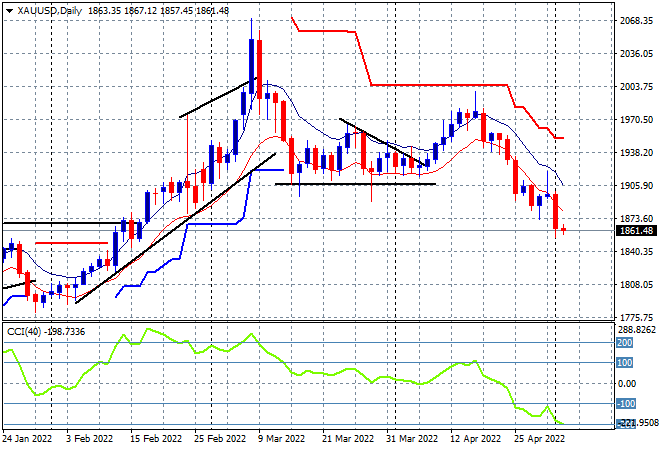

A mixed session here in Asia for risk takers as most of the big stock markets are closed still with the dominating catalyst for the day being the once in a decade rate rise by the RBA, which lead to some oscillation in stock prices but put a light underneath the Australian dollar. Even still, the USD remains super strong against all the majors with Euro and Pound Sterling still under a lot of pressure. Oil markets are steady with Brent crude still indicating a $107USD per barrel level price while gold is slipping again after its big falls overnight, currently at the $1861USD per ounce level, as daily momentum remains highly negative:

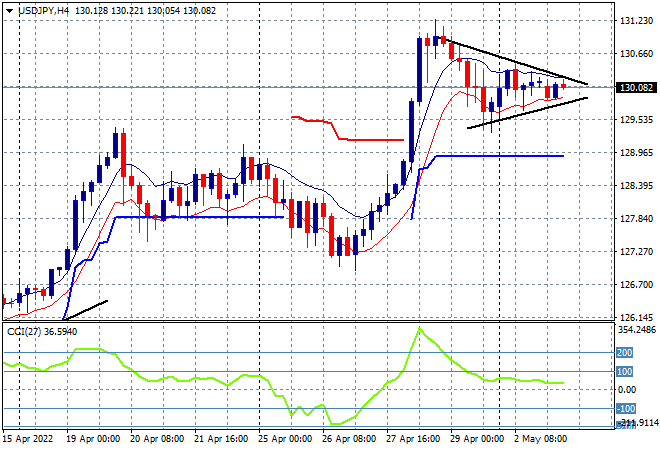

Mainland Chinese share markets were closed again for a holiday while the Hang Seng Index put in a scratch session to finish just 0.2% higher at 21128 points. Japanese stock markets were also closed for yet another holiday while the USD/JPY pair is reflected that lack of action with a symmetrical triangle pattern on the four hourly chart showing no direction, albeit with a bullish bias as it hovers above the 130 level:

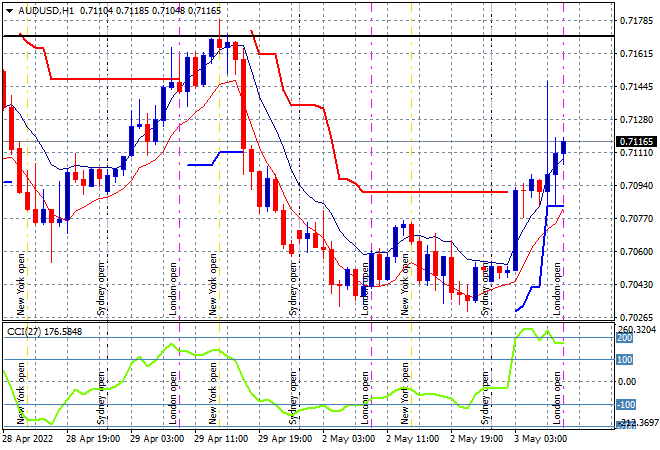

Australian stocks went down and then recovered most of that turn on the back of the RBA rate rise with the ASX200 still losing around 0.25% to finish at 7328 points. Meanwhile the Australian dollar surged after a morning 50 pip rally off of the 70 handle, then retraced most of that move to be around the 70.90 level before again picking up pace later this afternoon as the hourly chart shows. The target in this move – before the Federal Reserve kicks all of this down again – is the previous weekly high around the 71.70 level (upper horizontal black line):

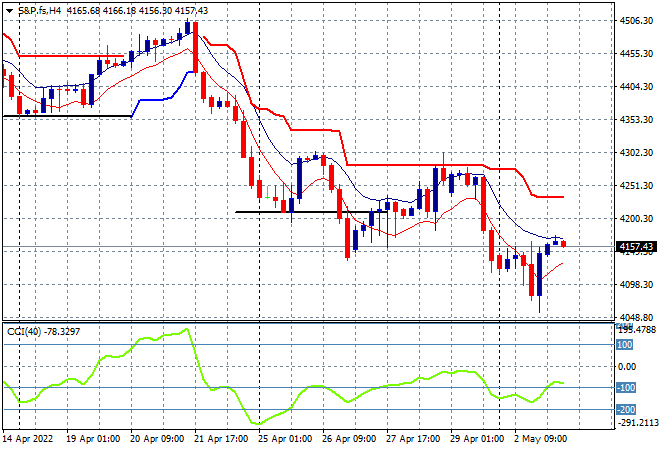

Eurostoxx and Wall Street futures are inching higher with the S&P500 four hourly chart showing price wanting to get out of this bottom pattern with the potential to breakout above the high moving average at around the 4200 point level, but its very very early days yet:

The economic calendar is very busy today following the RBA meeting, we’ve got German unemployment then a speech by ECB President Lagarde then US factory orders.