- Powell’s IMF speech, U.S. jobless claims, and more earnings will be in focus this week.

- Uber shares are a buy with upbeat earnings on deck.

- Disney stock is a sell amid expected weak Q3 results.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

Stocks on Wall Street soared on Friday, with the major averages scoring their best week of 2023, after weak jobs boosted hopes that the Federal Reserve could be done with its interest rate hiking campaign.

For the week, the blue-chip Dow Jones Industrial Average gained 5.1% to register its biggest weekly gain since October 2022.

The benchmark S&P 500 and the tech-heavy Nasdaq Composite rallied 5.9% and 6.6% respectively. It was the best week for both indices since November 2022. Meanwhile, the small-cap Russell 2000 surged 7.6%, its best week since February 2021.

The week ahead is expected to be another eventful one as investors continue to gauge the outlook for the economy and interest rates.

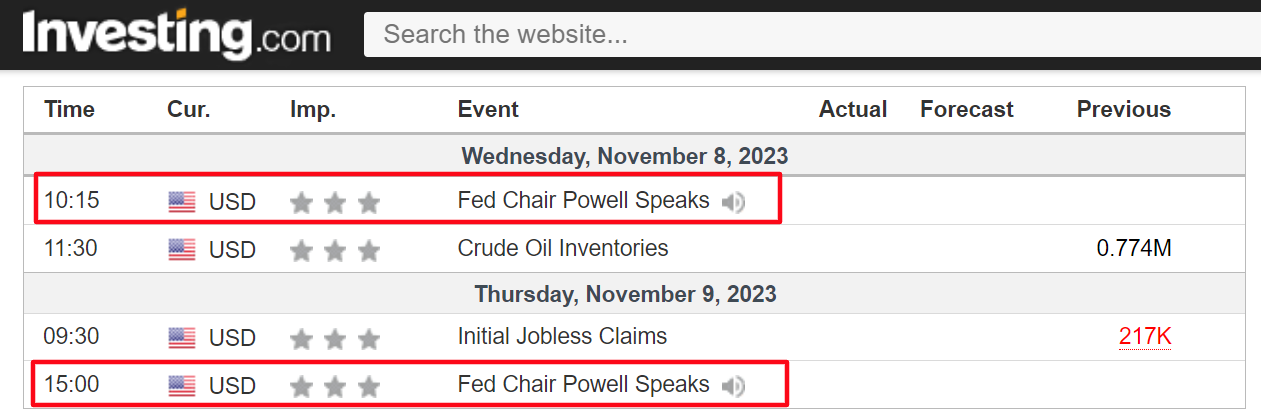

Investors will scrutinize a speech from Fed Chairman Jerome Powell, who will speak at a panel at the IMF's annual research conference.

Besides that, the economic calendar is light, with the release of the latest jobless claims figures likely to garner most of the attention.

Meanwhile, the pace of earnings slows down, though quarterly updates are still expected from notable companies such as AMC Entertainment (NYSE:AMC), Wynn Resorts (NASDAQ:WYNN), Roblox (NYSE:RBLX), Datadog (NASDAQ:DDOG), Twilio (NYSE:TWLO), Trade Desk (NASDAQ:TTD), Rivian (NASDAQ:RIVN), and Li Auto (NASDAQ:LI).

Regardless of which direction the market goes next week, below I highlight one stock likely to be in demand and another which could see fresh downside.

Remember though, my timeframe is just for the week ahead, Monday, November 6 - Friday, November 10.

Stock to Buy: Uber Technologies

I foresee a strong performance for Uber Technologies’ (NYSE:UBER) stock in the week ahead, possibly culminating in a breakout and a push towards new 52-week highs, following the release of the rideshare giant’s third quarter earnings report.

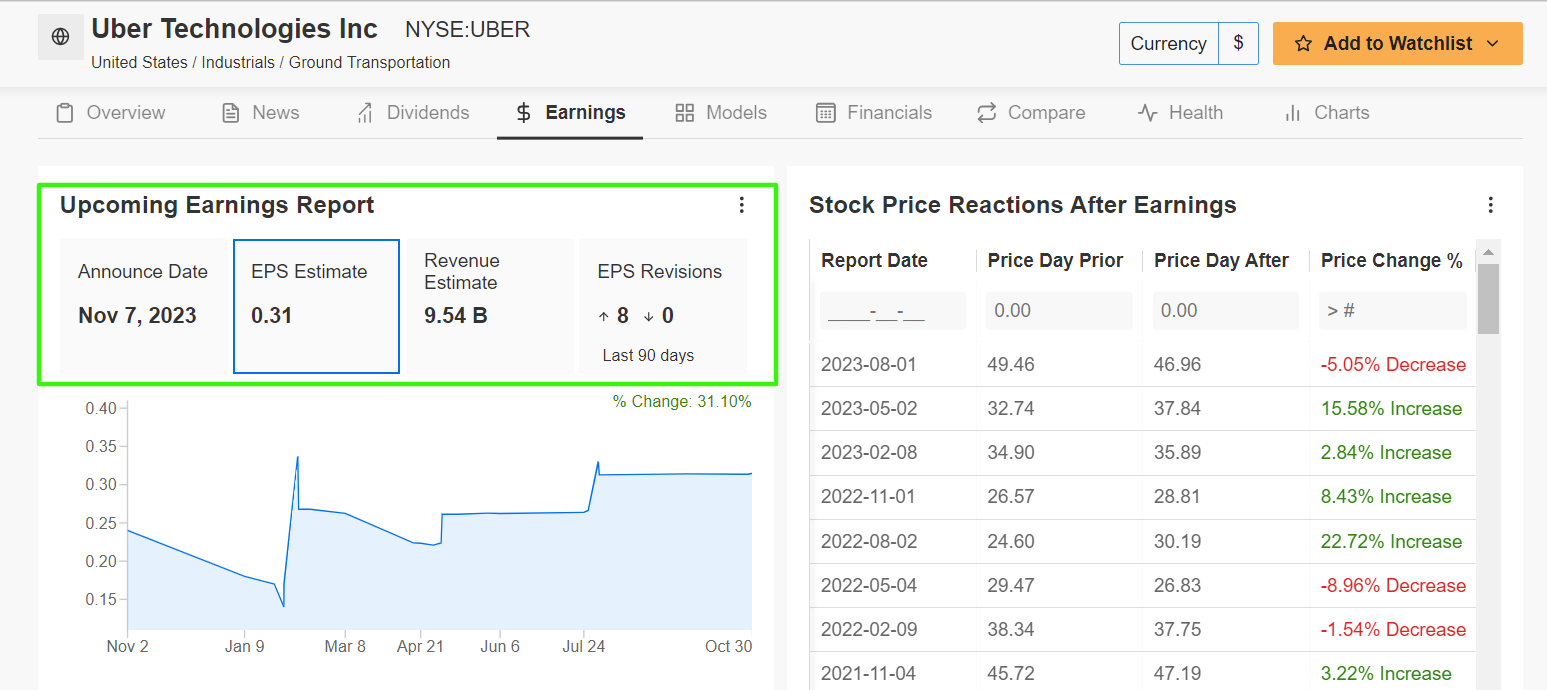

Uber is scheduled to deliver its Q3 update before the U.S. market open on Tuesday, November 7 at 6:55AM ET, and it is expected to shatter its sales record as more people use its transportation and food delivery services.

Market participants expect a sizable swing in UBER shares following the print, as per the options market, with a possible implied move of about 9% in either direction.

Not surprisingly, an InvestingPro survey of analyst earnings revisions points to surging optimism ahead of the results, with analysts growing increasingly bullish on the ride-hailing and delivery specialist.

Profit estimates have been revised upward eight times in the past three months, while 46 analysts have a Buy-equivalent rating on the stock vs. two Hold-equivalent ratings and zero Sell-equivalent ratings.

Uber is forecast to earn $0.31 per share, improving significantly from a loss of $0.61 per share in the year-ago period, amid the positive impact of ongoing cost-cutting measures and improving mobility trends.

Meanwhile, revenue is seen jumping nearly 15% annually to $9.54 billion. If that is confirmed, it would mark Uber’s highest quarterly sales total in its history thanks to strong demand from customers who continued to hail rides and order takeout food during the quarter.

Looking ahead, I believe Uber CEO Dara Khosrowshahi will provide solid profit and sales guidance for the rest of the year as the company remains well positioned to thrive despite the uncertain economic climate.

UBER stock ended Friday’s session at $47.75, not far from its 2023 peak of $49.49 reached on July 31. The San Francisco, California-based mobility-as-a-service company has a market cap of $97.6 billion at its current valuation.

Shares have soared 93% in 2023, far outpacing the comparable returns of major industry peer, Lyft (NASDAQ:LYFT), whose stock is down 3% over the same timeframe, amid indications that Uber is grabbing market share from its competitor.

Stock to Sell: Disney

I believe Disney's (NYSE:DIS) stock will suffer a difficult week ahead, with a potential revisit to recent lows on the horizon, as the entertainment giant’s latest financial results will probably miss expectations amid a weak performance in its key streaming and linear TV businesses.

