- Fed Chair Powell and earnings will again drive markets in the week ahead.

- Pinterest stock is a buy with upbeat earnings on tap.

- PayPal shares are set to struggle amid weak results, sluggish outlook.

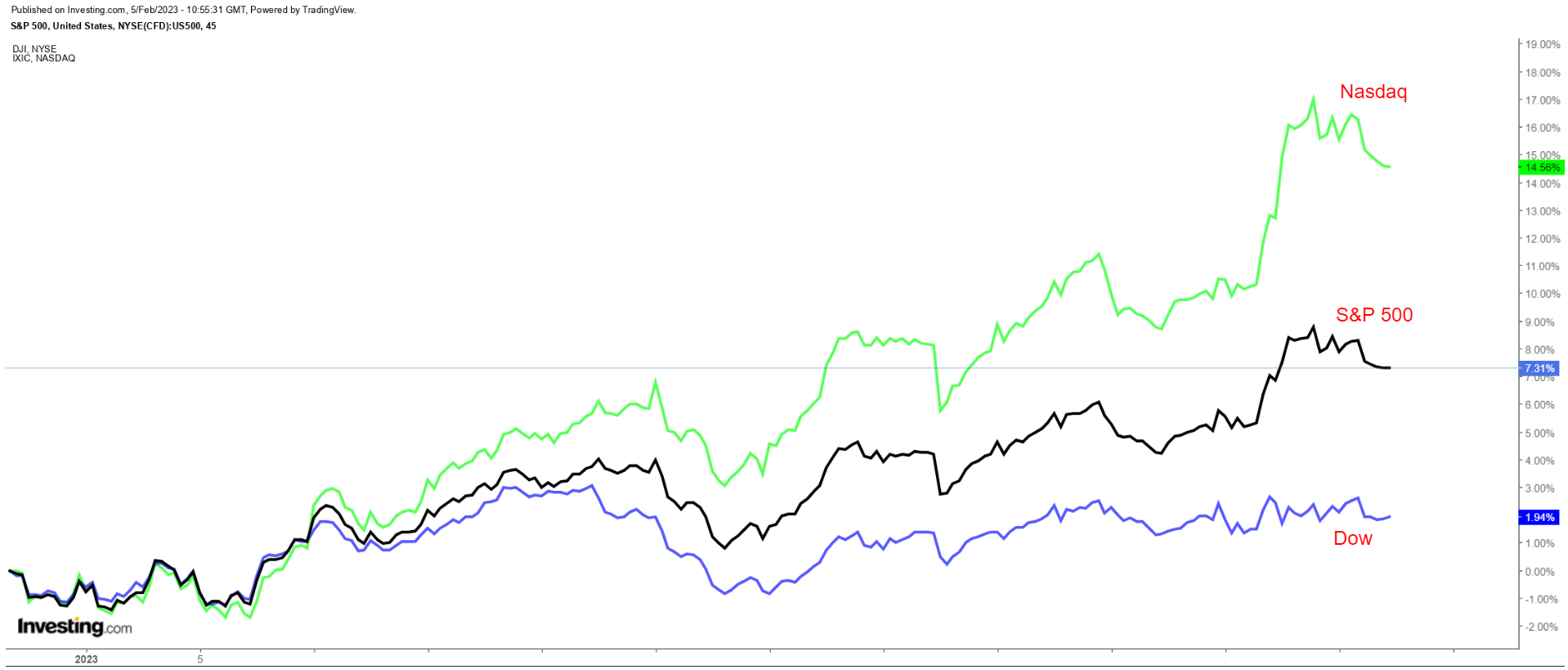

Stocks on Wall Street fell on Friday, after a blowout January jobs report revived fears that the Federal Reserve will continue hiking interest rates, while investors digested a mixed bag of megacap tech earnings.

Still, the S&P 500 and Nasdaq Composite managed to end the week on the positive side, with the tech-heavy Nasdaq notching its fifth straight winning week, the longest such streak since late 2021.

The S&P closed the week higher by 1.6%, the Nasdaq gained 3.3%, while the Dow was the outlier, falling 0.2%.

Source: Investing.com

The coming week is expected to be another busy one with most of the focus likely to fall once again on Federal Reserve Chairman Jerome Powell, who is scheduled to participate in a discussion at the Economic Club of Washington on Tuesday at 12:40PM ET.

Meanwhile, the corporate earnings season continues, with Walt Disney (NYSE:DIS), Robinhood (NASDAQ:HOOD), Affirm (NASDAQ:AFRM), Uber (NYSE:UBER), Lyft (NASDAQ:LYFT), Cloudflare (NYSE:NET), and Fortinet (NASDAQ:FTNT) all on the agenda. Some of the other notable reporters include PepsiCo (NASDAQ:PEP), Wendy’s (NASDAQ:WEN), Chipotle (NYSE:CMG), Kellogg (NYSE:K), CVS Health (NYSE:CVS), BP (NYSE:BP), and Philip Morris (NYSE:PM).

