- The NYSE FANG index is up +75% this year, approaching November 2021 highs

- But some stocks have flown under the radar and just set new all-time highs too

- InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

Equities have thrived this year, reaching milestones across various stock markets. The Japanese stock market has hit a 33-year high, while Turkey and Germany have achieved recent record highs. Additionally, the Nasdaq remains bullish, propelled by the meteoric rise of artificial intelligence.

The NYSE FANG index, which suffered a considerable 40% slump in 2022, has rebounded impressively, surging by 75% this year and nearing its November 2021 peak.

Standout performers include:

- Nvidia Corporation (NASDAQ:NVDA) with a staggering 199% increase

- Apple Inc (NASDAQ:AAPL) at +42%

- Microsoft Corporation (NASDAQ:MSFT) at +40.9%

- Meta Platforms Inc (NASDAQ:META) with an impressive surge of 136%

- Tesla (NASDAQ:TSLA) up by 122%

- Amazon.com (NASDAQ:AMZN) recording a solid 50% growth.

Apart from these well-known companies, others have recently hit all-time highs and are expected to deliver strong quarterly results. Let's examine them using InvestingPro.

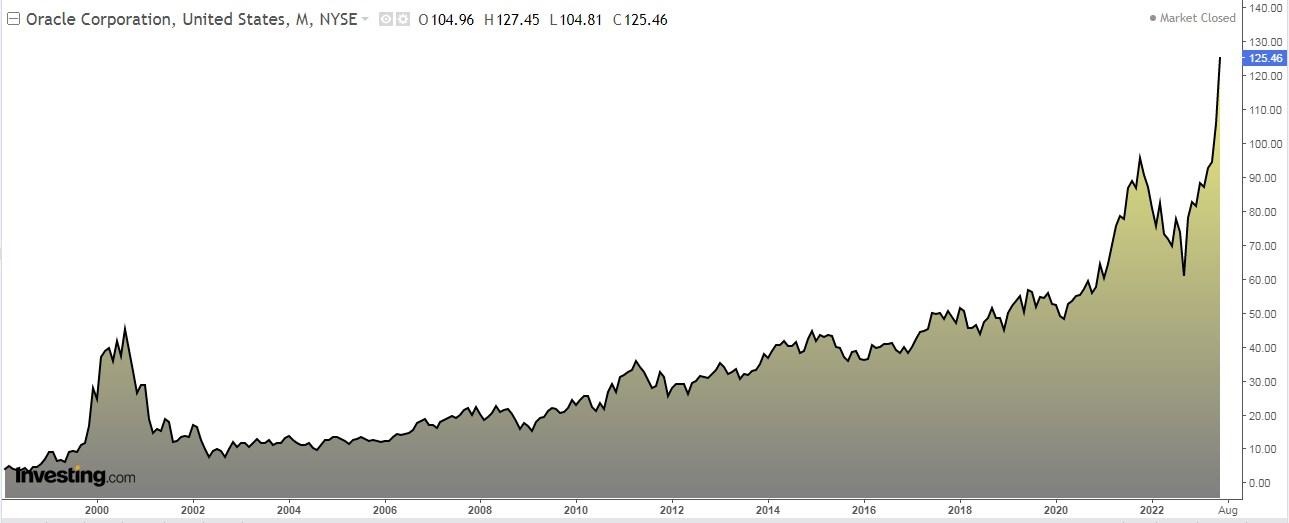

1. Oracle

Headquartered in Austin, Texas, Oracle (NYSE:ORCL) leads the global information management software market, surpassing its closest competitor, Software AG (OTC:STWRY).

Founded in 1977, Oracle's shares have soared by 50% this year, reaching unprecedented all-time highs.

It will distribute a dividend on July 26, and to be to receive it, shares must be held before July 11.

Source: InvestingPro

On September 14, the company is scheduled to report earnings. The earnings per share reported in the last earnings were at $1.67, surpassing Wall Street's expectations by $0.09.

Furthermore, it reported revenues of $13.8 billion, which exceeded the anticipated figures.

Source: InvestingPro

Wolfe Research and Deutsche Bank maintained their buy ratings on the stock and raised their price targets to $140 from $130 and to $135 from $120, respectively.

2. Lennar

Lennar (NYSE:LEN), a homebuilder based in Florida, ranked as the second-largest homebuilder in the United States in 2021 and secured the 129th position on the Fortune 500 list.

