DXY is a raging rocketship as EUR crashes:

The Australian dollar was weak:

Base metals rallied on misplaced China stimulus hopes:

As did miners:

EM stocks were hit:

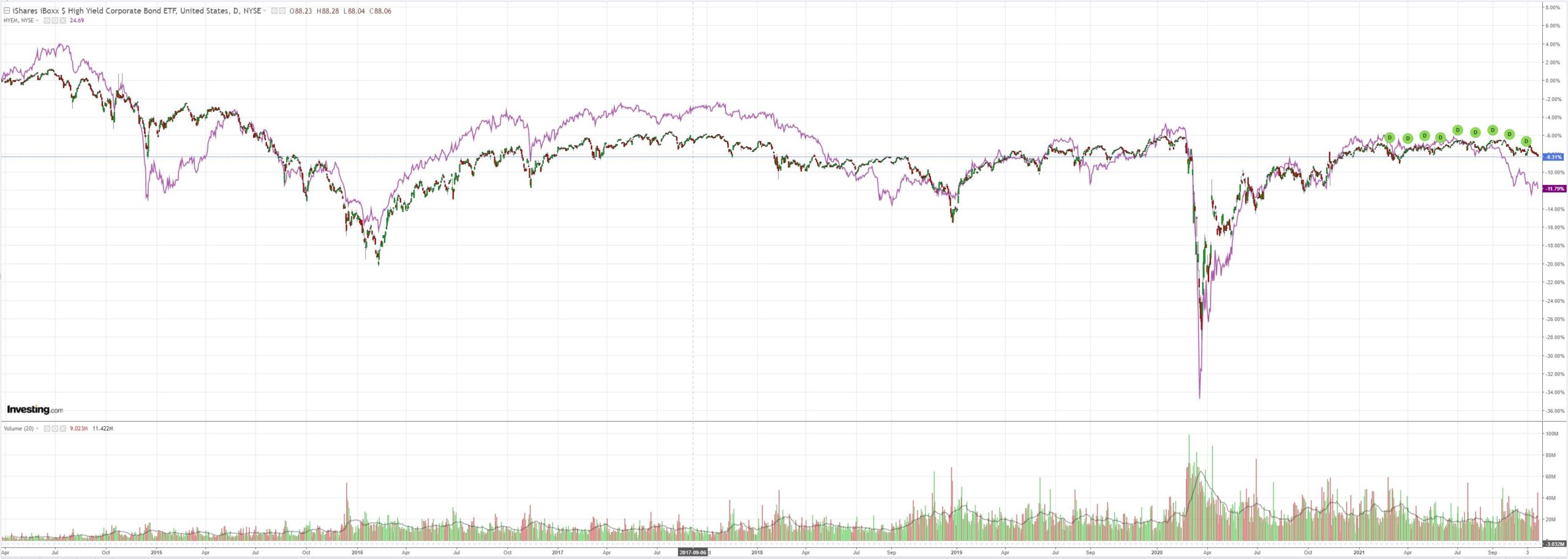

Along with junk:

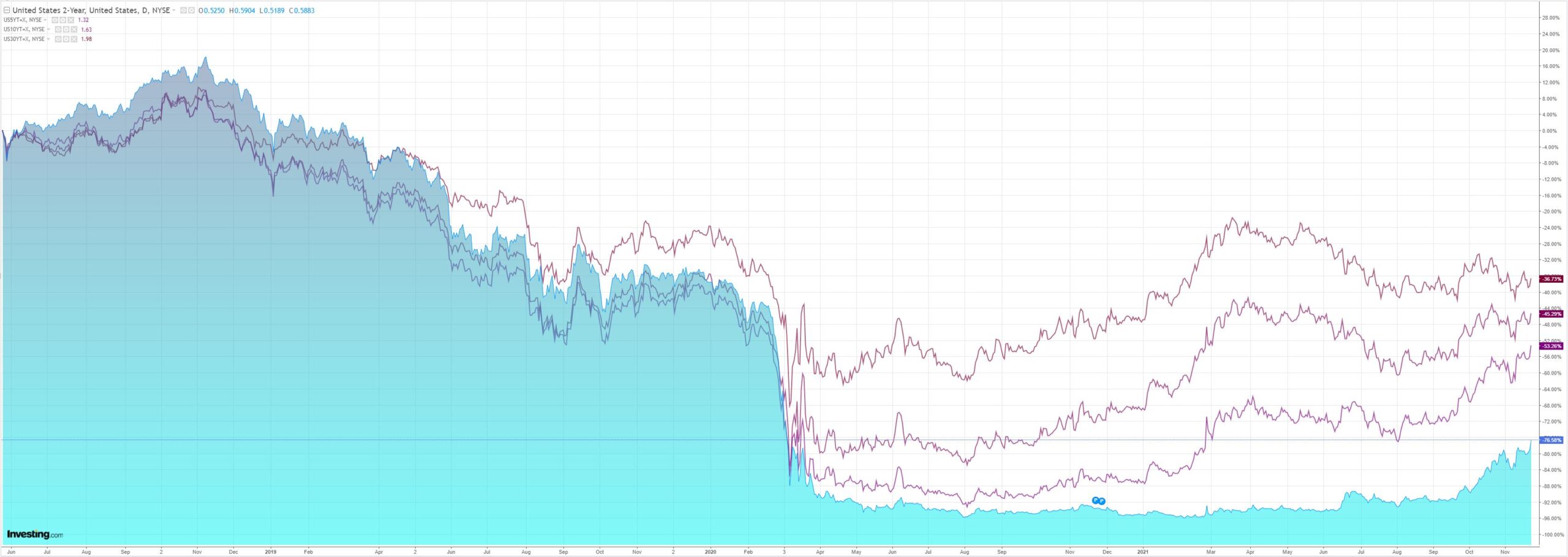

As yields spiked and the curve pancaked:

Stocks did not like it:

Westpac has the wrap:

Event Wrap

US President Biden renominated Powell for a second term as Fed Chair, with Brainard nominated for the Vice-chair role, maintaining continuity in leadership. Both will need to be confirmed by the Senate, and there are three Democrats who have publicly opposed Powell.

US existing home sales in October rose to an annualised 6.34m (est. was a pullback to 6.18mn from Sept. 6.29mn), and remain well above the average pre-pandemic level of around 5.5m. The median house price rose 13.1%y/y and inventory was 12% lower than last year at 1.3m. The Chicago Fed.’s National Activity survey index rose to +0.76 (well above trend), vs estimate of +0.10, from prior -0.18.

The ECB’s Villeroy repeated the core mantra, that there is little scope for policy targets to be achieved in 2022. He also suggested that although PEPP is to end, any recalibration of APP may not occur for some time. The marginal impact on the economy of Covid cases was seen as declining.

Event Outlook

Aust: The RBA’s Head of Domestic Markets is due to speak on ‘securities markets through the pandemic’ at 12:05pm. The RBA’s Deputy Head of Domestic Markets will then participate in a panel on the ‘transition to risk free rates, the future of BBSW’ at 2:50pm.

NZ: A steep decline is anticipated for Q3 real retail sales, with the elevated alert level weighing heavily on spending (Westpac f/c: -10.0%).

Eur/UK: The Markit manufacturing and services PMIs for Europe will likely weaken in November due to supply shortages and delta concerns (market f/c: 57.5 and 54.1 respectively). The UK PMIs are also expected to be impacted by Brexit.

US: November’s Markit manufacturing and services PMIs are expected to remain robust despite ongoing supply and delta concerns (market f/c: 59.0 for both). October’s unexpectedly strong lift in the Richmond Fed index points to a positive outlook for the region for November.

A reappointed Jay Powell will keep the Fed on tightening course. China is now easing but it’s very selective and has little bearing upon commodities.

So, we are still headed into circumstances similar to 2015 and 2018 in which Chimerica thought it could limit Chinese credit and US dollar liquidity simultaneously without doing any harm to markets and the economy.

On both occasions policymakers were wrong and I expect the same outcome again this time across 2022.

Recall that when the Chimerican double-tightening starts to break things in EMs and commodities, the initial stages of crisis make the underlying problem worse as capital seeks a safe haven in DXY. Like everything else in this crazy cycle, the amplitude of a DXY blowoff might prove extreme.

The AUD is still in the gun.