- Concerns on accelerating inflation, rising interest rates, and a slowing economy

- Despite tough macro backdrop, some out-of-favor growth stocks staged recoveries

- Uber, Trade Desk, and Pinterest offer upside

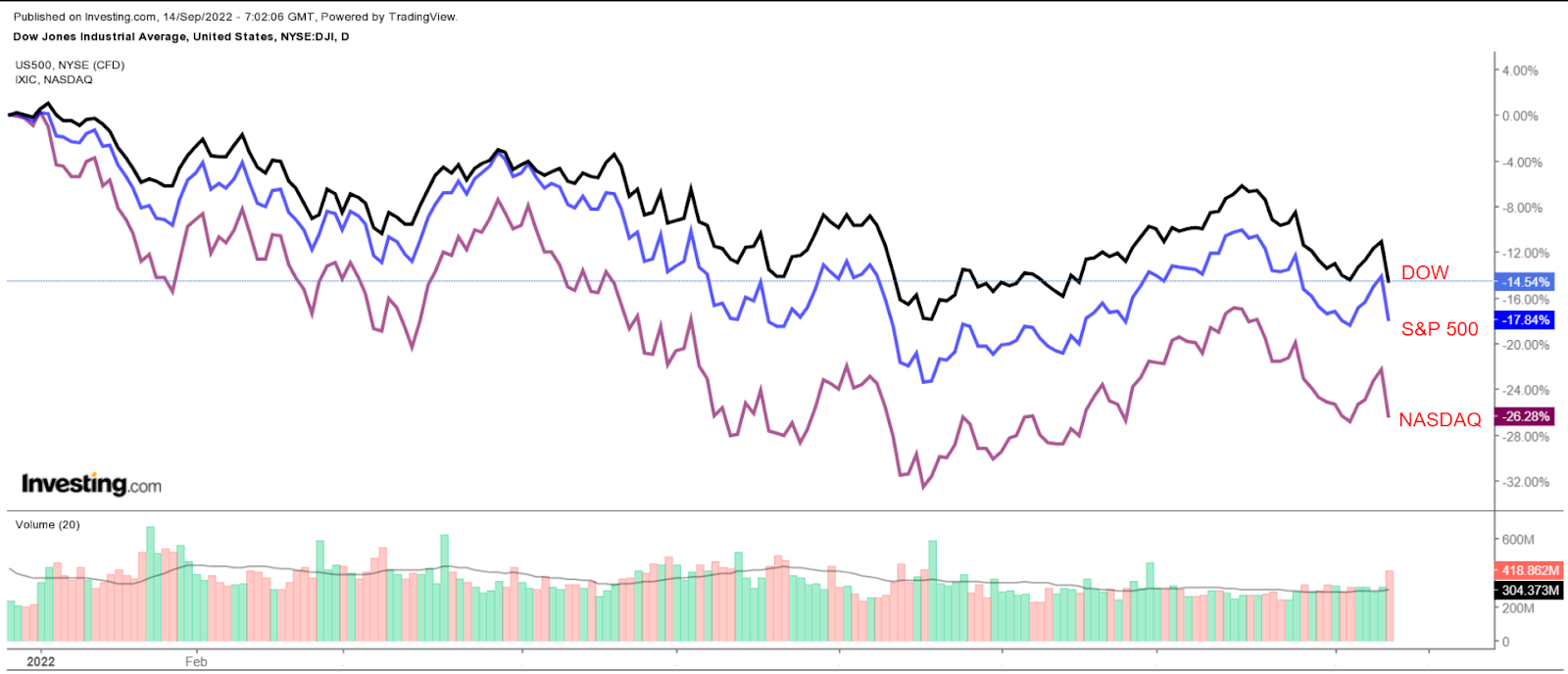

Stocks on Wall Street are on track to suffer one of their worst years in history amid ongoing fears over the Federal Reserve’s aggressive plans to hike interest rates to combat persistently high inflation.

The blue-chip Dow Jones Industrial Average is down 14.4% year-to-date, while the benchmark S&P 500 and the tech-heavy Nasdaq are off by 17.5% and 25.6%, respectively.

Despite this, three growth stocks have managed to stage impressive turnarounds and still offer additional upside due to plenty of growth potential in their respective businesses.

Uber

- Year-To-Date Performance: -25.3%

- Percentage From All-Time High: -51.1%

Uber (NYSE:UBER) shares have struggled in 2022, sinking about 25% as investors dumped high-growth technology names that are most sensitive to rising rates due to rich valuations.