The stock rose +34% year-to-date and +85% in the past 12 months, reaching all-time highs.

The company posted a second-quarter profit of $3.01 per share, above the average market estimate of $2.32 per share.

It will report earnings on September 19.

Source: InvestingPro

InvestingPro models give it a potential of $137.18.

Source: InvestingPro

Lennar presents 13 buy, 8 hold, and 2 sell ratings.

The company has increased its forecast for full-year home deliveries, capitalizing on strong demand that exceeds the available supply.

Homebuilders are currently benefiting from a significant shortage of existing homes in the market, which remains 44% below pre-pandemic levels. This scarcity has resulted in price hikes in certain regions and homes being sold above their list prices.

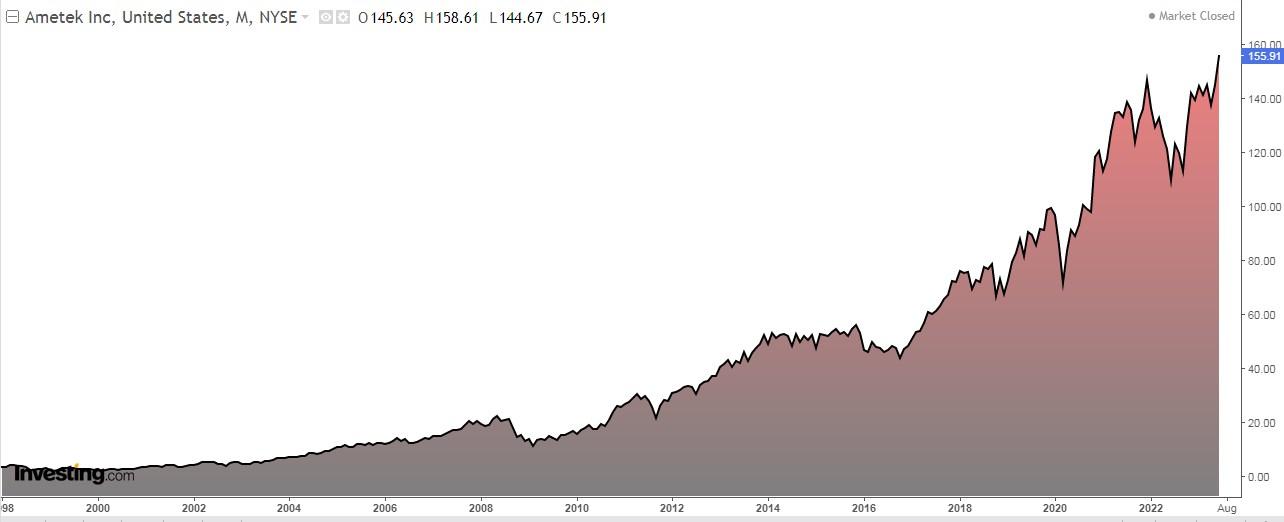

3. AMETEK

AMETEK (NYSE:AME) is a multinational conglomerate globally recognized as a designer and manufacturer of electronic instruments and devices.

AMETEK operates in over 220 locations worldwide. It currently ranks 402nd on the Fortune 500 list.

The company's shares have experienced a 13% increase year-to-date and a 27.20% increase over the past 12 months, reaching all-time highs.

The company will distribute a dividend of $0.25 per share, amounting to an annualized dividend of $1.00, considering its quarterly dividend schedule. Shareholders who held shares before June 12 will receive the dividend on June 30. The annual dividend yield stands at +0.7%.

In the first quarter, reported earnings per share of $1.49, surpassing the market estimate of $1.41 by $0.08. Additionally, it generated revenue of $1.6 billion for the quarter, exceeding the market estimate of $1.54 billion.

AMETEK is scheduled to release its financial results on August 1.

Source: InvestingPro

AMETEK has 10 buy ratings, 7 hold ratings, and 0 sell ratings. According to Wall Street analysts, the average long-term price target for the stock ranges between $175 and $180.

4. Grainger

W.W. Grainger (NYSE:GWW), a Fortune 500 company, is an industrial supplies company that was established in 1927 in Chicago. Originally founded to offer a reliable source of motors to consumers, it has now expanded its operations and caters to over three million customers across the globe.

