DXY finished the year with a pop:

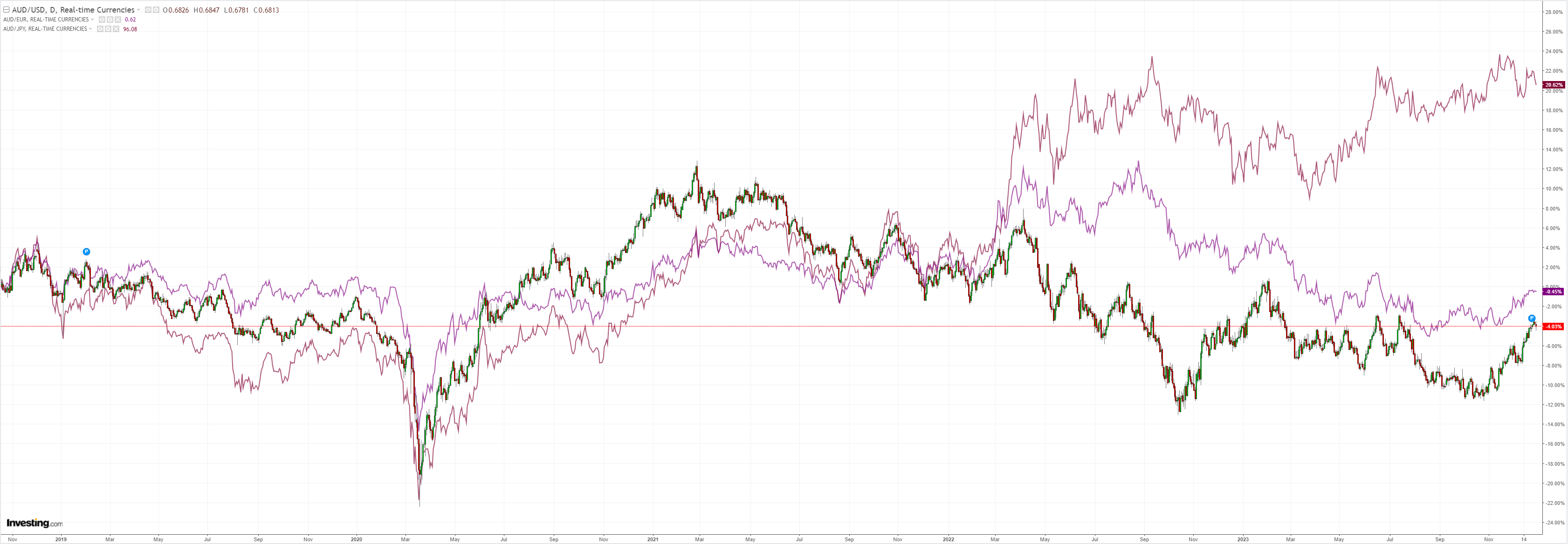

AUD with a drop:

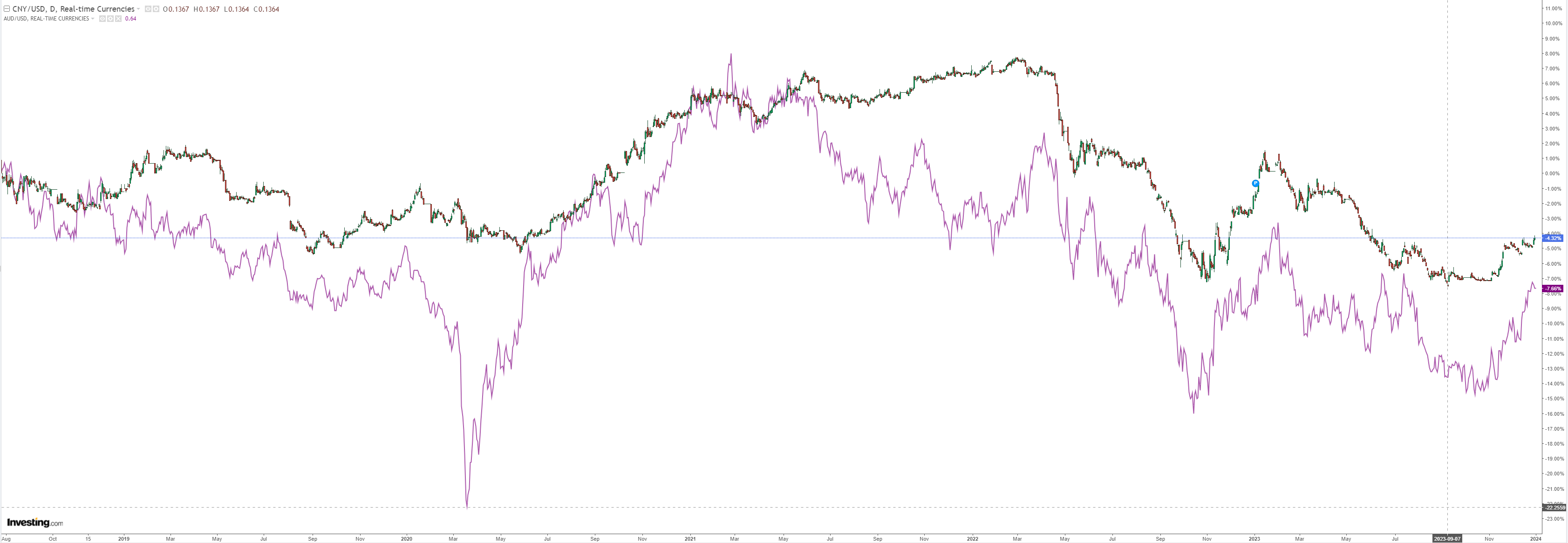

CNY is trying:

Bears still love AUD:

Oil puke:

Dirt is soiling the soft landing:

I’m going to short big miners:

EM dead:

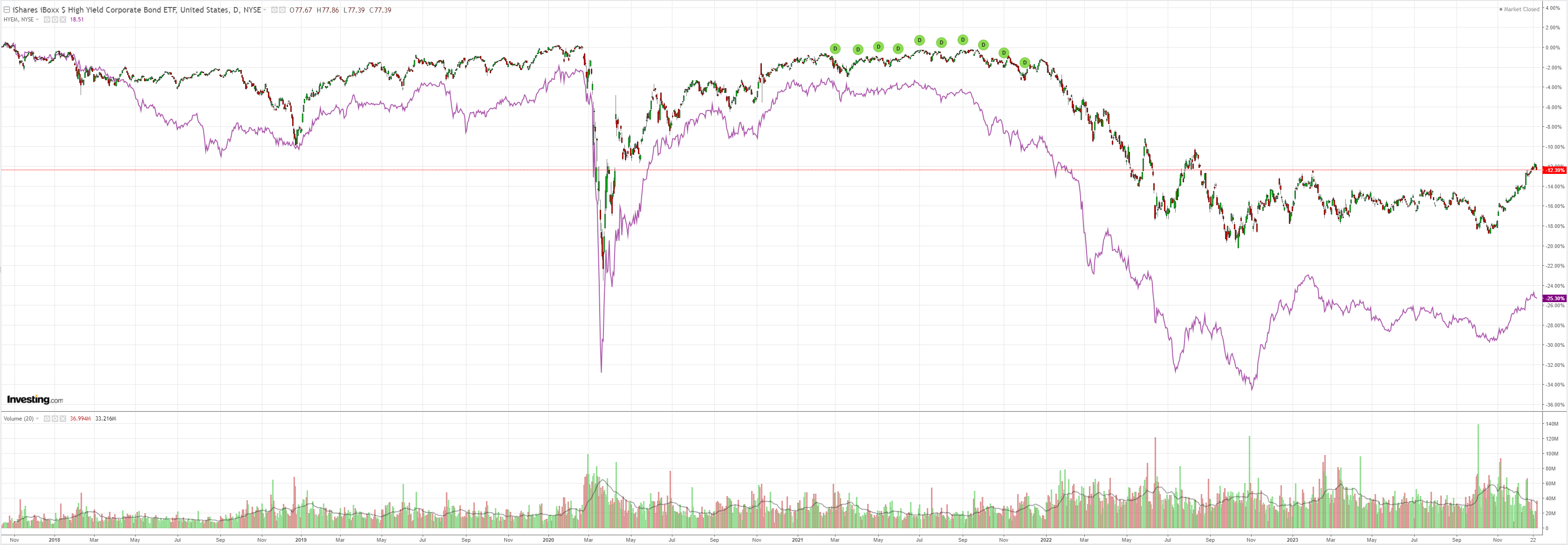

Junk needs to keep running:

Yields have heaps of room to fall:

Stocks are tired:

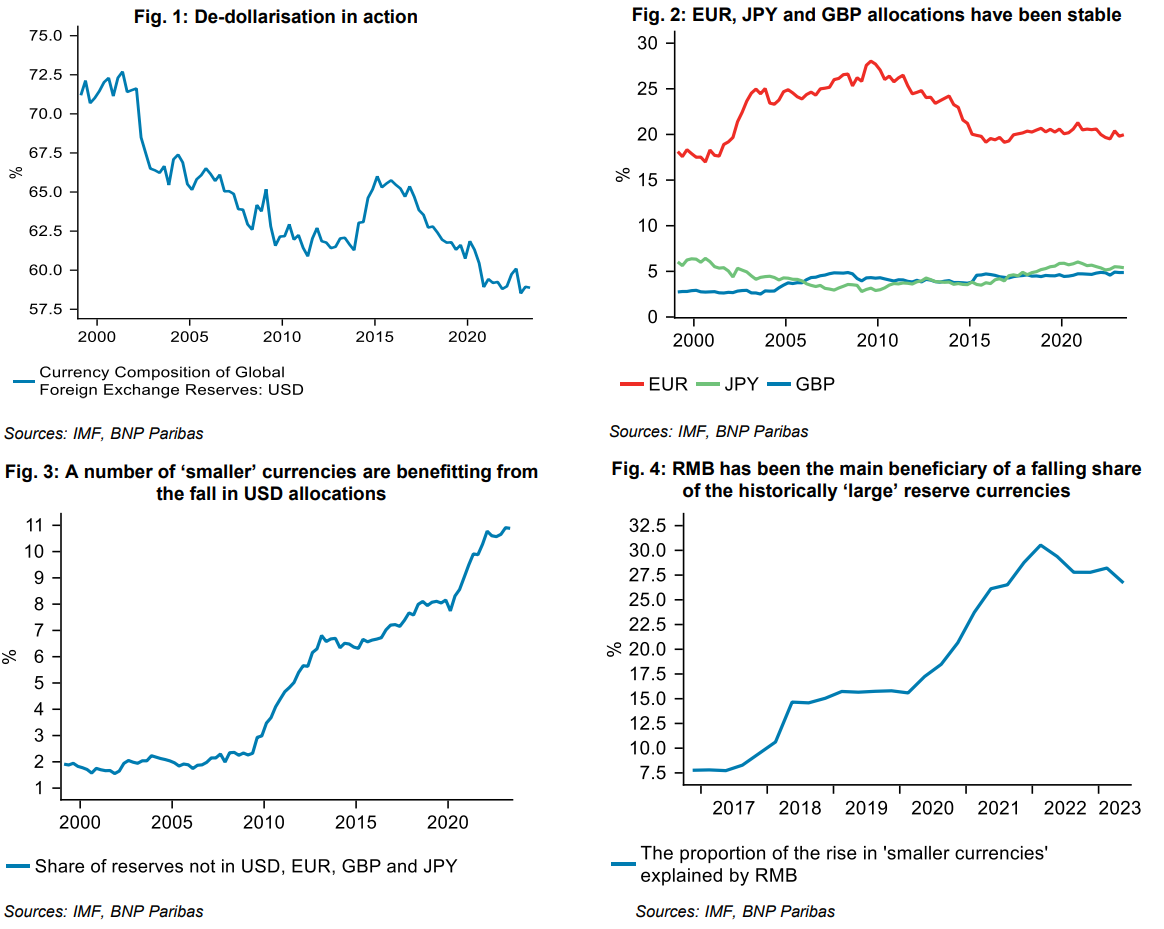

One of the forex megatrends that will accelerate in 2024 is de-dollariation. Not that I think of it as any threat to DXY but at the margins it will matter.

The USD’s share of global foreign currency reserves has fallen from above 70% in 2000 to below 60%, according to the International Monetary Fund’s Currency Composition of Official Foreign Exchange Reserves data (IMF COFER, see Figure 1).

Through this prism, de-dollarisation is already evident to some extent in official institutions’ reserve allocations.

Understanding the drivers of this adjustment is key to assessing the degree to which it might continue and, if so, which currencies stand to benefit.

So who has been benefitting from reserve managers reducing the percentage share allocations to USD? Not the traditional currencies: shares in the EUR, GBP and JPY have remained broadly stable over the same period (Figure 2). This means therefore that a range of smaller currencies – those other than the ‘big four’ – have benefitted (Figure 3).

The RMB, not surprisingly, has benefitted most within this group, accounting for about one-quarter of the rise.

Significantly, however, allocations to the RMB remain small at just 3% and have stopped increasing over the past year (Figure 4), reflecting a tempering after the initial allocations following the RMB’s inclusion in the IMF’s special drawing rights (SDR).

Data also suggest that holdings are concentrated in a few reserve managers (for example, Russia), which may now have little room to add more RMB.

The real story here is the failure to launch CNY. Any thought that it might substitute DXY as global reserve does not pass the laugh test as global capital boycotts Beijing.

That also helps explain the AUD not benefitting much from de-dollarisation. It has become a proxy for Chinese failure.

I expect this role to cap the AUD gains in 2024 and beyond.