Another sea of green across Asian share markets as the trading week comes to a close but all eyes will be on tonight’s US jobs report that will set the tone for the rest of the trading month.

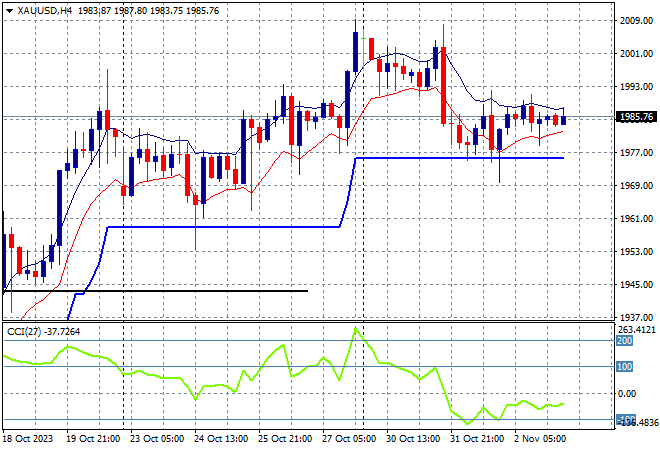

Oil prices have stabilised a little following their recent downward trend, with Brent crude consolidating above the $86USD per barrel level while gold is also steady, currently just above the $1985USD per ounce level:

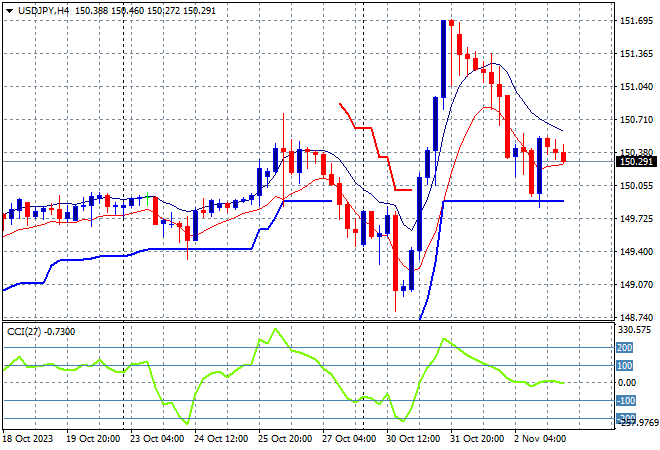

Mainland Chinese share markets are holding on to their initial gains with the Shanghai Composite up more than 0.7% at 3031 points while in Hong Kong the Hang Seng Index has surged more than 2% higher at 17586 points. Japanese stock markets were closed for another market holiday with trading in the USDJPY pair muted as it holds on just above the 150 level:

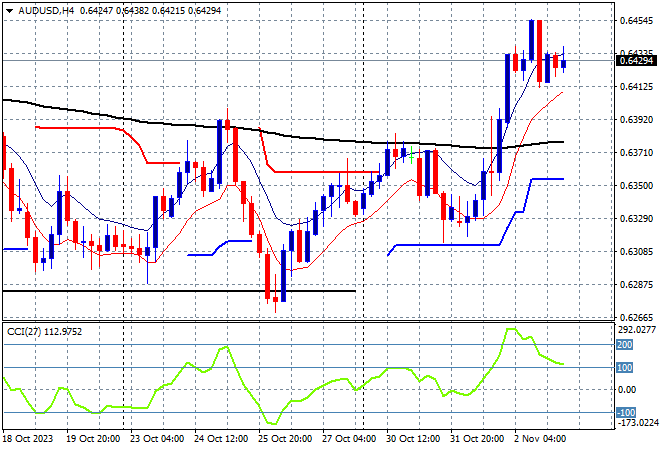

Australian stocks have again been one of the best performers with the ASX200 up 1% at 6972 points, just shy of former support at 7000 points while the Australian dollar has oscillated around its overnight high, still a little above the 64 cent level:

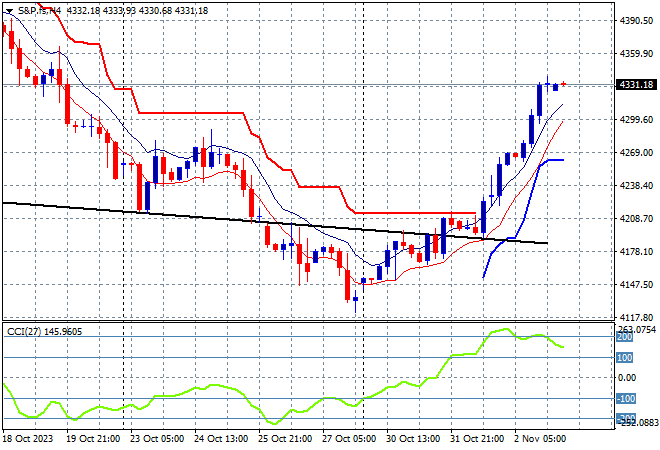

S&P and Eurostoxx futures are lifting again going into the London open as the S&P500 four hourly chart shows support getting upgraded from the 4200 to 4300 point level as short term momentum remains well overbought:

The economic calendar finishes the trading week with the big one – US unemployment or non-farm payrolls.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.