- Cryptocurrency marketplace Coinbase Global lost about a third of its value since going public in April 2021.

- Recent declines in prices of digital assets, especially of Bitcoin, have put pressure on COIN shares.

- Long-term investors could consider buying the dips in COIN stock, especially if it goes below $250 and toward $240.

Early investors in the digital asset trading exchange Coinbase Global (NASDAQ:COIN) have not had a good 2021. COIN went public on April 14, 2021, at an opening price of $381 and hit an intraday record high of $429.54.

But the stock ended the year at $252.37, tumbling over 33% from its IPO debut price and 41% from the all-time high (ATH).

In comparison, Bitcoin and Ethereum, the two largest cryptocurrencies by market cap, returned close to 50% and 390% in the past year. COIN stock’s 52-week range has been $208.00 - $429.54, while the market capitalization (cap) stands at $54.3 billion.

On Nov. 9, Coinbase Global issued third-quarter financials that missed analysts’ estimates. Around 90% of revenues currently come from the transaction fees from crypto trading on the platform.

In Q3, the marketplace generated $1.23 billion in net revenue as opposed to the second quarter figure of $2.03 billion. Wall Street was not impressed. Net income of $406 million translated into diluted EPS of $1.62.

Management said:

“Coinbase is not a quarter-to-quarter investment, but rather a long-term investment in the growth of the cryptoeconomy and our ability to serve users through our products and services.”

Prior to the release of the quarterly results, COIN stock was around $360. Since then investors have hit the ‘sell’ button. On Dec. 20, shares saw a multi-month low of $231.77, but closed the year higher at $252.37.

What To Expect From COIN Stock

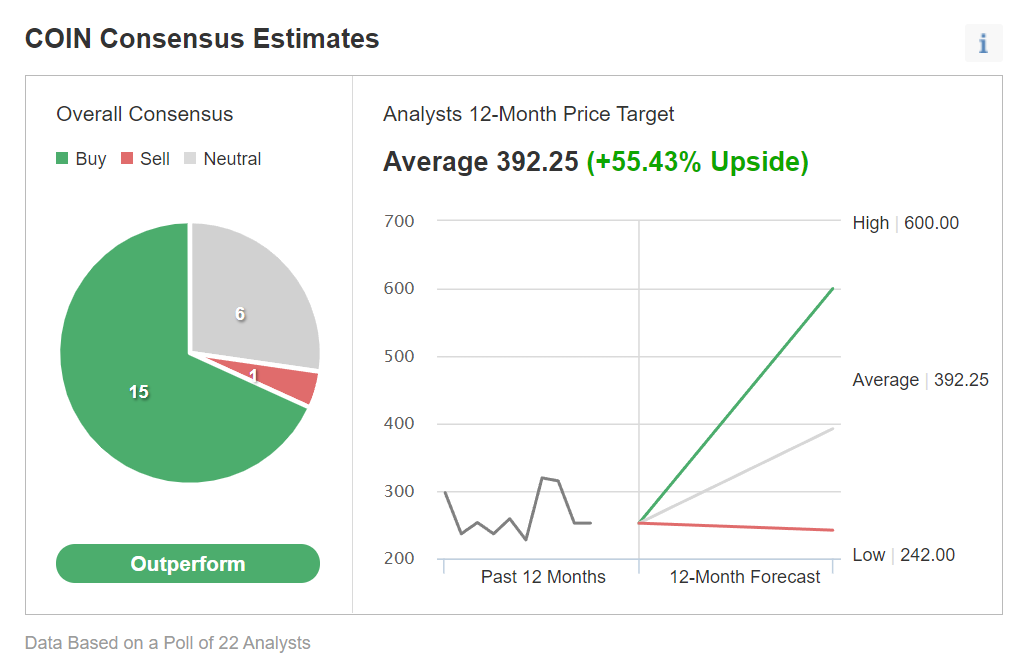

Among 22 analysts polled via Investing.com, Coinbase stock has an “outperform" rating.

Chart: Investing.com

Analysts also have a 12-month median price target of $392.25 on the stock, implying an increase of over 55% from current levels. The 12-month price range currently stands between $242 and $600.

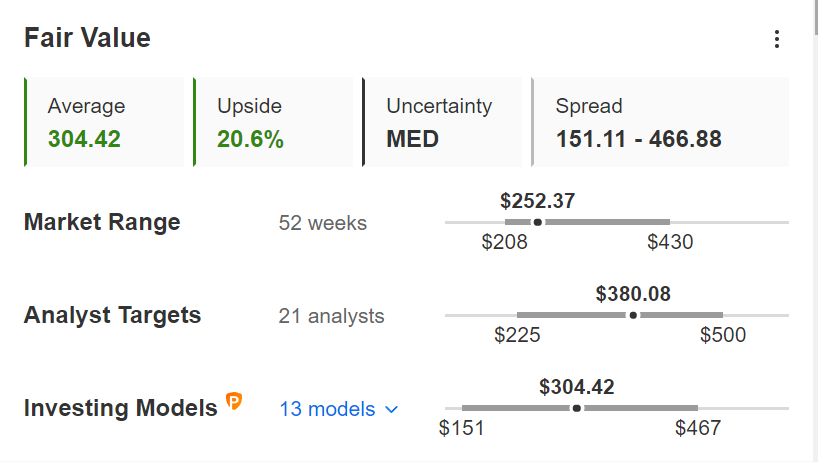

Source: InvestingPro

Similarly, according to a number of valuation models, like DuPont analysis or multiples (such as P/E, P/B, P/S) valuation, the average fair value for COIN stock via InvestingPro stands at $304.42, or a potential increase of about 20.5%.