Its stock has witnessed a significant increase of 34% year-to-date and 42% over the past 12 months, reaching new record highs.

Grainger reported first-quarter earnings per share of $9.61, exceeding the market estimate of $8.51 by $1.10. Additionally, the Chicago-based company generated revenues of $4.1 billion for the quarter, surpassing the market estimate of $4.08 billion.

The company is scheduled to announce its financial results on July 27. For the fiscal year 2023, it anticipates revenue in the range of $16.2 billion to $16.8 billion.

Source: InvestingPro

The latest dividend declaration resulted in a quarterly payout of $1.86 per share, translating to an annualized dividend of $7.44. This showcases a notable uptick of 8.1% compared to the previous dividend of $1.72.

Eligible shareholders were remunerated on June 1, while the present annual dividend yield stands at +1.1%. Analyst assessments for the company indicate 5 buy, 11 hold, and 2 sell recommendations.

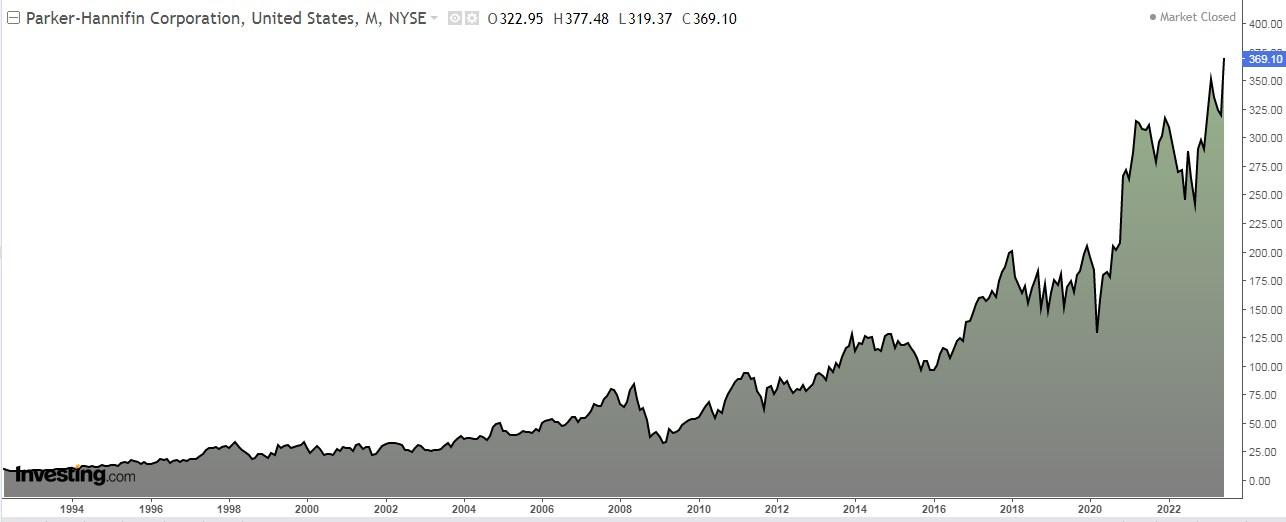

5. Parker-Hannifin

Parker-Hannifin (NYSE:PH), formerly known as Parker Appliance Company, is a prominent American corporation based in Mayfield Heights, Ohio, within the Cleveland metropolitan region.

Established in 1917, the company has been listed on the New York Stock Exchange since December 9, 1964.

It holds a prominent position as one of the largest providers of motion control technologies worldwide. As of 2022, Parker Hannifin achieved a notable rank of 253rd on the Fortune 500 list.

The stock has risen by 29% year-to-date and has reached unprecedented all-time highs.

The Ohio-based company reported third-quarter earnings per share of $5.93, surpassing the market estimate of $5.02 by $0.91. Furthermore, the company generated revenues of $5.1 billion for the quarter, exceeding the market estimate of $4.78 billion.

It is scheduled to release next on August 3.

Source: InvestingPro

Wall Street gives it potential at $440. It has 14 buy, 8 hold, and 1 sell ratings.

***

Get ready to boost your investment strategy with our exclusive summer discounts.

As of 06/20/2023, InvestingPro is on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual: Save an amazing 52% and maximize your profits with our exclusive web offer.

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and the best expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, Summer Sale won't last forever!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, nor is it intended to encourage the purchase of assets in any way.