Everything but DXY, that is:

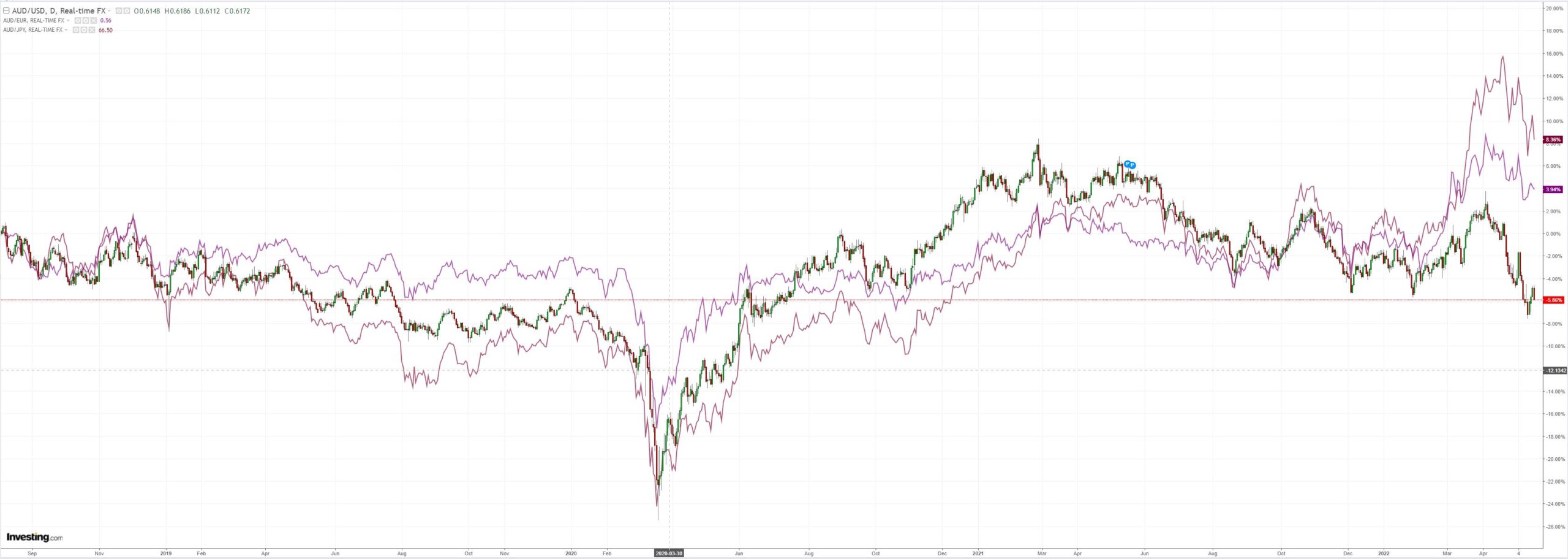

AUD was pulverised:

Oil fell:

Metals too:

Big miners (LON:GLEN) reversed:

EM stocks (NYSE:EEM) gave way:

Global junk (NYSE:HYG) is screaming RECESSION AHEAD:

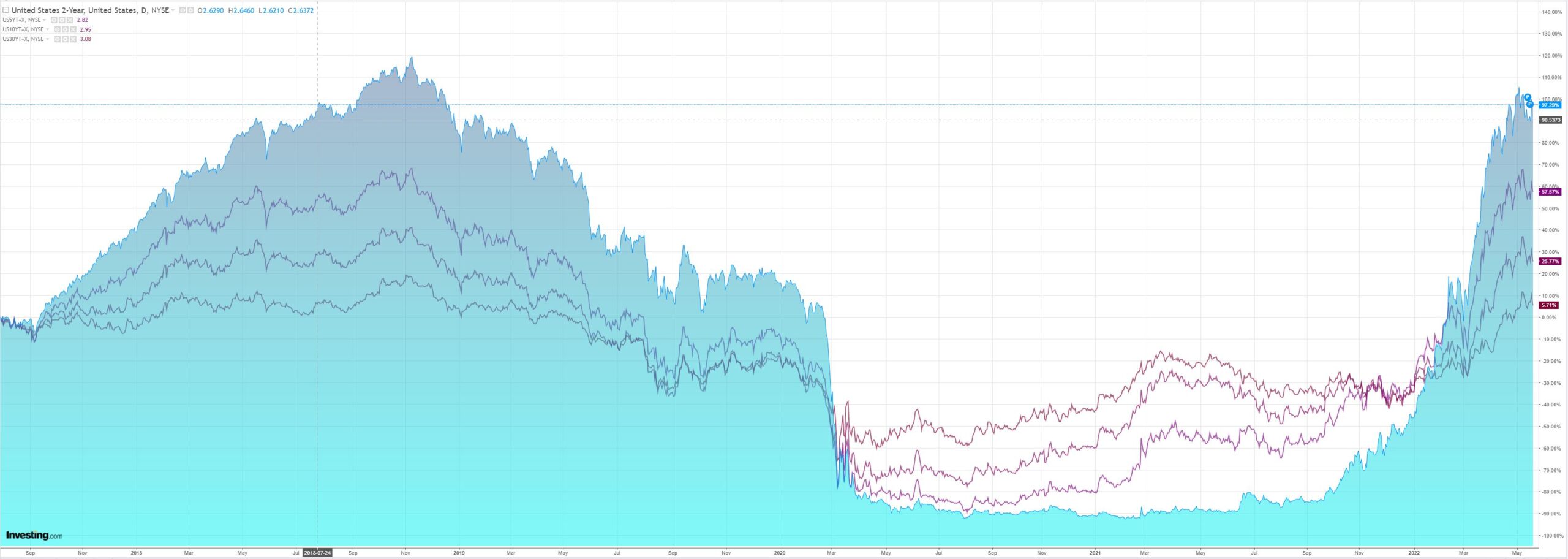

The Treasury curve was steamrolled:

And stocks were smashed:

Westpac has the wrap:

Event Wrap

US housing starts in April remained elevated, at an annualised 1.724m (est. 1.756m, prior 1.728m revised down from a cycle high of 1.793m). Building permits were also elevated at 1.819m (est. 1.814m, prior 1.870m).

Canadian CPI in April rose 0.6%m/m (est. 0.5%m/m) and 6.8%y/y (est. unchanged at 6.7%y/y), but the core components were notably firmer.

Eurozone CPI in April was finalised slightly lower at 7.4%y/y from its flash reading of 7.5%y/y, while core was unchanged at 3.5%y/y.

UK inflation data for April spiked higher as national utility and household energy provider caps were lifted. Headline CPI rose +2.5%m/m (est. +2.6%m/m) and +9.0%y/y (est. +9.1%y/y, prior +7.0%y/y) – a 40-year high, and core CPI rose 6.2%y/y (as expected, prior 5.7%y/y). PPI rose 14.0%y/y (est. 12.5%y/y, prior 11.9%y/y).

Some key earnings downgrades added to the turn in sentiment in equity markets. Target (NYSE:TGT) shares fell as much as 25% (the most since October 1987) after it reduced its full-year forecast for operating income margin. Walmart (NYSE:WMT) shares fell 11% (the most since October 1987) after quarterly profit missed analysts’ estimates and it lowered its full-year outlook for earnings growth. Rising costs featured in both reports.

Event Outlook

Aust: Given that weekly payrolls suggest weather and holiday events dampened jobs growth in April, Westpac anticipates employment to lift by 20k for the month. The participation rate holding flat at 66.4% should see unemployment rate move downwards (Westpac f/c: 3.9%).

NZ: Higher oil and dairy prices are will likely keep the PPI elevated in Q1. The 2022 Budget should show the Government’s books are in a relatively good shape given the impacts of COVID-19.

Japan: Volatility in machinery orders is expected to persist with supply issues continuing to cloud the investment outlook (market f/c: 3.9%).

US: Initial jobless claims are set to remain at a very low level (market f/c: 200k) and the May Phily Fed index should continue to reflect relatively healthy business conditions (market f/c: 15.0). Limited supply and cooling demand are a headwind to existing home sales in April (market f/c: -2.1%). The leading index is expected to point towards a slowing of economic momentum in April (market f/c: 0.0%). The FOMC’s Kashkari will speak on inflation.

The US economy is still not buckling. Retail and housing volumes are rolling but not enough. The financial market panic is actually now easing conditions for the latter.

The Fed is locked in for 50bps in June and July meaning that everything is going to be stress-tested and something will eventually snap.

Oil is still feeding inflation in at above 50% per month and must be broken.

Europe is buggered by its war and energy shock. China is reeling as OMICRON crashes property. EMs are on their knees as DXY rages.

Nothing changes unless or until the US consumer breaks and adds a trade shock to everybody else’s woes.

AUD still going lower.