After 6 weeks of steady gains, the U.S. dollar is finally showing signs of exhaustion but there could be one last push before a full-fledged top ahead of this month’s Reserve meeting.

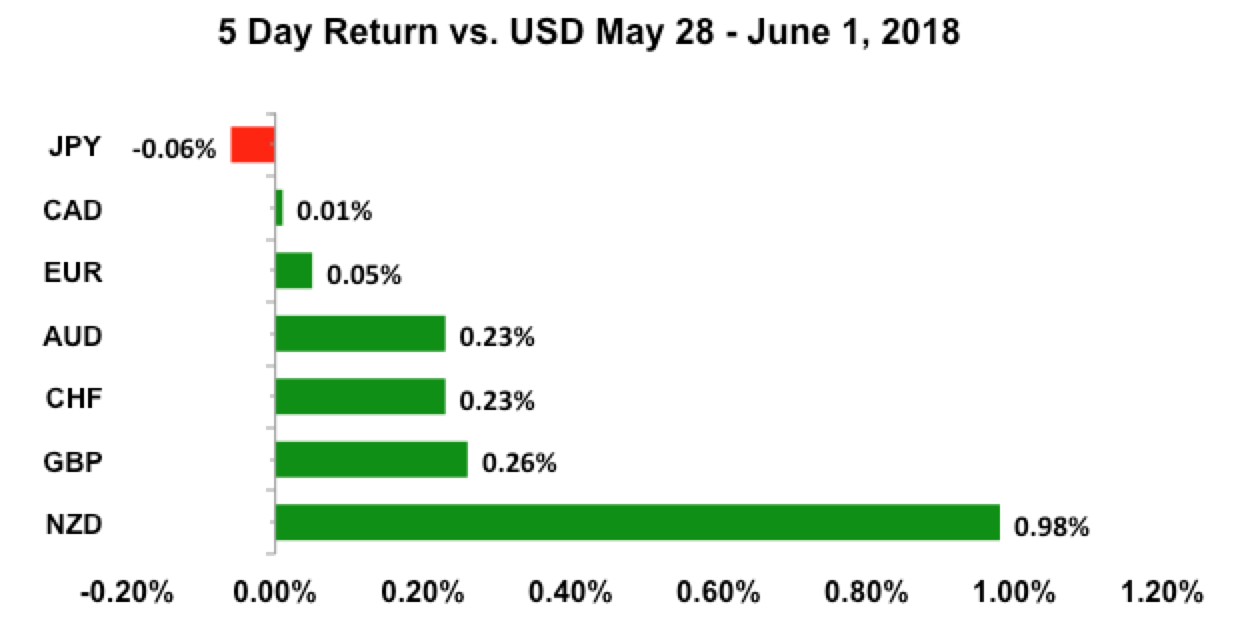

The greenback saw losses against most of the major currencies but in each one, it gave up less than 1% of its gains. To put this move into context, the EUR/USD rallied 7.25% over the past 6 weeks. The Australian dollar, on the other hand, remained trapped in a tight range ahead of the Reserve Bank’s monetary policy meeting. Interestingly enough the New Zealand dollar experienced the strongest gains for no reason other than a short squeeze as NZD data was mixed. U.S. Nonfarm Payrolls, the biggest event of the week, had very little impact on the market. Instead, forex traders were charged by the political developments in Europe and U.S. President Trump’s brewing trade war.

