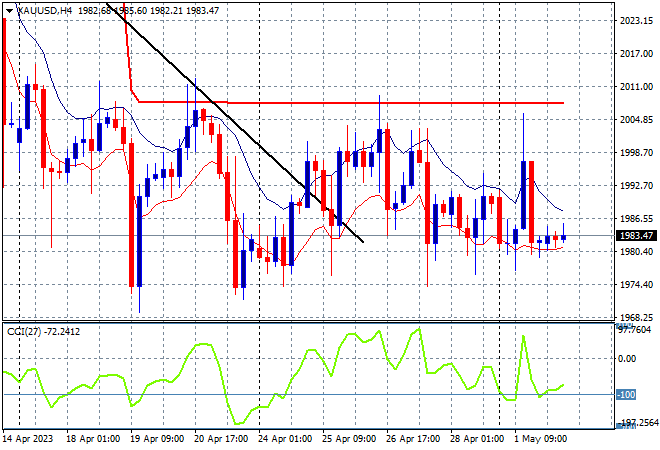

A mixed session for Asian stock markets as the RBA plays its Uno Reverse card and shocks with another rate rise, sending the Australian dollar soaring while the local stock market slumps. After a long weekend for most bourses while Wall Street put in a scratch session it looks like another staid session tonight as traders weigh up the next Fed meeting. The USD remains fairly strong against the majors with oil prices trying to stabilise as Brent crude pushed down to the $79USD per barrel level while gold continues to go nowhere as it remains stuck below the $2000USD per ounce level:

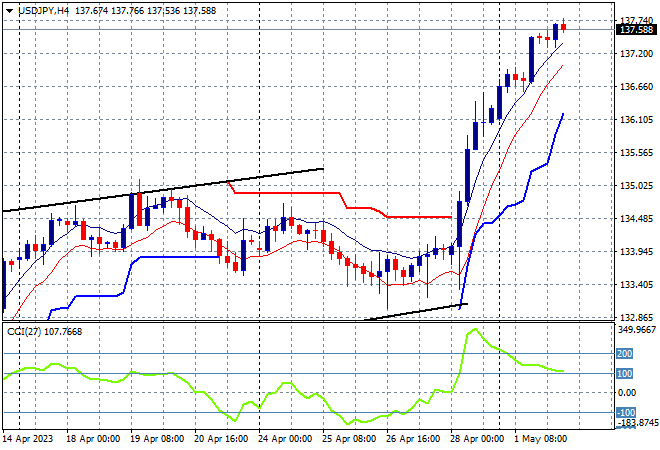

Mainland Chinese share markets are still closed for May Day holidays while the Hang Seng is just chugging along quietly, up 0.1% and still failing to get above the 20000 level, closing at 19909 points. Japanese stock markets are also listless after a big surge in the previous session with the Nikkei 225 up only 0.1% at 29157 points with the USDJPY pair still lifting to be at the mid 137 level to make a new monthly high:

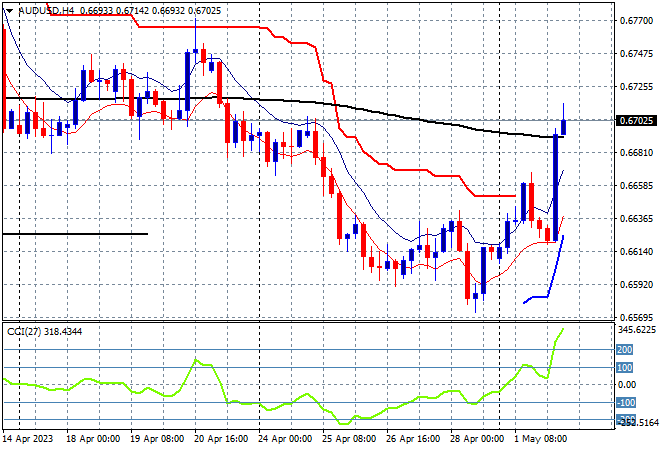

Australian stocks were flummoxed by the RBA rate rise with the ASX200 managing to close nearly 1% lower at 7267 points. The Australian dollar surge following the meeting to be just above the 67 handle, making a new weekly high and leaving traders scratching their heads on how they missed this turn of events:

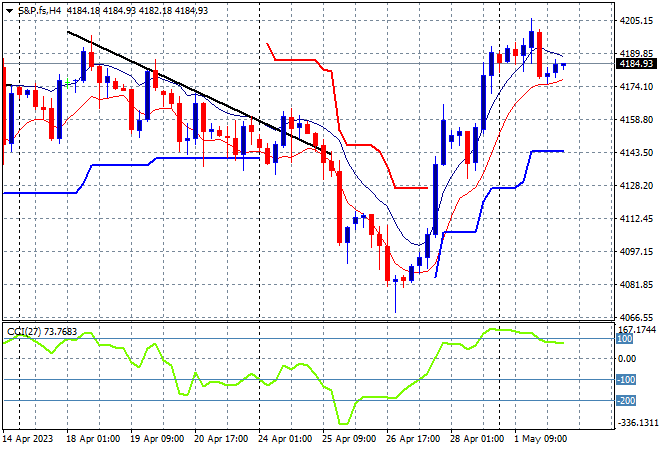

Eurostoxx and S&P futures are up slightly with earnings season still dominating risk sentiment before the next Fed Meeting as the S&P500 four hourly chart shows price action wanting to hang on to the recent surge. The psychological level at 4200 points or at least the April highs just below that is the upside target here to reach:

The economic calendar includes Euro core inflation and US factory orders.