The world’s largest cryptocurrency bitcoin has shrugged off the latest US inflation report showing that consumer prices fell more than expected in June.

Yearly inflation fell to a flat 3%, undershooting the 3.1% forecast. While this would typically be a boon to risk assets like bitcoin, a rally has yet managed to materialise, with the BTC/USD pair effectively flat at $57,780.

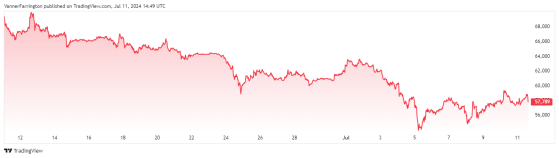

Bitcoin is down 17% month on month – Source: tradingview.com

Bitcoin has shown heightened volatility recently, with daily amplitudes (the measure between intraday lows and intraday highs) often exceeding 5%.

Today, for instance, bitcoin has slipped from a high of $59,650 to a low of $57,050, before settling at around $57,870 at the time of writing.

However, analysts at ETC Group believe bitcoin’s well-documented volatility has reduced over time and will “most likely continue to do so” with increased scarcity and mainstream adoption.

ETC Group did add a caveat to this: “To be fair, the volatility of cryptoassets is relatively high compared to traditional asset classes such as equities, bonds, and most commodities.”

Read more on Proactive Investors AU