- AI remains the investment theme of choice for investors as Q3 earnings season gets underway.

- While top AI names appear overvalued, there are still opportunities among lesser-known names.

- Below, we discuss 3 undervalued stocks that could deliver big gains after reporting strong numbers.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

Artificial Intelligence continues to be the main theme on the minds of investors as the Q3 earnings season gets underway.

AI stocks have indeed had a remarkable 2024 so far, with the likes of Nvidia (NASDAQ:NVDA) more than doubling in value since the start of the year.

However, the stocks that have been the stars of AI investing in recent months won't necessarily be the best performers between now and the end of the year. Indeed, the shares of many of the sector's heavyweights are considered heavily overvalued.

While investors have so far focused on the shares of companies directly involved in AI development and infrastructure, such as Nvidia, or Microsoft (NASDAQ:MSFT), a shareholder in OpenAI, creator of ChatGPT, attention could now turn more to those companies most likely to benefit from AI applications.

Of course, AI has so much potential that all companies can use it in one way or another to reduce costs and/or increase productivity or develop new services.

However, the benefits of AI are more obvious for some companies than for others. In this article, we therefore propose 3 stocks from companies that have started to integrate AI into their business that investors would do well to keep on their radar ahead of their Q3 earnings release.

Consequently, discussed below are three stocks currently trading well below their intrinsic value, based on InvestingPro Fair Value, which uses several recognized valuation models for each stock on the market.

1. Consensus Cloud Solutions

Consensus Cloud Solutions Inc (NASDAQ:CCSI) offers a cloud-based secure fax solution that helps companies, especially in the healthcare sector, to exchange and manage documents digitally.

The company's Clarity platform uses AI to streamline clinical documentation.

The share price is down nearly 8% over the past month and around 14% over the past year.

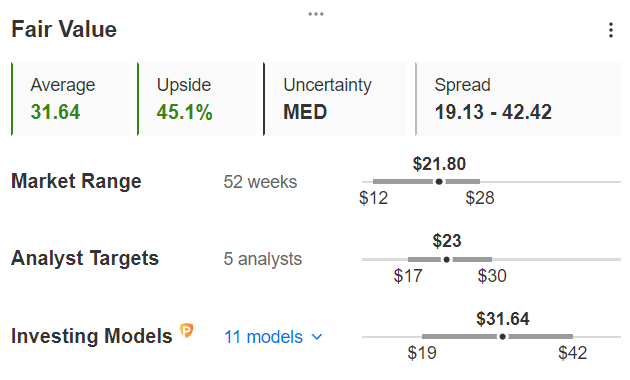

Valuation models currently consider the stock to be significantly undervalued. InvestingPro's Fair Value is $31.64 based on 11 models, which translates into a potential upside of over 45%.

Source : InvestingPro

Note, however, that the analysts who follow the stock are far more cautious, valuing the stock on average at $23, just 7.1% above the current price.

As for the next quarterly results, due on November 7, the analyst consensus is for EPS of $1.29, down 14.5% on the same quarter last year.

Source : InvestingPro

Revenues are expected to come in at $85.34 million, down 5.8% year-on-year.

2. Perion Network

Perion Network (NASDAQ:PERI) operates in the digital advertising space, helping brands and publishers enhance their online presence through targeted advertising and data-driven technology.

The company leverages AI through its WAVE platform to create dynamic audio ads using generative AI, tailoring messages in real time based on context, behavior, and demographics.

The stock has fallen by 2.3% over the past month, and by over 70% year-on-year. However, the models consider this fall to be greatly exaggerated.

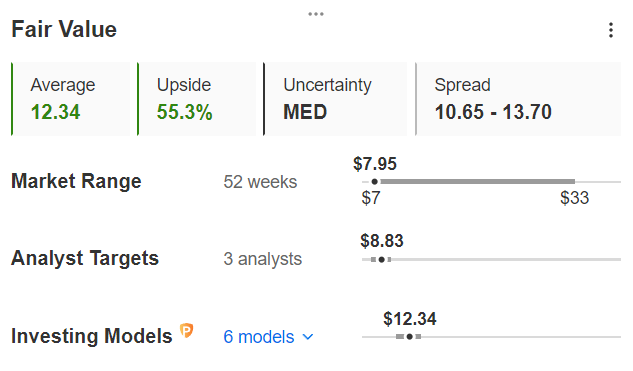

Indeed, InvestingPro Fair Value values the stock at $12.34 on the basis of 6 models, which represents a potential upside of over 55%.

Source : InvestingPro

However, as is the case with consensus, analysts are far less optimistic, targeting an average of $8.83 over a 12-month horizon, i.e. only 14.6% above Wednesday's closing price.

With regard to the next quarterly results due on November 6, analysts are forecasting EPS of $0.2, compared with $0.84 in the same quarter last year, a sharp drop in earnings that has no doubt already been widely priced in.

Source : InvestingPro

Revenues are expected to come in at $100.1 million, also down sharply from $185.3 million the previous year.

MARA Holdings

MARA Holdings Inc (NASDAQ:MARA) is a Bitcoin mining company focused on mining Bitcoin using sustainable energy sources.

Last month, the company announced a strategic collaboration with AlphaGeo, an AI-powered geospatial predictive analytics company, to improve sustainability and operational efficiency as part of its energy-focused global expansion.

The stock has benefited greatly from Bitcoin's rise this year, posting a gain of 13.9% over one month and 114% over one year.

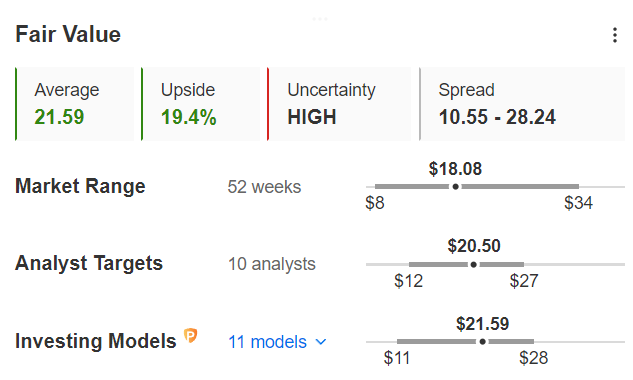

However, models suggest the stock still has potential, with InvestingPro Fair Value at $21.59 based on 11 models, corresponding to a potential gain of over 19%.

Source : InvestingPro

The slightly lower analyst target of $20.50 reflects a potential upside of just over 13%.

MARA's next quarterly results are due on November 6 and should show a loss per share of 29 cents according to analysts, compared with a loss of 6.8 cents last year.

Source : InvestingPro

Revenues are expected to come in at $145.3 million, up 48.5% year-on-year.

Conclusion

Highly undervalued according to valuation models, and the subject of mixed forecasts from analysts for their forthcoming quarterly results, these shares can be considered value opportunities for which the bar is not high for a positive surprise in upcoming earnings results.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.