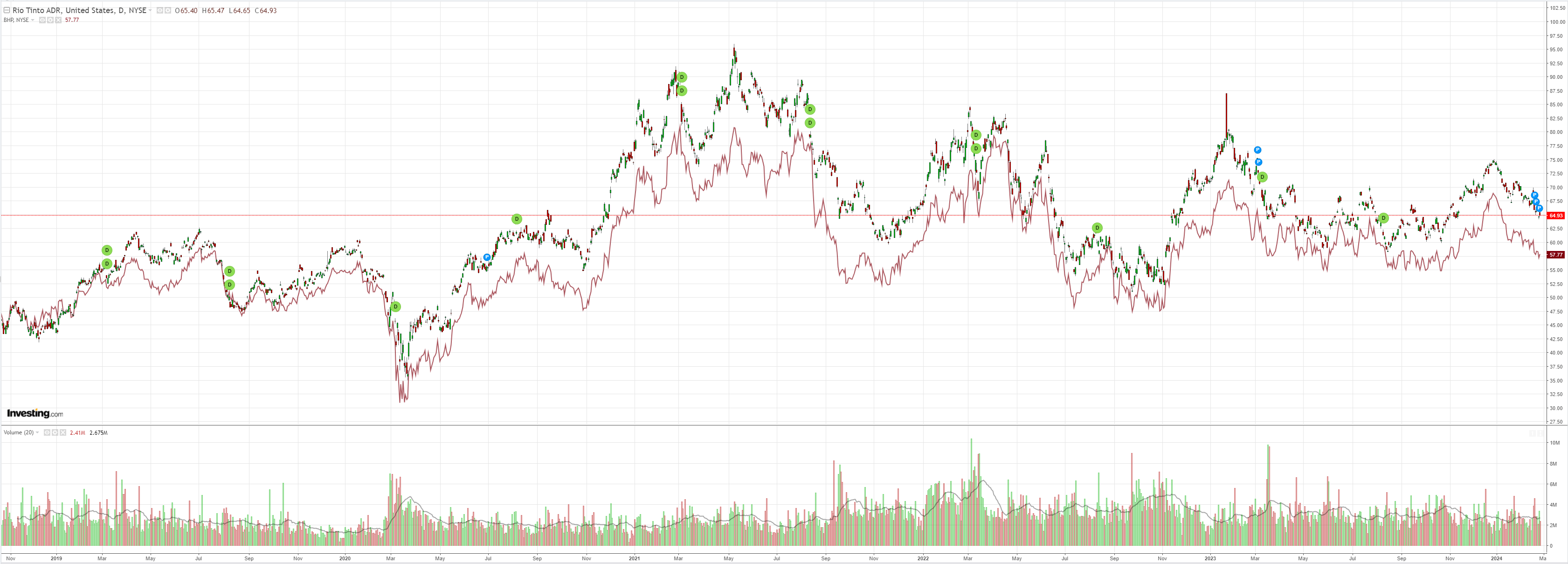

Dirt yawn:

Miners held on:

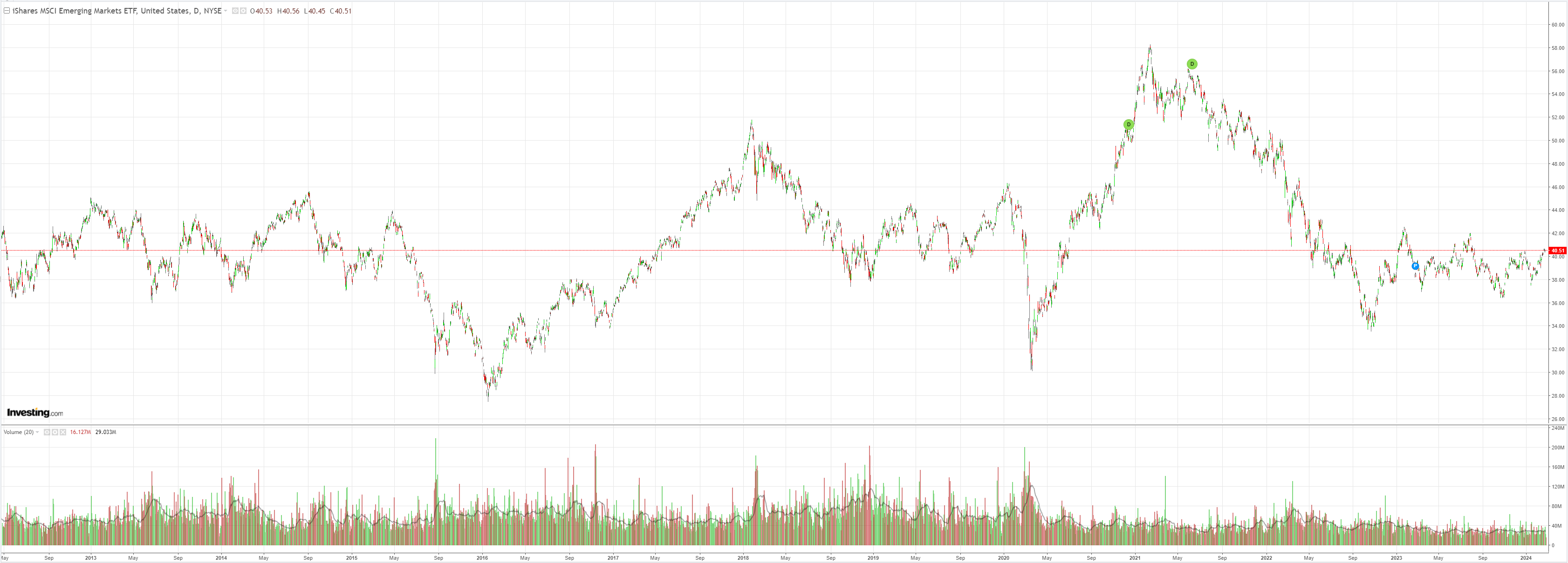

EM yawn:

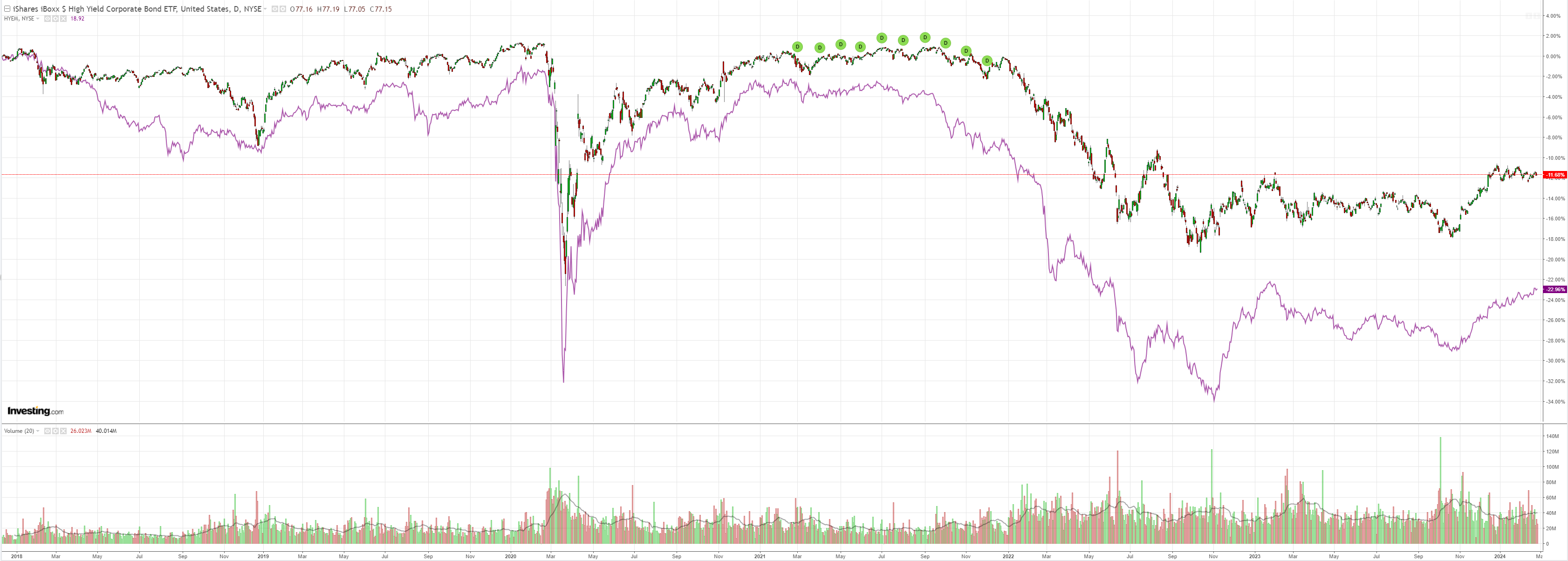

But EM junk is still risk bullish:

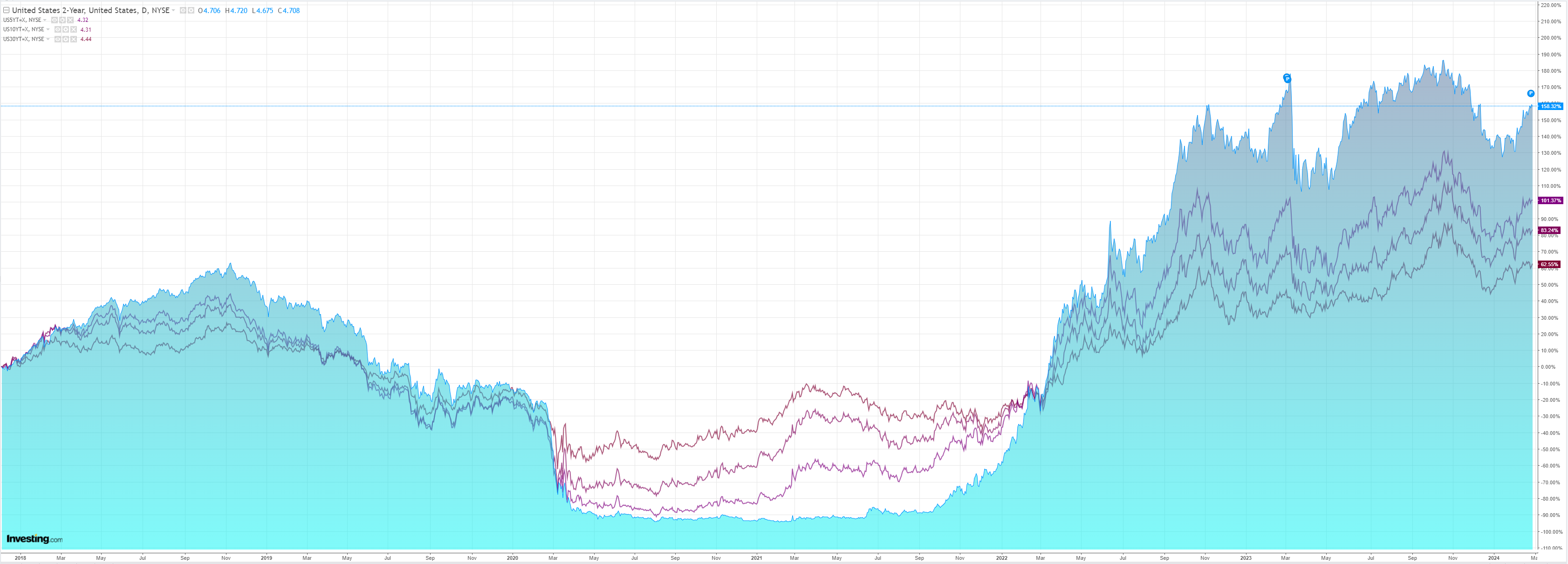

Yields rose:

Stocks firmed:

Not much to report in dataland. Goldman has neat discussion on DXY:

FX has been trapped in a narrow range.

US data have been even stronger than our robust expectations, and both markets and Fed speakers have evolved to acknowledge there appears to be no rush to ease policy.

In our view, the most important and potentially sustainable aspect of this evolution is that Fed officials now seem less convinced that the risks around their dual mandate are becoming evenly balanced.

If that further evolves to a more careful discussion around the neutral rate, we could start to see a similar dynamic to the last cycle where the impact of rate hikes on FX was dampened by a smaller overall hiking cycle.

This time around, that would work in reverse if the Fed couples rate cuts with a mention of a higher neutral rate, which would limit the Dollar’s potential downside.

However, as we have been writing for weeks, we mostly see this as validation of our view that the Dollar’s high valuation is likely to be eroded only slowly, and USD returns will provide a high bar to beat throughout 2024.

And, in the near term, excessive spillovers to global fixed income markets curtail the FX impact in the spot market (with some exceptions for more duration-sensitive currencies like the Yen).

More pronounced FX shifts will require cyclical divergence to translate into policy divergence, which will likely only emerge when policy moves are more imminent.

Although we think the current backdrop is broadly Dollar-supportive, it is not enough to take us away from our baseline expectation of a modestly weaker Dollar over time.

But we see a plausible case for a stronger Dollar in scenarios that are not too far from our baseline, especially when policymakers’ reaction functions are still under review.

I’m not sure I see the need to lift the US neutral rate. The unfolding productivity megaboom in AI, health, energy and transport is more likely to lower it given productive capacity will lift.

But I agree the US is the place to be, and that does not appear to be slipping away any time soon.

Which is a lead weight sitting on AUD.