DXY to the moon:

AUD flushed to the lows:

Oil is up with the OPEC cut:

Metals down:

Miners (NYSE:RIO) too:

EM stocks (NYSE:EEM) were soft:

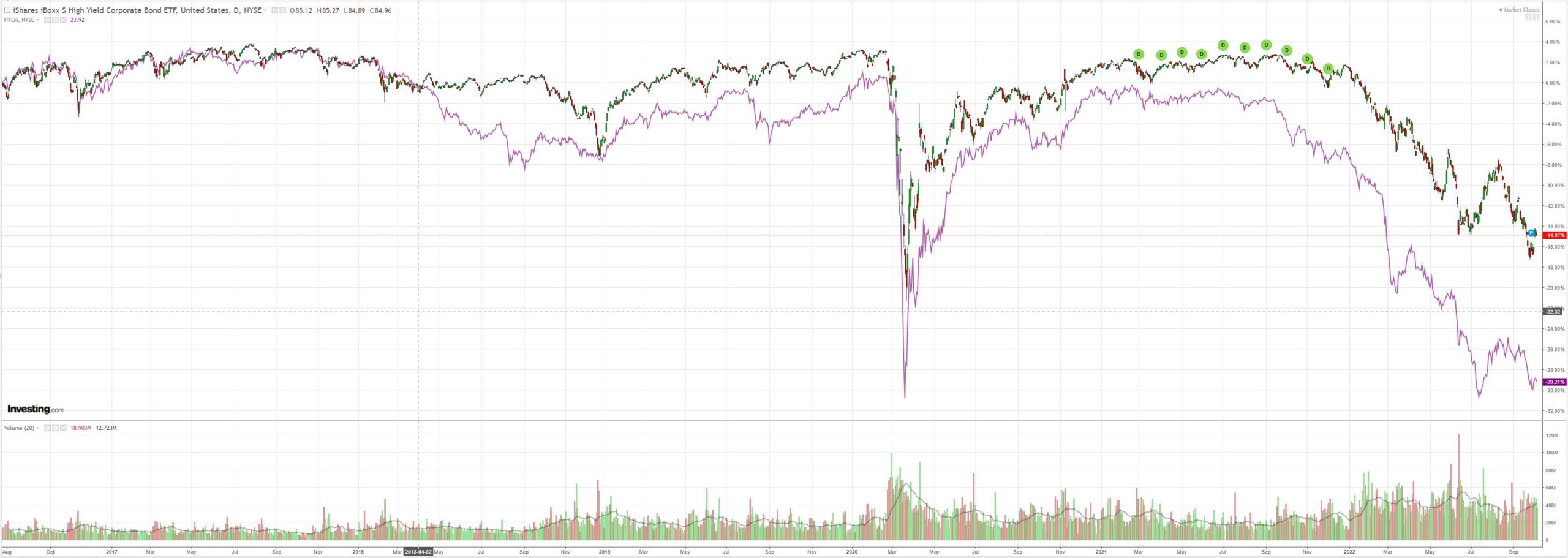

Junk (NYSE:HYG) rolled:

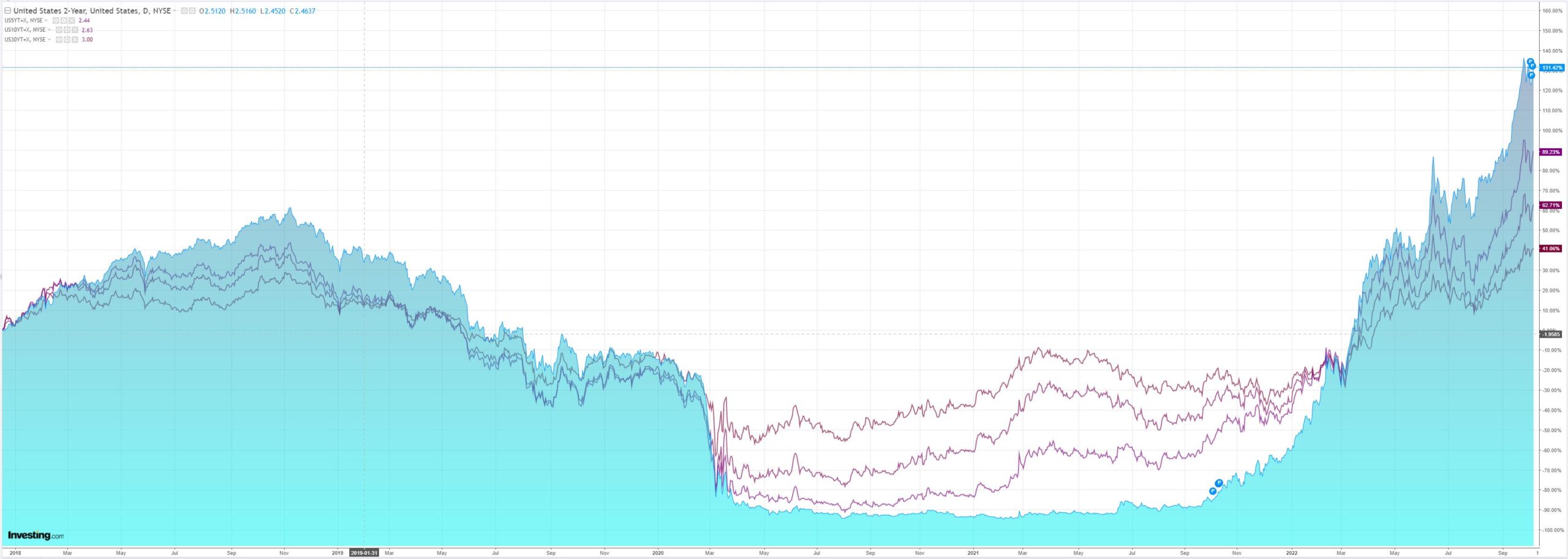

Yields piled higher:

Stocks sank:

It’s US jobs tonight, which is always pretty random., but there are signs of strength in the US economy. GDPNow has bounced bigly:

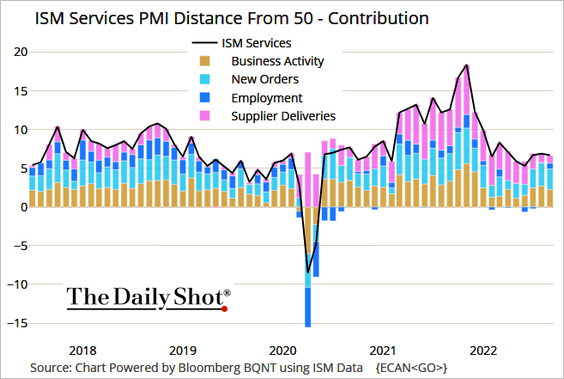

Driven largely by services:

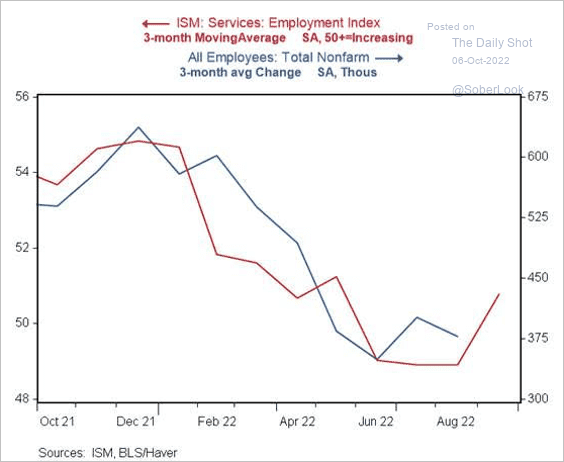

Which should support the BLS:

However, employment reports everywhere are a random walk for trading purposes so there’s no guarantee.

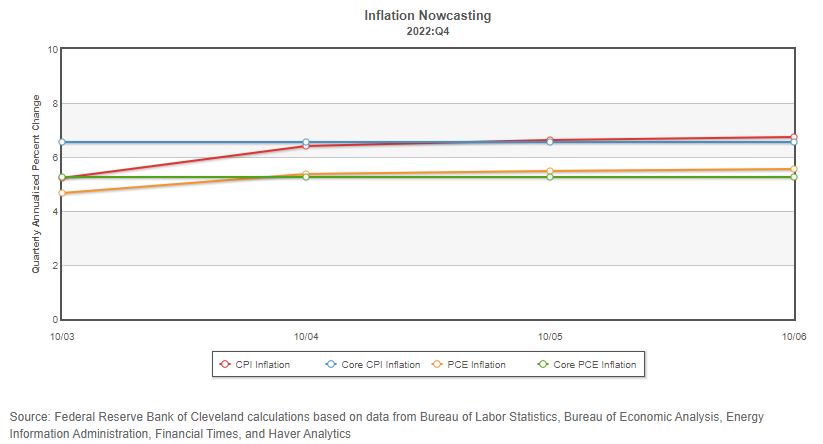

That said, economic strength is consistent with sticky inflation. The Fed’s Nowcast is still firming:

| Inflation, month-over-month percent change | |||||

|---|---|---|---|---|---|

| Month | CPI | Core CPI | PCE | Core PCE | Updated |

| October 2022 | 0.72 | 0.53 | 0.54 | 0.42 | 10/06 |

| September 2022 | 0.32 | 0.51 | 0.30 | 0.40 | 10/06 |

| Inflation, year-over-year percent change | |||||

|---|---|---|---|---|---|

| Month | CPI | Core CPI | PCE | Core PCE | Updated |

| October 2022 | 8.04 | 6.58 | 6.21 | 5.12 | 10/06 |

| September 2022 | 8.20 | 6.64 | 6.24 | 5.11 | 10/06 |

I can’t see any Fed pivot in these numbers. The BLS will need to be a shocker to turn AUD up.