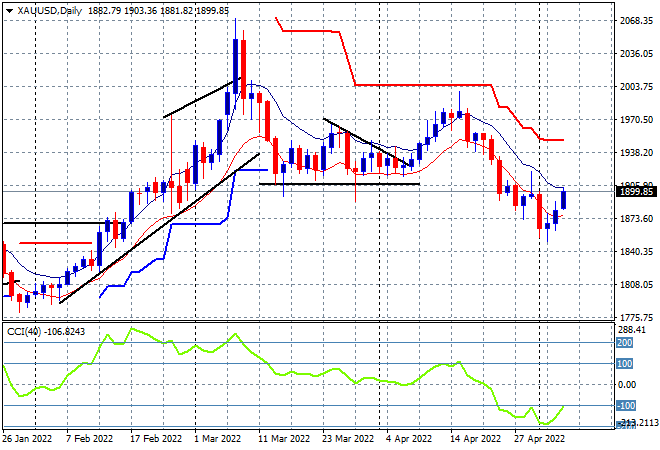

Asian stocks have reacted in mixed fashion today to the overnight moves on Wall Street following the Fed’s highly expected 50 point rise in interest rates. There has been some minor retracement of the major currencies which all reversed their downward course against the nearly unstoppable USD, while oil markets are pushing higher again with Brent crude now above the $110USD per barrel level price while gold is finally gaining traction after being a laggard overnight, about to threaten the $1900USD per ounce level, as daily momentum turns up into a possible swing trade:

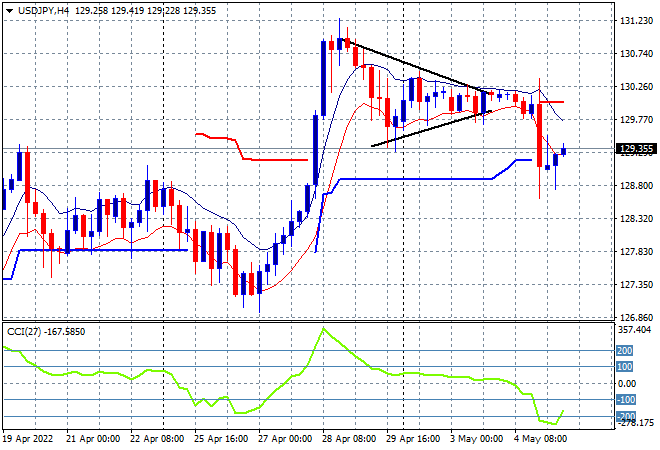

Mainland Chinese share markets finally reopened after a big break with the Shanghai Composite playing catchup, currently up 0.7% to 3068 points while the Hang Seng Index is trying to regain its previous losses, up nearly 0.5% at 20957 points. Japanese stock markets are still closed for yet another holiday while the USDJPY pair is trying to clawback its whomping from overnight, currently at the 129.30 level:

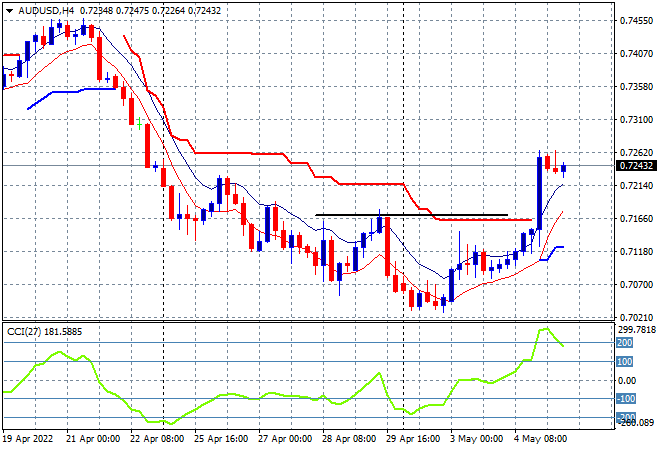

Australian stocks did very well, considering a much higher Australian dollar with the ASX200 closing just over 0.8% higher to finish at 7364 points. Meanwhile the Australian dollar has retraced ever so slightly from its stonking breakout overnight, still holding above the 72 handle despite what looks like a growing gulf in the interest rate differential between the RBA and the Fed:

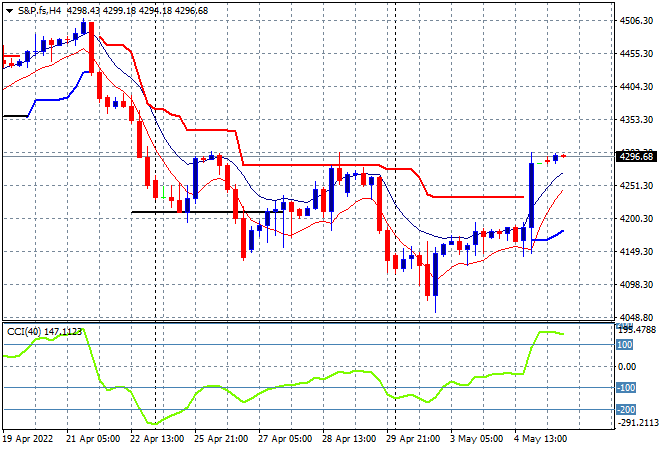

Eurostoxx and Wall Street futures are lifting higher with the former playing catchup while the S&P500 four hourly chart showing price wanting to complete this inverse head and shoulders bottom pattern with the potential to breakout above the previous weekly high at the 4300 point level:

The economic calendar now has the BOE meeting to contend with later tonight, then we get US initial weekly jobless claims.