U.S. DOLLAR

Data Review

- Nonfarm Payrolls 223k vs. 190k Expected

- Unemployment Rate 3.8% vs. 3.9% Expected

- Avg. Hourly Earnings 0.3% vs. 0.2% Expected

- Consumer Confidence Index 128.0 vs. 128.0 Expected

- Conf. Board Present Situation 161.7 vs. 157.5 Prior

- Conf. Board Expectations 105.6 vs. 104.3 Prior

- ADP Employment Change 178k vs. 190k Expected

- GDP Annualized (QoQ) 2.2% vs. 2.3% Expected

- Personal Consumption 1.0% vs. 1.2% Expected

- GDP Price Index 1.9% vs. 2.0% Expected

- Core PCE 2.3% vs. 2.5% Expected

- Advance Goods Trade Balance -$68.2b vs. -$71.0b Expected

- Beige Book Shows a Upbeat Economy led by Manufacturing Activity

- Personal Income 0.3% vs. 0.3% Expected

- Personal Spending 0.6% vs. 0.4% Expected

- PCE Core 0.2% vs. 0.1% Expected

- PCE Deflator 0.2% vs. 0.2% Expected

- Chicago PMI 62.7 vs. 58.0 Expected

- Pending Home Sales -1.3% vs. 0.4% Expected

- ISM Manufacturing 58.7 vs. 58.2 Expected

Data Preview

- Factory and Durable Goods Orders- Durable revisions are hard to predict but revisions can be market moving

- US Trade Balance: Potential for downside surprise given strong dollar and lower ISM manufacturing index

- ISM Non-Manufacturing Composite: Potential for upside surprise given strong job and wage growth

Key Levels

- Support 108.00

- Resistance 111.00

Although the U.S. dollar pulled back, nonfarm payrolls the most important piece of data released last week changes nothing for the Federal Reserve. Job growth exceeded expectations in May, the unemployment rate declined and wages grew by 0.3%. For now, the US dollar is taking President Trump’s attack on global trade in stride but how long that last remains to be seen as retaliation from other nations could hurt the dollar. Looking ahead, the lack of major US economic reports means the focus will be on trade and the lead-up to the June 13 monetary policy meeting. Decent job growth and hawkish comments from US policymakers reinforce the widely held view that the Chairman Powell will raise interest rates next week. Unless something challenges that outlook, investors will be holding onto their dollars into the FOMC meeting.

Economists are looking for this week’s non-manufacturing ISM report to show stronger performance in the service sector. The market is pricing in a 100% chance of tightening so there’s little doubt that the move will happen. How quickly the Fed follows with another hike is the real question and we won’t know the answer until they meet in 8 trading days. Fed officials favor gradual rate increases and according to Fed fund futures, investors see a 75% chance of another hike in September or November with the odds rising to 87% in December. Technically, USD/JPY is still the best pro-dollar trade as the greenback’s rally is tiring against other currencies.

British Pound

Data Review

- BRC Shop Price Index -1.1% vs. -1.0% Expected

- GfK Consumer Confidence -7 vs. -8 Expected

- Manufacturing PMI 54.4 vs. 53.5 Expected

Data Preview

- Services and Composite PMI: Potential for upside surprise given stronger consumer confidence & higher manufacturing PMI index

Key Levels

- Support 1.3300

- Resistance 1.3600

Better than expected UK PMI numbers confirmed the bottom in GBP/USD that was days in the making. At the start of last week, the outlook for GBP/USD was grim as a quiet U.K. calendar provided sterling with the perfect catalyst for a move to new lows. Risk aversion drove GBP/USD to its weakest level in 6 months last Tuesday, the same day that the Dow Jones Industrial Average tumbled more than 500 points intraday. Sterling took its cue almost exclusively from the market’s appetite for risk along with its demand for US dollars and euros. But the uptick in the PMI report toward the end of last week helped GBP/USD stabilize and further gains are possible in the days ahead if the other PMI reports are strong. Construction and service sector PMI reports are due for release along with the central bank’s survey of inflation expectations for the next 12 months. This week’s price action suggests that GBP/USD is trying to stabilize but a move above 1.3450 would be needed for the month-long downtrend to ease.