Moreover, we can look at the company’s financial health determined by ranking more than 100 factors against peers in the financials sector. In terms of profit health, Coinbase Global scores 5 out of 5 (top score). And the cashflow health is at 4. Its overall performance is rated as “great.”

Trailing P/E, P/B and P/S ratios for COIN stock are 23.5x, 10.1x, and 9.2x. By comparison, those metrics for peers stand at 5.2x, 2.7x, and 2.8x.

Readers might also be interested to know that these numbers for the fintech giant PayPal (NASDAQ:PYPL), which enables users in certain countries to trade in a number of cryptocurrencies, are 44.9x, 10.0x, and 9.0x. Also, PYPL shares lost 19.5% in 2021.

In the coming weeks, we expect COIN stock to trade in a range, possibly between $245 and $265. Once it establishes a base, a new leg up is likely to start later in 2022.

Adding Coinbase Global Stock To Portfolios

COIN bulls with a two- to three-year horizon who are not concerned about short-term volatility could consider buying the stock around these levels for long-term portfolios. The fair value is at $304.42, and analysts' consensus expectations have set a target of $392.25.

Alternatively, investors could consider buying an exchange traded fund (ETF) that has COIN as a holding. Examples would include:

- Global X Blockchain (NASDAQ:BKCH)

- Bitwise Crypto Industry Innovators ETF (NYSE:BITQ)

- VanEck Digital Transformation ETF (NASDAQ:DAPP)

- ARK Innovation ETF (NYSE:ARKK)

Finally, those who are experienced with options could consider an options trade. However, most option strategies are not suitable for most retail investors. Therefore, the following discussion is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Traders who are long-term bullish on COIN shares, but believe that the short-term choppiness may persist, could put together a diagonal debit spread on COIN stock using "Long-Term Equity Anticipation Securities” (LEAPS) options.

The strategy, which is also referred to as “Poor Man's Covered Call” or “Poor Person's Covered Call,” involves options. We have covered numerous examples before using Apple (NASDAQ:AAPL), NVIDIA (NASDAQ:NVDA) and Taiwan Semiconductor and most recently PayPal as examples.

Diagonal Debit Spread On COIN Stock

Buying 100 shares of Coinbase would currently cost around $25,237 based on the stock's closing price last Friday, a considerable investment for many people.

But in this strategy, a trader would first buy a “longer-term” call with a lower strike price. At the same time, the trader would sell a “shorter-term” call with a higher strike price, creating a long diagonal spread.

In other words, the two call options for the underlying stock (i.e., COIN in this case) have different strikes and different expiration dates. The trader goes long one option and shorts the other to make a diagonal spread.

In this LEAPS covered call strategy, both the profit potential and risk are limited. The trader establishes the position for a net debit (or cost). The net debit represents the maximum loss.

Most traders entering such a strategy would be mildly bullish on the underlying security—here, Coinbase.

Instead of buying 100 shares of Coinbase, the trader would buy a deep-in-the-money LEAPS call option where that LEAPS call acts as a surrogate for owning the COIN stock.

At time of writing, COIN was $252.37.

For the first leg of this strategy, the trader might buy a deep in-the-money (ITM) LEAPS call, such as the COIN Jan. 19, 2024, 180-strike call option. This option is currently offered at $114.30 (mid-point of the current bid and ask spread). In other words, it would cost the trader $11,430 instead of $25,237 to own this call option that expires in over two years.

For the second leg of this strategy, the trader sells an out-of-the-money (OTM) short-term call, such as the COIN Feb. 18, 260-strike call option. This option’s current premium is $19.90. In other words, the option seller would receive $1,990, excluding trading commissions.

There are two expiration dates in the strategy, making it quite difficult to give an exact formula for a break-even point for the trade.

Maximum Profit Potential

The maximum potential is realized if the stock price is equal to the strike price of the short call on the expiration date of the short call.

In other words, the trader wants the COIN stock price to remain as close to the strike price of the short option (i.e., $260 here) as possible at expiration (on Feb. 18), without going above it.

In our example, the maximum return, in theory, would be about $2,395 at a price of $260 at expiry, excluding trading commissions and costs. (We arrived at this number using an online calculator. However, those readers who want to see the detailed calculation of this profit potential should refer to previous examples covered.)

Understandably, if the strike price of either the long or short option had been different, the profit potential would also change.

Therefore, by not investing $25,237 initially in 100 shares of COIN, the trader’s potential return is leveraged.

Ideally, the trader hopes the short call will expire out-of-the money (worthless). Then, the trader can sell one call after the other, until the long LEAPS call expires in about two years.

Finally, we should note that a diagonal debit spread requires regular position management.

Bottom Line

Investors who want to participate in the growth of the cryptocurrency ecosystem, but do not want to buy digital assets could regard COIN stock as a proxy.

Management is working on diversifying the revenue stream. For instance, the Coinbase Ventures segment is looking at potential startup investments. Wall Street also expects the platform to become a key player in the non-fungible tokens (NFT) space.

On a final note, in the months ahead, Coinbase Global could become a takeover candidate as well. Therefore, despite short-term volatility, we’re bullish on COIN shares in the long-run.