Some very dovish Fedspeak and revisions to the latest US PPI print gave equity markets a small lift overnight, following a slump from the stronger than expected CPI print. Wall Street rebounded and futures for Asian share markets look more optimistic as a result although the USD remains fairly strong against most of the majors with the Australian dollar barely able to get off the floor after breaking below the 65 cent level.

10 year Treasury yields retraced slightly below the 4.3% level while oil prices also had a minor slip with Brent crude falling back below the $82USD per barrel level. Meanwhile gold remains under pressure and unable to climb back above the key $2000USD per ounce level.

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were closed for the New Year holiday, and will do so all week while in Hong Kong the Hang Seng Index was also closed.

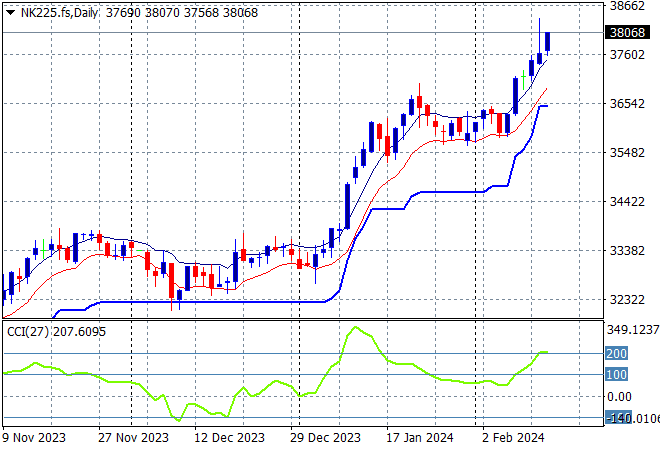

Japanese stock markets reacted poorly to the slump on Wall Street with the Nikkei 225 closing nearly 0.7% lower at 37703 points.

Trailing ATR daily support was never threatened by price action after this bounce went beyond the September highs at the 33000 point level with daily momentum getting back to overbought readings with a significant breakout. A selloff back to ATR support at 32000 points remains unlikely as the November highs are wiped out in this breakout but I’m cautious of a strong pullback here on any volatility:

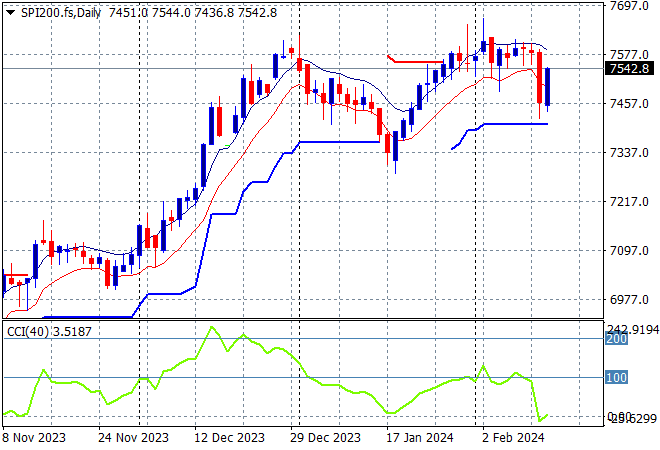

Australian stocks also did not do well as the ASX200 finished nearly 0.8% lower at 7547 points.

SPI futures however are up nearly 0.7% due to the rebound on Wall Street overnight. The daily chart was looking firmer with the medium term uptrend and short term price action coming together to take out the previous December highs. As I said previously, watching for any continued dip below the low moving average could see a significant pullback but watch ATR support which has been defended so far:

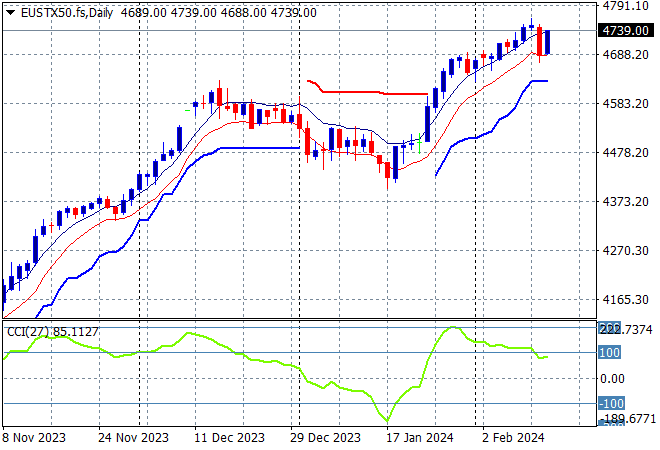

European markets came back after suffering broad losses across the continent in the previous session as the Eurostoxx 50 Index eventually finished 0.4% higher at 4709 points.

