DXY is fading as hopes bloom of a Fed pause:

CNY is not really confirming it:

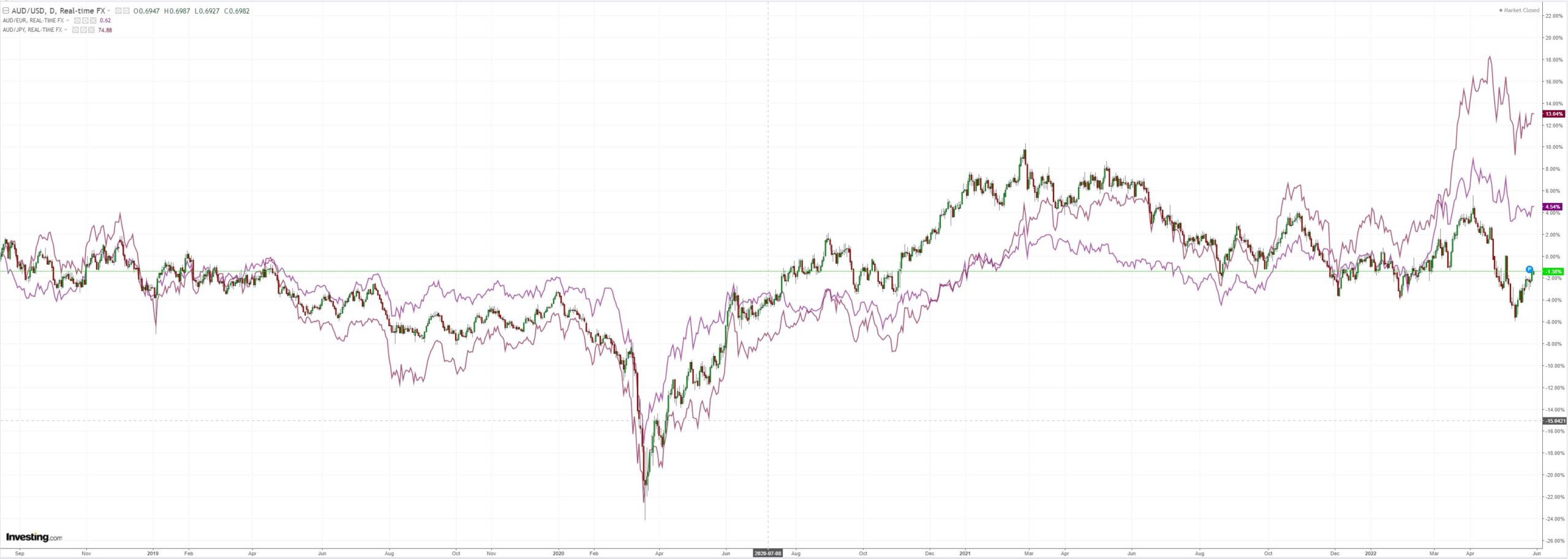

AUD is:

