The last group of companies scheduled to report second quarter financial results this season are major U.S. retailers, which are perhaps the most sensitive to economic conditions and consumer spending. The sector includes several notable year-to-date winners as the COVID vaccine rollout and government stimulus checks gave consumers greater confidence and more money to spend as they headed back to brick-and-mortar retail stores.

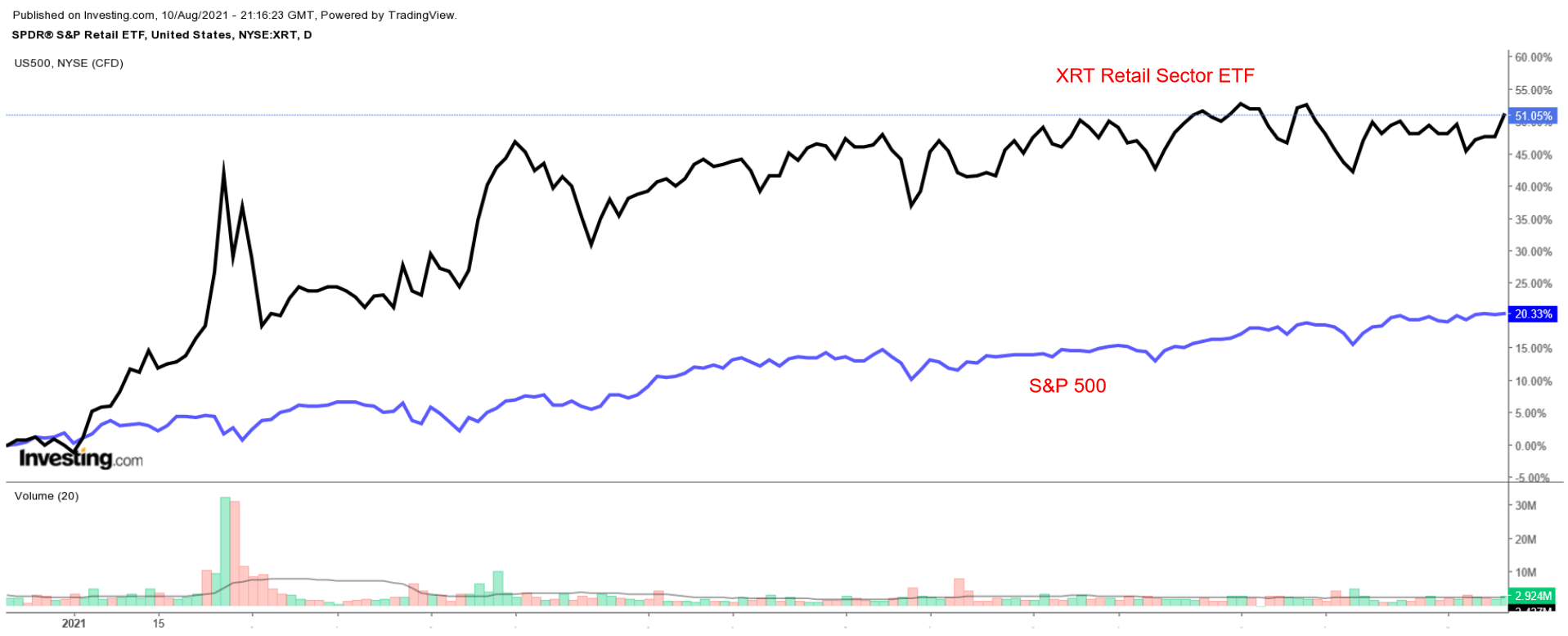

Not surprisingly, one of the sector’s main ETFs—the SPDR® S&P Retail ETF (NYSE:XRT)—has rallied around 51% since the start of 2021, easily outperforming the S&P 500’s 18% gain over the same period.

Below we highlight three retailers which are expected to report impressive profit and sales growth when they release their latest quarterlies in the days ahead.

1. Target

- Earnings Date: Wednesday, Aug. 18

- EPS Growth Estimate: +0.9% Y-o-Y

- Revenue Growth Estimate: +7% Y-o-Y

- Year-To-Date Performance: +49.6%

- Market Cap: $130.6 Billion

Target Corporation (NYSE:TGT)—whose financial results have beaten Wall Street estimates for five consecutive quarters—is scheduled to next report earnings before the opening bell on Wednesday, Aug.18.

Consensus calls for second quarter earnings per share of $3.41, which would be a slight improvement from EPS of $3.38 in the year-ago period.

Revenue is expected to climb 7% year-over-year to $24.59 billion as the big-box retailer continues to benefit from its efforts to add faster order pickup and shipping options.

The company announced on its Q1 earnings report that sales through its ‘Drive Up’ curbside pickup service spiked by 123% from a year earlier. In-store pickup sales rose 52%, while sales through its ‘Shipt’ shipping service gained 86%.

In addition, investors will monitor growth in comparable sales, which include sales both online and at stores open for at least a year. Target said the key metric surged by 22.9% in Q1, with physical comparable store sales rising 18%, and digital comparable sales growing 50%.

Overall comments on the economy and the health of the U.S. consumer from executives on the post-earnings conference call will also be of note as Target prepares for the back-to-school period amid a resurgence in Delta variant cases.

Target has been one of the leading performers in the retail space this year, with shares up around 50% in 2021, as it benefits from both the reopening economy and ongoing strength in e-commerce and online sales. TGT stock reached a new all-time high of $265.73 on Tuesday before ending at $264.07, earning the Minneapolis, Minnesota-based retailer a valuation of $130.6 billion.

2. TJX Companies

- Earnings Date: Wednesday, Aug. 18

- EPS Growth Estimate: +411.1% Y-o-Y

- Revenue Growth Estimate: +61.1% Y-o-Y

- Year-To-Date Performance: +4.6%

- Market Cap: $86.2 Billion

TJX Companies (NYSE:TJX), which owns T.J. Maxx, Marshalls, and HomeGoods brands, has underperformed many of its peers in the retail group, with shares gaining less than 5% year-to-date amid concerns about the impact of the coronavirus pandemic on its stores in Canada and Europe.

The price-conscious chain—whose off-price model is heavily dependent on customers visiting its stores—operates a total of 4,557 stores in nine countries. Of those, 1,267 stores are located in Canada, the UK, Ireland, Germany, Austria, the Netherlands, Poland and Australia.

TJX stock closed at $71.43 yesterday, within sight of its record high of $74.65 touched on May 10. At current levels, the Framingham, Mass.-based discount clothing and home decor chain has a market cap of $86.2 billion.

TJX, which reported blowout earnings and revenue in the first quarter, is projected to report second quarter results ahead of the opening bell on Wednesday, Aug. 18.

Analyst estimates call for the budge-conscious retailer to post earnings of $0.56 per share, improving 411% from a loss of $0.18 per share in the year-ago period, when TJX had to temporarily close nearly all its stores in the U.S. and abroad.

Revenue is expected to soar by 61% year-over-year to $10.75 billion, as customers in the U.S. flocked back to its stores in greater numbers amid easing pandemic-related restrictions.

As such, open-only comparable-store sales, an adjusted metric that compares sales on days existing stores were open to their sales on the same days in 2019, will be in focus after jumping 16% in Q1.

In addition, market players are hoping TJX will provide guidance for the months ahead after it failed to offer a formal forecast of its results in the previous quarter due to uncertainty around the pandemic, particularly internationally.

3. Macy’s

- Earnings Date: Thursday, Aug. 19

- EPS Growth Estimate: +119.7% Y-o-Y

- Revenue Growth Estimate: +39.3% Y-o-Y

- Year-To-Date Performance: +71.9%

- Market Cap: $6.0 Billion

Macy’s (NYSE:M)—which has either matched or beaten Wall Street’s earnings and sales estimates for six straight quarters—next reports financial results ahead of the open on Thursday, Aug. 19.

Consensus calls for the department store chain to post earnings per share of $0.16 for the second quarter, a reversal from a loss per share of $0.81 in Q2 last year, when the pandemic forced it to shut down most of its stores.

Revenue is forecast to climb 39% from the same period a year earlier to $4.96 billion, as it continues to attract new customers and consumers return to the mall to shop amid the emergent return to normalcy.

Beyond the top- and bottom-line figures, investors will keep an eye on Macy’s update regarding its overall comparable sales figures. Sales online and at Macy’s stores open for at least 12 months rose 62.5% year-over-year in Q1.

E-commerce, which was the bright spot for Macy’s in the previous quarter with annualized growth of 34%, will also be eyed.

In addition, market players will focus on Macy’s outlook for the rest of the year after the retailer raised its profit and revenue guidance in the last quarter, despite lingering uncertainty resulting from the COVID health crisis.

Macy’s has been one of the standout performers in the retail industry this year, with shares up around 72%, thanks to rapidly recovering sales across all three of its brands: its namesake chain, Bloomingdale’s, and luxury beauty retailer Bluemercury.

M stock closed at a six-week high of $19.34 last night, giving the New York, New York-based department store chain a market cap of $6.0 billion.