Euro

Data Review

- GE Retail Sales 2.3% vs. 0.5% Expected

- GE Unemployment Change -11k vs. -10k Expected

- GE Unemployment 5.2% vs. 5.3% Expected

- EZ Economic Confidence 112.5 vs. 112.0 Expected

- EZ Consumer Confidence 0.2 vs. 0.2 Expected

- GE CPI 0.5% vs. 0.3% Expected

- EZ Unemployment Rate 8.5% vs. 8.4% Expected

- EZ CPI Core (YoY) 1.1% vs. 1.0% Expected

- EZ CPI Estimate (YoY) 1.9% vs. 1.6% Expected

- GE Manufacturing PMI 56.9 vs. 56.8 Expected

- EZ Manufacturing PMI 55.5 vs. 55.5 Expected

Data Preview

- EZ PPI: Potential for upside surprise given stronger German & French PPI

- GE and EZ Services and Composite PMI: Revisions are hard to predict but changes are market moving

- EZ GDP: Revisions are hard to predict but changes are market moving

- GE Trade Balance, Current Account Balance and industrial Production: Potential for downside surprise given weaker manufacturing PMI index. Steady confidence

Key Levels

- Support 1.1500

- Resistance 1.1800

It was a challenging week for the euro as the political drama in Europe and the expiration of the European Union’s exemption to the US’ aluminum and steel tariffs deterred investors from buying. These concerns took EUR/USD to its weakest level in 10 months. However as political uncertainty turned into reality, investors came to terms with the escalation of trade tensions in Europe (President Trump also threatened to ban the sale of German autos). Italy managed to form a populist coalition government, ending months of uncertainty for the region’s 4th largest economy. In Spain, the Eurozone’s 3rd largest economy, Prime Minister Rajoy lost a no confidence vote and will be replaced by opposition leader Pedro Sanchez. Investors took the news in stride as most parties in Spain support rather than contest EU membership. The lack of meaningful data from the Eurozone this week leaves a global trade war the main concern as we have begun to see an upturn in Eurozone data. German retail sales rose 2.3% in the month of April, versus a forecast for only 0.5% growth. Germany’s unemployment rate also declined while consumer prices moved higher. This strength was mirrored in the Eurozone especially through consumer price inflation, which grew by 1.9% yoy in May, up from 1.2% in April. These reports along with the nearly 9 cent drop in EUR/USD means the ECB should be less pessimistic at their June 14th policy meeting (a day after the Fed).

AUD, NZD, CAD

Data Review

Australia

- Building Approvals -5.0% vs. -3.0% Expected

- AIG PMI Manufacturing 57.5 vs. 58.3 Prior

- CH Non-Manufacturing PMI 54.9 vs. 54.8 Expected

- CH Manufacturing PMI 51.9 vs. 51.4 Expected

- CH Composite PMI 54.6 vs. 54.1 Prior

New Zealand

- Building Permits -3.7% vs. 13.0% Prior

- Consumer Confidence 0.4% vs. -5.9% Prior

Canada

- Bank of Canada Keeps Rates Unchanged at 1.25%, expresses optimism

- Current Account Balance -$19.50b vs. -$18.20b Expected

- Q1 GDP 1.3% vs. 1.8% Expected

- March GDP 0.3% vs. 0.2% Expected

Data Preview

Australia

- RBA Cash Rate Target- We could see a tinge of optimism from RBA

- AU Retail Sales: Potential for upside surprise given rise in sales component of PSI

- AU Services PMI: Will have to see how retail sales fares

- AU GDP: Weaker retail sales but much stronger trade makes this Q report hard to handicap

- AU Trade Balance: Potential for downside surprise given pullback in manufacturing PMI

- China Trade Balance: Chinese trade data is very market moving but hard to predict

New Zealand

- No Data

Canada

- International Merchandise Trade, Building Permits and IVEY PMI: IVEY released the same day as trade balance

