With global geopolitical risks on the rise, cyber attacks have accelerated. One beneficiary of the proliferating menace? Cybersecurity stocks.

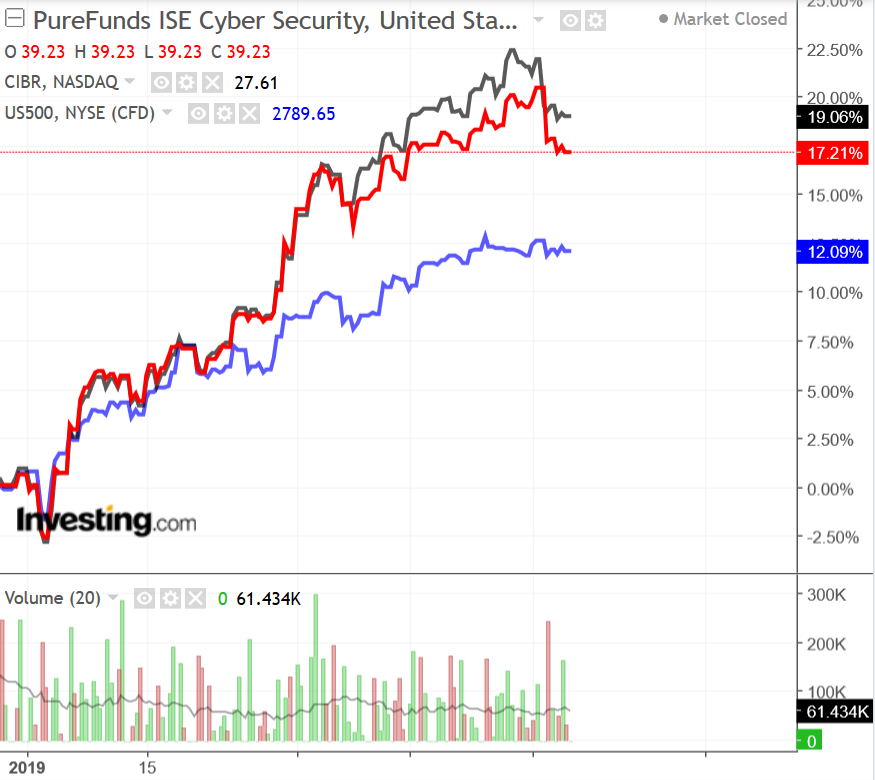

While the S&P 500 and Dow are both up around 11% since the beginning of 2019 and the NASDAQ has gained more than 14% over the same period, the PureFunds ISE Cyber Security ETF (NYSE:HACK) is up 16.4%. During the same timeframe the First Trust NASDAQ CEA Cybersecurity Fund (NASDAQ:CIBR) has benefited even more—it's up 17.9%. Both funds are outperforming the broader market and each is trading just below its all-time high.

As demand for cybersecurity solutions balloons, companies in this space are well-positioned to capitalize over the long-term. Considering their dominance in the sector, these three stocks have the potential to provide some of the best long-term growth:

1. Palo Alto Networks: Cream of the Crop

Palo Alto Networks (NYSE:PANW), headquartered in Santa Clara, CA, is widely considered the premier firm within the cybersecurity industry. Its core product is a platform that includes advanced firewalls and cloud-based offerings that extend those firewalls to cover other aspects of security. The company serves 50,000+ organizations in 150+ countries, including 85 businesses listed on the Fortune 100.

Shares of Palo Alto, which reached an all-time high of $260.63 on Feb. 27, are up 24.4% since Jan. 1. The stock closed at $234.34 as of last night.

The company reported a big earnings beat on Feb. 26 and announced plans to repurchase $1 billion in stock. It also introduced its new automated security product, Cortex, which Palo Alto Networks hailed as “the industry’s only open and integrated, AI-based continuous security platform.”

Jefferies analyst John DiFucci, who already had a buy rating on the stock, upped his price target to $296 from $249. He called Cortex a “product stretching further than a typical endpoint detection and response product” in the integrated network and cloud data arena.

2. Zscaler: Cloud-Based Cybersecurity Specialist

So far this year, Zscaler Inc (NASDAQ:ZS) shares have been on a tear, jumping almost 47%. Investors have grown increasingly bullish on the cloud-based information security specialist.

The San Jose-based company provides automated threat forensics and dynamic malware protection against advanced cyber hazards such as spear phishing. The stock is up about 75% since the company went public in March 2018. Shares are currently trading at $57.53 as of yesterday's close, just 6.5% below the stock's all-time high of $61.53, hit on March 4.

In its most recent earnings report on Feb. 28, Zscaler topped estimates for its fiscal second-quarter. It also provided an outlook that came in better than expected thanks to strong growth from its Private Access service, which lets organizations deliver secure access to internal applications and services.

Wedbush analyst Daniel Ives, who has an outperform rating on the stock, upped his price target to $68 from $53. He also said the party is just getting started:

"Zscaler delivered a Picasso-like quarter highlighted by total revenue growing 65% and billings accelerating 74% year-over-year, crushing Street expectations as the company is hitting profitability much earlier than the Street expected.”

Taking all these elements into account, Zscaler appears to be rapidly transitioning into the go-to name in cloud-based cybersecurity.

3. CyberArk Software: Best PAS Solutions Provider

Cyberark Software (NASDAQ:CYBR) is headquartered in Petah Tikva, Israel with U.S. offices in Newton, MA. The cybersecurity company offers Privileged Account Security (PAS), meaning the company's technology helps manage all the privileged accounts within an organization via automatic password management, access control, dual control, video recordings and assorted other features.

The stock, currently trading at $106.92, just below an all-time high of $113.07 touched on March 1, has gained about 44% so far this year.

CyberArk's fourth-quarter earnings, released on Feb. 14, were much better than expected, beating on both the top and bottom line. As well, the company raised guidance for the first quarter, as CyberArk benefits from the growing adoption of Privileged Access Management (PAM).

"Through our innovation, we have cemented our leadership position as the industry's global solution provider to secure privileged access from on-premise to the cloud," Chairman and CEO Udi Mokady said on the company's post-earnings conference call.

Given the long-term potential of PAS and PAM and its strong position in that market, CyberArk looks well-placed to remain a leading cybersecurity play for the foreseeable future.