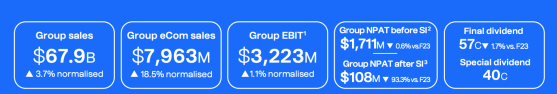

Despite conceding a 93% collapse in annual net profit, Woolworth Group Ltd will pay shareholders a 40 cents a share special dividend.

In May, the group sold a 5% stake in Endeavour Group, with plans to return the proceeds to shareholders through a special dividend of A$489 million, which will also release A$209 million in franking credits.

However, the second half of the financial year has been a struggle for the supermarket giant, with the company pointing to a $1.5 billion impairment in New Zealand Food, which impacted its overall profit for the year.

Josh Gilbert, market analyst at eToro, says shareholders should be pleased with the results.

"Woolworths announced robust sales for FY24, with growth of 5.6% year-over-year, while its earnings beat expectations, rising 3.4%.

“The positive from this result today is the upbeat outlook on sales to start FY2025. In what is clearly a challenging environment for consumers, Woolworths is attracting customers through its own brand products which is helping to drive sales.

"Many had expected a weak outlook to start this year but we didn’t get that. Although the next fiscal year won’t be easy, it gives investors room to be cautiously optimistic.

“Growth continued in its eCommerce segment, with average weekly visits growing 20% from FY23. This sector of the business will remain an imperative for Woolies in the years ahead, and its investments in this segment are bearing fruit.

"The positive for investors is that Amanda Bardwell, currently MD of WooliesX, will take the helm as CEO starting on September 1. Although her biggest task will be winning back the public’s trust after facing something of a PR nightmare in 2024, her experience in the digital side of the business brings huge potential for growth.

“As the new CEO takes the reins, investors will hope that this shift at the top of the food chain, coupled with Bardwell's proven capabilities, will not only help steady the ship but also guide the business back to its best. It will be a baptism of fire for Amanda Bardwell, who will have to navigate increased regulatory scrutiny, cost pressures and increasing competition from Coles and Aldi.

“But, after a challenging start to the year, shareholders can be pleased with today’s result, especially with its special dividend taking its full-year dividend to $1.44 per share, which some would see as well deserved for sticking with the business through a difficult period."

Cost of living pressures cutting in

Shrinking profitability at Big W due to cost of living pressures has had an impact on Woolworths’ performance. Shoppers across Australia have pulled back on discretionary spending in a highly competitive sector.

“In H2, inflation in our Food businesses and BIG W moderated significantly as we lowered prices and passed on lower cost prices to customers. Average prices in Woolworths Food Retail in Q3 and Q4 were down 0.2% and 0.6% respectively on the prior year,” Woolworths Group CEO Brad Banducci said.

“However, cost of living remains the primary concern for our customers, and we are committed to do more to help them in the current environment by offering more value on their shopping baskets and by supporting them with new digital tools, and extra value through Everyday Rewards.”

Speaking specifically about New Zealand Food, Banducci said "New Zealand Food’s financial performance continues to be materially impacted by higher wage costs and a value-conscious customer in a very competitive market.

“Pleasingly, customer scores improved in key areas such as Fruit & Veg and Availability and item and sales momentum improved in Q4. However, wage costs which have increased by 19% over the last two years, materially exceeded sales growth which led to a 57% decline in normalised EBIT for F24.

"While it will take time for New Zealand Food to get back to the returns we believe the business should deliver, we are optimistic that the multi-year transformation plan is improving the underlying performance of the business.”

The numbers

In the financial year ending June 30, 2024, Woolworths Group reported a 3.7% growth in group sales, after adjusting for the extra 53rd week in the period. In the second half of the year, sales increased by 3.0%. When excluding the impact of the Petstock acquisition, normalised sales for F24 rose by 3.1%, with second-half sales growing by 1.7%.

The Australian Food segment saw a 3.7% increase in normalised sales for FY24, although sales growth slowed to 1.8% in the second half, largely due to moderating inflation despite continued strong growth in eCommerce.

In contrast, New Zealand Food and BIG W faced challenges during the year, as value-conscious customers increasingly opted to cross-shop and trade down. Nevertheless, both businesses made significant strides in their transformation plans, with improved customer satisfaction scores and item growth in the fourth quarter.

On a group level, normalised earnings before interest and tax (EBIT) for FY24 rose by 1.1%, driven by gains in the Australian Food and Australian business-to-business (B2B) segments, partially offset by declines in New Zealand Food and BIG W.

A notable highlight for the year was the strong digital and eCommerce growth, particularly within Australian Food, where customers increasingly utilised digital tools and eCommerce services to find value. WooliesX, the group's digital and eCommerce platform, reported a 19.8% increase in normalised sales, contributing to about half of the Australian Food segment’s sales growth.

Additionally, WooliesX's digital and analytics platform (DAP5) and EBIT surged by 94%, accounting for around three-quarters of Australian Food EBIT growth.

The group also made progress in scaling its platforms, with the analytics platform WiQ and the retail media business Cartology contributing to incremental sales and EBIT growth. The development of the Moorebank Distribution Centre (DC) hub, under Primary Connect, is progressing as planned.

As part of the group's Everyday Retail strategy, Woolworths completed the acquisition of a 55% interest in Petstock Group in January.

Looking ahead, Woolworths will focus on improvements in customer satisfaction, item growth, and the easing of inflation. However, the group recognises that its customers continue to face significant financial pressures related to mortgages and rent, and expects them to remain cautious.

It says the trading environment is anticipated to remain challenging for the remainder of the financial year.

Read more on Proactive Investors AU