The daily chart shows price action still on trend after breaching the early December 4600 point highs but daily momentum has now retraced from being well overbought with futures a pullback this evening. There were some hopeful signs this could turn into a larger breakout but markets were overextended but watch for any falls below the low moving average or ATR support proper:

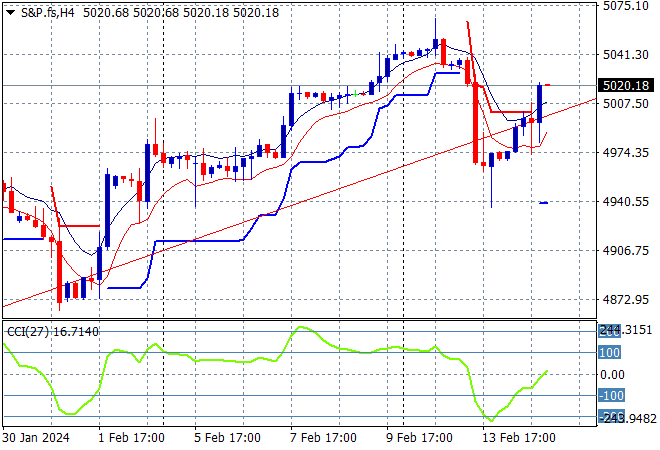

Wall Street regained some positivity overnight with a mild rebound as the NASDAQ gained 1.3% while the S&P500 bounced nearly 1% to just get back above the magical 5000 point level.

Short term momentum has now bounced out of oversold territory with a classic buy the dip that has taken in back on trend and restoring some confidence. I’m watching for a fill above the 5000 point level proper however:

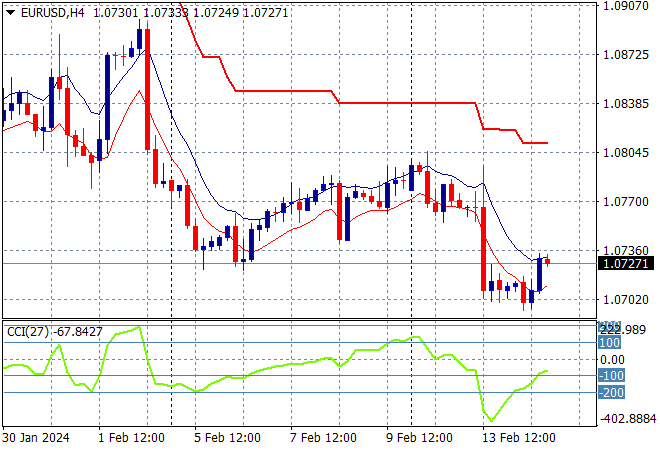

Currency markets remain in the dumps after the strong US inflation print despite some very dovish Fed comments overnight with USD still dominating. Euro managed a small blip higher to get back above the 1.07 level but is well below the recent weekly lows.

The union currency had already been at a new weekly low almost below the 1.07 level but this was taken out and then some for a new monthly low, hovering over that level this morning. Short term momentum has retraced out of oversold mode but only barely, with price action well contained below trailing ATR resistance:

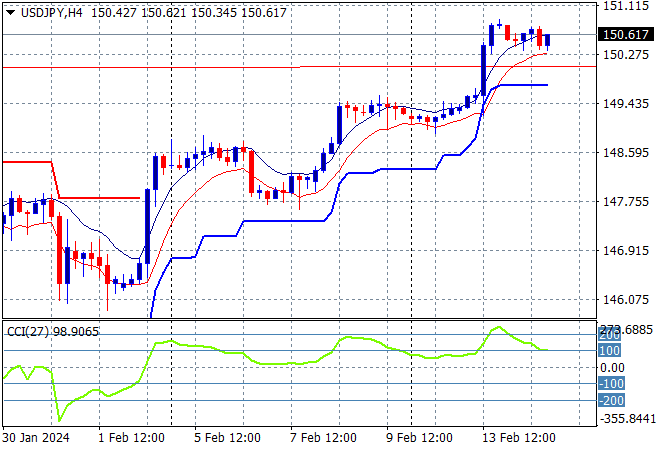

The USDJPY pair remains somewhat stable well above the 150 handle and should hold here at the historic highs.

This was looking very optimistic as Yen sells off due to BOJ meanderings with momentum now considerably overbought so watch for a short term pullback to the 150 level proper as part of a mid trend consolidation:

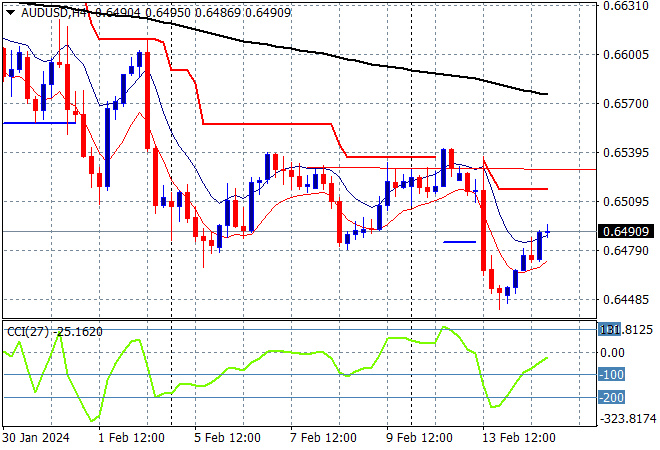

The Australian dollar remains under pressure with a late bounce almost sending it through the 65 handle but this looks to be shortlived as it remains the weakest undollar following the US inflation print.

The Aussie has been under medium and long term pressure for sometime with the latest rally just a relief valve being let off before this realignment back to a strong USD. There were some signs of a breakout here at the 65 level but any possible inversion above trailing ATR resistance is now off the cards:

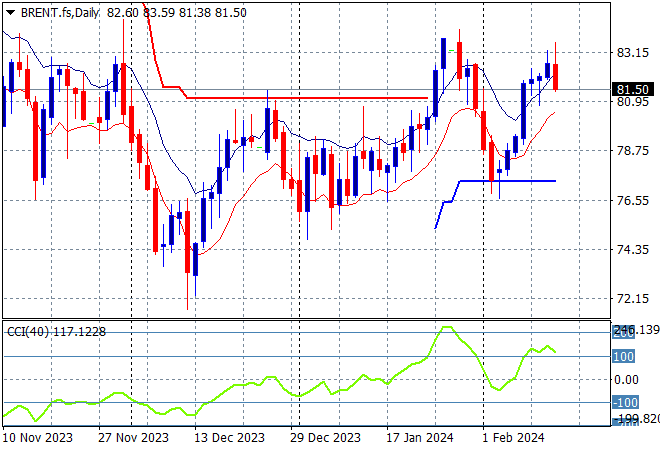

Oil markets have been lifting slightly higher before the US CPI print but took a step back overnight after failing to best the recent highs with Brent crude falling back below the $82USD per barrel level.

After retracing down to trailing ATR daily support at the $77 level, price is still above the weekly resistance levels that so far have held from the January false breakout with the short term target the late January highs above $84 still the next target:

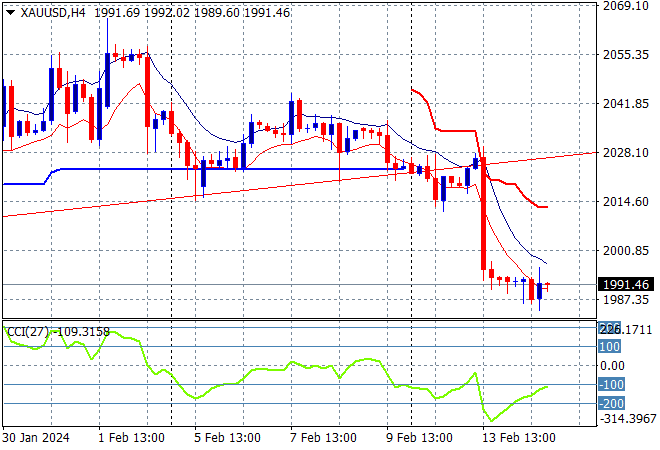

Gold remains in a depressed state following the US CPI print with its big break below the ascending triangle pattern on the daily chart saw it extend its recent breakdown below the $2000 level where it stayed overnight.

Daily momentum is still well oversold with short term support at the $2000 level wiped out here as expected on USD strength with more downside potential building if it can’t make a new session high soon: