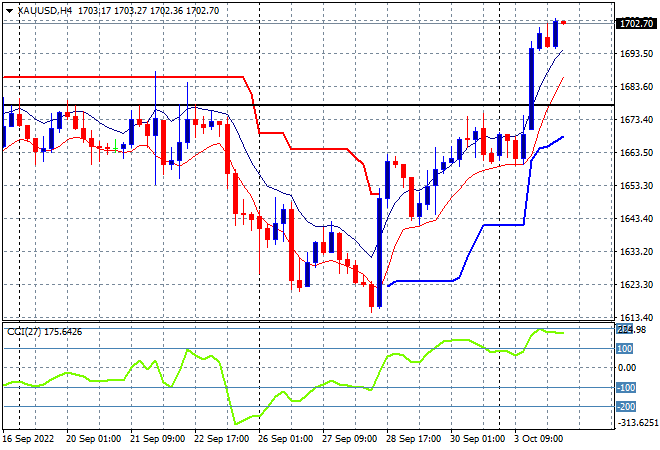

Supergreen! Asian stock markets have soared across the region in response to the bounce on Wall Street overnight, with local stocks having one of their best days on record, up nearly 4% because the RBA held back with only a 25bps rise in rates at its meeting today. The USD is weakening against the majors but holding ground against the Aussie dollar while oil prices are lifting going into the overnight sessions, with Brent crude up through the $89USD per barrel level while gold is pushing higher after breaking through the $1700USD per ounce level:

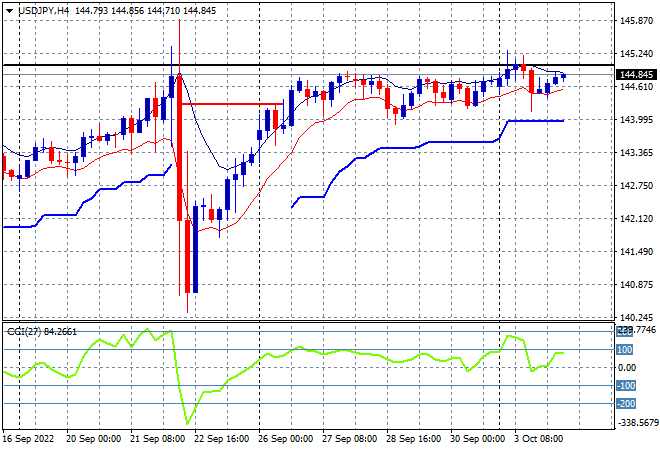

Mainland Chinese share markets are closed all week for National Day holidays while the Hang Seng Index is also closed for today only. Japanese stock markets are bouncing back strongly, with the Nikkei 225 closing nearly 3% higher at 26968 points while the USDJPY pair is hovering at its recent weekly highs just below the 145 handle:

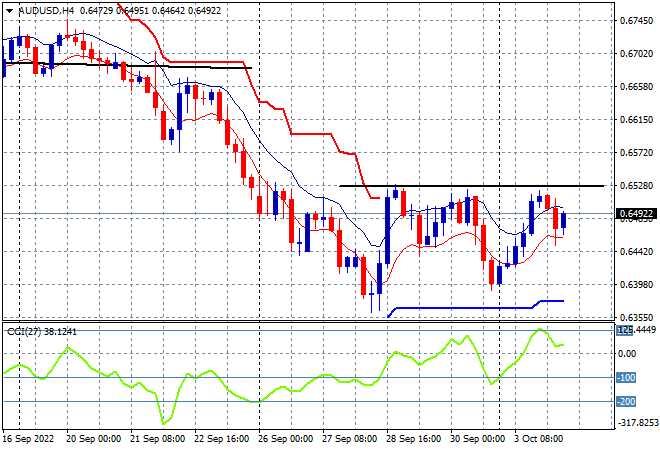

Australian stocks are doing even better, helped by the RBA losing its cool, with the ASX200 closing nearly 4% higher at just shy of the 6700 point level. The Australian dollar was poised to breakout higher on the RBA hike but has rolled over in late afternoon trade, unable to head back above the 65 handle:

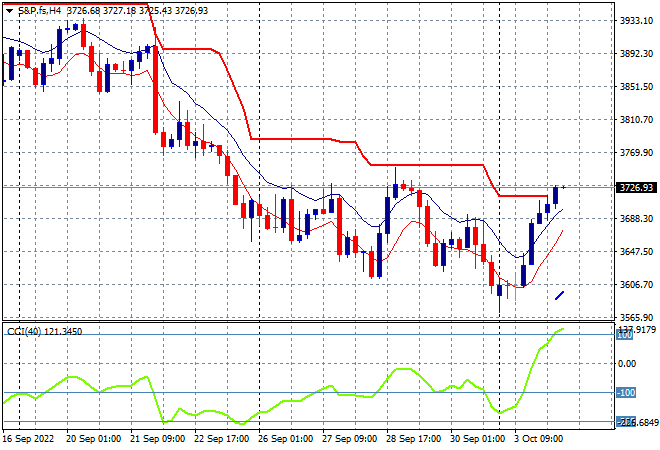

Eurostoxx and US futures are pushing higher among this ebullience as we go into the London session with the S&P500 four hourly futures chart showing price action now above the 3700 point level. Medium term and possibly psychological long term resistance at the 4000 point level is still a long way away, yet former support at 3800 points maybe the target in this bounceback but price needs to get above short term ATR trailing resistance first:

The economic calendar has a quiet night with a slurry of Fed speeches and US factory orders for August.