Silver has been on a tear lately. The second tier metal is up over 25% since the beginning of June and 11% in the last 4 sessions since breaking above the April high. It has not been this high since August 2014.

When stocks do this technical and momentum traders get excited. Higher highs beget more higher highs. But there are at least 4 reasons that you should consider selling your Silver right now and buying Gold instead.

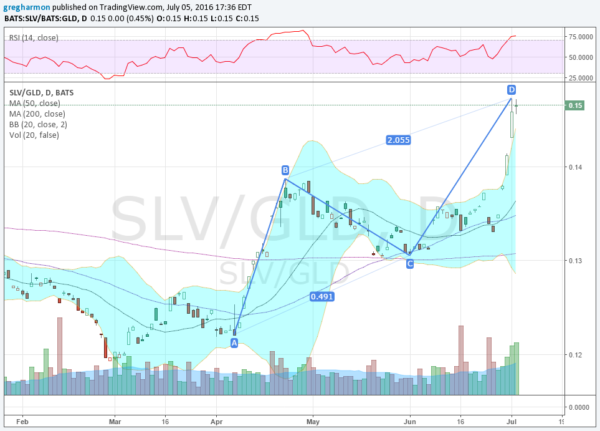

The ratio chart below of Silver/Gold gives you the guide. The first reason is the completion of the AB=CD pattern. When this happens it is usually followed by a pullback. A 50% pullback of the move higher would likely reconnect the ratio to the 50 day SMA, where it started higher for the current leg.

Next, the last two candles show signs of topping. The long candle from Friday had a large upper shadow, indicating an intraday pullback. Tuesday’s candle, a doji star, signals indecision and a possible reversal lower. A lower close today, Wednesday, will confirm the reversal pattern.

The third reason is that the ratio is outside of its Bollinger Bands®. This signals an overbought condition. The momentum indicator at the top, the RSI, is also confirming an overbought condition. Overbought can stay overbought for a while—or get more overbought. But combined with the pattern completion and topping candles, momentum adds to the mosaic of a reversal.

There are many ways to exploit this set-up. If you are long Silver you can just sell it and buy Gold until the ratio finds a bottom. Or, if you are neutral, you can buy Gold and sell Silver short.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.