- Stocks rattled by inflation fears, Fed’s aggressive rate hike plans, and concerns about a potential recession.

- Three companies likely to outperform due to strong fundamentals, reasonable valuations, and high dividend payouts.

- The three—British American Tobacco, Devon Energy, and ConAgra Foods—should be on your watchlist.

- If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

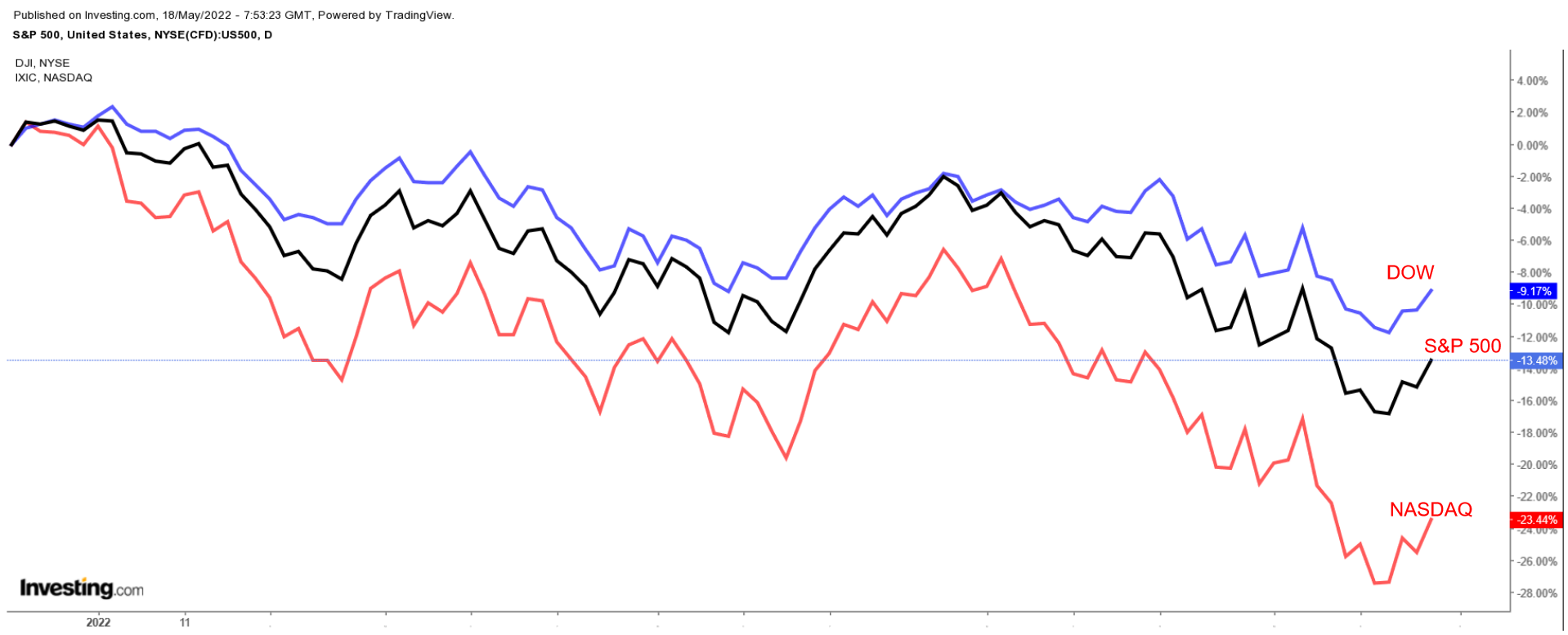

Wall Street’s major averages have gotten off to one of their worst starts to the year on record as investors fret over the Federal Reserve’s plans to raise interest rates to combat persistently high inflation.

The blue-chip Dow Jones Industrial Average is down 10% year-to-date, while the benchmark S&P 500 and the tech-heavy NASDAQ Composite are off by 14% and 23%, respectively.

While steep declines have walloped unprofitable high-growth technology companies in recent months, defensive-minded value stocks are seeing impressive gains amid the current bout of market turmoil.

This is evident from a comparison of the iShares S&P 500 Value ETF (NYSE:IVE) performance with that of the iShares S&P 500 Growth ETF (NYSE:IVW) in the chart below. IVE has outperformed IVW by a wide margin so far this year as investors dump risky stocks for safer bets.

With volatility on Wall Street not looking to decrease substantially any time soon, we've highlighted three leading value stocks that are well worth considering, given the current conditions.

1. British American Tobacco (LON:BATS)

- P/E Ratio: 12.0

- Dividend Yield: 6.74%

- Market Cap: $99 Billion

- Year-To-Date Performance: +16.6%

British American Tobacco (NYSE:BTI) is the world’s second largest tobacco company based on net sales. Its most recognized and best-selling products—which are sold in over 180 countries—are the Lucky Strike, Newport, Camel, Kent, and Dunhill brands. Its portfolio also includes reduced-risk tobacco products such as Vype, Vuse, and glo.

High-quality blue-chip dividend stocks tend to outperform in a turbulent environment as market players seek defensive-minded consumer staple companies with relatively down-to-earth valuations.

With a reasonable price-to-earnings (P/E) ratio of 12.0, British American—whose shares are up 16.6% year-to-date—comes at an extreme discount when compared to its notable peers, such as Philip Morris (NYSE:PM), and Altria (NYSE:MO), which have P/E ratios of 18.4 and 33.0, respectively.

The UK-based cigarette and tobacco manufacturing company is also a quality dividend stock. BTI currently offers a quarterly payout of $0.7354 per share, which implies an annualized dividend of $2.94 at a sky-high yield of 6.74%, one of the highest in the sector.

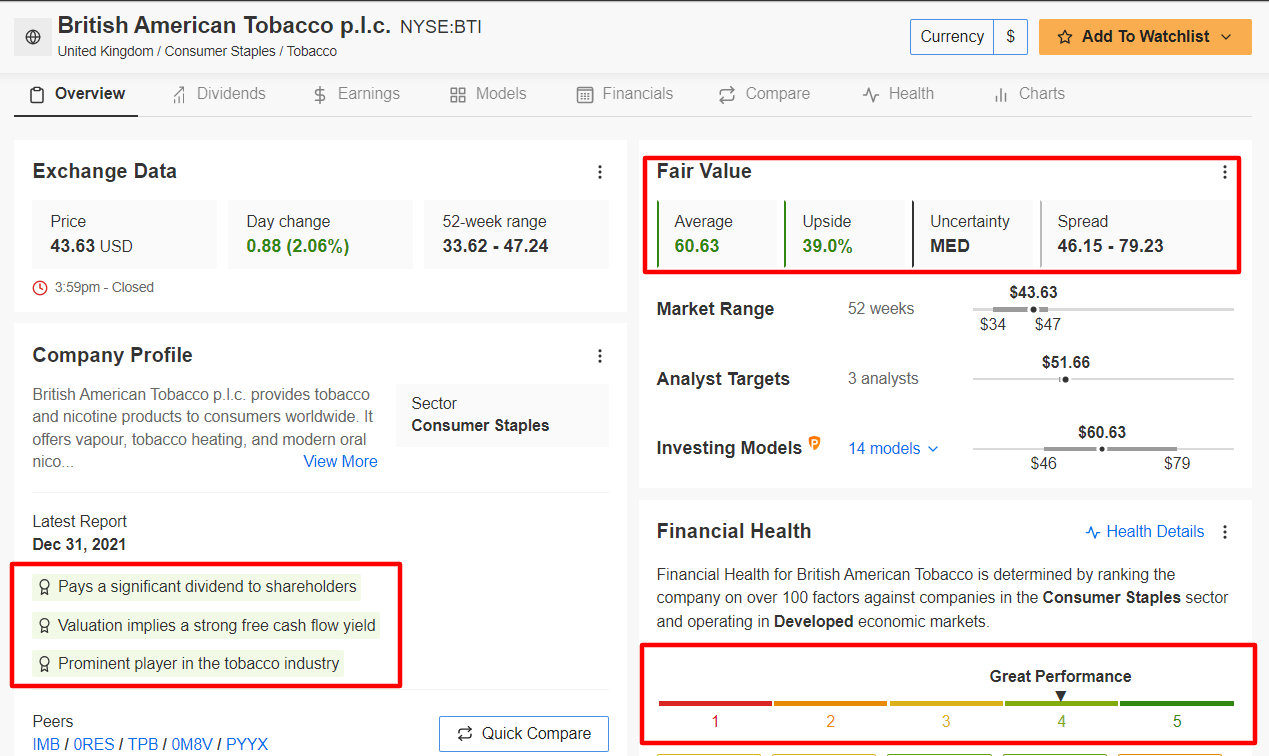

BTI ended Tuesday’s session at $43.63, within sight of a recent four-year peak of $47.24 reached on Feb. 17. At current levels, British American—which has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index—has a market cap of $99 billion.

In a sign of how well its business has performed amid the current environment of soaring inflation and slowing growth, BTI reported first quarter profit and sales which easily beat consensus expectations on Apr. 28.

The Big Tobacco company, which has capitalized on its recent shift to non-combustible, reduced-risk products, also backed its full-year guidance and said revenues in its new product categories are expected to grow to 5 billion pounds ($6.21 billion) by 2025.

Taking that into account, British American’s stock could see an increase of 39% in the next 12 months, according to the InvestingPro model, bringing shares closer to their fair value of $60.63.

Source: InvestingPro

2. Devon Energy

- P/E Ratio: 13.6

- Dividend Yield: 7%

- Market Cap: $47.9 Billion

- Year-To-Date Performance: +64.7%

One of the largest independent shale oil and gas producers in the US, Devon Energy (NYSE:DVN) has been a standout performer in the energy sector this year, reaping the benefits of higher energy prices and improving global demand.

Shares of the Oklahoma City, Oklahoma-based company have jumped nearly 65% in 2022, far outpacing the comparable returns of both the Dow Jones Industrial Average and the S&P 500, making it one of the market’s top gainers of the year.

Despite robust year-to-date returns, Devon remains one of the best names to own to hedge against further volatility thanks to its ongoing efforts to return more cash to shareholders in the form of higher dividend payouts and stock buybacks.

The low-cost oil and gas producer recently raised its quarterly dividend by 27% to $1.27 per share. This represents an annualized dividend of $5.08 and a yield of 7.0%, making it an extremely attractive play in the current environment.

For comparison, the yield on the benchmark US 10-year Treasury is hovering below 3%, while the implied yield for the S&P 500 is currently at about 1.5%.

In addition, Devon’s stock has a comparatively low P/E ratio of 13.6, making it cheaper than other notable names in the oil and gas space, such as EOG Resources (NYSE:EOG), and Pioneer Natural Resources (NYSE:PXD).

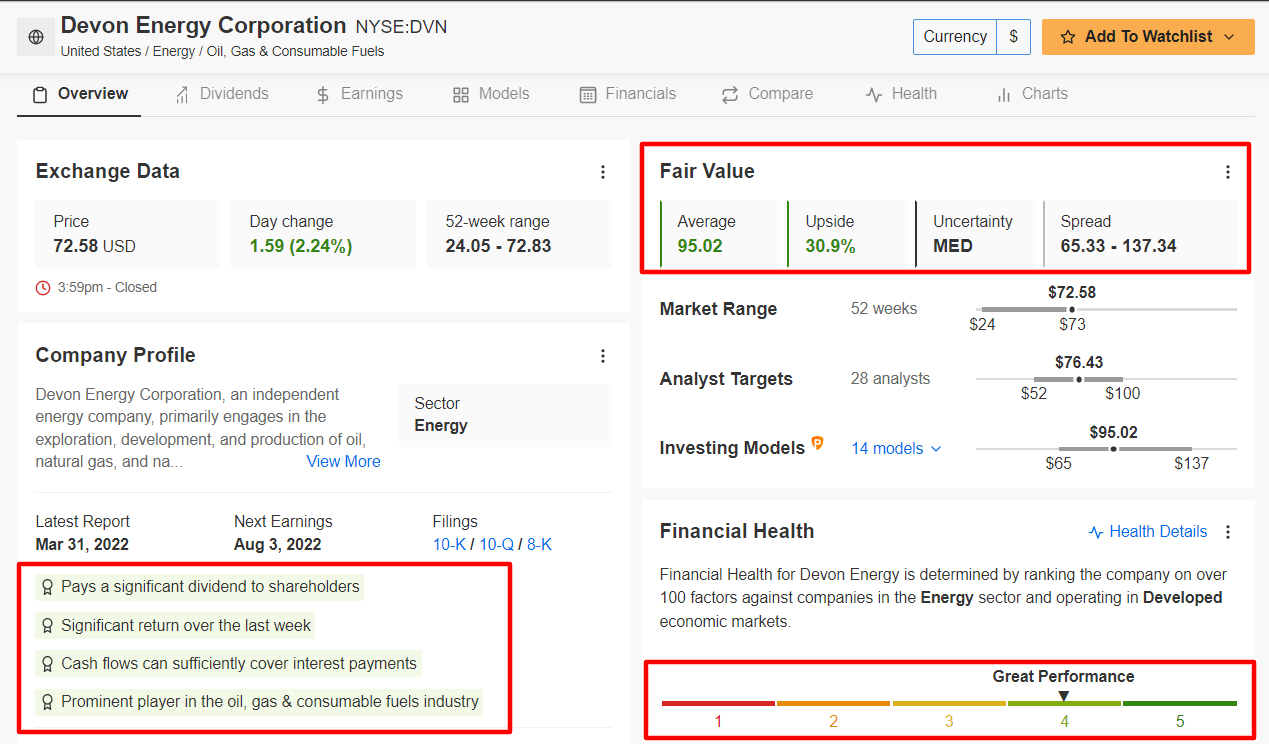

Shares of DVN closed at $72.58 last night, a level not seen since August 2014. At current valuations, the energy producer has a market cap of $47.9 billion.

Devon is poised to continue to benefit from its stellar Permian operations while taking advantage of strong crude oil and natural gas prices, which will help fuel future profit and sales growth.

The company posted triple-digit year-over-year growth in both earnings and revenue when it reported first quarter earnings on May 2. It also boosted its stock buyback program by 25% to $2 billion and made it clear that it will continue to focus on shareholder returns.

Not surprisingly, the quantitative models in InvestingPro point to almost 31% upside in Devon stock from current levels over the next 12 months to a fair value of $95.02 per share.

Source: InvestingPro

3. ConAgra Foods

- P/E Ratio: 16.4

- Dividend Yield: 3.54%

- Market Cap: $16.9 Billion

- Year-To-Date Performance: +3.4%

ConAgra Foods (NYSE:CAG), which has recently rebranded to ConAgra Brands, is one of the world’s largest packaged food manufacturing companies, best known for producing consumer food staples such as Slim Jim beef jerky, Hunt’s ketchup, Duncan Hines cake mixes, and Reddi-wip.

As investors worry about accelerating inflation, slowing economic growth, and rising interest rates, ConAgra stock has potential to deliver strong returns in the months ahead as investors pile into defensive areas of the consumer staples sector.

With a P/E ratio of 16.4, CAG—whose shares are up 3.4% year-to-date—comes at a substantial discount when compared to other packaged-food giants, such as Kraft Heinz (NASDAQ:KHC), and Hormel Foods (NYSE:HRL). Kraft sports a lofty price-to-earnings ratio of 54.1, while Hormel trades at a P/E ratio of 31.2.

