The tech heavy NASDAQ Composite is trading near its highest level on record. While most of the focus has been on the high-profile FAANG group of stocks, which include Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Google parent Alphabet (NASDAQ:GOOGL), there is another important industry group in the technology space that has been leading the charge higher this year: cloud-based software stocks.

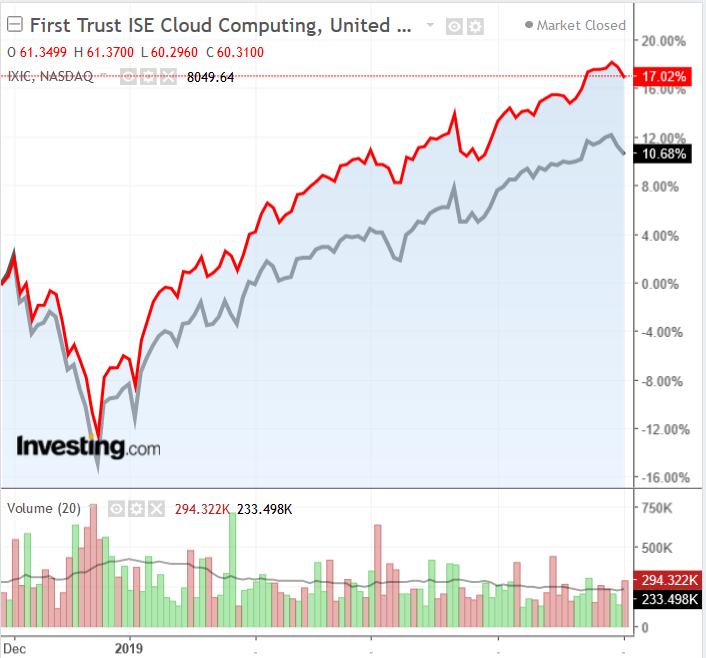

In fact, the First Trust ISE Cloud Computing ETF (NASDAQ:SKYY) has rallied around 24% since the start of 2019, outperforming the NASDAQ Composite, which has gained about 21% on the year.

Chart powered by TradingView

Below we focus on three leading names in the cloud software space, each of which displays some of the best potential for long-term growth. As well, in the wake of their latest quarterly earnings reports, released earlier this week, each stock is worth considering now.

Twilio, Inc.

Twilio (NYSE:TWLO), a cloud communications platform specialist we've highlighted twice before, here and here, topped consensus estimates for earnings and revenue when it posted first-quarter earnings after Tuesday's closing bell.

Chart powered by TradingView

The San Francisco-based company reported adjusted earnings per share of 5 cents, compared with a loss of 4 cents per share in the year-ago period. Revenue rose to $233.1 million, up an impressive 81% from the same quarter a year earlier.

Twilio's active customer accounts also maintained a torrid pace of growth, climbing nearly 65% year-over-year to 154,797 by the end of the quarter. “A growing number of customers around the world are rewarding us with their business as they utilize our platform to create better ways to engage with their customers,” said Jeff Lawson, Twilio’s Co-Founder and Chief Executive Officer.

Twilio's second quarter outlook was also bullish. It forecast revenue of $262 million to $265 million. That was well ahead of consensus estimates calling for revenue of just $251.5 million.

We expect Twilio to continue to do well on the customer acquisition front as it positions itself as a leader in the cloud communications space. The integration of SendGrid—the cloud-based email marketing platform it acquired in October last year for $2 billion—should also provide more opportunities to grow its sales.

Twilio shares, which closed yesterday at $128.57, not far from its all time high of $141.53, have gained 202% in the past year.

Zendesk, Inc.

Software-as-a-service company Zendesk's (NYSE:ZEN) first-quarter earnings and revenue figures beat expectations when it reported after the bell on Tuesday, but GAAP losses were wider than expected.

Chart powered by TradingView

The company said it lost 41 cents a share in the first-quarter, wider than a loss of 28 cents a share in the year-ago period. However, adjusted for one-time items, Zendesk actually earned 4 cents a share, above estimates for adjusted EPS of 3 cents. Yet more impressive, revenue jumped 40% from the year-ago period to $181.5 million, beating forecasts for sales of $179.5 million.

Looking ahead, Zendesk's outlook for the current quarter and for full-year 2019 came in above Wall Street targets. The San Francisco-based company said it expects revenue between $191 million and $193 million for the second-quarter, versus the consensus of $191.2 million.

For the full-year, Zendesk projects revenue in a range between $802 million to $810 million. Analysts had expected $802.5 million.

We grow increasingly bullish on the software company, which was previously highlighted as a top software sector play here, as it continues to build on the strong adoption of its customer relationship management (CRM) solutions. Strong demand for its flagship Zendesk Suite product, a bundled subscription-based service, should continue making this company a good bet going forward.

Zendesk shares, up 75% year-to-date, closed at $84.77 last night, not far from its all-time high of $87.92.

Paycom Software, Inc.

Paycom (NYSE:PAYC) reported upbeat earnings and revenue figures for the first-quarter on Tuesday evening.

Chart powered by TradingView

The cloud-based workforce management software company said adjusted earnings per share were $1.19, up 24% from the first quarter of 2018. Sales rose 30% to $199.9 million, the third straight quarter of 30%+ sales growth. Nearly all of it was recurring revenue, the company said.

“Our strong first-quarter results were driven by our proprietary software offering and focused sales efforts, positioning us well to accomplish our performance objectives for 2019,” said Chad Richison, Paycom’s founder and CEO.

The Oklahoma City-based company was optimistic on its prospects for the current June quarter, saying it expects revenue to be in a range of $162.5 million to $164.5 million. It also provided full-year revenue guidance in a range of $718 million to $720 million. The scope of both were above consensus estimates calling for Q2 revenue of $162.6 million and full-year sales of $712.2 million.

Despite robust gains so far this year, Paycom's stock still looks attractive going forward, considering the strong demand for its enterprise-level software solutions for human resources, which has made it one of the true leaders in its field. Shares closed at $201.46 yesterday, just below the stock's all-time high of $203.20. The stock is up 79% over the past 12 months.