Elsewhere, on the economic calendar, most important will be Friday’s U.S. consumer sentiment report for January as investors nervously await the next CPI inflation report due on Feb. 14.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Pinterest

After closing just below a 52-week high on Friday, I expect Pinterest (NYSE:PINS) shares to outperform in the coming week as the social media company’s latest financial results will surprise to the upside in my view, thanks to an improving fundamental outlook.

Pinterest is scheduled to release its fourth-quarter earnings update after the U.S. market closes on Monday, Feb. 6. Based on the options market, traders are pricing in a large move for PINS stock following the report, with a possible implied swing of 13.1% in either direction.

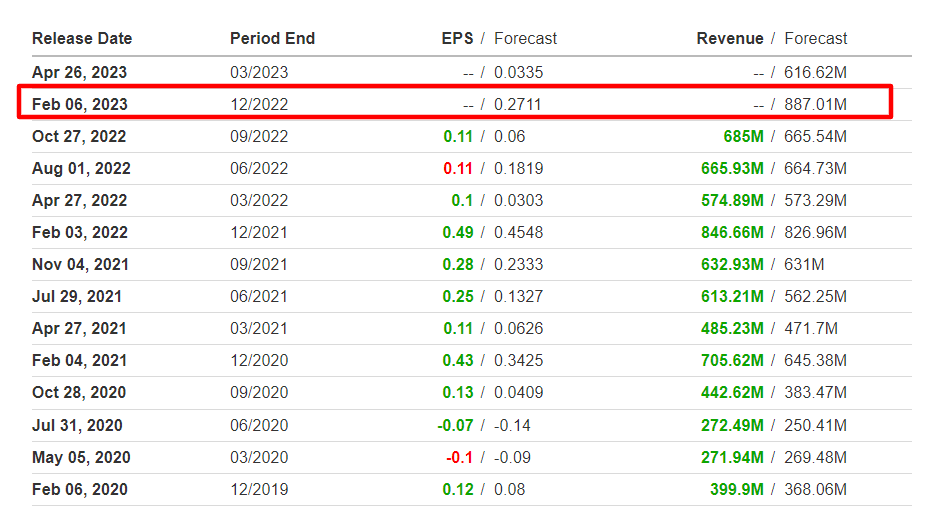

The image-sharing social media company has topped Wall Street’s top line expectations for 12 straight quarters dating back to Q4 2019, while trailing profit estimates only twice in that span.

Source: Investing.com

Consensus estimates call for Q4 earnings of $0.27 per share, as per Investing.com, down 42.8% from EPS of $0.49 in the year-ago period. The company announced plans to lay off roughly 5% of its workforce last week as it attempts to rein in costs.

Meanwhile, revenue is forecast to rise 4.8% year-over-year to $887 million. If that is in fact the reality, it would mark Pinterest’s highest quarterly sales total on record as it stands to benefit from increasing budget allocations from advertisers thanks to its unique position in the social media, search, and shopping ecosystems.

Despite worries over an industry-wide slowdown in digital ad spending, Pinterest has seen companies flock to its platform as they seek to avoid the toxic and controversial content seen on other social media networks, such as Facebook (NASDAQ:META), Snap (NYSE:SNAP), TikTok, and Twitter.

That leads me to believe that the company will provide positive guidance for the current quarter given its improving fundamentals, stabilizing user growth trends, and increasing monetization potential under the leadership of chief executive Bill Ready. The former Google e-commerce executive, who replaced founding CEO Ben Silbermann last year, has already made progress on the social media company’s turnaround efforts.

Source: Investing.com

PINS stock broke out to a fresh 52-week high of $29.17 on Thursday, a level not seen since Feb. 2, 2022. It pulled back on Friday to end the week at $27.48, earning it a valuation of $18.6 billion.

Shares have roared back in the early part of 2023 following last year’s brutal selloff, gaining 13.2% year-to-date. Despite its recent turnaround, the stock remains roughly 70% away from its all-time peak of $89.90 reached in February 2021.

Stock To Sell: PayPal

I believe shares of PayPal (NASDAQ:PYPL) will underperform in the week ahead, as investors position themselves for a disappointing earnings report from the embattled digital payments provider.

PayPal’s financial results for its fourth quarter are due on Thursday, Feb. 9, after the closing bell and are once again likely to take a hit from a slowdown in its core e-commerce business due to a combination of unfavorable consumer spending and customer demand trends as well as rising competition in the mobile payments processing industry.

Based on moves in the options market, traders are pricing in a possible implied move of 9.3% in either direction in PayPal’s shares following the update.

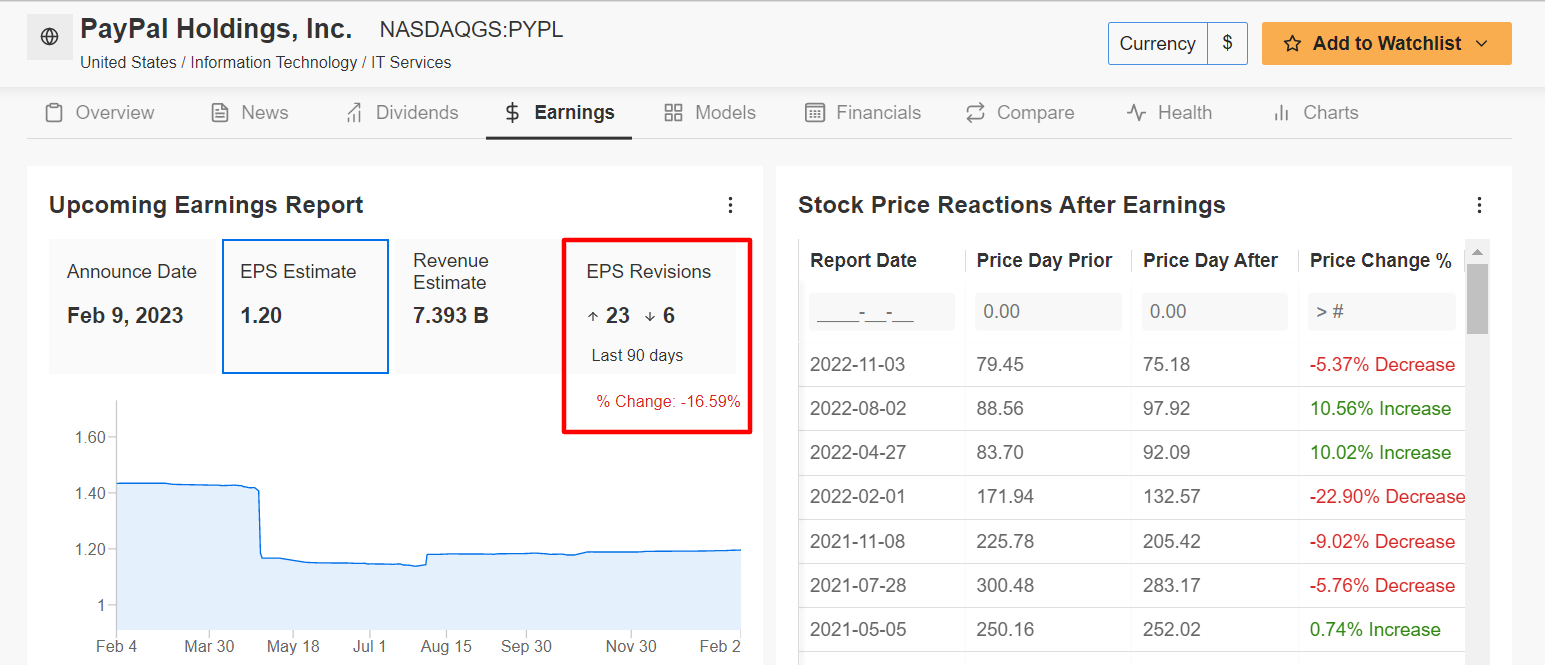

Unsurprisingly, analysts have slashed their EPS estimates by 16.5% in the 90 days leading up to the earnings report, according to an InvestingPro survey.

Source: InvestingPro

Consensus calls for the digital payment processing company to post earnings of $1.20 per share, as per Investing.com, increasing 8.1% from EPS of $1.11 in the year-ago period. Meanwhile, revenue is seen rising 6.8% from last year to $7.39 billion.

PayPal said last month it planned to lay off 7% of its workforce, or roughly 2,000 employees, a move in line with the San Jose, California-based company’s previous commitment to rein in costs.

Despite the year-over-year improvement on both the top-and-bottom line numbers, I think PayPal’s management will be prudent in its guidance for the year ahead due to the challenging operating environment and slowing e-commerce trends.

In addition, I believe that the growing popularity of Apple's (NASDAQ:AAPL) Apple Pay and Block’s Cash App will negatively impact PayPal’s growth in the near term as it becomes increasingly vulnerable to losing market share in the online payments industry.

The company also faces fundamental uncertainty from recent news that several big banks, including JP Morgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), and Wells Fargo (NYSE:WFC), are working together to launch their own digital wallet that customers can use to shop online by the second half of 2023.

Source: Investing.com

PYPL stock, which fell to a bear-market low of $66.39 in late December, closed at $85.52 on Friday. At current valuations, the San Jose, California-based fintech giant has a market cap of $97.5 billion.

Shares, which have rallied to start the new year along with the tech-heavy Nasdaq, are up a whopping 20% through the first five weeks of 2023. Notwithstanding the recent turnaround, the stock remains about 72% away from its July 2021 all-time high of $310.16.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.