DXY was up on Friday night:

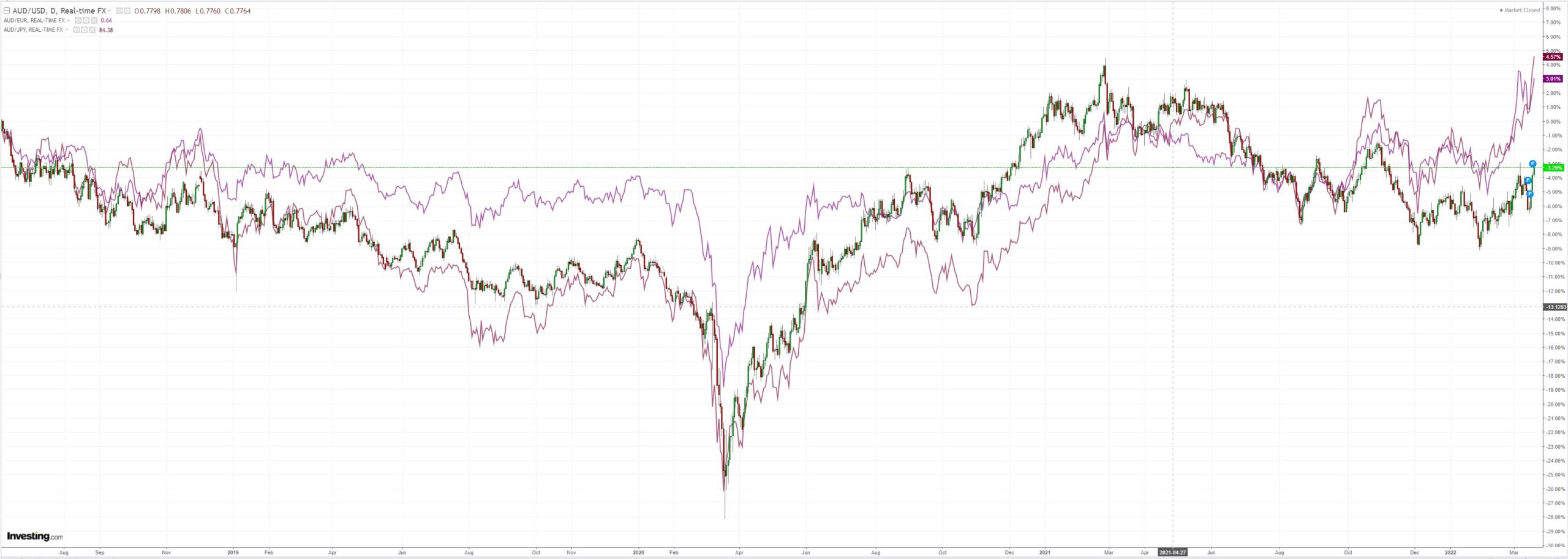

The AUD broke out against the DM universe:

The shorts have puked by half:

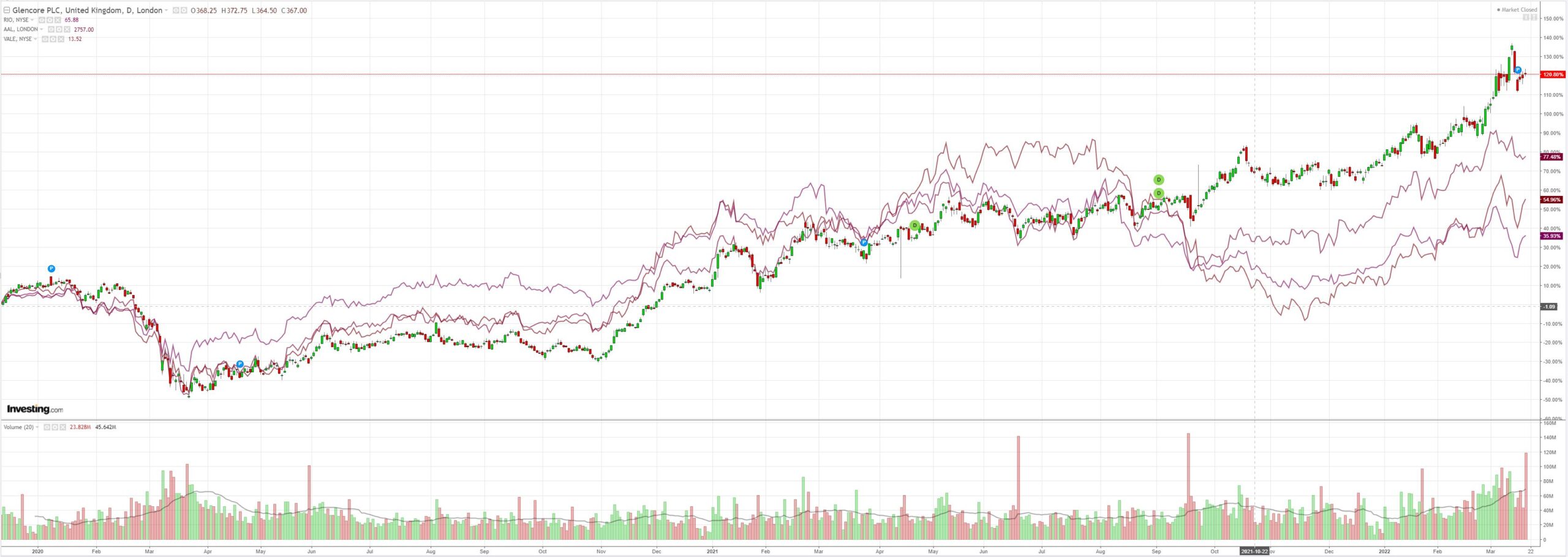

As commodities now set about filling the chart and litteral gap:

EM stocks (NYSE:EEM) spiked:

But, and this is crucial, the rally is not credit-led. On the contrary, EM junk (NYSE:HYG) is still under pressure even if US high yield is enjoying a relief rally. That’s not bullish:

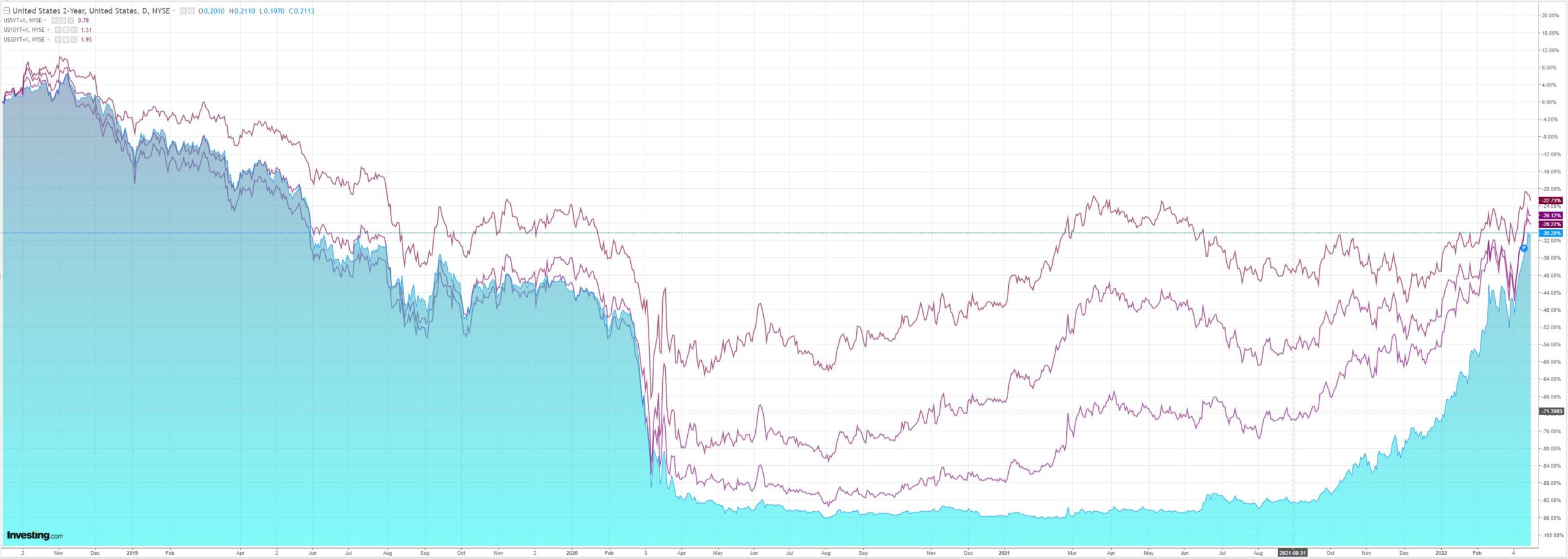

The Treasury curve is still flattening:

Stocks continued the relief rally:

BofA is still bullish DXY:

The Fed has finally acknowledged that the US has an inflation problem, but the market still thinks otherwise. The Dots are now very close to our call for 6 more hikes this year and 4 next year. We still believe that this will not be enough to bring inflation down to the 2 percent inflation target in the next two years. However, the market does not believe the Fed will be able to hike by so much and still expects it to eventually meet the inflation target. The market still believes inflation is transitory and that aggressive tightening will be a policy mistake. In the meantime, the war in Ukraine continues. Headlines on progress in the peace talks have been contradictory. With the war now moving to Kyiv, we are entering the most crucial stage, with both sides having a lot to lose. Despite the market taking a positive turn on optimistic views that the war will not spread, the sanctions will not escalate further and a peace deal is approaching, the battle in Kyiv could still test red lines. We have closed our short EURJPY trade after hitting our reduced stop loss of 127 during the recent market rally. Despite the recent EURUSD rebound we still believe the short term risks are to the downside. Inflation is higher in the US than in the Eurozone. To a large extent, inflation in the US reflects overheating, while inflation in the Eurozone reflects negative supply shocks. The Fed has just started tightening, while we expect the ECB to be cautious as long as the war continues. Uncertainty from the war and high energy prices are much more negative for the Eurozone than for the US. Our EURUSD forecasts for 2022 is 1.05.

In normal circumstances that would sink the AUD. But these times are not normal. Expect the AUD to keep fighting the rising DXY so long as the war outpaces market fears of the tightening Fed. Only once demand destruction from higher interest rates and commodity prices is sufficient will the AUD plummet into what is now an odd-on end-of-cycle shock.

In short, sell the AUD rips.