Triangle Energy (Global) Ltd's Cliff Head Joint Venture (CHJV) has lodged an application with the National Offshore Petroleum Titles Authority (NOPTA) to declare the WA-31-L tenement area as an identified greenhouse gas storage resource.

The declaration is the initial regulatory approval needed for an offshore carbon capture and storage (CCS) project and facilitates the CHJV progressing to apply for a carbon dioxide (CO2) injection licence.

The CHJV is a producing shallow-water oilfield in the Perth basin offshore Western Australia operated by Triangle, with a 78.75% interest, and partner Pilot Energy (ASX:PGY) Ltd holding the rest.

NOPTA’s approval will trigger a change in the CHJV structure, resulting in Pilot holding a 60% direct operated participating interest in both the CHJV (oil project) and the Cliff Head CCS Project, and Triangle holding a 40% direct participating interest in both projects.

CO2 storage resource upgrade

Over the past six months, the CHJV technical teams, along with CO2 storage sub-surface adviser CO2Tech, have undertaken a full technical assessment of the CO2 storage potential across the WA-31-L tenement area ahead of the NOPTA application.

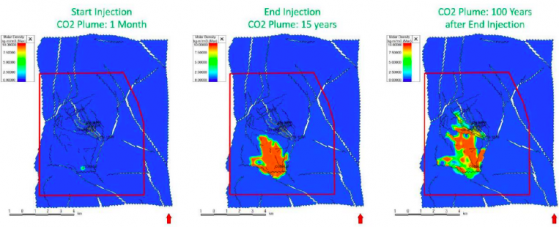

This assessment resulted in a 50% increase in the CCS Project 2C contingent resources to 9.7 million tonnes, sufficient to facilitate CO2 injection over 15 years at an annual rate of 665,000 tonnes.

The expanded technical data also supported a new CO2 injection well to be drilled downdip from the field instead of converting five existing wells. The existing wells will instead be retained for pressure maintenance and monitoring.

The capital cost of this plan is under review but is expected to fall within the previous guidance of $110 million for 665,000 tonnes per annum injection capacity, with up to a further $60 million to expand annual injection capacity to 1.1 million tonnes.

As the CCS application is one of the first applications to be made under the Offshore Petroleum and Greenhouse Gas Storage Act 2006 (OPGGS Act) and the Offshore Petroleum and Greenhouse Gas Storage (Greenhouse Gas Injection and Storage) Regulations 2011 (the Regulations), Triangle said it used a conservative assessment of the CO2 storage potential across the tenement area.

CO2 plume migration 2C case.

Next steps

Prior to arriving at a final investment decision on the Cliff Head CCS Project, the partners will pursue the following:

- Permitting - continued engagement with regulators to secure the necessary regulatory approvals.

- Commercial offtake - engaging with prospective parties for carbon management services.

- EPCM contractor - commence engagement with potential EPC contractors.

- Detailed Front-End Engineering & Design (FEED) and costings for the CCS project.

- Capital - continued engagement for potential partnership arrangements for the CCS project.

Read more on Proactive Investors AU