- The year-to-date rally on Wall Street is showing signs of fatigue amid uncertainty over the Federal Reserve’s outlook for interest rates.

- I used the InvestingPro stock screener to search for undervalued dividend stocks with solid fundamentals and robust ‘Fair Value’ upside.

- Below is a list of ten stocks in the S&P 500 that are expected to provide some of the highest returns based on the InvestingPro models.

- Looking for more actionable trade ideas to navigate the current market volatility? The InvestingPro stock screener helps you easily identify winning stocks at any given time. Sign up today!

U.S. stock indexes have been rattled in recent sessions as investors raised their bets the Federal Reserve will have to maintain its aggressive monetary tightening campaign for longer than currently expected to prevent a flare-up in inflation.

The blue-chip Dow Jones Industrial Average, the benchmark S&P 500, and the tech-heavy Nasdaq Composite are all down at least 4% so far in August.

As we grapple with fresh uncertainty surrounding the Fed's rate plans, identifying undervalued stocks becomes paramount as investors find themselves seeking stability and potential opportunities.

Amid the current backdrop, I used the InvestingPro stock screener to identify the best undervalued stocks that have the potential to weather market turbulence and provide attractive investment returns.

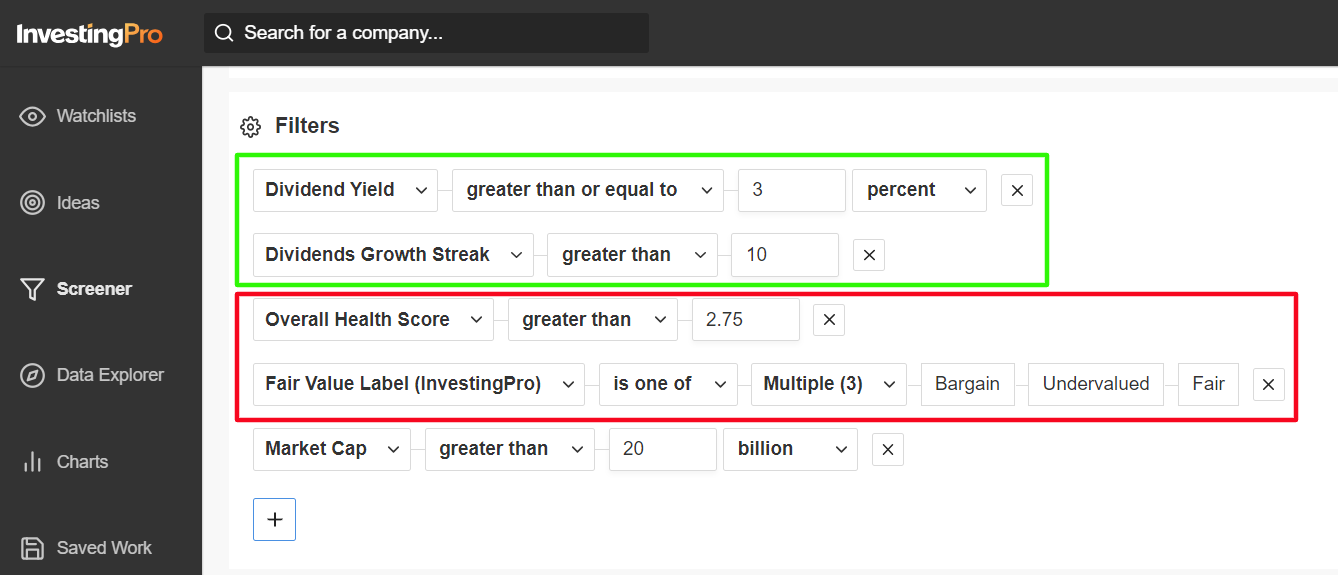

I first scanned for stocks with a dividend payout yield of 3% or above and a dividend growth streak of at least ten years. Source: InvestingPro

Source: InvestingPro

I then filtered for companies with an InvestingPro Overall Health Score greater than or equal to 2.75. It should be noted that companies with InvestingPro health scores higher than 2.75 have consistently outperformed the broader market by a wide margin over the past seven years, dating back to 2016.

I then searched for names with an InvestingPro ‘Fair Value’ Label of ‘Bargain,’ ‘Undervalued,’ and ‘Fair.’ And those companies with a market cap of $20 billion and above made my watchlist.

Once the criteria were applied, I was left with a total of 11 companies, of which we picked the top 10. These stocks all offer compelling valuations, strong fundamentals, and the potential for long-term growth, providing investors with a diversified selection to consider during uncertain times.

Let's take a look at each one of them to understand why they are buy now:

Top 10 Undervalued Dividend Stocks To Buy Now

1. ExxonMobil

- Thursday’s Closing Price: $106.35

- Fair Value Estimate: $122.53 (+15.2% Upside)

- Dividend Yield: 3.4%

As one of the world’s biggest energy companies, ExxonMobil (NYSE:XOM) has consistently generated robust cash flows, allowing it to maintain its dividend payout for the last 40 years. The ‘Big Oil’ company’s ongoing commitment to returning capital to shareholders should make XOM stock a staple in a well-diversified portfolio.

2. Chevron

- Thursday’s Closing Price: $157.94

- Fair Value Estimate: $183.76 (+16.3% Upside)

- Dividend Yield: 3.8%

Chevron (NYSE:CVX) is an attractive option for income-oriented investors thanks to its promising fundamentals, strong balance sheet, and robust free cash flow growth. CVX’s stock current valuation provides an attractive entry point for investors seeking reliable income streams. The oil producer has increased its dividend payout for 35 years in a row.

3. Coca-Cola

- Thursday’s Closing Price: $60.11

- Fair Value Estimate: $63.18 (+5.1% Upside)

- Dividend Yield: 3.1%

With a history of consistent dividend payouts and a resilient business model, Coca-Cola (NYSE:KO) has successfully weathered various economic cycles. This could make KO stock a solid choice for those looking to mitigate mounting risks surrounding the Fed’s rate outlook. Coca-Cola’s dividend payout has experienced 52 consecutive years of growth, earning it the status of ‘Dividend King’.

4. Pfizer

- Thursday’s Closing Price: $36.16

- Fair Value Estimate: $50.64 (+40% Upside)

- Dividend Yield: 4.5%

Pfizer (NYSE:PFE) operates in a recession-resistant sector, making its dividends comparatively insulated from economic downturns. The pharmaceutical company’s consistent cash flows and disciplined financial management enhance its dividend sustainability, making PFE stock a solid choice for the current backdrop.

5. Philip Morris International

- Thursday’s Closing Price: $94.08

- Fair Value Estimate: $104.77 (+11.4% Upside)

- Dividend Yield: 5.4%

With a history of maintaining a healthy dividend payout ratio, Philip Morris (NYSE:PM) demonstrates its commitment to sustainable shareholder returns. Its solid financial health and defensive attributes make PM stock a strong contender for investors seeking stability in uncertain times. The cigarette company has boosted its dividend distribution for a continuous span of 15 years.

6. United Parcel Service

- Thursday’s Closing Price: $167.00

- Fair Value Estimate: $207.75 (+24.4% Upside)

- Dividend Yield: 3.9%

Operating in an essential sector, United Parcel Service (NYSE:UPS) provides services with consistent demand, regardless of the economic outlook. The shipping giant’s ability to maintain competitive advantages makes UPS an underrated dividend stock in the current market. The company has maintained a streak of 13 years in which it increased its dividend payout.

7. Amgen

- Thursday’s Closing Price: $256.62

- Fair Value Estimate: $309.81 (+20.7% Upside)

- Dividend Yield: 3.3%

Despite often being overlooked in its sector, Amgen (NASDAQ:AMGN) has consistently generated robust cash flows, allowing it to maintain its dividend commitments. This presents an opportunity for investors to buy AMGN stock at a favorable valuation while enjoying attractive dividend payouts. The biopharmaceutical company has raised its dividend distribution for 12 straight years.

8. Altria

- Thursday’s Closing Price: $43.40

- Fair Value Estimate: $57.54 (+32.6% Upside)

- Dividend Yield: 8.7%

Altria's (NYSE:MO) dividend yield is notably higher than those of the other companies mentioned, making MO stock an attractive choice for income-oriented investors. The cigarette-and-tobacco manufacturing company has proven over time that it can provide investors with higher dividend payouts regardless of the economic environment. Altria has increased its annual dividend for 13 years in a row.

9. Phillips 66

- Thursday’s Closing Price: $112.39

- Fair Value Estimate: $151.07 (+34.4% Upside)

- Dividend Yield: 3.7%

Phillips 66 (NYSE:PSX) is another solid option for investors to weather the current Fed-induced turmoil thanks to its growing dividend payout, reasonable valuation, and strong fundamentals. With a record amount of cash on hand, Phillips 66 - which has raised its annual dividend payout for 11 consecutive years - returned $3.3 billion to shareholders in 2022.

10. Public Service Enterprise Group

- Thursday’s Closing Price: $60.72

- Fair Value Estimate: $66.20 (+9% Upside)

- Dividend Yield: 3.8%

Operating in a sector with non-cyclical demand, Public Service Enterprise Group's (NYSE:PEG) dividends could remain resilient regardless of the shifting macro environment. Its conservative financial approach adds to PEG stock’s appeal for risk-conscious investors. The utility provider has raised its dividend payout for 11 consecutive years. Source: InvestingPro

Source: InvestingPro

The InvestingPro stock screener empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

By utilizing this tool, investors can filter through a vast universe of stocks based on specific criteria and parameters, saving them substantial time and effort.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading decisions.

Start your 7-day free trial to unlock must-have insights and data!

***

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average via the SPDR Dow ETF (DIA). I also have a long position on the XLE) and the XLV. Additionally, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.