- Housing Starts and Labor Data: Will update after IVEY PMI

Key Levels

- Support AUD .7400 NZD .6900 CAD 1.2800

- Resistance AUD .7600 NZD .7100 CAD 1.3100

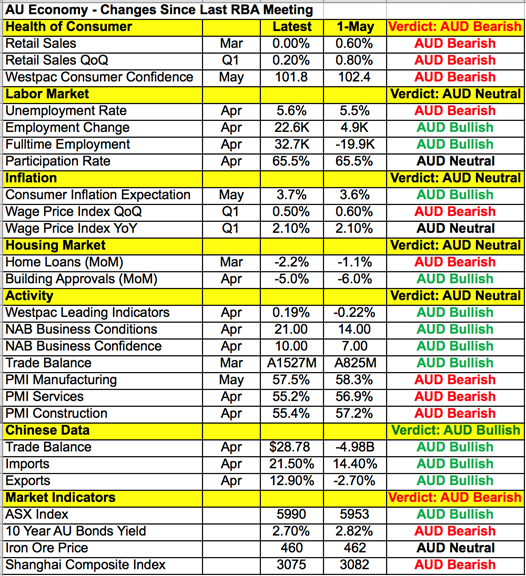

This is a big week for the Australian dollar. There will be a Reserve Bank monetary policy announcement on Tuesday, along with the release of retail sales, first quarter GDP, service sector PMI, Australian and Chinese trade balances. When the RBA last met, their comments drove the Australian dollar lower because their confidence in growth was offset by concerns about declining terms of trade and low inflation. We’ve seen some improvements since then including stronger full time job growth, business confidence and consumer inflation expectations, but they won’t be enough to convince the central bank that the risks that are fading. So even if there is a tinge of optimism, it is important to realize that the RBA remains firmly neutral with no plans to raise rates this year. With that in mind, the Australian dollar lost significant value this year so if the RBA is encouraged by recent data and if enough of this week’s retail sales, Q1 GDP, trade balance and service sector PMI reports surprise to the upside, we could see AUD/USD trade back up to 77 cents.

Meanwhile, after rising for 6 days straight, USD/CAD fell sharply on the back of the Bank of Canada’s monetary policy announcement but the loonie gave up all of its gains when President Trump killed the NAFTA deal. According to Prime Minister Trudeau, the talks were going well up until Vice President Pence demanded a sunset clause that would require NAFTA to be renegotiated in 5 years unless both parties agreed to renew. What appeared to be a done deal is now very much up in the air and until there’s a positive resolution, the Canadian dollar will have a tough time rallying. Once progress is made however, the Canadian dollar will soar because the Bank of Canada, who was unambiguously dovish in April made a U-turn in May by dropping the reference to being “cautious on rates” and removing the language that pertains to the need for “monetary policy accommodation” from their monetary policy statement. Instead, policymakers felt that inflation is “likely to be a bit higher in the near term,” and activity “a little stronger than projected.” They also expect “solid wage growth” to contribute “positively to housing and consumer demand.” This is a nod to the acceleration in manufacturing activity, recovery in retail sales and uptick in oil prices. However given that data wasn’t uniformly positive last month (GDP growth slowed, core retail sales declined and CPI growth eased), the shift in tone caught the market by surprise as July rate hike expectations jumped from 53.2% to 77% between Tuesday and Wednesday. Looking ahead, we expect the Bank of Canada’s optimism to translate into stronger data with the trade balance, IVEY PMI and employment reports scheduled for release. As long as USD/CAD remains below 1.2950, a move down to 1.2700 becomes likely.

Incidentally, the New Zealand dollar was one of last week’s best-performing currencies. No major economic reports were released but the terms of trade fell in the first quarter, business confidence declined and consumer confidence saw only a small improvement. After consolidating in a tight .6850 to .6975 range since mid-May, NZD/USD finally broke to the upside on the back of profit taking of long US dollar positions. The pair broke above 70 cents to trade as high as .7025. New Zealand’s economic calendar is light in the week ahead but the Treasury will be releasing their monthly economic indicators, which could elicit a mild reaction in NZD/USD. New Zealand’s currency will most likely take its cue from the market’s appetite for Australian dollars so keep an eye on AUD/NZD.

Weekly Trade Ideas: Don't miss these market moving opportunities identified by BK Forex. Download here

Editor's Note: Kathy Lien remains on partial maternity leave and will resume her daily posts in August. In the meantime, stay tuned for her once-weekly market updates.