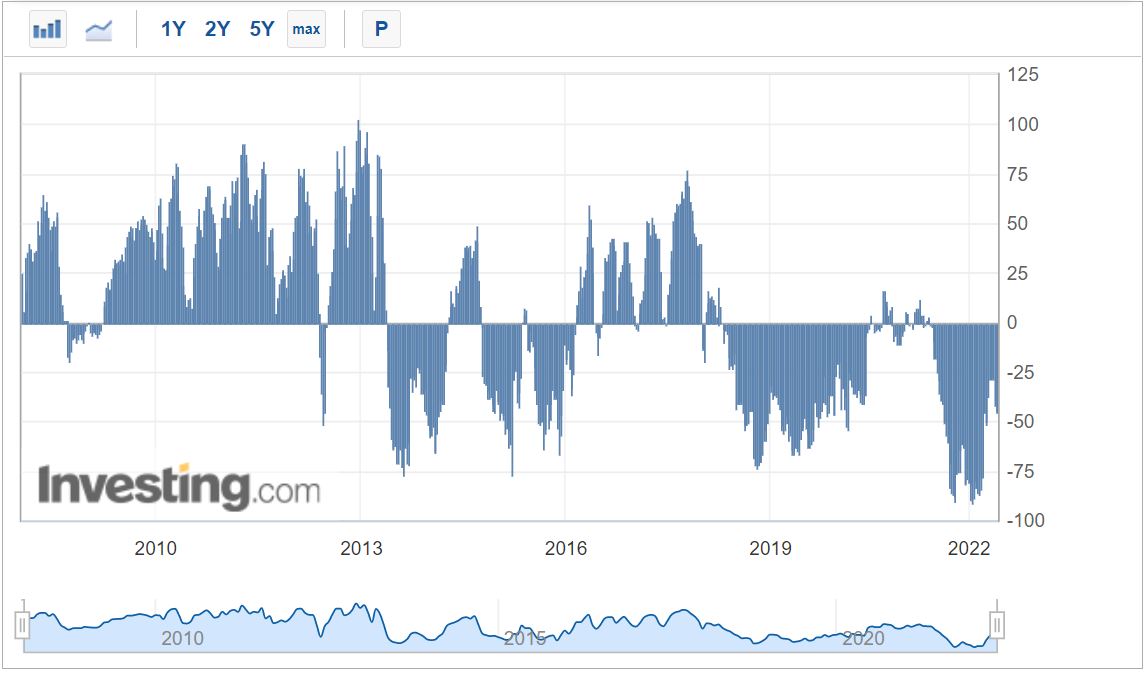

The AUD short remains moderate:

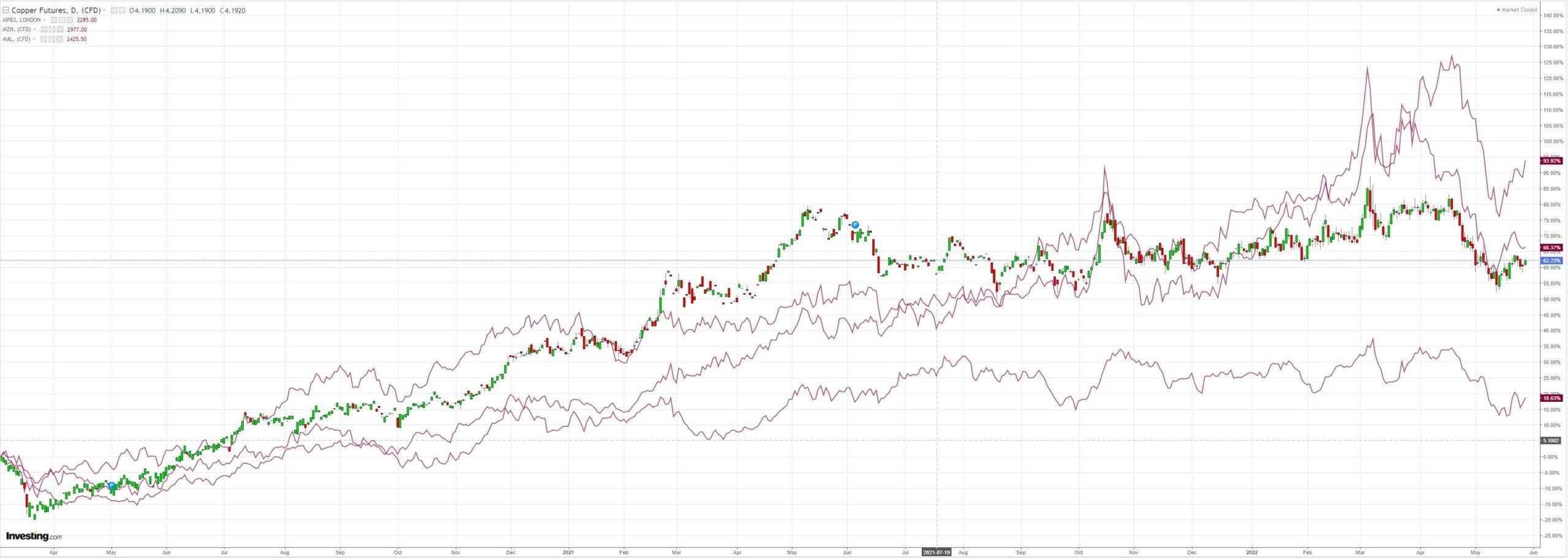

But everybody has a very big problem in Oil. If the Fed pauses now, this is going straight to $150:

It will drag all commodities higher with on the stagflation bid:

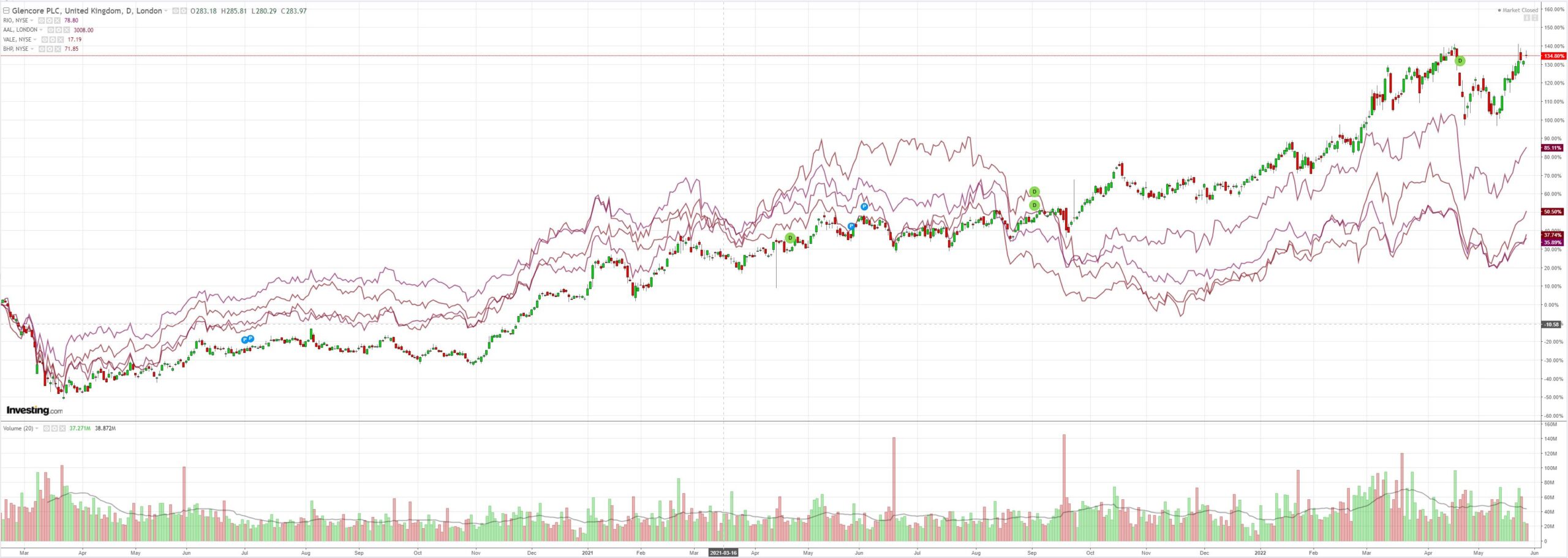

Miners (LON:GLEN) are back:

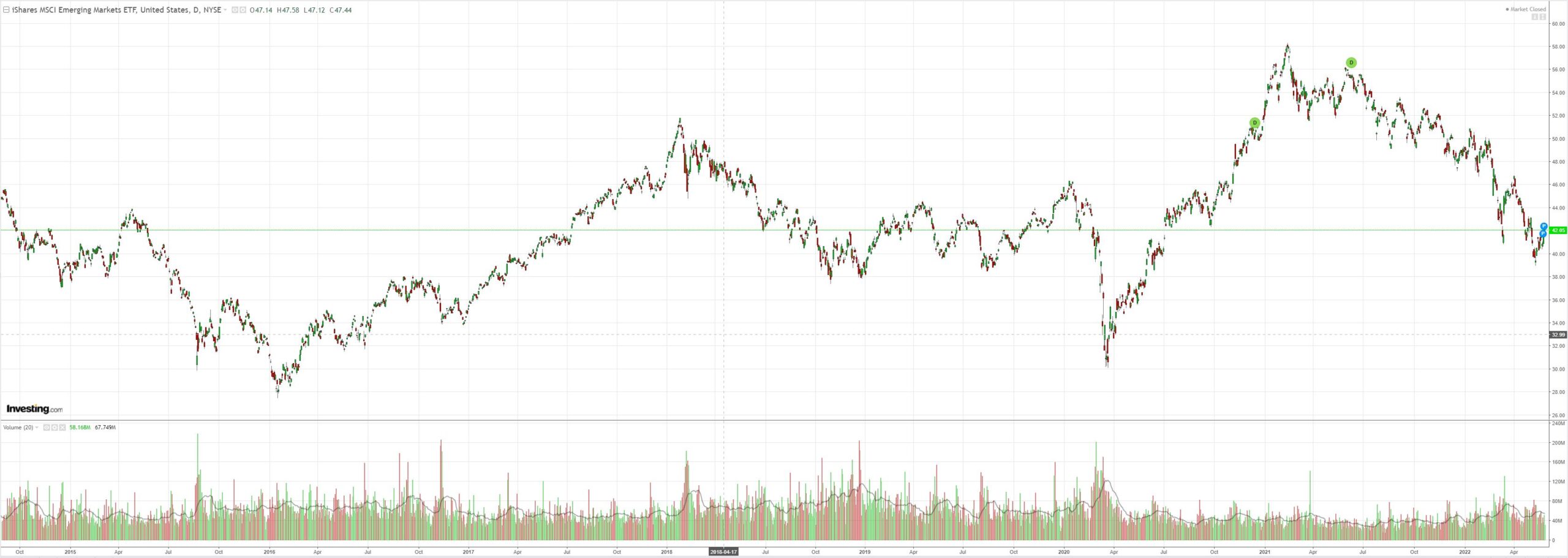

EM stocks (NYSE:EEM) not so much:

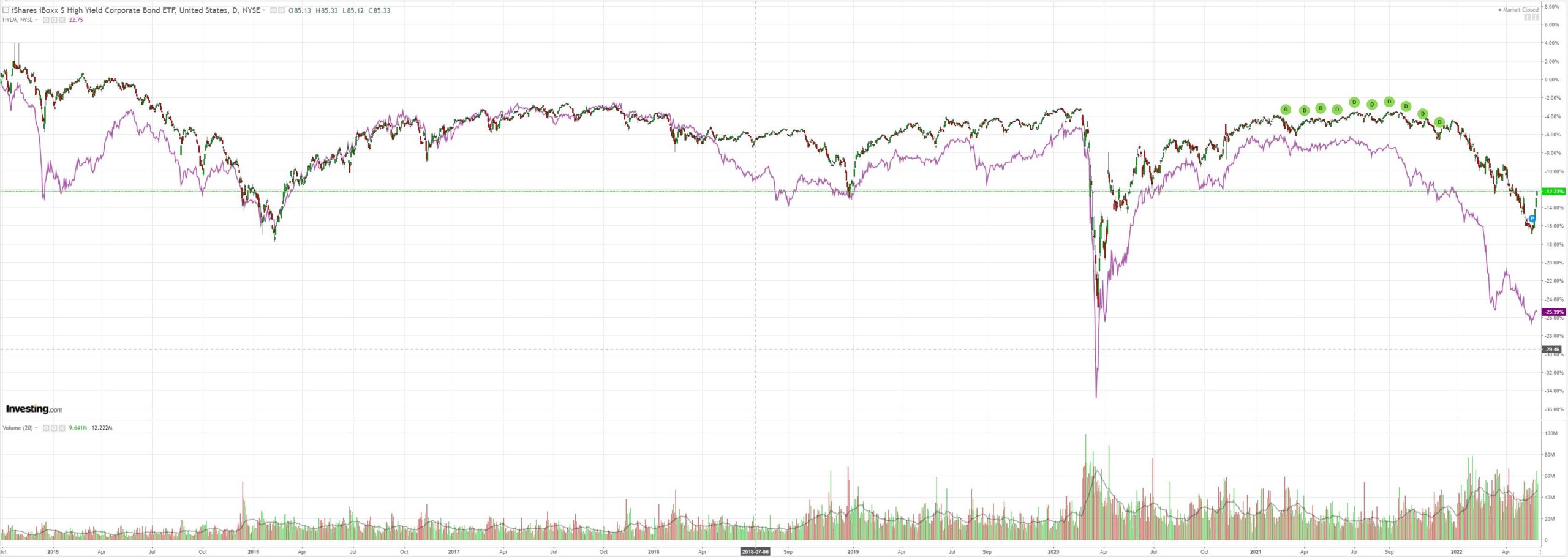

US junk (NYSE:HYG) is having a party. EM not:

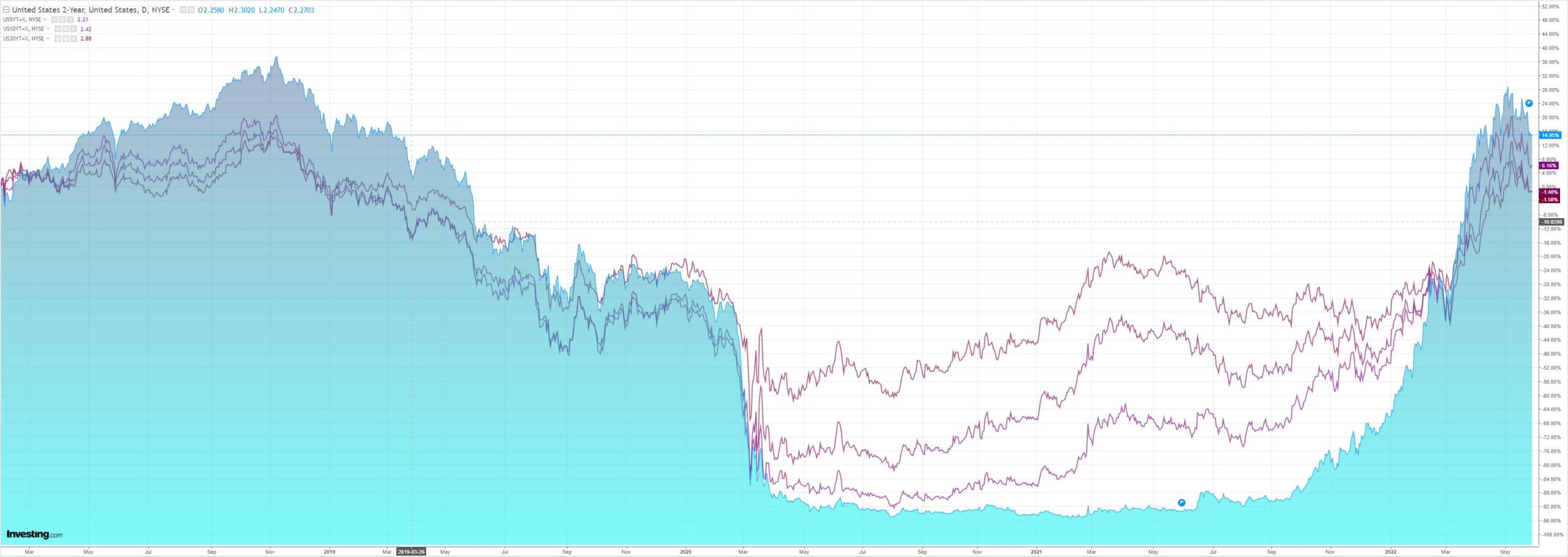

Yields are bid but for how long as oil wrecks everything?

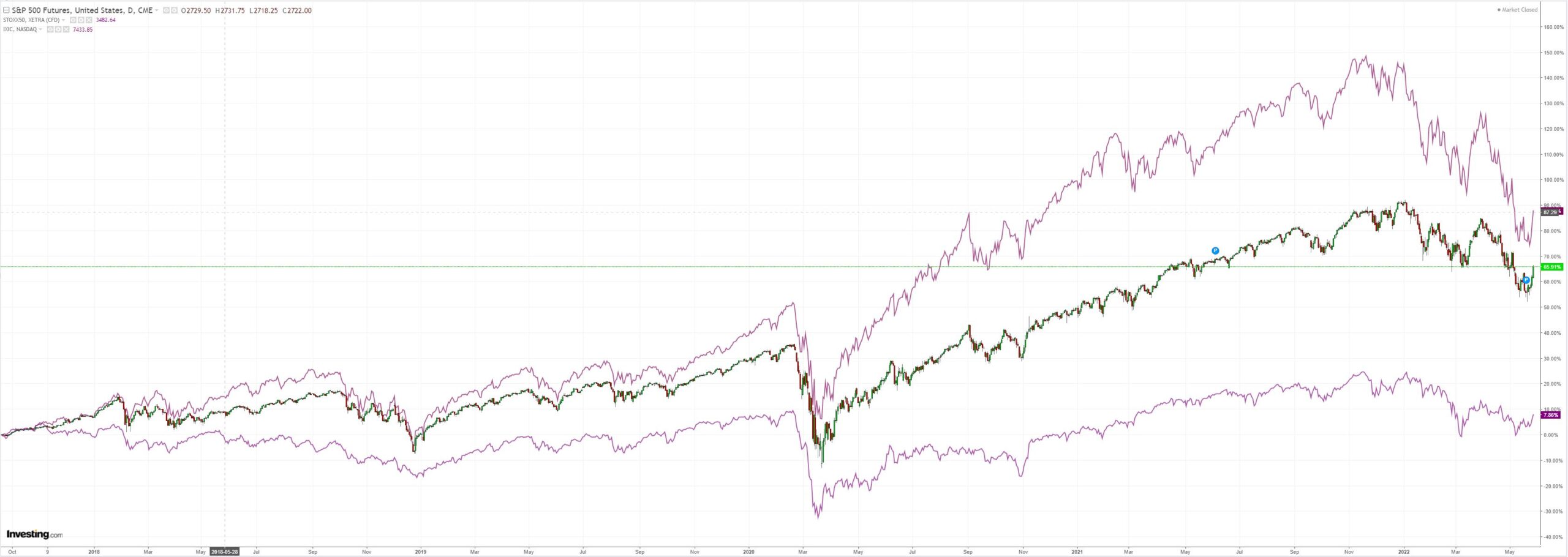

Stocks pumped up the reflation:

Westpac with the wrap:

Event Wrap

US personal income in April rose 0.4%m/m (est. +0.5%m/m), personal spending +0.9%m/m (est. +0.8%m/m, prior revised higher to +1.4%m/m from +1.1%m/m). The PCE deflator was firmer than expected at +6.3%y/y (est. +6.2%, prior +6.6%y/y), while core was in line at 4.9%y/y (prior 5.2%y/y).

University of Michigan consumer sentiment was finalised at 58.4, lower than its preliminary reading of 59.1 which was already the lowest since 2011. Current conditions were marked down to 63.3 from 63.6 (prior 69.4) and expectations to 55.2 from 56.3 (prior 62.5). 1yr-ahead inflation expectation pulled back to 5.3% from the preliminary 5.4% (prior 5.4%), with 5-10yr-ahead unchanged at 3.0%. Once again, inflation concerns were the main downside drivers, especially in middle income groups.

Event Outlook

Eur: Russia’s invasion of Ukraine will continue to weigh on European economic confidence in May (market f/c: 104.9) with elevated prices being the chief culprit to materially weak consumer confidence.

US: Markets will be closed for Memorial Day and the FOMC’s Waller will discuss the economic outlook.

The FOMC is facing a choice of nightmares. The US economy is slowing and global supply chains are loosening fast. There’s goods deflation coming to join falling asset prices and it is going to want to pause before too long.

But it can’t. Oil and the commodities complex is making it abundantly clear that any attempt to stop tightening will immediately result in another round of massive commodity inflation thanks to the Ukraine war, and recovery in China (such as it is). That will reverse yields higher while delivering demand destruction on a scale we have not yet seen.

The Fed’s choice now is:

- To ease up and deliver a stagflationary shock that smashes living standards followed by more rate hikes and a huge recession.

- To persist with tightening until the commodity complex crashes in an earlier recession. To my mind, it should choose the latter because it has to crush the inflationary expectations that have taken hold in commodity markets. To not do so will be to deliver a failure on both of its mandates of employment and inflation.

Whichever one it chooses will send the AUD in diametrically opposite directions – to 60 cents or 80 cents.

Place your bets!