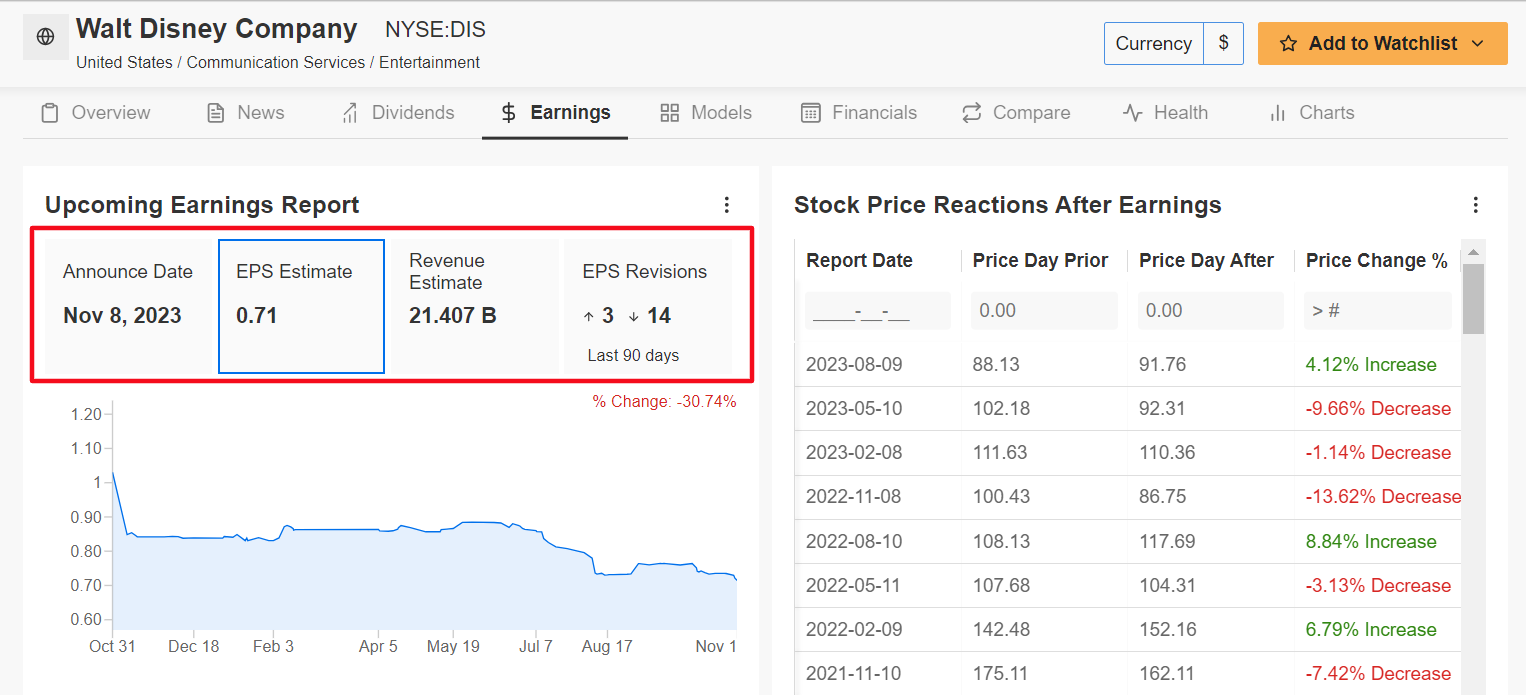

Disney’s earnings for its fiscal fourth quarter are due after the closing bell on Wednesday, November 8 at 4:05PM ET. Options trading implies a roughly 7% swing for DIS shares after the update drops, which would be the fourth report since CEO Bob Iger returned to the helm of the company in November 2022.

Underscoring several headwinds Disney faces amid the current macro environment, an InvestingPro survey of analyst earnings revisions points to growing pessimism ahead of the FQ4 report, with 14 out 17 analysts cutting their EPS estimates in the last 90 days.

Wall Street sees the House of Mouse earning $0.71 a share for the three-month period ended October 1, collapsing 31% from a profit of $1.03 in the preceding quarter, due to higher expenses related to the Disney+ streaming service as well as higher sports programming and production costs.

Meanwhile, revenue is forecast to rise 6.2% year-over-year to $21.4 billion, thanks to what I expect would be a relatively strong global performance in its iconic theme parks division.

It should be noted that Disney has missed Wall Street’s bottom-line expectations in four of the last eight quarters, while trailing revenue estimates thrice in that span.

As always, all eyes will be on streaming subscriber tallies for Disney+ and ESPN+, which are both expected to dip slightly during the quarter as consumers become more cost conscious about their media spending habits.

Beyond day-to-day operations, I expect Iger to address several challenges the company currently faces on the post-earnings call, including providing further details on plans to find potential strategic investors for ESPN as the company undergoes a broad strategic review of its asset mix.

DIS stock - which fell to a 2023 low of $78.73 on October 4 - closed at $85.07 on Friday. At current levels, the Burbank, California-based company has a market cap of $155.6 billion.

The entertainment company’s stock has underperformed the broader market by a wide margin in 2023, with DIS shares down -2.1% year-to-date.

Be sure to check out InvestingPro to stay in sync with the latest market trend and what it means for your trading decisions.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.