In addition, ConAgra offers a relatively high annualized dividend of $1.25 per share at a yield of 3.54%, making it an even likelier candidate to perform well given current market conditions.

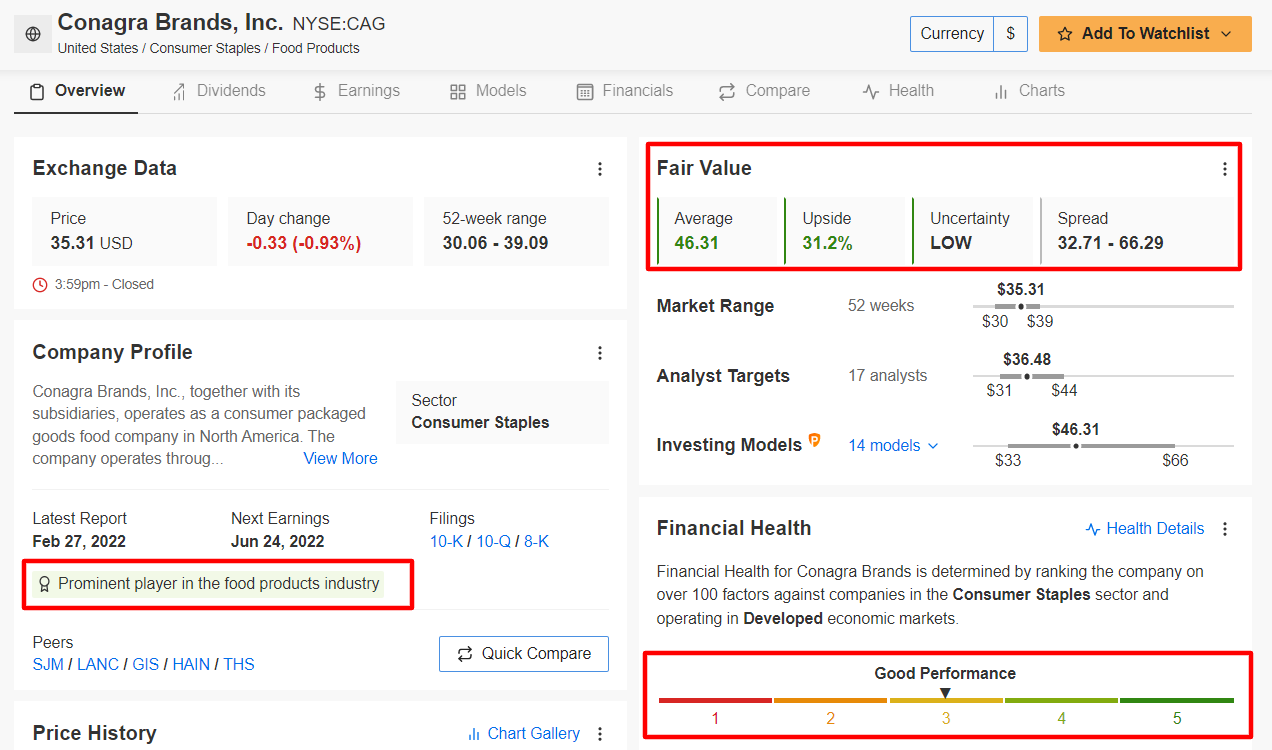

CAG ended at $35.31 last night, moving further away from a recent 52-week low of $30.06 touched on Mar. 11. At current levels, the Chicago, Illinois-based food corporation has a market cap of $16.9 billion.

ConAgra delivered better-than-expected earnings and revenue for its fiscal third quarter on Apr. 7, despite the negative impact of surging input prices and freight costs.

In a sign that bodes well for the future, the packaged-food company also raised its full-year sales outlook to account for rising demand and additional price increases.

As we can see, ConAgra’s stock is undervalued at the moment according to InvestingPro models and could see an upside of about 31% over the next 12 months to its fair value of $46.31.

Source: InvestingPro

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »