Converting mutual funds to exchange traded funds (ETFs) has been a trend gathering pace on Wall Street. We recently covered some of the differences between these two types of funds as well as the mechanics of the process.

The Investment Company Institute highlights that as of May, combined assets in ETFs in the US were over $6.3 trillion, showing a growth of 50% year over year. As the ETF universe continues to expand, we can expect to see more mutual-fund-to-ETF conversions. Therefore, today we introduce two of these new ETFs.

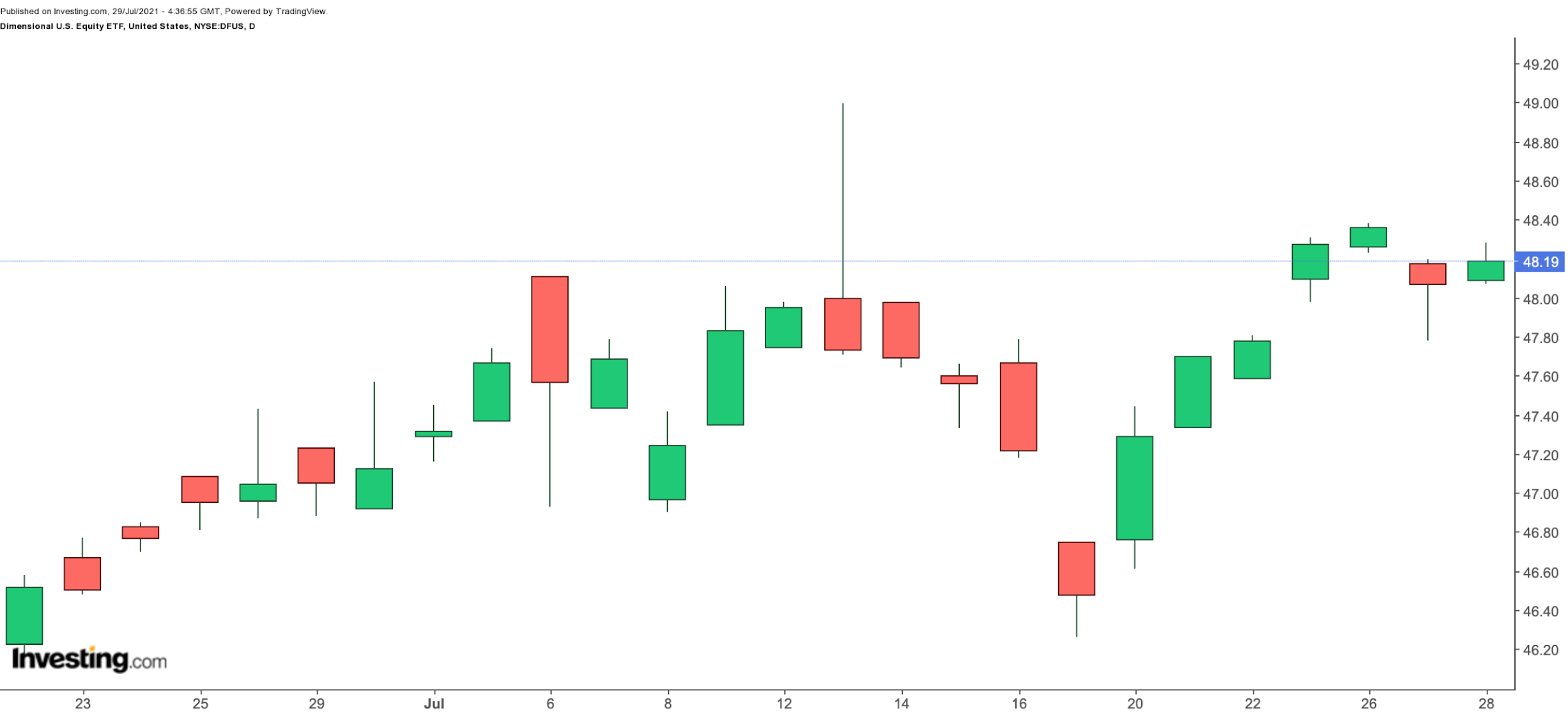

1. Dimensional US Equity ETF

Current Price: $48.19

52-Week Range: $45.75 - $49.00

Dividend Yield: 0.90%

Expense Ratio: 0.11% per year

The Dimensional U.S. Equity ETF (NYSE:DFUS) comes from Dimensional Fund Advisors, which in June converted $29 billion of mutual funds. The conversion meant the listing of four new ETFs on the New York Stock Exchange. Before the year’s end, Dimension will likely convert two more mutual funds into ETFs, putting the fund manager on track to becoming one of the largest ETF issuers in the United States.

This new fund tracks the performance of some of the largest US traded stocks across a range of industries. As a mutual fund, it started trading in September 2001, but as we have noted, the conversion occurred in June of this year. The fund currently has around $5.6 billion in assets.

DFUS, which has 2,080 holdings, tracks the returns of the Russell 3000 Index. In terms of the sub-sectoral breakdown, the information technology sector makes up the biggest slice, with 28.44%; followed by health care and consumer discretionary sectors, with 13.35% and 12.61%, respectively.

The top 10 holdings account for around 26.5% of the fund. Among the leading names are Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and NVIDIA(NASDAQ:NVDA).

Since its inception, DFUS is up about 2%. However, if we extend the timeframe to the past 10 years, the average annual total returns are more than 14%. Potential investors might want to keep the fund on the radar.

2. Adaptive Growth Opportunities ETF

Current Price: $26.14

52-Week Range: $22.27 - $26.59

Dividend Yield: 0.08%

Expense Ratio: 1.55% per year

The Adaptive Growth Opportunities ETF (NYSE:AGOX) began trading as an ETF on May 10. It mainly invests in other ETFs. The fund originally started trading as a mutual fund in September 2012.

AGOX currently has 35 holdings. In terms of industries, we have the technology sector at the top with 25.98%. Next in line are financial services (23.50%) and consumer cyclicals (14.26%). The fund’s top 10 holdings account for 43% of its $161 million in assets.

Among the leading ETFs in the AGOX are:

SPDR® S&P Homebuilders ETF (NYSE:XHB): up 27.6% year-to-date (YTD) (covered here);

Invesco DB Commodity Index Tracking Fund (NYSE:DBC): up 31.2% YTD;

VanEck Vectors Semiconductor ETF (NASDAQ:SMH): up 16.4% YTD;

Financial Select Sector SPDR® Fund (NYSE:XLF): 23.1% YTD (covered here);

iShares MSCI EAFE ETF (NYSE:EFA): up 8.3% YTD.

Since May, AGOX is up more than 6%. But since inception of the mutual fund, it has returned about 13.5% annually.

It may be a particularly interesting choice insofar as it might mean instant diversification for many retail portfolios. Nonetheless, interested investors should be mindful of the high annual expense.