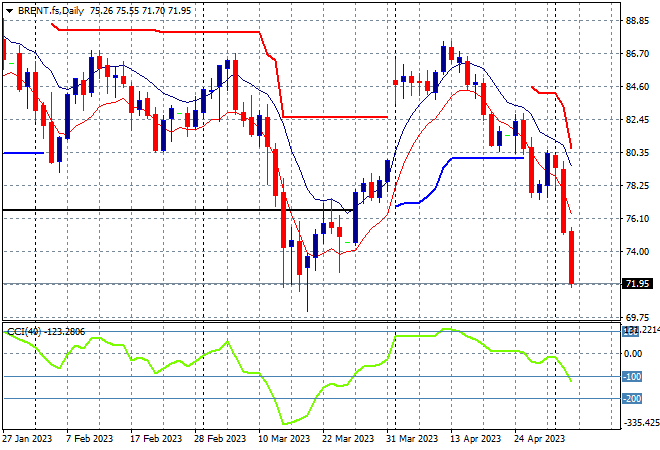

The Federal Reserve signalled a “conditional pause” with a small but expected rake hike overnight, but all eyes were on the regional bank crisis in the US that the Fed seems to be papering over, sending Wall Street lower again. European stocks were able to lift mildly as Euro came back slightly against King Dollar while the Australian dollar slumped following the rate hike, negating the RBA’s own insistent anti-inflation strategy. 10 year US Treasury yields pulled back to a monthly low at the 3.4% level while oil prices become further depressed with Brent crude slumping below the $72USD per barrel level to return to the March and hence yearly low. Gold continued its breakout above the $2000USD per ounce level, currently at $2055 after a big spike.

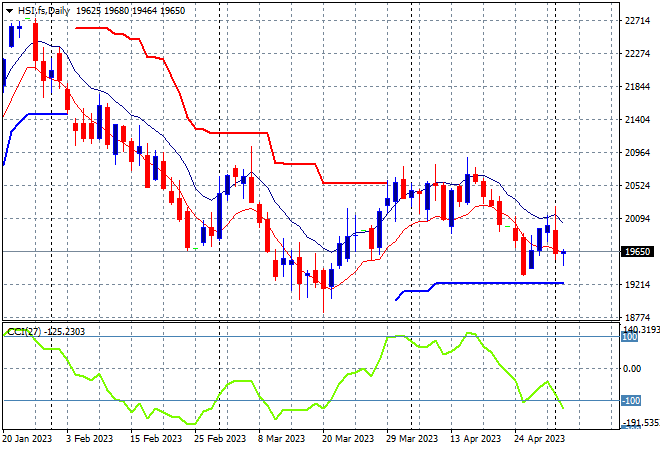

Looking at share markets in Asia from yesterday’s session where Chinese share markets were still closed for May Day holidays while the Hang Seng has broken down on the poor overall risk sentiment, off more than 2% at one stage to close 1.2% lower at 19699 points. After closing shy of the 20000 level on Friday the daily chart is still showing resistance building at the 20500 point level before this recent rollover as price action returns to the start of year correction phase. It looks like the 19000 point level is proving an anchor point in recent months that price action continues to draw down to:

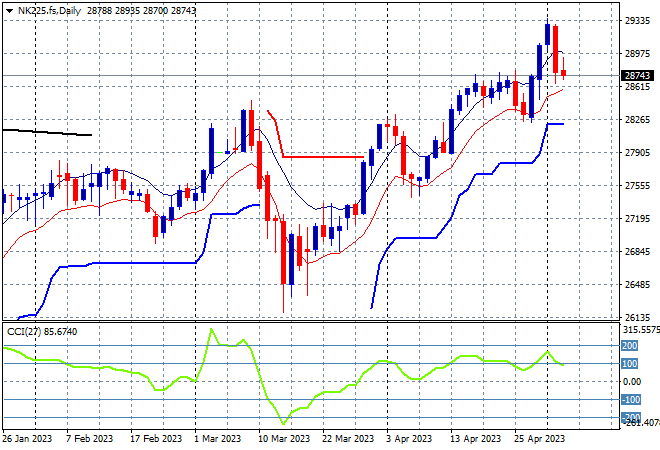

Japanese stock markets are also closed for the rest of the week with Nikkei 225 futures indicating a mild pullback despite larger falls on Wall Street overnight. Overall the trend remains up with some steam taken out as price action looks set to test the low moving average area on the re-open, but depending on risk sentiment could also could threaten trailing ATR support at 28000 points:

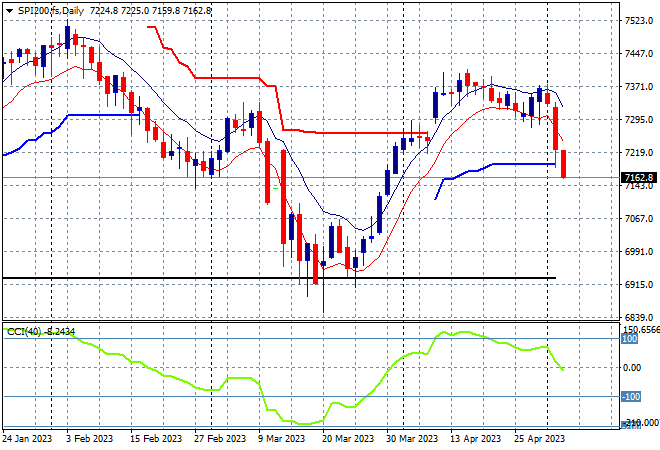

Australian stocks remained under a lot of pressure as the RBA wants to engineer a recession with the ASX200 again closing nearly 1% lower to 7197 points. SPI futures are down at least 0.5% but could break even lower as Wall Street wobbles and the higher Australian dollar. The attempt to get back to the January levels is completely out of reach now as daily momentum goes into the negative zone and price action is likely to break trailing ATR support. The March lows at the 6900 point level is the likely target here:

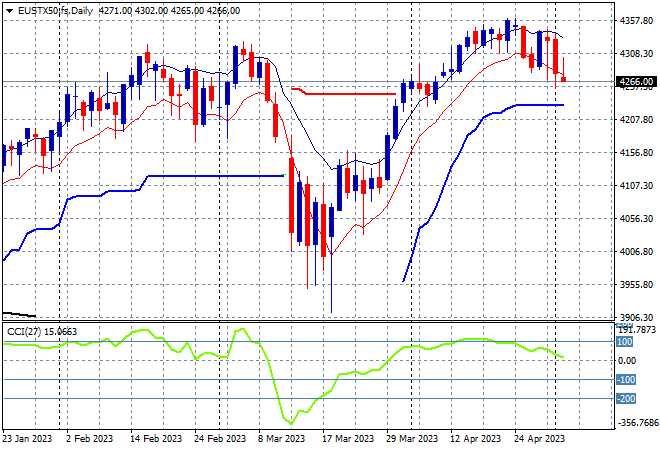

European markets were able to clawback some of the post Labour Day holiday losses with some mild increases across the continent, taking the Eurostoxx 50 Index back above the 4300 point level as it closed 0.5% higher to 4310 points. This is still building for a potential breakdown as post close futures follows Wall Street’s banking woes with another pullback below the low moving average likely in tonight’s session. The daily chart shows a possible break to trailing ATR support at the 4200 point level here:

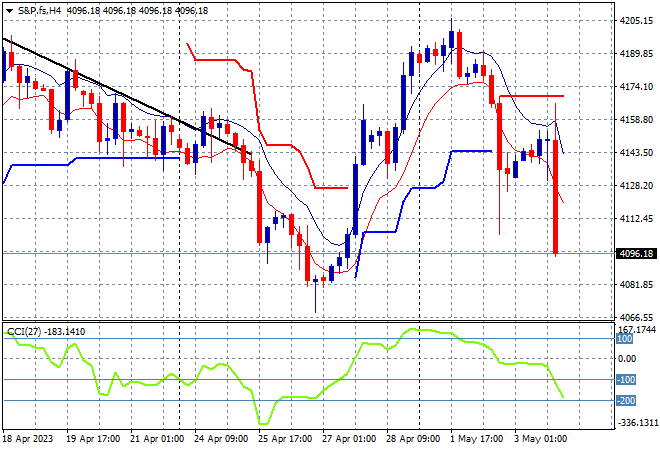

Wall Street continues to be hammered by regional bank stocks with the NASDAQ down another 0.5% while the S&P500 lost nearly 1% to finish below the 4100 point level at 4090 points as volatility builds. The four hourly chart showed price action stalling in the previous session after a big rebound off the early April lows with this break down building as the Fed’s rate hike is overshadowed by the continuing fallout and possible contagion in regional bank failures:

Currency markets were subdued heading into last night’s Fed meeting but most major undollars gained against USD as the expected rate hike was factored in, plus the signalling of a probable pause ahead. Euro was able to climb above the 1.10 handle again after bouncing off its previous weekly low and support at the low 1.09’s as it matches the previous weekly highs instead. Momentum is now back into overbought mode and price action is supportive of further upside if it can clear resistance here:

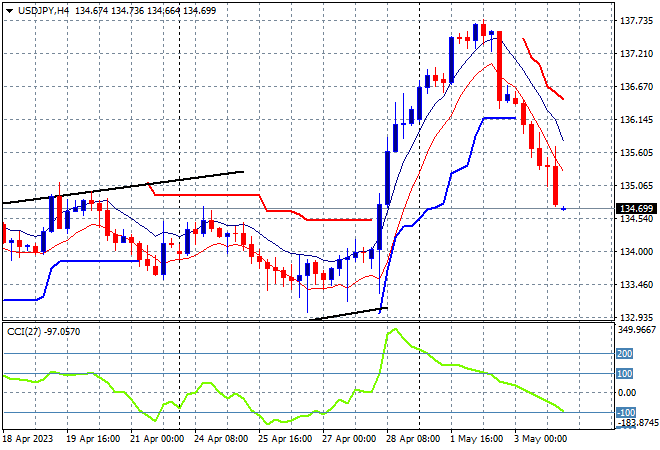

The USDJPY pair came down further again overnight, almost negating its big surge from Friday to finish just below the 135 level. This also looks like a lot of Yen safe haven buying as risk sentiment sours but also because of thin trading due to Japanese domestic holidays. Short term momentum readings have now pulled back from extreme overbought into quite negative readings, moving from a healthy retracement into a proper reversal where former resistance at the 134 level proper which must be defended:

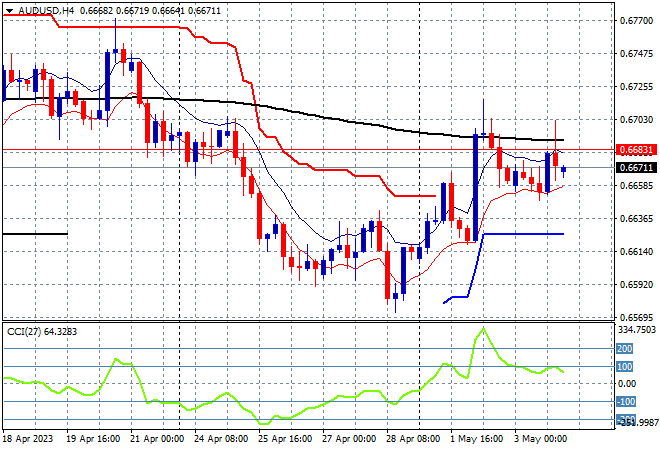

The Australian dollar was unable to hold onto its post RBA meeting surge in the wake of the Fed rate hike to finish just below the 67 handle where it look tenuous in early trade. This failure to really punch through overhead resistance at 67 cents is quite telling despite continued signals from the Fed that they intend to pause soon while the RBA seems hellbent on creating domestic carnage. Short term momentum has retraced back from its slightly overbought status but not yet rolled over:

Oil markets continue to fall back sharply on growth concerns with both markers off another 4% or so, with Brent crude snapping to a new monthly low at the $72USD per barrel level. This takes it below the December levels (lower black horizontal line) but has not yet overshot to the $70 level after breaching trailing ATR support, with daily momentum negative but not yet oversold:

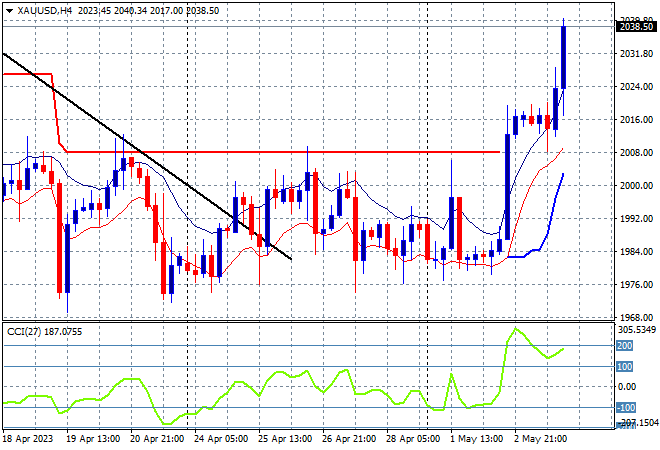

Gold continued its breakout last night on the anti-USD moves with a further surge above the $2000USD per ounce level, finishing at the $2038 level after previously bouncing along at weekly support levels just above the $1980 level. The four hourly chart shows a clear break above trailing ATR resistance and the psychologically important $2000 level with momentum now in the overbought zone – watch for a minor pullback to support those levels going ahead: