Asian share markets are having some mildly positive sessions to start a new hopefully quieter trading week as other risk markets also reduced in volatility across the complex due to an absence of economic releases and macro events. Yen is steady due to a market holiday while the Australian dollar is steady but remains unable to get back above the 66 cent level and currency traders await tomorrow’s US PPI print.

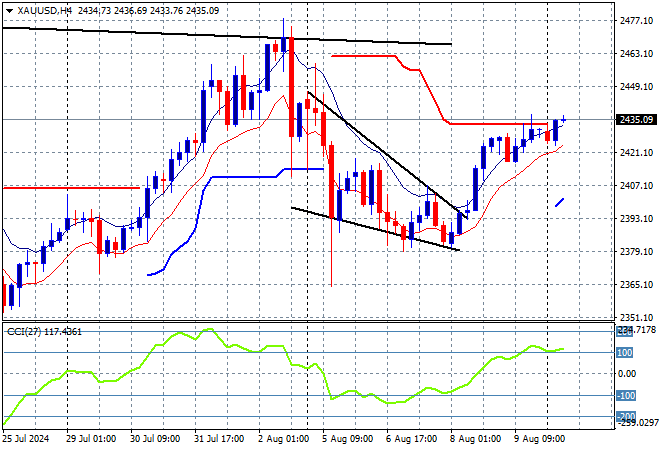

Oil prices are starting to gain upside momentum with a gap higher over the weekend pause as Brent crude pushes above the $80USD per barrel level while gold is also pushing further on its recent advance above the $2400USD per ounce level:

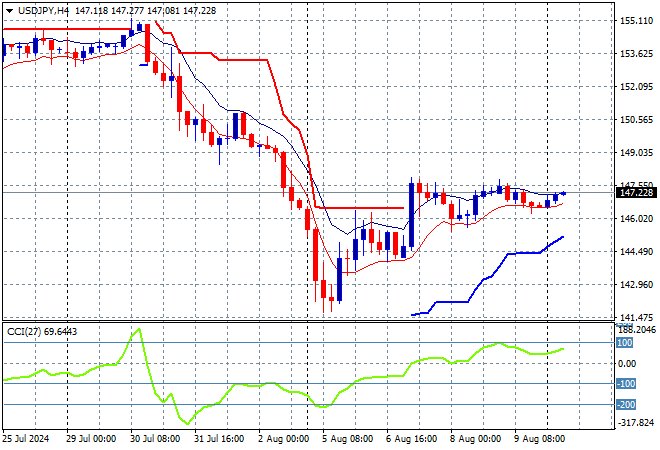

Mainland Chinese share markets are still struggling to find any traction as economic concerns continue to weigh down sentiment as the Shanghai Composite retraces slightly while the Hang Seng Index is also flat at 17085 points. Meanwhile Japanese stock markets are closed for yet another holiday with trading in USDPY equally subdued as it stays just above the 147 handle:

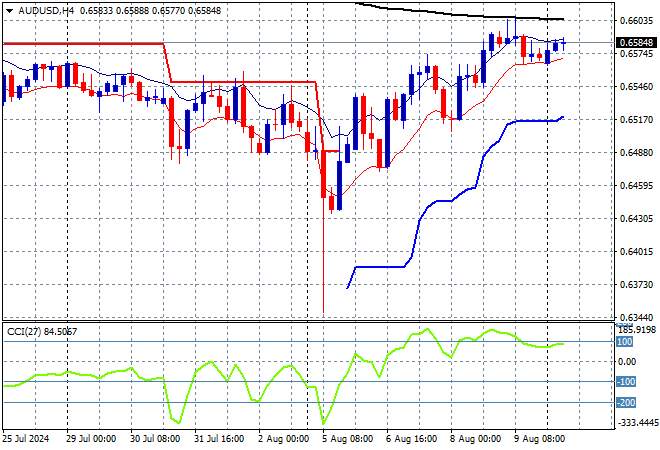

Australian stocks are pushing higher with the ASX200 putting in a solid 0.5% gain to close at 7813 points while the Australian dollar is trying to double down on its recent small breakout this afternoon but just can’t clear the 66 cent level:

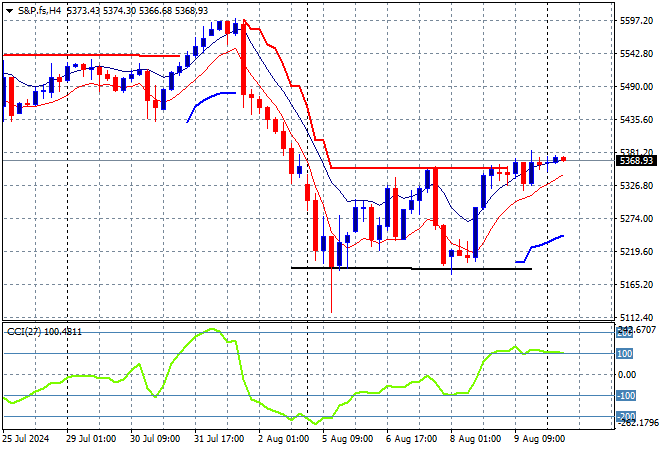

S&P and Eurostoxx futures are up more than 0.5% going into the London session with the S&P500 four hourly chart showing continued stability returning to the major index as a dead cat bounce pattern fails to complete:

The economic calendar tonight starts the trading week very quietly with almost nothing on the agenda this evening.