DXY was up overnight and looks set to break out. EUR fell:

AUD was crushed to new lows but rebounded:

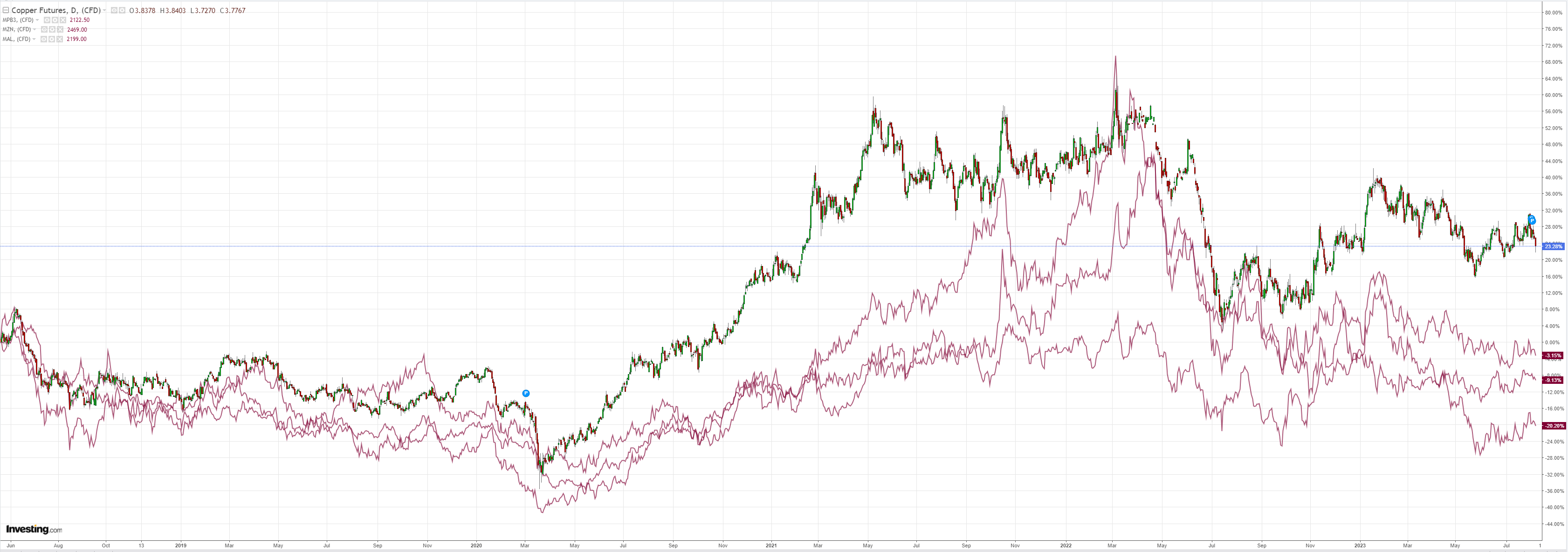

Goodbye, dirt:

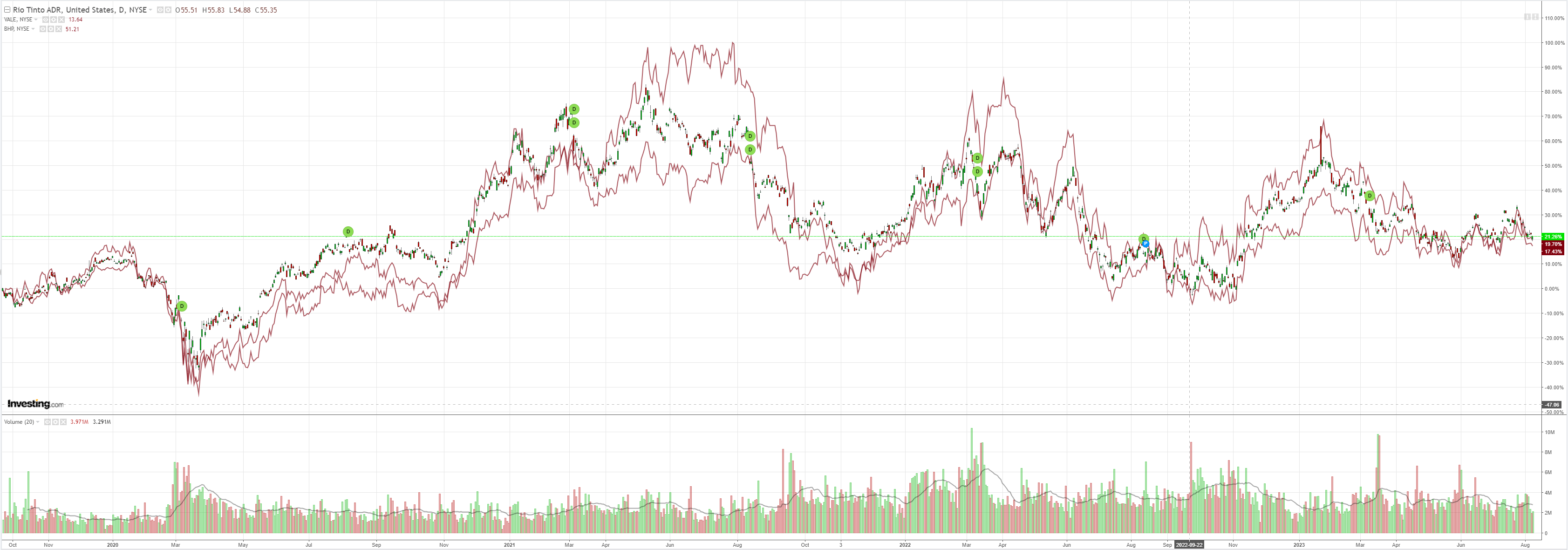

Farewell miners (NYSE:RIO):

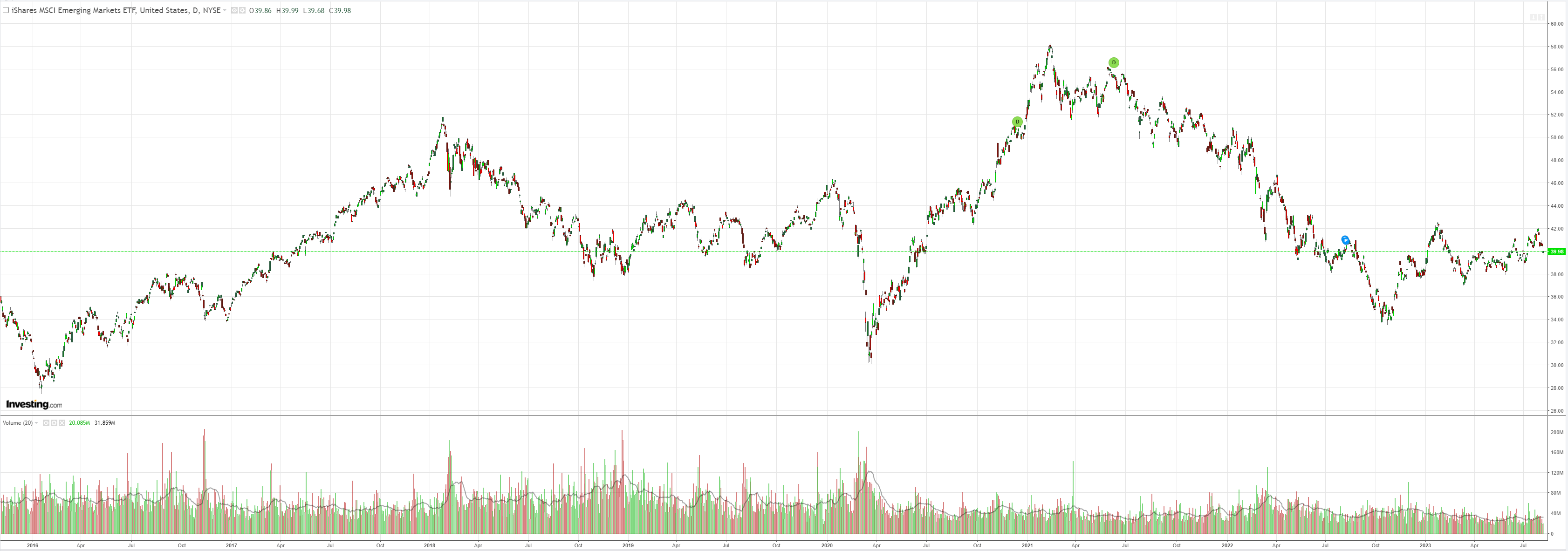

EM stocks (NYSE:EEM) are finished as an asset class:

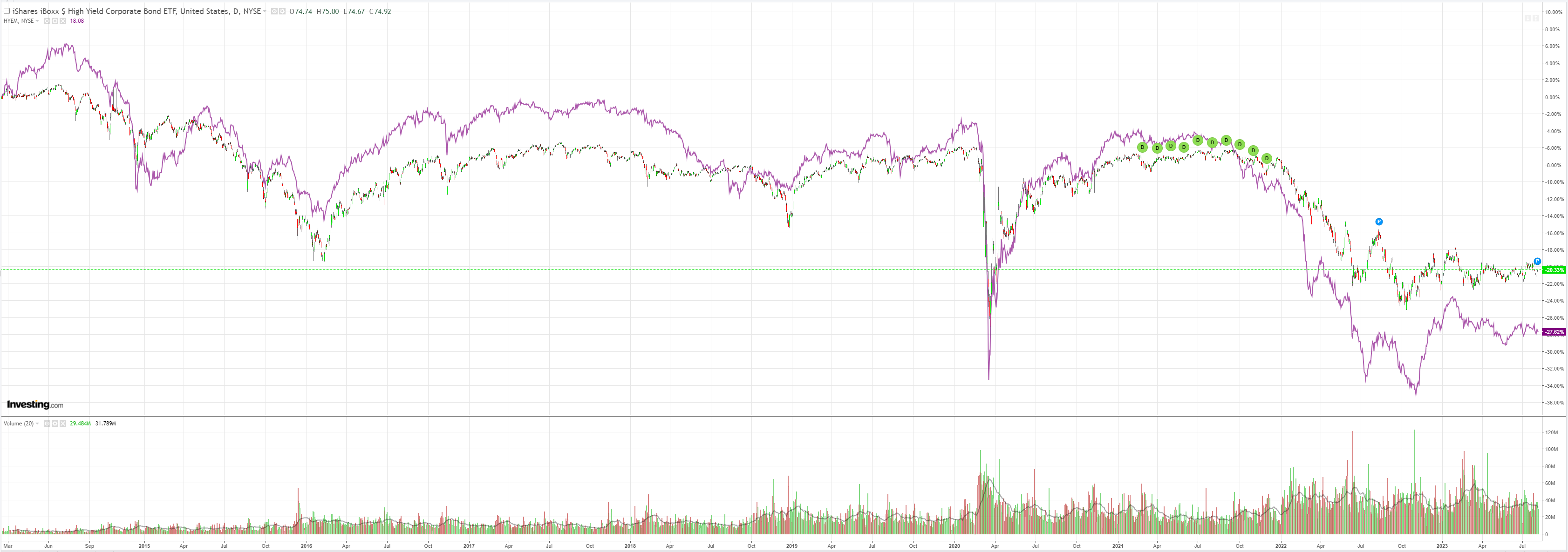

Junk (NYSE:HYG) is still a warning:

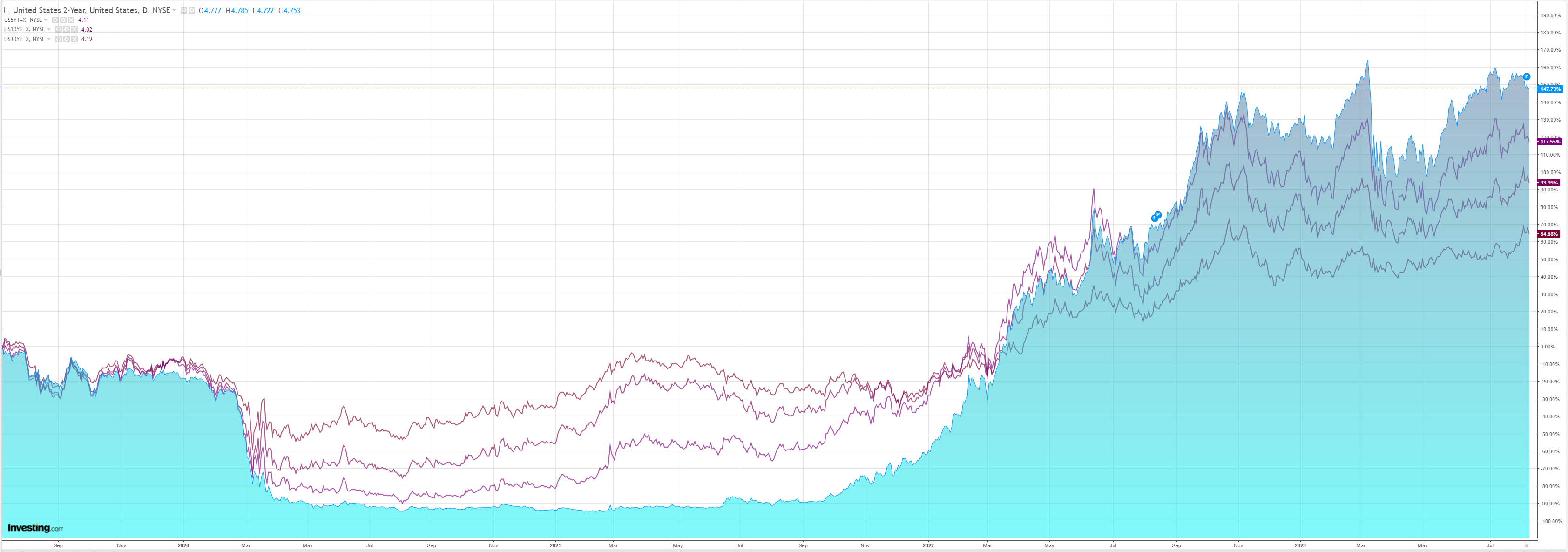

The bear steepener reversed:

But stocks fell anyway:

There are lots of things going on. Italy freaked out equities with a bank tax. The US CPI will probably come in weak on Thursday. These are playing a role.

But I think the market is starting to sense something is wrong in China. Very wrong.

This is why the AUD is copping it more than wider risk-off dynamics suggest should be the case.

For the past few months, I have been shopping around the notion that the AUD may go to 40 cents in the next business cycle.

This thesis is based upon the analogy of the 1990s in which the Japanese development model stalled in a property crash, and American technology firms took over the world with the rise of the internet, driving US economic leadership.

These two crushed commodities and the AUD.

Today we can supplant Japan with China and the internet with AI to get the same growth and forex dynamic for the global economy for the next business cycle.

But there is another possibility.

The Chinese economy is already in dire straits. It is being ripped apart by the impossible trinity of being unable to manage its currency, interest rates and capital flows simultaneously.

Its property and infrastructure debt bubbles are bursting. But it can’t slash interest rates and sink CNY as an offset lest it trigger capital flight and geopolitical backlash. This internal debt-deflation dynamic is uber-toxic for growth and inflation.

If it gets out of hand, AUD may hit the 40s long before my 5-10 year outlook.