Investing.com — General stock market wisdom says that getting as much as 60% of your picks right is usually more than enough to sustain long-term gains. However, when the bull market comes (such as the one we're experiencing), we want to do far better than that.

Regrettably, the harsh reality for most retail traders differs greatly from that. A recent study from Quantified Strategies revealed that approximately 80% of retail traders actually end up losing money, with roughly 90% quitting trading in two years.

Certainly, these traders haven't subscribed to our AI-powered strategies for just under $9 a month.

So far in May, our Beat the S&P 500 strategy has picked only winners - among its selection of stocks for the month - an impressive record even amid the ongoing bull market.

But if that's not enough, amid these winners, our AI has picked four double-digit gainers. To name a couple:

Impressive, right? Well, but what if I told you that's not even our top-performing strategy...

In fact, our flagship Tech Titans strategy as a whole is up an astounding 12% in May, with several 20%+ stocks in May, such as:

- Perficient Inc (NASDAQ:PRFT): +55.86% in May.

- Marathon Digital Holdings (NASDAQ:MARA): +21.03% in May.

And many others! Want to see them all?

Subscribe here for less than $9 a month and miss another bull market again!

Now, honestly - what was the last time you spotted so many unknown double-digit winners in a single month?

I'm guessing never...

Well, don't worry; none of us have done it by ourselves either. This is precisely why our AI stock-picking tool may prove to be the greatest game-changer for retail investors in a very long time.

Unlike everything out there, our strategies are forward-looking and just a momentum indicator.

That's how we managed to crush the market by a very wide margin since the official launch in October last year. In fact, these are the gains you would have notched since October by following our AI picks (numbers as of premarket today):

- Beat the S&P 500: +31.96%

- Dominate the Dow: +19.66%

- Tech Titans: +68.53%

- Top Value Stocks: +35.51%

- Mid-cap Movers: +23.61%

That's against the following gain from the benchmark indexes during the same period:

- S&P 500: +15.42%

- Dow Jones Industrial Average: +10.37%

- Nasdaq Composite: +16.64%

This is not a backtest; this is real-world performance, unfolded in real time to our users.

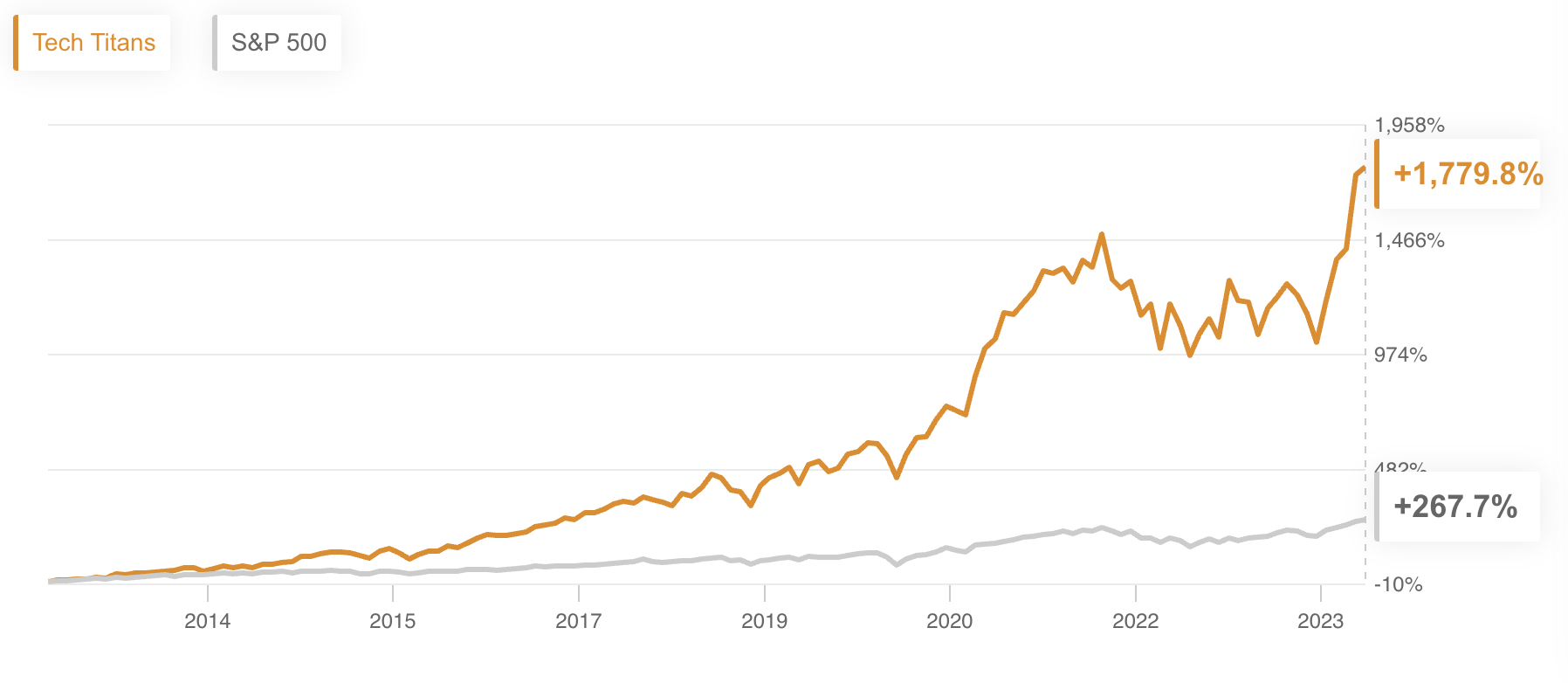

In fact, our backtest suggests that going for the long run will give you even heftier gains. See in the chart below for reference:

Source: ProPicks

This means a $100K principal in our strategy would have turned into an eye-popping $1,879,800K by now.

As earnings season nears the end, the question is: Will you keep on guessing or have an insight into the winners?

For less than $9 a month, that decision has never been easier.

Join now for less than $9 a month and never miss another bull market again!

*And since you made it all the way to the bottom of this article, we'll give you a special 10% extra discount on all our plans with the coupon code PROPICKS20242!