Asian share markets are failing to advance following a turbulent Friday night session in the wake of a strong US unemployment print but weaker ISM measures. The Australian dollar is failing to make headway as it breaks below the 67 cent level in afternoon trade.

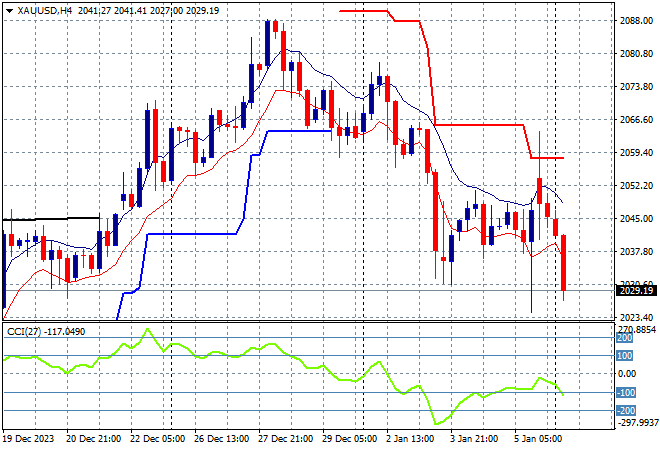

Oil prices are starting to pull back as Brent crude stays anchored around the $78USD per barrel level while gold is falling back on USD strength, unable to consolidate following the volatile Friday night session to fall below the $2030USD per ounce level:

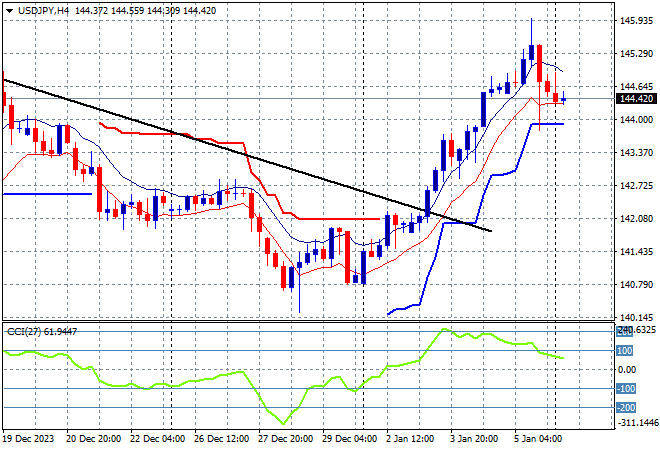

Mainland Chinese share markets are falling sharply on tensions around property shares as the Shanghai Composite retreats below the 2900 point barrier, currently some 1.2% lower at 2893 points while in Hong Kong the Hang Seng Index is down more than 2% at 16184 points. Japanese stock markets are closed again with light trading in the USDJPY pair opening and staying slightly above the 144 level:

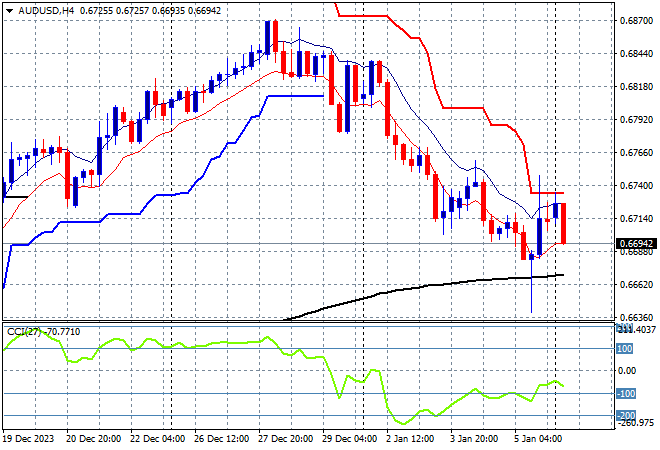

Australian stocks weren’t able to get moving as the new trading week started, with the ASX200 closing 0.5% lower to 7451 points while the Australian dollar has dropped sharply in afternoon trade, continuing its decline after its New Year slump with a break below the 67 cent level:

S&P and Eurostoxx futures are pulling back further from their volatile finishes on Friday night going into the London open with the S&P500 four hourly chart showing a continued breakdown below the 4800 point level with short term momentum almost oversold:

The economic calendar is usually quiet following the most recent US non farm payrolls/unemployment print from Friday night.