After rallying to a record high of $64.05 in February 2021, the shares tumbled rapidly to a low of $19.90 on June 30 and have recovered some of their steep declines. However, they remain roughly 51% below the recent peak.

In my view, the sizable decline in Uber’s stock has created a compelling buying opportunity for long-term investors as improving mobility trends and ongoing momentum in food delivery demand have skewed the risk/reward to the upside.

Indeed, Uber delivered impressive quarterly results in early August, boosted by strong customer demand.

More importantly, it reported positive quarterly cash flow for the first time in its history, and forecast third-quarter operating profit above estimates.

“This marks a new phase for Uber, self-funding future growth with disciplined capital allocation, while maximizing long-term returns for shareholders,” Nelson Chai, Uber’s chief financial officer, said in the earnings release.

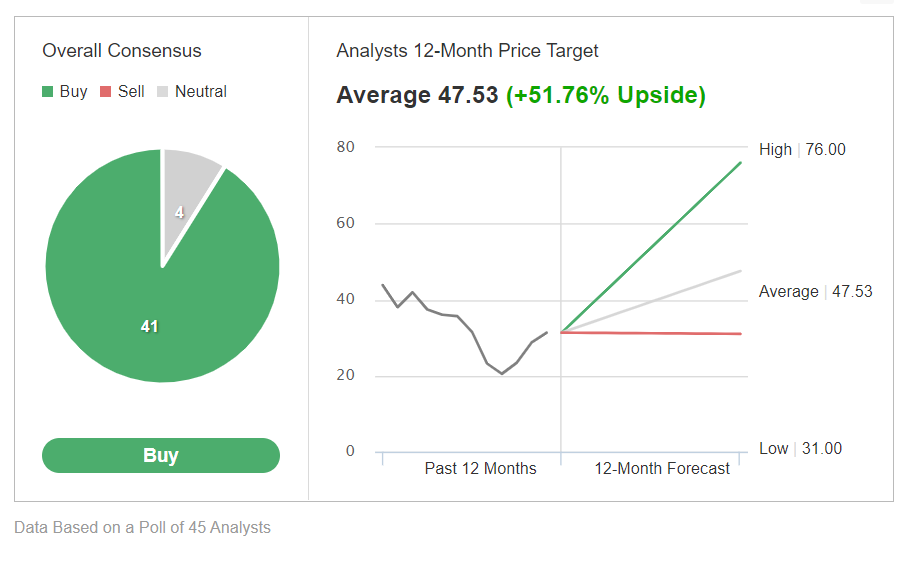

Even with the recent upswing, Uber’s stock remains a favorite on Wall Street, with 41 of 45 analyst ratings collected by Investing.com reflecting a bullish recommendation with fairly high conviction and roughly 52% upside potential.

Trade Desk

- Year-To-Date Performance: -30.3%

- Percentage From All-Time High: -44.1%

Trade Desk (NASDAQ:TTD), which operates a self-service software platform where customers can buy and manage data-driven digital advertising campaigns, has seen its valuation collapse this year, with shares falling around 30%.

But shares of the digital ad-buying specialist, which has a market cap of $31.2 billion, have staged an impressive recovery since falling to a 52-week low of $39 on July 14. Investors that missed the sharp moves higher last year should consider buying Trade Desk given its innovative online ad-buying platform. The digital advertising company’s tools make it easier for brands to reach audiences across various devices with greater precision in a world without third-party cookies.

Investors that missed the sharp moves higher last year should consider buying Trade Desk given its innovative online ad-buying platform. The digital advertising company’s tools make it easier for brands to reach audiences across various devices with greater precision in a world without third-party cookies.

“If we continue to execute, I believe we will benefit as much as any company in the world from this tailwind,” founder and CEO Jeff Green said.

Trade Desk posted solid quarterly results despite several macroeconomic headwinds. Additionally, management sounded upbeat regarding the outlook for the months ahead, forecasting Q3 revenue growth of 28% to $385 million.

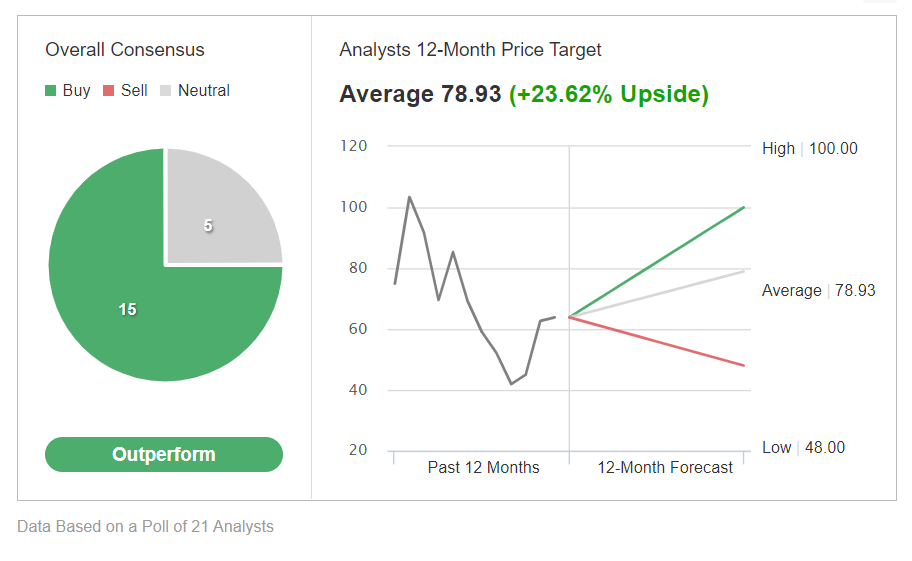

Not surprisingly, most analysts remain generally bullish on the TTD stock, as per an Investing.com survey, which revealed that 15 out of 21 analysts covering the name rated it as a ‘buy’.

- Year-To-Date Performance: -32.4%

- Percentage From All-Time High: -72.6%

Pinterest (NYSE:PINS) has seen its stock drop more than 30% this year as it fell out of favor with investors amid worries over decelerating user growth and a worsening macro backdrop.

Even as PINS stock remains down sharply for the year, shares have rebounded significantly since falling to a recent 52-week trough of $16.14 in mid-May.

Activist investor Elliott Investment Management sparked a turnaround in the stock in July after revealing it had become the largest shareholder with a 9% stake.

Despite year-to-date losses, I believe Pinterest stock is poised to bounce back given its improving fundamentals, stabilizing user growth trends, and increasing monetization potential under new CEO Bill Ready.

Ready, an Alphabet (NASDAQ:GOOGL) alum specializing in e-commerce, took over the role in June, succeeding co-founder and longtime CEO Ben Silbermann, who is now the board’s executive chairman.

“As the market-leading platform at the intersection of social media, search and commerce, Pinterest occupies a unique position in the advertising and shopping ecosystems, and CEO Bill Ready is the right leader to oversee Pinterest’s next phase of growth,” Elliot said in a statement following the company’s solid earnings report on Aug. 2.

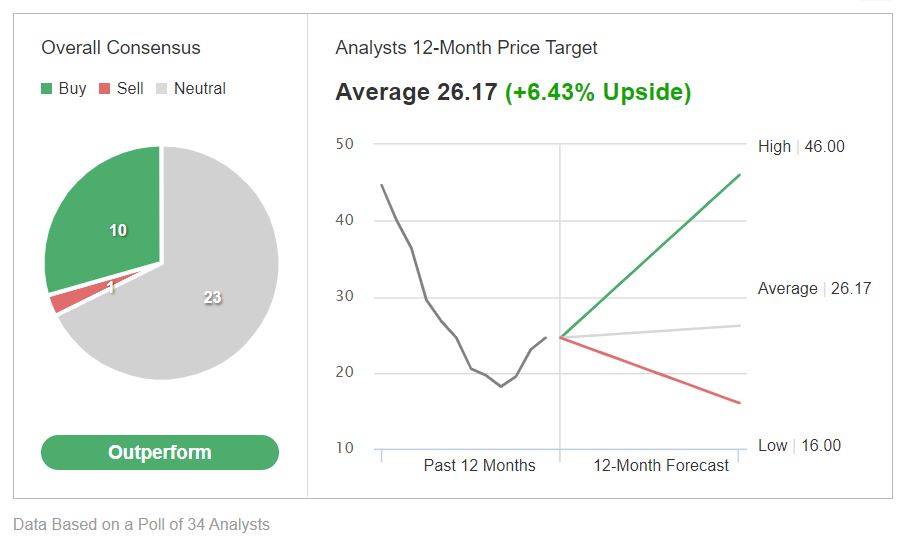

Wall Street has a long-term bullish view on PINS stock, with 33 out of 34 analysts surveyed by Investing.com rating it as either ‘buy’ or ‘hold’ and an average analyst price target of $26.17, upside of 6.4%.

Disclosure: At the time of writing, Jesse has no position in any stock mentioned. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.