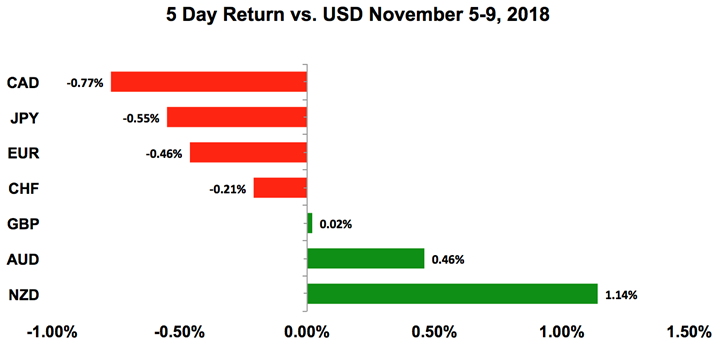

At the start of last week, investors took profits on long dollar positions on the fear that the US Midterm Elections would cause a significant market disruption. However, when the Democrats won control of the house, investors sold dollars and took it right back up in the NY session. 24 hours later, the Federal Reserve’s positive outlook gave them the confidence to send USD/JPY above 114 and EUR/USD to a one-week low of 1.1327. As we look ahead, there’s a tough fight happening between the bulls and bears and the winner will depend on whether US data reinforces the Fed’s optimism. We think there could be a further pullback that could take USD/JPY to 113 and EUR/USD to 1.16 but just like last week, these declines should attract more buyers. The worst-performing currency last week was the Canadian dollar, which was hit hard by the drop in oil prices. This performance contrasted sharply with AUD and NZD, the 2 biggest winners. With that in mind, the US dollar, British pound and Australian dollar will be the three main currencies to watch this week.

US Dollar

Data Review

- Fed Keeps Rates at 2.25%, Expresses Confidence in Economy

- ISM Non-Manufacturing Composite 60.3 vs 59 Expected

- PPI Final Demand 0.6% vs 0.2% Expected

- PPI Ex Food and Energy 0.5% vs 0.2% Expected

- PPI Ex Food, Energy and Trade 0.2% vs 0.2% Expected

- University of Michigan Sentiment 98.3 vs 98 Expected

- University of Michigan Expectations 88.7 vs 87.2 Expected

- University of Michigan Current Conditions 113.2 vs 114.9 Expected

Data Preview

- US CPI - Gas prices plunged in Oct offset by better than expected PPI

- US Retail Sales, Empire Manufacturing and Philly Fed - Might be a miss as forecasts are high but Redbook, retail sales increased slightly and wage growth slowed

- Industrial and Manufacturing Production - Potential for downside surprise given lower manufacturing ISM index

- Japan Q3 GDP - Weaker trade and retail sales in Q3 point to lower GDP but economists already forecasting softer data

Key Levels

- Support 112.00

- Resistance 114.00

Starting with the US dollar, the main takeaway from last week is that investors don’t see any meaningful changes for the US economy after the Midterm Election. The economy is doing well, the labor market is strong and the Fed plans to raise interest rates this year and next. The split Congress could make it more difficult for President Trump to push through tax reform and other measures but immediately after the election, the president talked about working together and negotiating any plan that the Democrats propose. Perhaps he realizes that to get any policies passed, there needs to be an attitude of collaboration and investors are hoping that the president’s response to the election signals a step in that direction. Now, of course, the Democrats will focus on stalling many of the administration's efforts from repealing the health-care law, to changing campaign finance and ethics rules but they will also be looking for common ground in areas such as infrastructure. The market’s positive reaction to the election along with the Fed’s confidence in the labor market and household spending keep rate-hike expectations intact.

With that in mind, the dollar is in play because there are two very important pieces of US data scheduled for release this week – the consumer price report and retail sales. Both of these reports have a direct influence on Fed policy and will determine the market’s confidence in the Fed’s outlook. Economists are looking for improvements to both, especially CPI after the strong producer price report on Friday but with oil prices falling 10% last month and the Dollar Index hitting a 2-year high, the risk is to the downside. Retail sales could miss as well simply because wage growth slowed and the forecasts are high. Nonetheless, if data is good, the Fed will be vindicated and investors will have the confidence to take USD/JPY to 115 but if either report falls short of expectations in a meaningful way, the pair could fall to 113 quickly.

