Street Calls of the Week

(Adds quotes from S&P, Wednesday's data on wages paragraphs 5-13)

By Swati Pandey

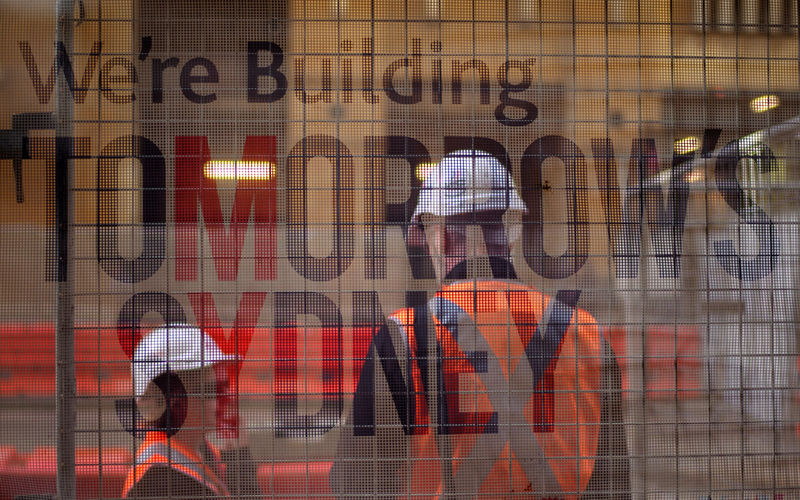

SYDNEY, May 17 (Reuters) - S&P affirmed Australia's coveted triple-A rating on Wednesday, citing low public debt and a "wealthy and resilient economy" although concerns remain about the government's ability to return to a budget surplus.

The Australian government last week pledged to deliver a small surplus in 2020/21, ending more than a decade of deficits that have threatened its top-notch credit rating. Moody's and Fitch welcomed the government's economic blueprint, adding the budget had no major impact on ratings. is one of only 10 nations in the world with a AAA credit rating from the top three agencies. However, S&P retained its negative outlook.

"The substantial delay in fiscal repair, and the risk of further delay, raises our doubt over the ability of the Australian government to meet its fiscal objectives," S&P said, adding: "We believe that the potential for wage growth and inflation to remain low remains a downside risk to the government's current projections."

Data out on Wednesday showed Australian wage growth stuck at its slowest pace on record, while consumer sentiment faltered in May, putting a lid on consumer spending and a drag on the course of inflation. also saw risks in the booming housing market, mainly in Sydney and Melbourne where median property prices have nearly doubled since 2009. At the same time, bank credit to households has jumped to a record high of 175 percent of gross domestic product (GDP).

S&P sees the credit-to-GDP ratio climbing to 188 percent in 2020.

"...Such rapid credit growth can lead to vulnerabilities with regard to financial, fiscal, and economic stability if the dynamic expansion experiences a sudden and unexpected slowdown," it added.

Australia's A$1.7 trillion economy has, in recent months, benefited from higher prices for iron ore, its top export earner. The economy grew at 2.4 percent in 2016, extending a run of 101 quarters without a recession.

S&P expects headline GDP growth to be around 2.3 percent in 2017 and accelerate to around its "potential growth rate" in the following years.

That is lower than the government's budget forecast of 2.75 percent in 2017/18 and strengthening to 3 percent through to 2020/21.