Many investors may be wondering why EUR/USD verticalized after the Italians voted against Prime Minister Renzi’s Senate reforms, especially after EUR/USD dropped within a few pips of 1.05. We have identified at least 3 reasons for the reversal:

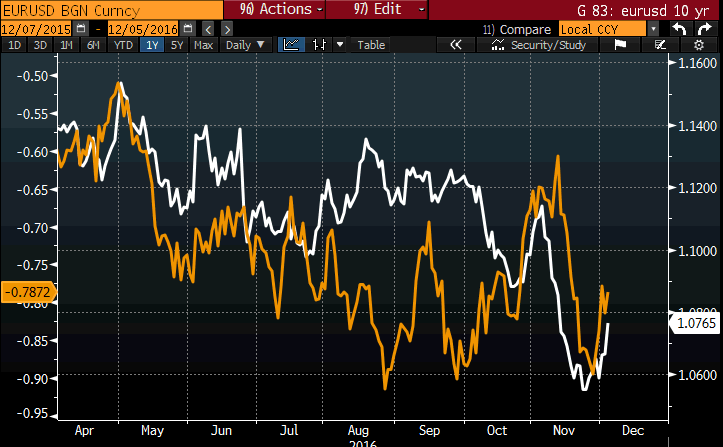

1. German – U.S. yield spread verticalizes

Anyone trading currencies knows how much of an impact the yield spread has on the direction of currencies. The following chart shows how the German – U.S. yield spread moved sharply higher Monday, driving EUR/USD up with it. For the early part of the North American trading session, U.S. yields were up nicely especially after the pop in non-manufacturing ISM but by the end of the day, they were up only 1bp against a 5bp increase on 10-year German bunds. U.S. yields even briefly turned negative intraday and at that time, EUR/USD came within 4 pips of 1.08. If U.S. yields remain stuck at current levels, the EUR/USD could extend higher. But if the upside momentum returns, 1.08 could mark the top in the currency.

2. Investors Don’t View Italian 'No' Vote on Senate Reform as 'No' Vote to EU Membership

Based on the relatively mild sell-off in Italian bonds, the sharp rise in the EUR/USD and rally in European stocks, investors clearly don’t view Italy’s 'no' vote on Senate reform as a vote on EU membership. Nor do they view it as a dramatic change in Italy’s political structure because the 'no' vote basically keeps the Constitution as it has been since 1948. This is not the same as Brexit, which dramatically changes the very fabric of U.K. politics and economics. While Prime Minister Renzi’s resignation ushers in a new period of political uncertainty, remember that Italian politics has always been courtesy of Berlusconi. In the past 6 years, Italy has also gone through 4 Prime Ministers. Renzi has been asked to stay on until the Senate Budget Law is passed, which should occur before year end. The big “risk” for Italy is the banks and the willingness of foreign investors to recapitalize weaker institutions. Only time will tell but for now, investors only seem mildly worried.

3. Aggressive EUR/USD Short Covering

Euro was sold aggressively ahead of the Italian referendum and taken even lower after the 'no' vote, but the market was very short euros ahead of the event and the massive amount of option barriers at 1.05 kept the currency from falling further versus the U.S. dollar. When Europe opened for trading and investors saw no additional selling and a relatively mild drop in Italian bonds combined with a rise in European equities, they bailed out of their short positions, taking EUR/USD sharply higher in the process.

Looking ahead, the “main” resistance level for the euro is 1.08 and we expect the currency pair to remain below this level ahead of the European Central Bank monetary policy meeting. Some investors hope that the ECB will announce a fresh round of stimulus, but given ECB President Draghi’s optimism, a steady stance is just as likely, so we do not recommend holding EUR/USD short positions the day of ECB.

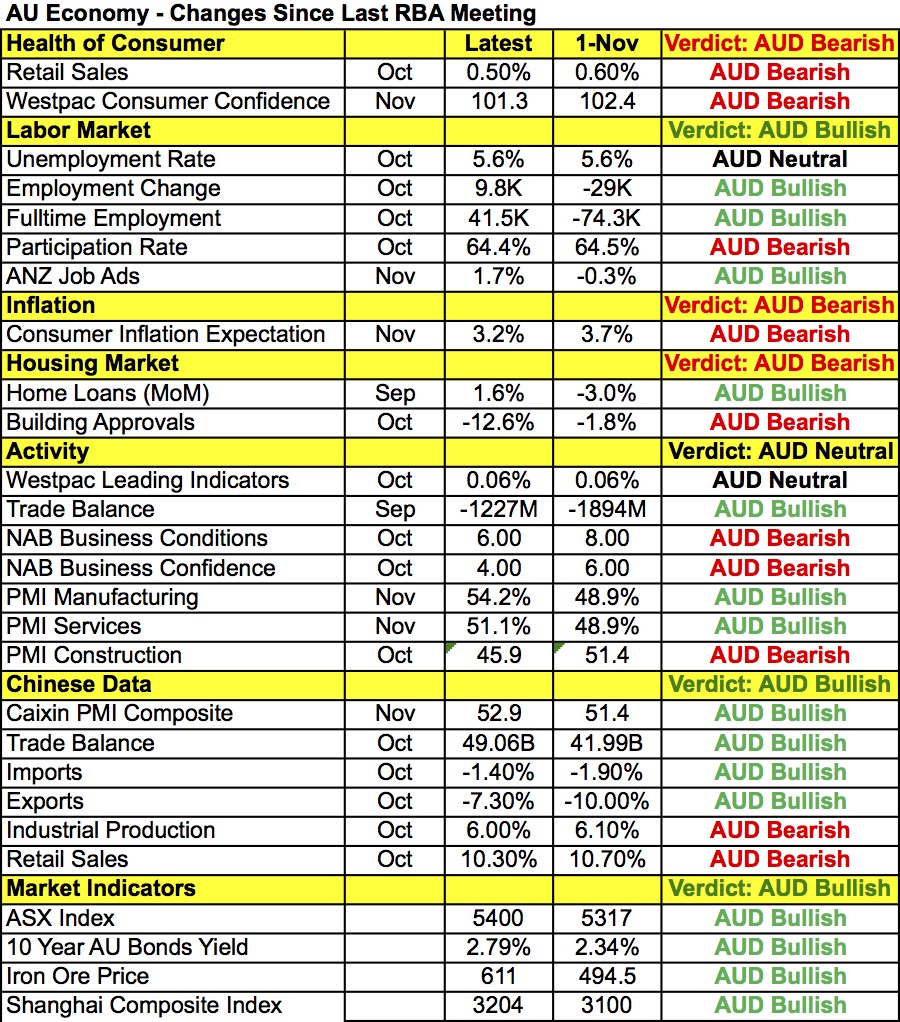

Speaking of rate decisions, the Reserve Bank of Australia was scheduled to meet Monday night and it was widely expected to leave monetary policy unchanged. The last time that the central bank met in November, the RBA statement was upbeat and this month we expect continued optimism. While the following table shows a slight decline in consumer and business confidence, manufacturing- and service-sector activity is on the rise, job growth returned in October and the trade balance narrowed. More importantly, Iron ore prices are up sharply and improvements have been seen in Chinese data. The only areas of concern are inflation and housing because building approvals dropped 12.6% in October and consumer inflation expectations declined. But we think there is still enough improvements for the RBA to maintain a steady optimistic stance that could provide a jolt of positive momentum for the Australian dollar. The New Zealand dollar was hit hard by Prime Minister Key’s shocking decision to resign. The National Party will hold a special caucus to select a new leader after which Key would officially tender his resignation to the Governor General. Considering that this announcement was unexpected, the impact on the New Zealand dollar was more significant although by the end of the North American session, NZD had also recovered all of its earlier losses. USD/CAD extended its losses as oil prices pushed higher and investors position for an optimistic monetary policy statement from the Bank of Canada. The trade balance and IVEY PMI report are scheduled for release Tuesday and stronger numbers are expected all around.

The U.S. dollar ended Monday lower versus the euro but unchanged against most of the major currencies. The stronger-than-expected non-manufacturing ISM report helped to lift the greenback, but there was a lot of volatility in USD/JPY, which dropped as low as 113.20 intraday. Investors may not be surprised that service-sector activity grew at its fastest pace in 13 years, reinforcing the Federal Reserve’s plans to raise interest rates. We heard from Fed Presidents Bullard, Dudley and Evans, all of whom seem to agree that conditions are right for a hike because they are close to their targets. Still, Dudley said that one hike is all that is needed to reach a neutral rate, suggesting that the Fed could pause for some time after hiking next week. The U.S. trade balance is scheduled for release and while manufacturing activity is on the rise, the stronger dollar may have hampered trade activity.

The British pound ended the day unchanged against the U.S. dollar and lower versus the euro. Sterling held onto its recent gains thanks to a stronger-than-expected UK services PMI report, which came in at 55.2 vs. 54.2 the prior period. The Composite PMI also exceeded expectations, posting a reading of 55.2, when 54.6 was expected. BoE’s Governor Carney offered additional support with his comment that current indicators showed that the UK was experiencing continued economic growth and that fiscal tightening was expected to take a downturn in the future. Brexit hearings began Monday in the UK Supreme Court. The court's President Neuberger confirmed in his opening remarks that the hearings and subsequent judgment would be based on law and would be impartial to the politics that surround the situation. The hearings are scheduled to last a few days and a decision is not expected until 2017. It will still be a while before Brexit has a resolution, but notes from the hearings quite possibly will be market moving. The UK remains quiet in the next 24 hours with no data due for released.