Euro

Data Review

- GE Factory Orders 0.3% vs -0.5% Expected

- GE Services PMI 54.7 vs 53.6 Expected

- GE Composite PMI 53.4 vs 52.7 Expected

- EZ Services PMI 53.7 vs 53.3 Expected

- EZ Composite PMI 53.1 vs 52.7 Expected

- EZ PPI 0.5% vs 0.4% Expected

- GE Industrial Production 0.2% vs -0.1% Expected

- EZ Retail Sales 0.0% vs 0.1% Expected

- GE Trade Balance 18.4b vs 20.0b Expected

- GE Current Account Balance 21.1b vs 21.0b Expected

- ECB Bulletin shows an upbeat tone with an expected upbeat labour market

Data Preview

- GE CPI - If data is revised, it could be market moving, otherwise no impact

- GE ZEW Survey - Potential for upside surprise given stronger Industrial production & factory order

- GE GDP - Potential for downside surprise given retail sales & trade weakened in the third quarter

- EZ Industrial Production and GDP - Will update after GE GDP but industrial production improved in Germany

- EZ Trade Balance - Potential for upside surprise given stronger GE and French trade balance

- EZ CPI - German CPI slowed but FR CPI increased so a bit of a wash

Key Levels

- Support 1.1300

- Resistance 1.1500

Euro, on the other hand, traded almost entirely on anti-dollar flows. Data was mixed with weaker Eurozone retail sales offset by stronger German factory and industrial production activity. Eurozone and German third-quarter GDP numbers are scheduled for release this week along with the ZEW survey. For the most part, we are looking for relatively good data because the activity has been better but we also don’t expect any of these reports to have a meaningful impact on EUR/USD. 1.13 is the main support level – if it breaks, we should see a swift move down to 1.12. If it holds, EUR/USD should find its way back to 1.1425.

British Pound

Data Review

- Services PMI 52.2 vs 53.3 Expected

- Composite PMI 52.1 vs 53.4 Expected

- BRC Sales Like for Like (YoY) 0.1% vs 0.5% Expected

- Visible Trade Balance -9.73b vs -11.4b Expected

- Trade Balance Non-EU -2.34b vs -3.9b Expected

- Industrial Production 0.0% vs -0.1% Expected

- Manufacturing Production 0.2% vs 0.1% Expected

- GDP 0.0% vs 0.1% Expected

Data Preview

- Employment Report - Potential for downside surprise given weaker manufacturing and services report job growth

- Consumer Price Index - Potential for downside surprise given lower shop prices, also decline in prices in the manufacturing and construction sectors, mixed prices in services

- Retail Sales - Potential for downside surprise given lower shop prices, a modest increase in BRC retail sales

Key Levels

- Support 1.2800

- Resistance 1.3100

This week will be an important one for sterling because the Brexit withdrawal agreement could be released. The Cabinet has been invited to read a draft of the proposed EU withdrawal agreement and could hold a meeting to approve the document as early as Monday. If that happens, UK Brexit negotiator Raab could meet with EU Chief Barnier on Tuesday after which the agreement will be publicly released. Unfortunately, the draft may not address the biggest issue of the Irish border. There’s a backstop being discussed in Britain that would involve the UK temporarily remaining in a customs union with a review clause that would allow them to exit when they are ready. It seems that both sides like the idea but the EU wants the review clause to be a decision that involves both parties whereas the U.K. wants it to be unilateral. So it's not clear if they will be able to find a mutual agreement on the backstop by next week or even the EU Summit later this month but if they do, GBP/USD will soar. Data wise it will also be a busy week with jobless claims, retail sales and consumer prices scheduled for release. Most of these reports are expected to be softer as the improvements seen earlier this year begin to fade. On a technical basis, the level to watch for GBP/USD is 1.2950. If it breaks we could see a swift slide to 1.28. However if it holds and GBP/USD rises back above 1.3050, the next stop could be 1.32 especially if the move is fueled by positive Brexit news.

AUD, NZD, CAD

Data Review

Australia

- RBA Leaves Rates Unchanged, Upgrades GDP forecast

- AU PSI 51.1 vs 52.5 Prior

- Current Account Balance $16.0b vs $5.3b Prior

- Caixin PMI Composite 50.5 vs 52.1 Prior

- Caixin PMI Services 50.8 vs 52.8 Expected

- CH Trade Balance $34.01b vs $35.15b Expected

- CH PPI 3.3% vs 3.3% Expected

- CH CPI 2.5% vs 2.5% Expected

New Zealand

- RBNZ Leaves Rates Unchanged, Says Cuts Still on the Table

- GDT Prices Drop 2.0%

- Unemployment Rate 3.9% vs 4.4% Expected

- Employment Change (QoQ) 1.1% vs 0.5% Expected

- Avg. Hourly Earnings 1.4% vs 0.8% Expected

- 2-Year Inflation Expectation 2.03% vs 2.04% Prior

Canada

- Building Permits 0.4% vs 0.3% Expected

- IVEY PMI 61.8 vs 50.4 Prior

- Housing Starts 205.9k vs 198k Expected

- New Housing Price Index 0.0% vs 0.0% Expected

Data Preview

Australia

- AU Employment Report - Employment conditions improved in services and construction but deteriorated in manufacturing

- CH Retail Sales and Industrial Production - Chinese data can be difficult to predict but market moving

New Zealand

- Manufacturing PMI - Potential for upside surprise given a slight improvement in business confidence and stronger labour data

Canada

- No Data

Key Levels

- Support AUD .7100 NZD .6600 CAD 1.3000

- Resistance AUD .7300 NZD .6800 CAD 1.3300

The Australian dollar is in focus for a few reasons. Fundamentally, Australian labor-market numbers are scheduled for release this week along with Chinese industrial production and retail sales. So far, Australian data has been good and according to the PMIs, employment conditions improved in the services and construction sectors last month. This positive data trend and the Reserve Bank’s decision to upgrade their 2018 and 2019 GDP forecasts took AUD/USD to its strongest level in more than a month last week. The central bank also lowered their jobless rate forecast to 4.75% in 2020. However, after testing and breaking through the 100-day simple moving average, AUD/USD is now trading back below resistance. This is problematic because, on a technical basis, it suggests that the pair has peaked and is poised for a deeper correction below .7150. Whether that happens or not hinges on the labor data, risk appetite and the market’s demand for US dollars. If risk appetite sours or strong US data sparks fresh buying of US dollars, AUD/USD could extend its losses despite good data.

Like Australia, solid data took the New Zealand dollar to its strongest level in 3 months. In the case of NZD, the unemployment rate fell to a 10-year low of 3.9% from 4.4% thanks to a 1.1% increase in job growth. However, the Reserve Bank did not seem impressed. After leaving interest rates unchanged at last week’s meeting, Reserve bank Governor Orr said they are not taking a rate cut off the table because it has been a challenge to lift inflation further and if GDP falls short of forecast, they may have to resort to easing. Regardless of how serious the RBNZ is, the mere mention of rate cuts was enough of a reason for NZD/USD traders to take profit. New Zealand’s business PMI report is due for release this week and based on the improvements in the labor market, we are not looking for any meaningful deterioration.

The Canadian dollar, on the other hand, could find it very difficult to rally if oil prices continue to fall. Since the beginning of October, crude-oil prices have fallen more than 20% and in this time, the price of Western Canada Select dropped more than 50%. Although manufacturing activity improved according to the latest IVEY PMI report, the decline in Canadian crude prices and the setback to the Keystone XL pipeline project could cost the sector and in turn, Canada’s economy significantly. There are no major Canadian economic reports scheduled for release next week to help the currency and we suspect that if oil prices do not turn higher soon, the Bank of Canada could pare its optimism. USD/CAD hit a 3-month high on Friday and the next stop for the pair could be 1.33.