This afternoon the RBA will reveal its next rate hike measure – predicted to lift the cash rate another 25 basis points (bp) to 3.6% at 2:30 pm AEDT time.

Bloomberg’s survey of 27 economists offered a unanimous consensus on the 25bp hike, although sentiment is mixed on whether that’s the right move.

While the Australian Institute has argued inflation is corporate profit-driven and rate hikes are the wrong tool to flatten inflation, others believe a 50bp hike is necessary and there may be many more rate hikes to come.

ASX futures fell 0.2% or 12 points overnight and rates traders are pricing two more increases this year after today’s hike.

The RBA isn’t the only central bank forging on with rate hikes.

European markets closed lower on Monday after the European Central Bank’s officials flagged support for more interest rate increases, with Austrian central bank chief Robert Holzman suggesting a 50bp increase at each of its next four meetings.

US markets were mixed, waiting for US Federal Reserve chair Jerome Powell’s statements (expected at 2am AEDT) and the latest job data, expected later in the week.

The S&P500 and the Dow were up 0.1% but the Nasdaq fell 0.1% and both the FTSEurofirst 300 and the UK FTSE 100 also lost ground, shedding 0.1% and 0.2% respectively.

In other market news

Currencies were mixed.

- The Euro rose from US$1.0620 to US$1.0693 and was near US$1.0675 at close.

- The Aussie fell from US67.60 cents to US67.16 cents and was near US67.25 cents.

- The Japanese yen also fell, slipping from 135.52 yen per US dollar to JPY136.17 and was near JPY135.95 at the US close.

Oil rose on negative sentiment for logistics and supply vulnerability from the CERAWeek energy conference in Houston, Texas.

Chevron (NYSE:CVX) chief executive Mike Wirth pointed to a tight market vulnerable to supply disruption and the ongoing war in Ukraine.

Brent crude rose US$0.35 or 0.4% in response to US$86.18 a barrel while Nymex lifted US$0.78 or 1% to US$80.46 a barrel.

Base metals, including iron ore, were affected by China’s cautious economic growth targets, disappointing investors who hoped for a larger economic impact on the global stage.

- Copper futures rose 0.6%.

- Aluminium futures fell less than 0.1%.

- Iron ore fell 0.9% or US$1.14 to US$125.50 a tonne.

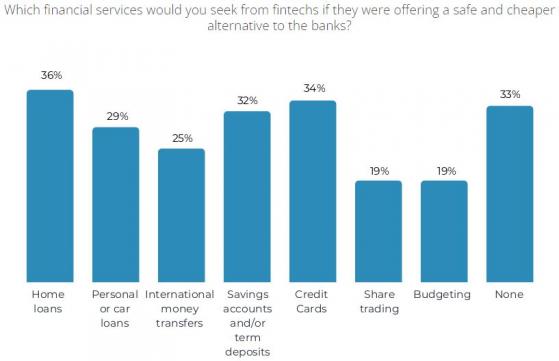

67% of Aussies consider ditching the banks

A new survey commissioned by Money Transfer Comparison has revealed some two-thirds (67%) of Australians are considering making the switch to specialist fintech firms due to overly expensive banking fees.

A staggering 85% of those surveyed stated they believed banks’ fees were too high for missed payments, overdrawn accounts and international money transfers.

International money transfers from traditional banks are particularly expensive, with major banks such as NAB charging $30 per overseas transfer, while alternative fintech companies charge no fees or commission at all.

“When comparing traditional banking fees with the fees that competing fintech services provide, the level of dissatisfaction from the public is clear,” Money Transfer Comparison founder and managing director Alon Rajic said.

“Associated fees for services offered by both banks and fintech services can differ greatly.

“For instance, annual credit card fees from major banks can be as much as $295, with a high annual interest rate of almost 20%, whereas some non-banks do not include annual fees on their card services and charge interest as low as 12%.

“Interest rates on loans from banks are also significantly higher than alternative lenders – Commonwealth Bank can offer an up to 19.50% fixed interest rate on car loans, while Loans.com.au, an alternative lender, offers a standard 6.69% fixed rate on its car loan offering.”

Source: Money Transfer Comparison Study March 2023

“It is clear banking is another area in which Aussies are looking to cut costs,” Rajic said.

“We could see an increase in bank customers leaving in favour of innovative and specialist online financial service providers, many of which offer cheaper services than traditional banks – and particularly amid growing inflation and interest rates.”

Read more on Proactive Investors AU