The massive release of start-of-the-month data really kicks off today with Australian GDP, Chinese PMIs and Japanese capital spending all set to be released. The US also blessed the markets with greater clarity of how its second quarter resurgence was performing with a large swathe of data released overnight. US data is incredibly important at the moment as the market is looking for anything that may upset an increasingly expected July rate hike. Investors are looking for major disappointments in US data, and last night did not provide that with most coming largely in-line with what the market was expecting. And in-line US data was enough to see the DXY dollar index gain another 0.3%, although the Bloomberg Dollar Index, which has a more diversified global currency weighting, closed the session largely unchanged.

US personal income in April grew 0.4% month-on-month as expected, but personal spending surged 1%, much higher than market expectations. Increased spending, a resurgent US housing market and its corresponding wealth effect all bodes well for consumption’s contribution to 2Q GDP.

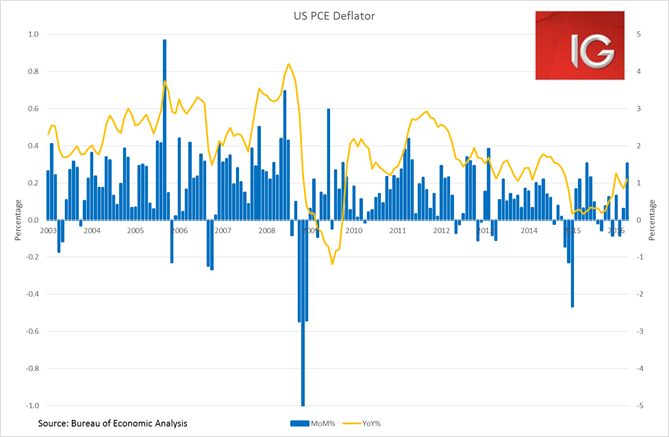

Core PCE inflation, the Fed’s preferred inflation gauge, was unchanged at 1.6% year-on-year, but grew at a slightly faster 0.2% month-on-month pace. Market pricing for rate hikes is likely to shoot up dramatically should inflation start moving noticeably higher, although this has not happened yet. But the PCE deflator did see its strongest monthly gain (+0.3%) since May 2015, and may be pointing to stronger inflation going forward.

Equity markets seem unimpressed by the recent data releases as both US and European markets all close in the red. Asian markets do not look like they are heading for a better session as both the ASX and the Nikkei look set to open down. However, Chinese markets look like they may push higher again today as investors speculate about Chinese equities being included in the MSCI’s global equity indices. China has recently made some major changes to ease foreign ownership of its shares, but given its very well-known, costly and largely unsuccessful intervention in the markets a decision by the MSCI include them on 14 June is likely to be met by strong criticism globally. A lot of institutional investors are mandated to buy the MSCI indices and are unlikely to be happy about having their returns dictated by MSCI having to keep China happy. A lot of investors have concerns about buying the MSCI Emerging Markets Index as it is because of the heavy weighting given to Chinese banks as they go through the pointy end of the credit cycle.

Australian 1Q GDP expectations were upgraded substantially after net exports contributed 1.1%. The Aussie dollar added 0.6% overnight off the better than expected data. The market now expects GDP to grow 2.8% year-on-year in 1Q, somewhat at odds with the very weak inflation numbers we are seeing. We are still expecting two more rate cuts from the RBA, in August and December, as the deterioration in core inflation measures is unlikely to turn around in just one quarter. Australia may increasingly be heading towards Sweden’s predicament of high growth, low inflation and low rates. Well we almost won Eurovision in Sweden…