- Apple will publish its quarterly results today.

- The tech giant's Q2 earnings are under greater scrutiny after disappointing results from other Magnificent 7 stocks.

- China and Apple Intelligence are set to take center stage.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Investors are eagerly awaiting Apple's (NASDAQ:AAPL) third-quarter earnings report, which will be released after the closing bell today.

This announcement will come after the tech giant reclaimed its position as the world's most valuable company, with its share price up 15.35% since the start of the year.

These results will be critical, as the company has faced weak demand and rising competition in China over the past year.

Despite these challenges, analysts remain optimistic, citing positive catalysts such as growth in Apple Intelligence, the company's forthcoming AI system, and stabilizing demand for the iPhone 16 in key markets like China.

As one of the highlights of a busy week of earnings reports, Wall Street strategists will closely watch Apple's performance. Here’s what they expect from the tech giant for the third quarter.

Sales in China and Apple Intelligence in the Spotlight

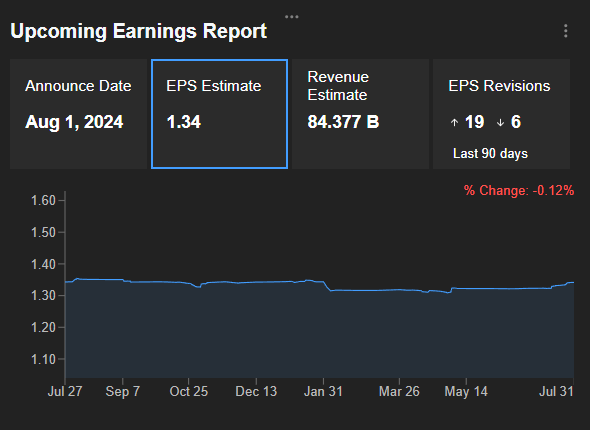

Analysts expect Apple to report sales of $84.377 billion, a 3.15% year-on-year increase, and earnings per share of $1.34, up 6.35% from the same quarter last year.

However, beyond these key figures, investors will focus on several crucial details, including sales in China, the development of Apple Intelligence, and the performance of Apple's highly profitable services division.

Source: InvestingPro

China remains a critical market, with analysts predicting a 2.6% drop in sales in the country. Apple faces intense competition from local manufacturers like Huawei, which has led to a decline in the company's market share in China to 14% in the second quarter, down 2% year-on-year.

Apple's plans for artificial intelligence unveiled at the Worldwide Developers Conference (WWDC24) in June, significantly boosted its share price. On Monday, it released the first version of Apple Intelligence with iOS 18.1, allowing developers to test new features.

This AI assistant is expected to enhance Siri, enabling the chatbot to generate emails and images. The technology will be available only on the latest devices, starting with the iPhone 15 Pro, which could trigger a major wave of device upgrades.

The company is also expected to provide more details on this development in tonight's report.

Apple's Share Price Potential According to Analysts and Valuation Models

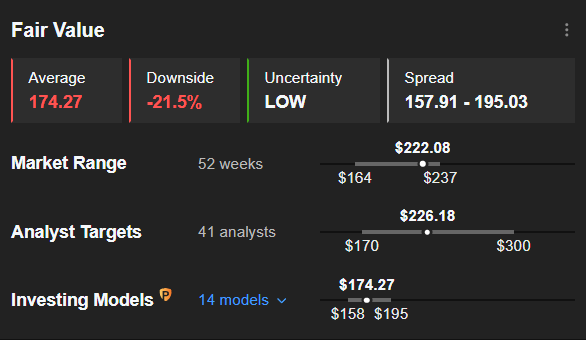

To properly assess Apple's upcoming earnings release and its potential impact on the share price, it's crucial to consider analysts' forecasts and valuation models.

Analysts have set an average 12-month target price of $226.18 for Apple, which is just 1.85% above Wednesday's closing price. This suggests that they currently view the stock as fairly valued.

Source: InvestingPro

The InvestingPro Fair Value, which integrates several well-regarded valuation models, advises caution. It estimates Apple's fair value at $174.27, indicating a potential downside risk of over 21% from the current share price.

Conclusion

Given the cautious targets from analysts and the valuation models suggesting Apple is significantly overvalued, today's earnings results will need to deliver a substantial beat to boost the share price.

However, as seen in previous releases, the company's future guidance, whether optimistic or pessimistic, could ultimately sway market sentiment.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.