Hopes of a stimulus-fueled rally in iron ore prices have begun to fizzle as local manufacturing and property data in China continue to disappoint.

According to data released by China Real Estate Information (NASDAQ:CRIC), property developers’ sales saw a 28% year-on-year (YOY) decline for the month of June.

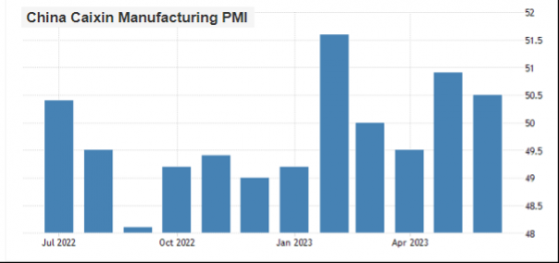

Additionally, a slowdown occurred in local manufacturing as the Purchasing Managers’ Index (PMI) fell to 50.5 points, unable to sustain the strong print seen in May. As such, cracks may be beginning to emerge for analysts’ forecasts of higher iron ore prices in 2024.

Source: Trading Economics

The fundamental drivers for lithium on the other hand have been strengthening as global electric vehicle (EV) sales are likely to grow ~35% in 2023 to roughly 14 million units.

Growth has been driven by significant government policies and subsidies in key markets of Europe, China and the US which are supporting both consumers and manufacturers through tax deductions and rebates.

Supply, demand, prices and signals

The dynamics of lithium supply and demand have been debated intensely, with some sell-side research houses forecasting a large surplus in 2024, whilst some believe the market will be in a deficit. Naturally, this has led to large dispersions in price assumptions and heightened volatility amongst lithium equities.

At Stock Doctor, instead of trying to forecast markets, we prefer to look at the facts and interpret based upon what the data is showing us. Here are two key observations we have on recent company announcements.

There is an abundance of lithium, but mining it is difficult

It is commonly known that lithium is abundant, and companies are investing heavily to discover and expand both brine and spodumene production.

Despite this, we have consistently seen project delays, cost blowouts, labour shortages and poor recoveries which highlight that mining and processing lithium can be operationally complex. In terms of CAPEX inflation, Liontown Resources (ASX:LTR) Ltd, Mineral Resources Ltd (ASX:MIN), Pilbara Minerals Ltd and recent hopeful Lake Resources Ltd have all pointed towards higher commissioning and construction costs.

In the case of LKE, capex guidance for its flagship Kachi project increased threefold from ~US$500 million to ~US$1.5 billion in just three years. Both MIN and Allkem have struggled with grade dilution and recoveries at their respective projects in Mt Marion and Mt Catlin, which has seen unit costs soar well above previous management guidance.

Permitting and ESG considerations are important

There is a shortage of defined resources located in Tier 1 jurisdictions such as Australia and North America. Furthermore, out of those companies that do have JORC-compliant resources, even fewer projects have progressed with environmental approvals and mining permits.

This means that it will likely take a number of years to bring greenfield projects online, and until then, brownfield expansions should account for the vast majority of supply growth. Consequently, the companies that will benefit most from today’s high-price environment are those already in production with low-risk expansion projects and relationships with off-take partners.

How are we positioned?

Given these observations, we have been investing in companies that we believe have quality operations that can generate high returns on capital even in subdued commodity price environments. These businesses also have adequate financial health (as measured by our proprietary Health Model), solid cash flows and avenues for further reinvestment.

An example of our investment methodology can be viewed via our recent initiation on Pilbara Minerals Ltd (ASX:PLS), which we believed to be undervalued following the March sell-off within the sector.

PLS has a globally significant asset in Pilgangoora and is a pure-play spodumene miner which has benefitted the company as chemical prices have fallen further than hard rock prices (see MIN’s recent announcement regarding the toll treatment with Ganfeng).

With more than A$2 billion in net cash, PLS is well-placed to finance its P1000 project which will see production grow ~10% per annum into 2025 and deliver any excess capital in the form of dividends, or value accretive acquisitions.

Source: Stock Doctor

For more information on how Stock Doctor utilises financial data to drive investment decisions and generate above-market returns, click here.

Daniel Ortisi is an equity research analyst with the team at Stock Doctor and is responsible for coverage across the mining and materials sector. Daniel has had previous experience working within deal advisory, M&A and financing across a variety of industries, with a speciality in financial analysis and modelling.

Read more on Proactive Investors AU